- Bitcoin exchanged in a large level of support at the graph and could see an important meeting here.

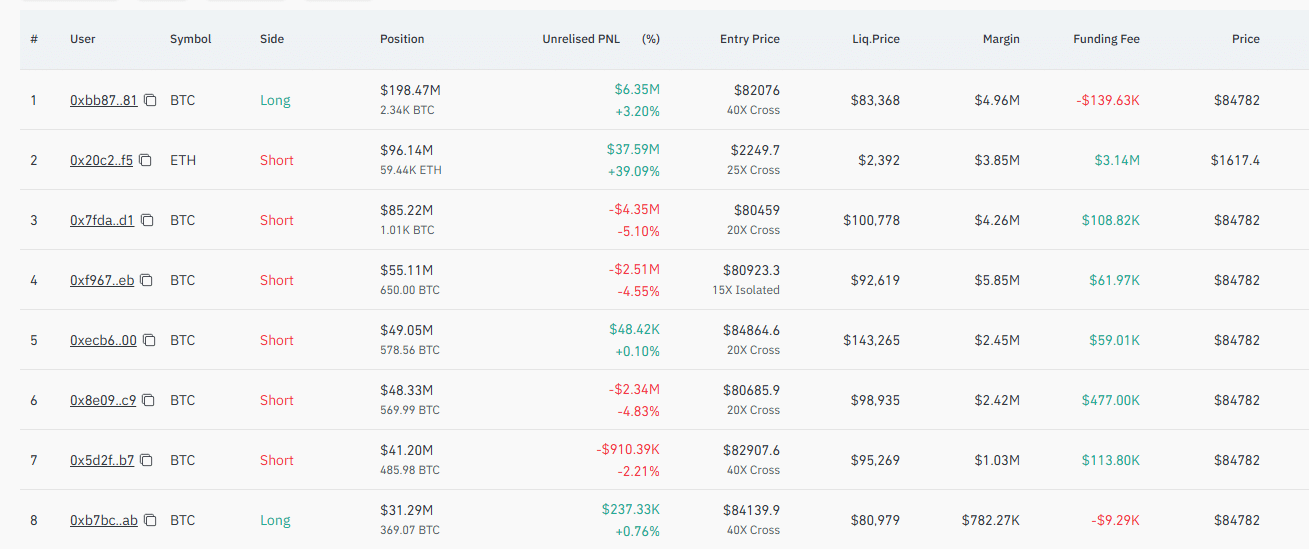

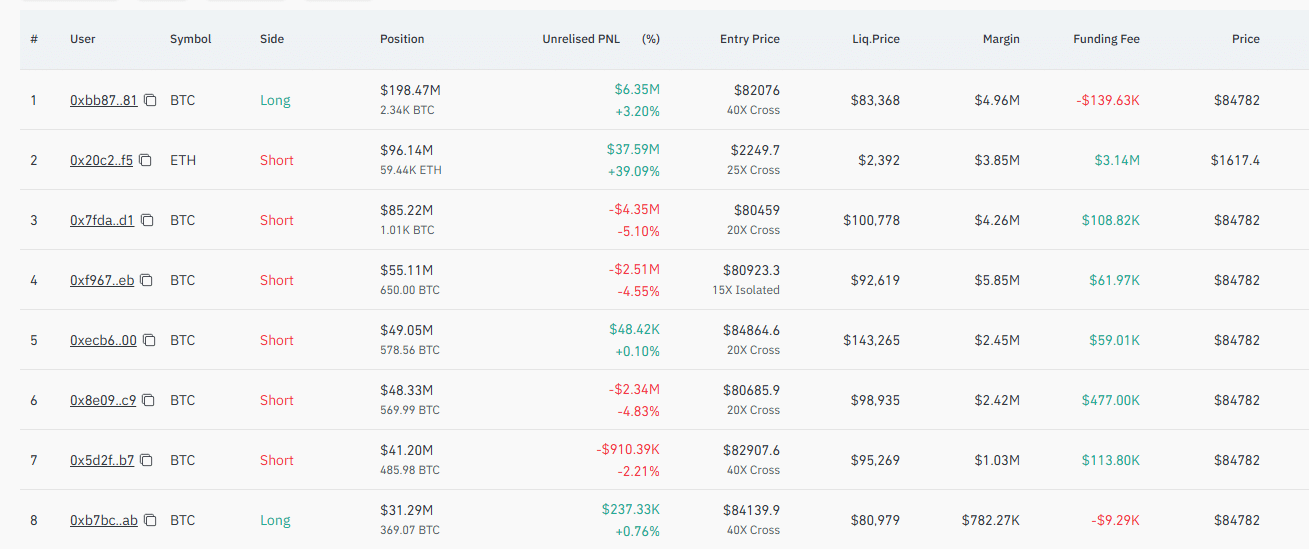

- A whale opened a long position of $ 198.11 million, but short traders in the market keep themselves back and push at the price.

Bitcoin’s [BTC] The market movement has remained slow despite acting in an important level of support, and despite the large position of the whale, it has only risen 1.42% in the last 24 hours.

Analysis, however, shows that although the presence of the bulls is clear, the negative market sentiment pushes at a possible rally and can influence the price.

Bitcoin hits historical offer, eyes a bouncing

In the past month, Bitcoin has entered a critical support zone on the graph, a level that caused historically significant rallies.

As indicated on the graph, this zone has consistently fueled the most important price increases. If Bitcoin successfully has this level successful for the fifth time, this can cause a substantial upward movement, which means that the price of the actual may go to $ 150,000 or further.

Source: TradingView

This bullish sentiment and the potential for a market trally are intensified after a hyperliquisic whale that open a long position of $ 198.11 million, in the expectation that it will actively see a big prize.

The gradual increase in last day has led to $ 5.99 million in non -realized profit, with a financing costs of $ 142.110.

Source: Coinglass

The wider derivatives market supports this bullish story, which suggests the possibility of a rally.

Buying volume on the market remained high, reading a speed time of 1.035, which points to more buyers than sellers – who could actively push it higher.

How can traders channel liquidity?

