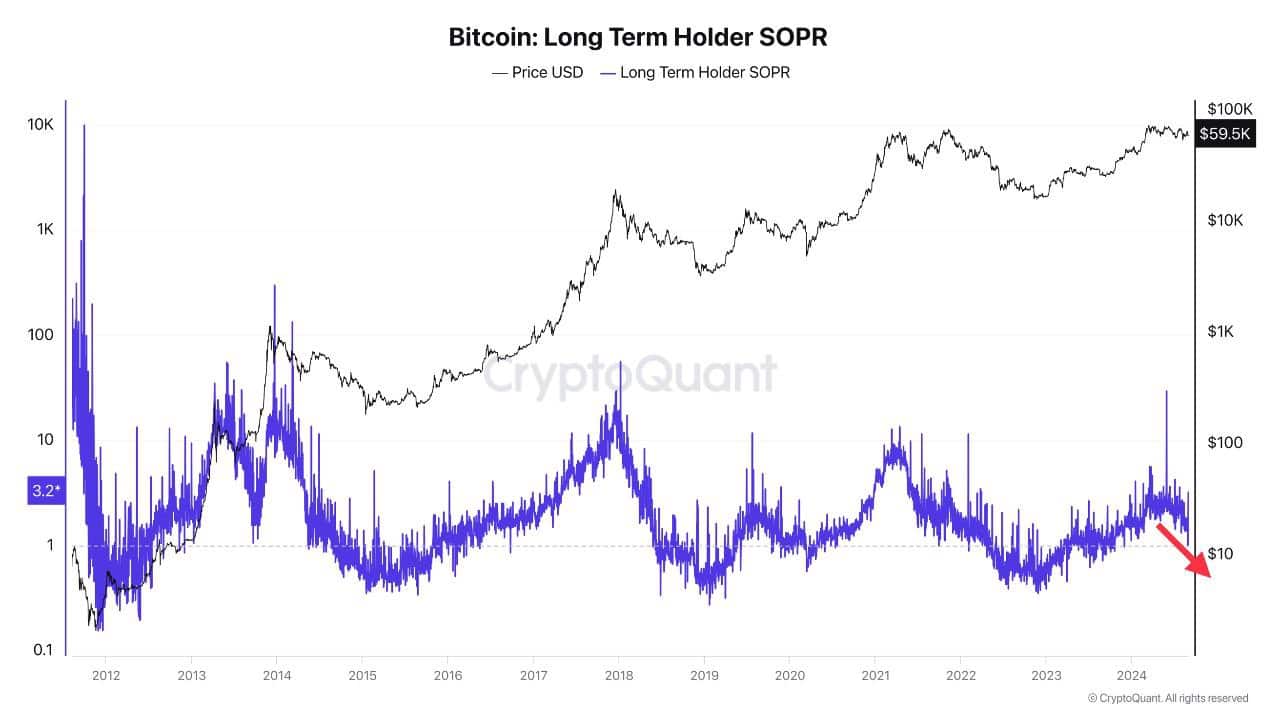

- Bitcoin’s long-term holder SOPR reached 1, indicating that average sales are at breakeven levels

- Analysis of BTC’s key metrics and patterns suggested that the bull run is still ongoing.

Bitcoins [BTC] recent price action and on-chain metrics are crucial for understanding market sentiment, given its position as the cryptocurrency with the largest market capitalization.

The Long-term Holder SOPR, which tracks Bitcoin transactions of those who have held BTC for more than 155 days, is an important benchmark. When the value of the SOPR is above 1, it indicates profits, while a value below 1 indicates losses.

After Bitcoin’s most recent price drop, the SOPR reached 1, meaning many traders sold at break-even – a sign of caution in the market.

Source: CryptoQuant

Bitcoin [BTC]which had previously risen to $62k is now trading below this level due to massive liquidations around the aforementioned level.

