- TAO showed no signs of recovery as it traded near a critical support level historically linked to price increases.

- Multiple technical and market indicators aligned, indicating a high probability of further declines.

Bit tensor [TAO] has consistently underperformed over multiple periods. On a monthly scale, the token is down 14.22%.

In the daily press session, TAO extended its losses and opened with a sharp decline of 5.05%, confirming the ongoing downtrend.

AMBCrypto had previously emphasized that TAO was on precautionary grounds. The current price drop appeared to be driven by broader market weakness, leaving the asset vulnerable to a deeper downturn.

Can TAO hold up in terms of major support?

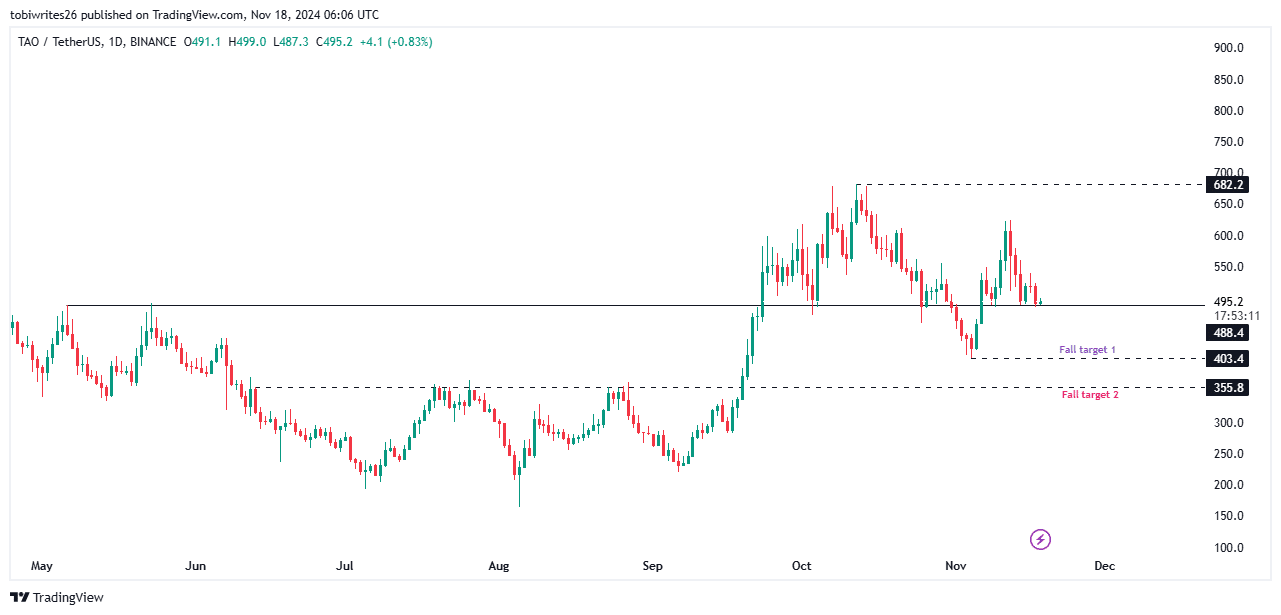

TAO was trading at a critical support level of $488.4 at the time of writing, a zone that has previously led to significant price reversals.

On two previous occasions, this level has served as a springboard for rallies, and traders are now watching closely as TAO conducts its third test of this support.

If history repeats itself, TAO could rise to $682.2 on a successful recovery. However, failure to maintain this level could open the door to further declines.

Initial downside targets are at $403.4, with a deeper decline to $355.8 possible if selling pressure increases.

Source: TradingView

To predict TAO’s next move, AMBCrypto analyzed additional metrics, highlighting key factors that could determine the asset’s trajectory.

