- Although the previous inflows were worth billions, the ETF recorded a net outflow on June 10.

- Long-term holders cashed out, signaling a further decline for BTC.

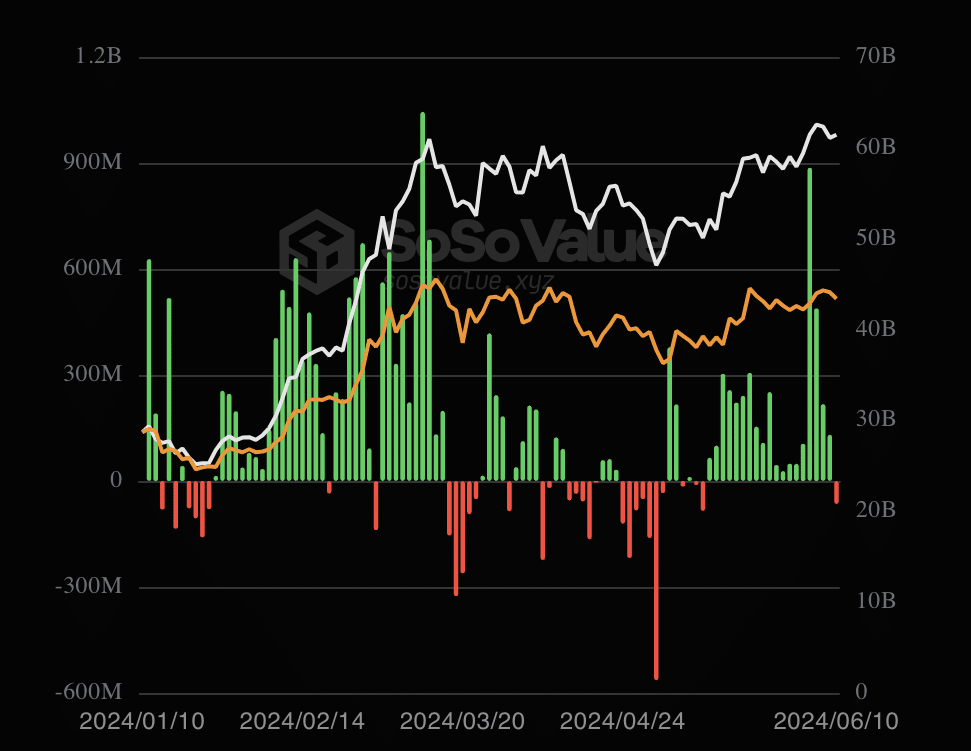

Bitcoin [BTC] ETFs have recorded 19 consecutive days of inflows, after a long period of outflows. Led by BlackRock Bitcoin ETF, inflows have been worth nearly $3 billion in recent weeks.

For example, on June 10, BlackRock recorded inflows of $6.34 million. Bitwise’s IBIT was $7.59 million. however, the it seems the tides have changed as Grayscale’s GBTC had a higher outflow of $39.53 million.

Due to GBTC’s record, total outflows were higher than inflows. For the uninitiated, a Bitcoin ETF is not the same as BTC, the cryptocurrency.

Source: Sosowaarde

The outflow takes first place

Bitcoin ETFs do not require you to own Bitcoin. Instead, you just need to have exposure to the cryptocurrency because the price affects the net asset value of the ETF.

In the first quarter (Q1) of 2024, the assets, led by BlackRock Bitcoin ETF, recorded billions of dollars of inflows on several days. This caused the price of the coin to rise to a new record high in March.

Later, no more money came in, causing Bitcoin to drop below $60,000 at one point. But the rebound in recent weeks caused BTC’s correction to slow down.

It was also during the same period that BlackRock Bitcoin ETF reached $20 billion in assets under management. AUM stands for Assets Under Management. The AUM reflects the inflow and outflow of a fund and the price development of the assets.

However, with the recent increase in outflows, Bitcoin’s price could be on its way to a decline. At the time of writing, BTC changed hands at $67,539. This represents a decline of 2.63% in the last 24 hours.

Will BTC Dive Below $67,000?