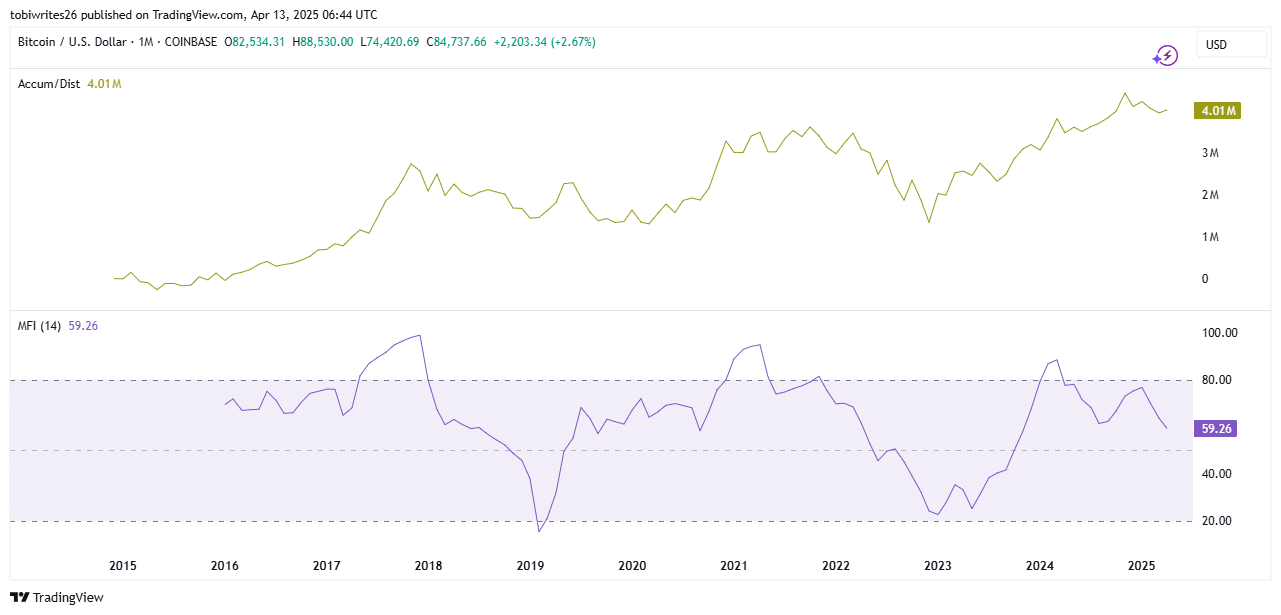

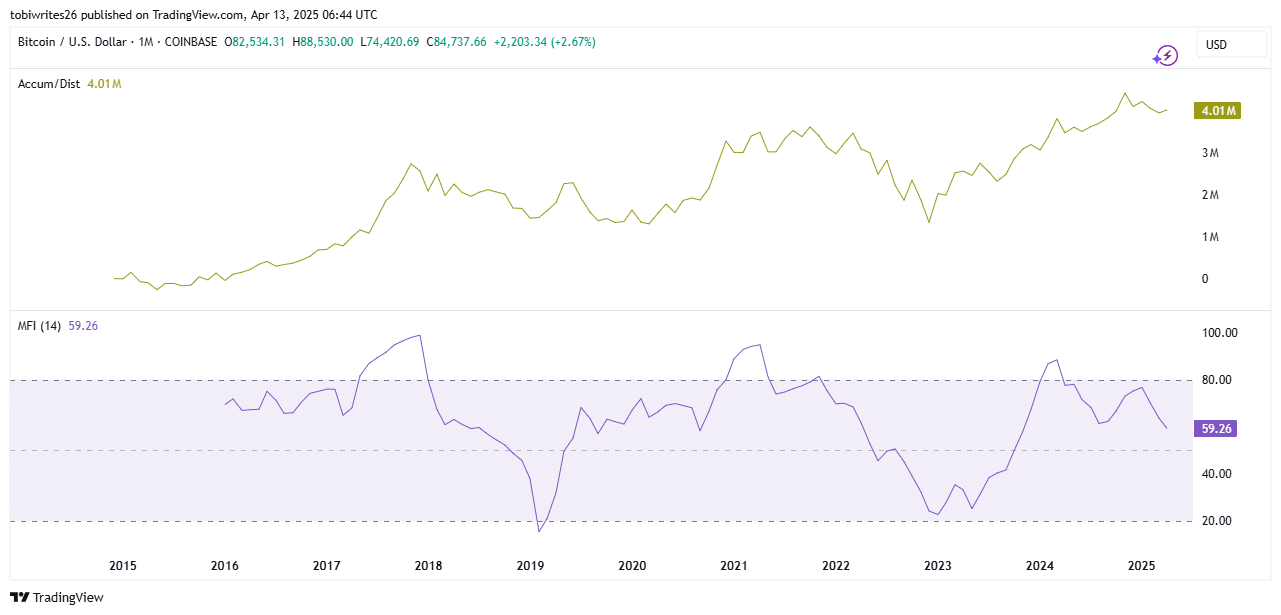

To understand the depth and trend of market movement, Ambcrypto studied the liquidity flow to the market.

With the help of the accumulation/distribution indicator it shows that there has been a gradual accumulation of Bitcoin, which implies that traders actively buy it.

Accumulation volume reached $ 4 million in Bitcoin.

Source: TradingView

Despite a decrease in the liquidity flow, the Money Flow Index (MFI) on the Bullish graph remains at 59.26. This indicates that traders benefit from the dip, the identification of optimism for the outlook of the active.

If the liquidity flow improves, Bitcoin may be able to rise further, which extends the current profit.

Short traders feel the heat

This gradual rise in Bitcoin’s price has not preferred short traders.

At the time of writing, for $ 56.41 million in short contracts was strongly concluded, compared to $ 13.25 million in long positions – relieving the possibility of a market trally.

A study of Bitcoin’s financing speed confirms the tendency for a rally.

With a rate of 0.0098%, a positive financing percentage can imply that long traders pay costs to maintain their positions and to prevent price differences between the location and futures markets.

Bitcoin is currently in a favorable position for a rally, but this will only come true if a broader market sentiment continues to tune into the current bullish indicators.