Bearish sentiment is taking over TAO

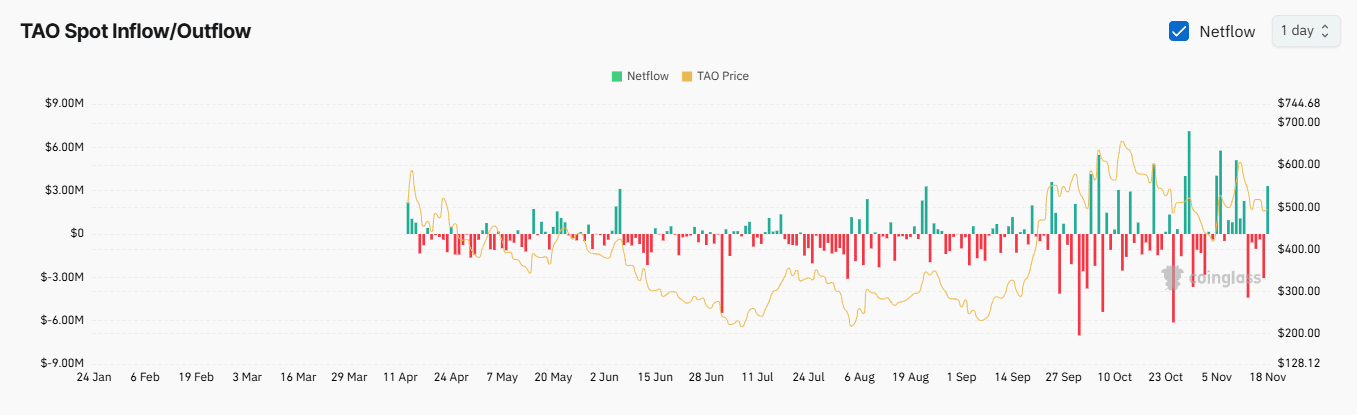

Market sentiment around TAO has turned bearish, according to AMBCrypto’s analysis based on Coinglass data.

Over the past 24 hours, TAO’s Exchange NetFlow has turned positive, indicating that more tokens have been deposited on exchanges than have been withdrawn.

A positive NetFlow typically signals potential sell-offs as traders position themselves to offload their positions. At the time of writing, more than $3.90 million had been deposited into TAO, likely with the intention of selling.

Source: Coinglass

Additionally, the market witnessed significant long liquidations, with $295.62K worth of long positions closed, compared to just $9.59K worth of shorts.

This imbalance suggested that traders betting on a rally were being forced out of their positions as bearish pressure increased.

Further analysis revealed a Long-to-Short ratio of 0.9084, indicating that more traders were betting on TAO’s decline than its recovery. This trend reflected growing pessimism among market participants.