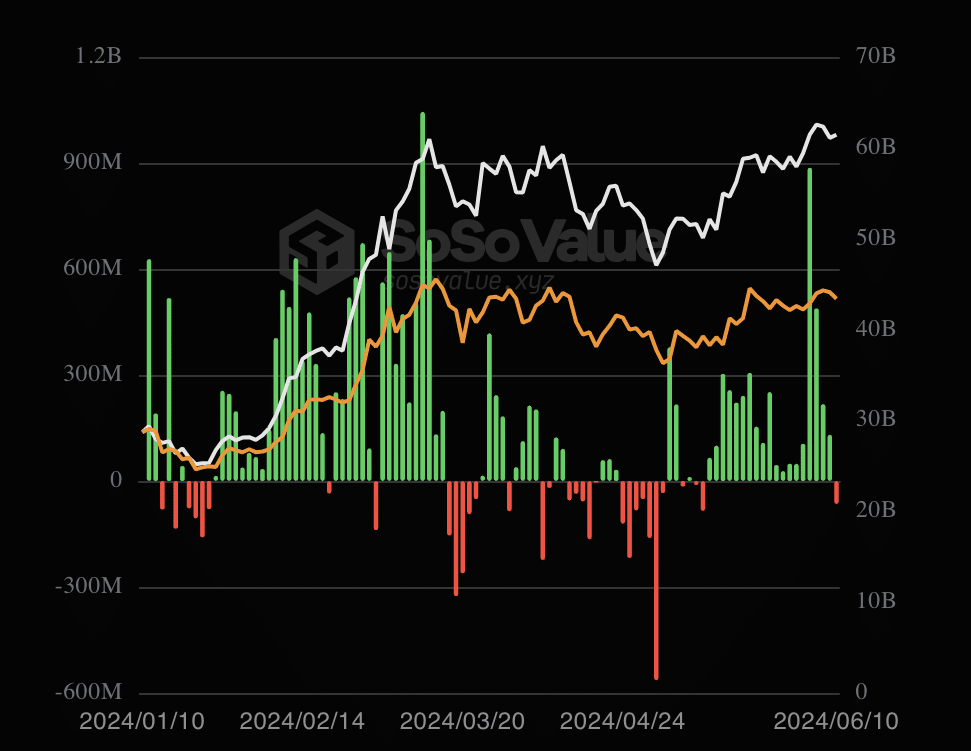

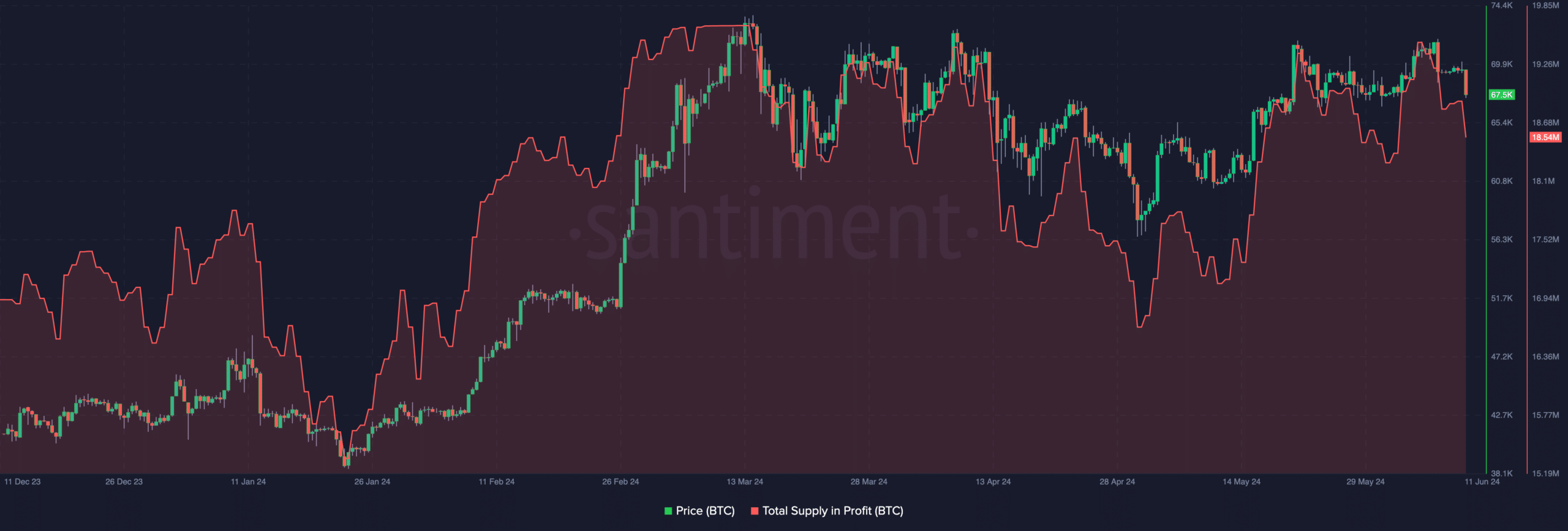

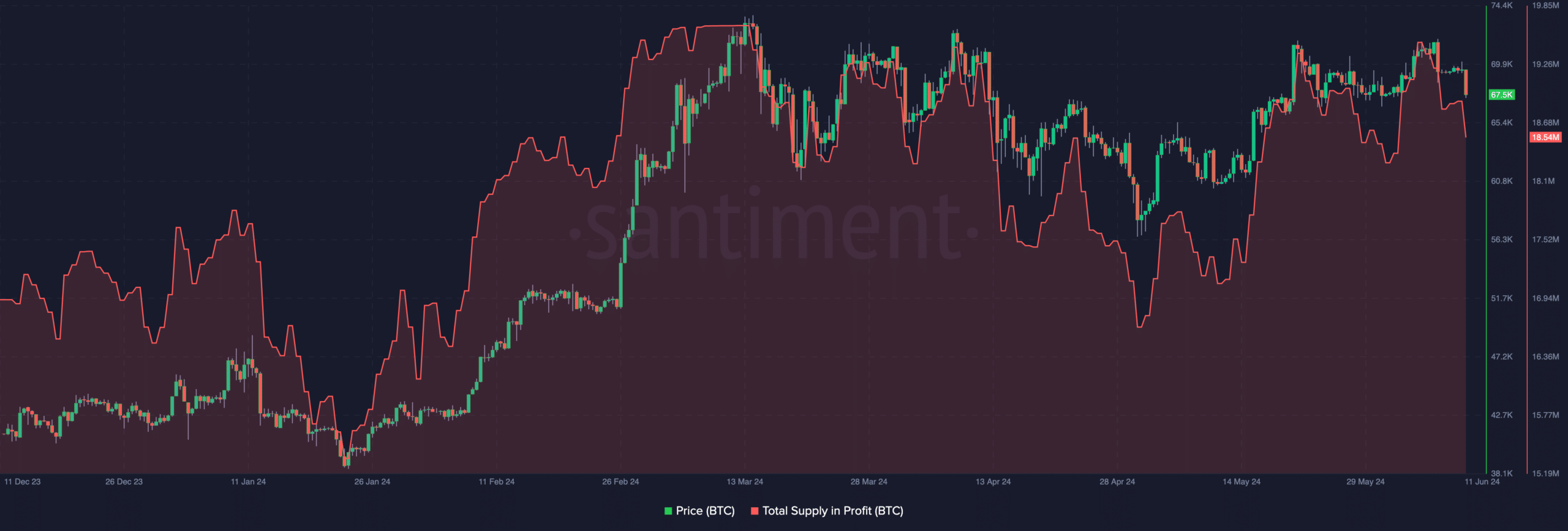

As a result, the total supply becomes profit dropped. According to Santiment, Bitcoin’s total profit supply has fallen from a ceiling of 19.64 million to 18.54 million.

Should the price of Bitcoin continue to fall, the profit supply will also go down. However, a lower profit offer could be an opportunity for market participants to buy the coin at a discount.

Source: Santiment

If this buy signal appears, Bitcoin could rise towards $70,000 in the short term. However, if the selling pressure continues, the price of BTC could drop to $65,000.