Indicators correspond to data in the chain

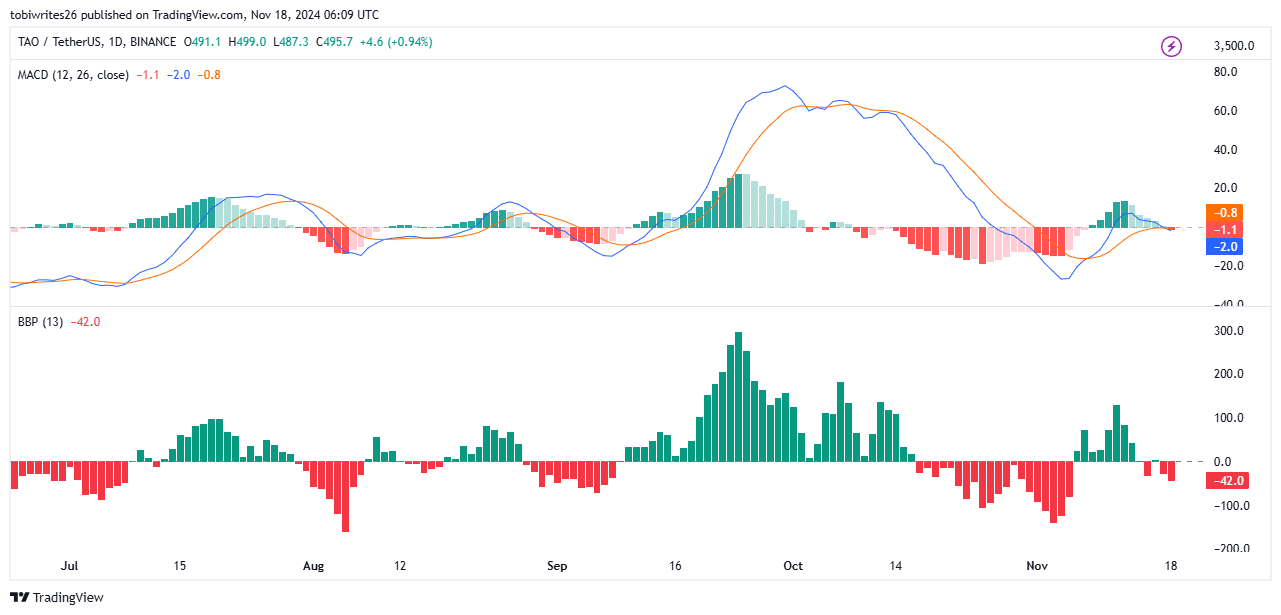

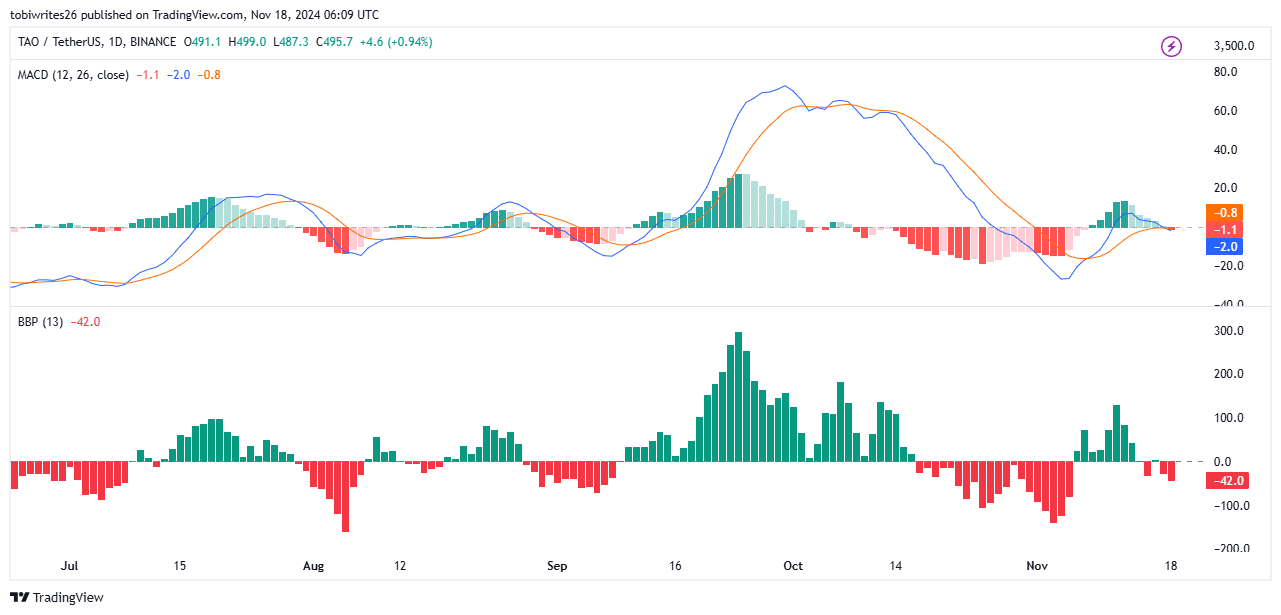

Technical indicators confirmed the bearish outlook for TAO, with instruments such as the Moving Average Convergence Divergence (MACD) and Bull Bear Power highlighting a strong seller presence in the market.

The MACD has formed a ‘death cross’, a bearish signal that occurs when the blue MACD line crosses below the orange signal line. This pattern in the chart below often precedes a decline in momentum, reinforcing the downtrend.

Source: TradingView

Moreover, the Bull Bear Power indicator further underlined the dominance of Bittensor bears.

Read Bittensor’s [TAO] Price forecast 2024–2025

The growing red momentum bars on the indicator showed that sellers were currently in control, reinforcing bearish sentiment.

Based on these technicals, overall market sentiment remained bearish, suggesting further declines are likely for TAO.