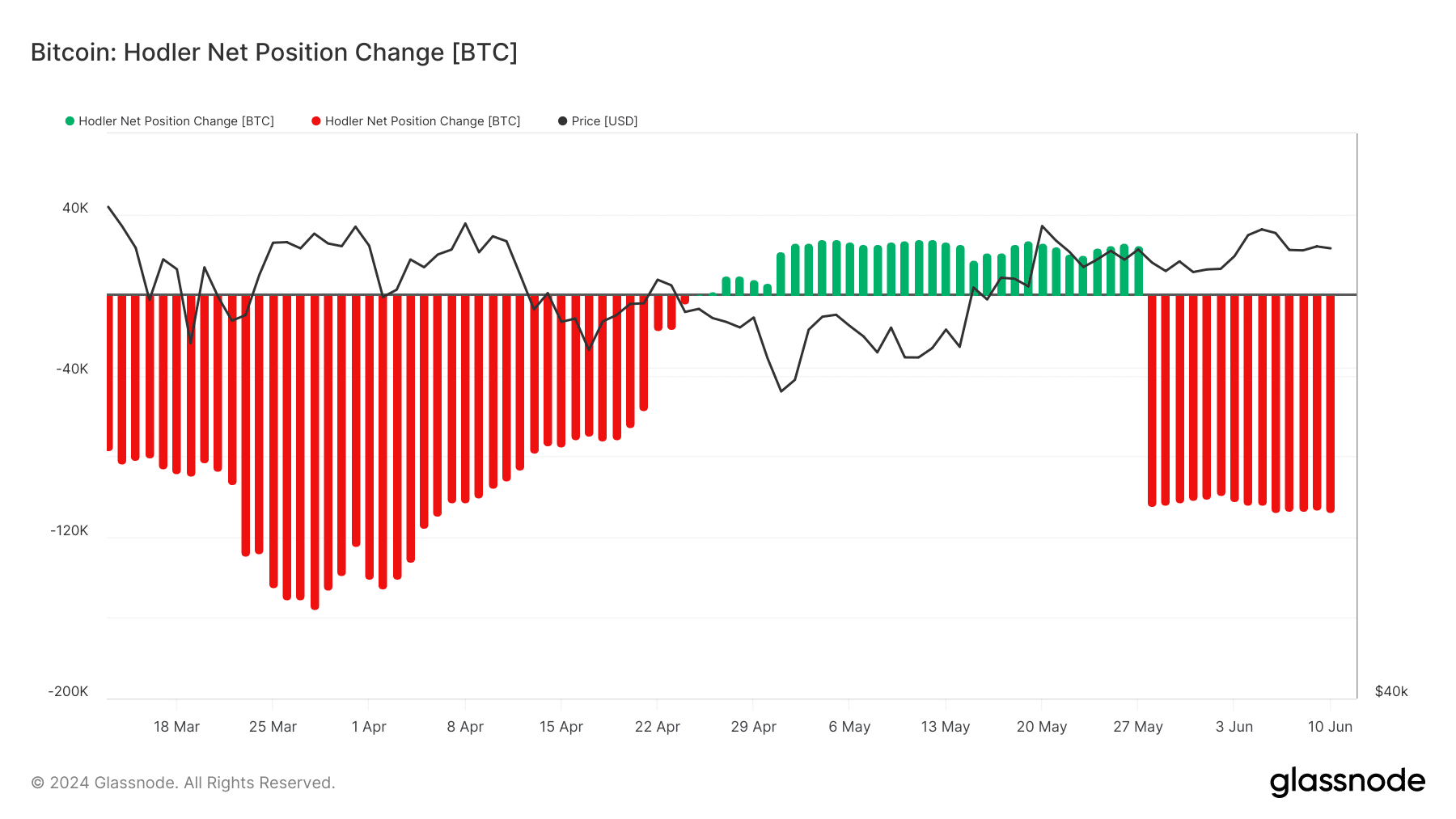

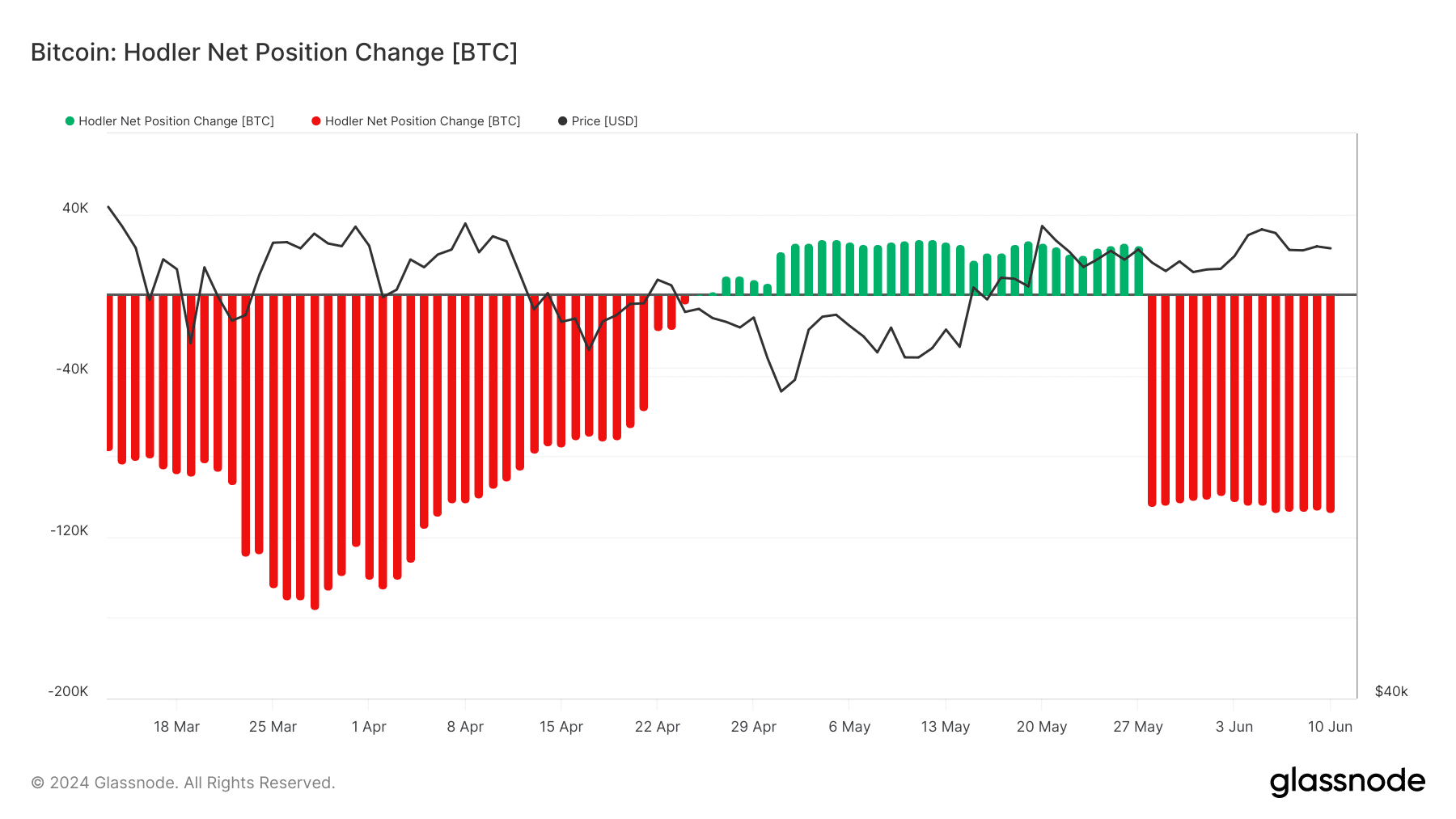

In addition to BlackRock Bitcoin ETF and the above benchmark, AMBCrypto looked at a crucial indicator. The metric considered was the Hodler Net Position Change.

A positive reading of this indicator indicates that long-term holders are accumulating. On the other hand, a negative value implies an increase in Bitcoin paid out.

Source: Glassnode

Is your portfolio green? Check the Bitcoin Profit Calculator

According to Glassnode, Bitcoin’s Hodler Net Position Change was -107,211 BTC. This implies that HODLers have made gains.

As such, Bitcoin’s price could fall rather than recover. However, the bearish bias could be negated if accumulation starts to occur in large numbers.