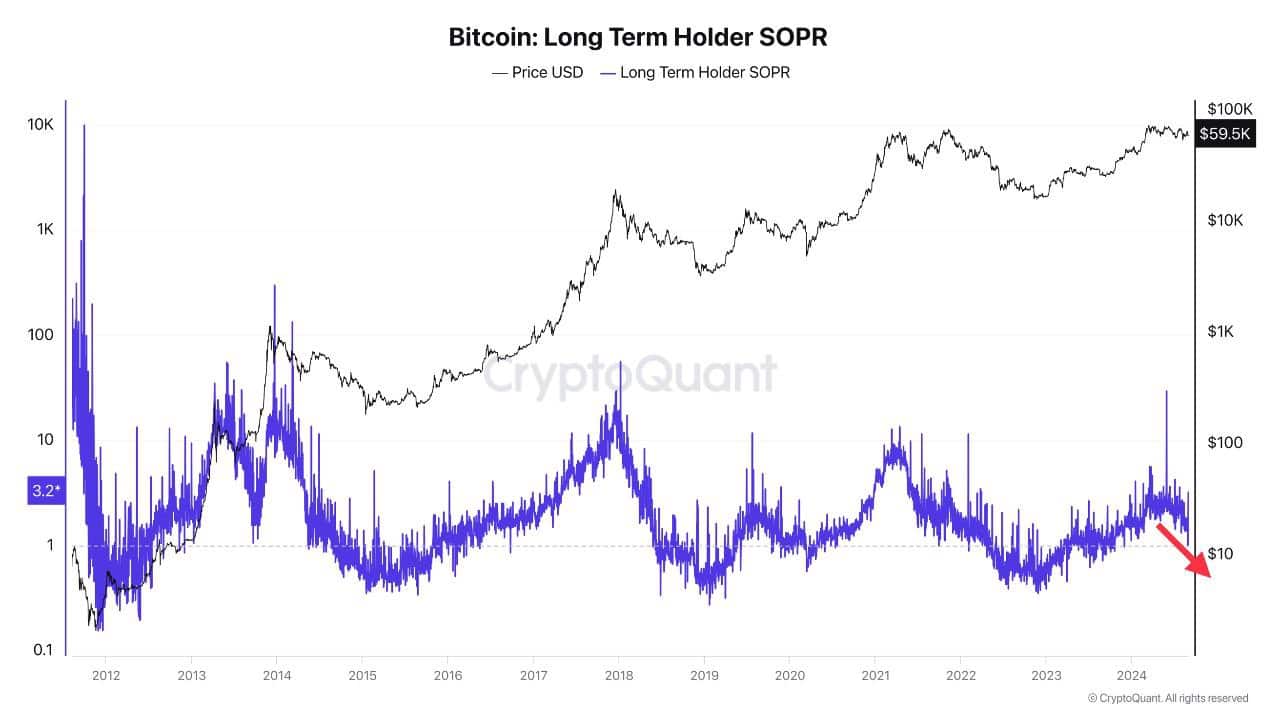

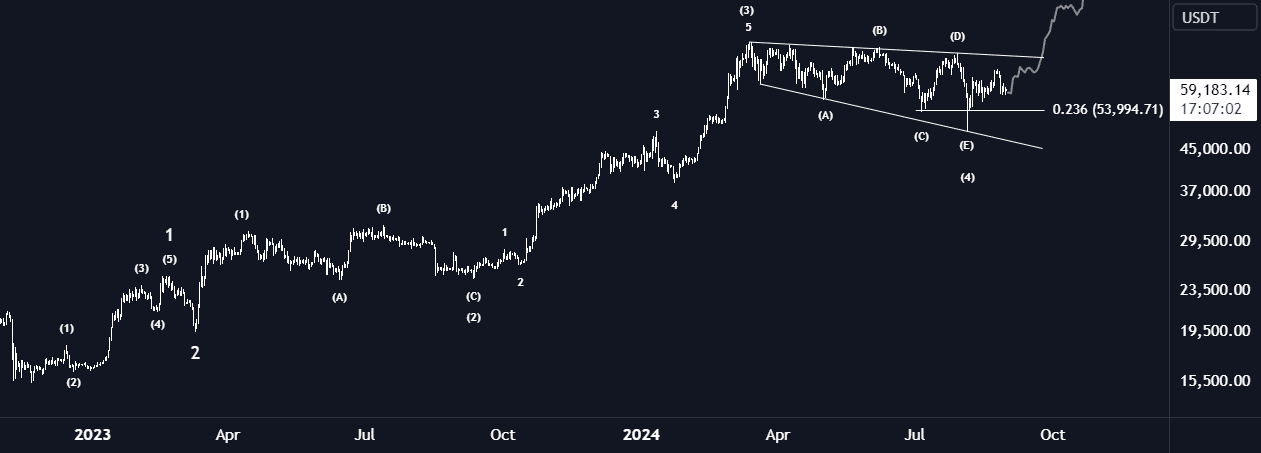

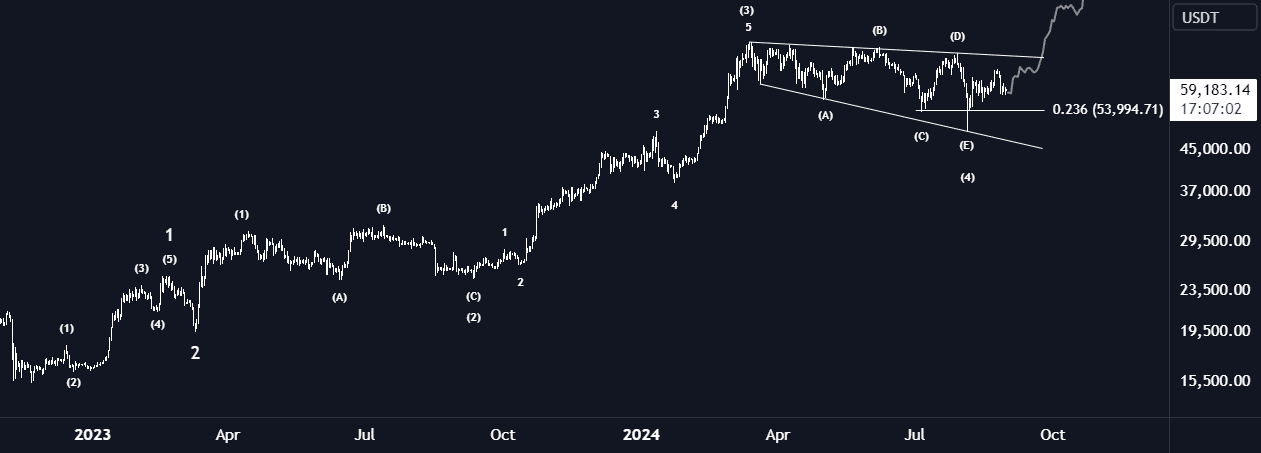

BTC’s wider wedge at a critical support level

Currently, Bitcoin price action in the BTC/USDT pair is progressing within an expanding wedge pattern. This is usually a consolidation phase, signaling calm before a possible market move.

This pattern is at a critical support level, with accumulation continuing as traders remain skeptical of Bitcoin’s potential for an upside projection.

Now there is potential for Bitcoin to slide towards the $53,000 price level before a possible rebound, likely in the fourth quarter of 2024. The price hovering around $59,000 adds to the uncertainty surrounding this critical period.

Source: TradingView

Further analysis of Coinglass’ funding rates revealed little change over the past month. This is despite the massive market flush on August 5 caused by the Japanese stock market crash due to interest rate hikes.

Since then, although financing rates have stabilized, they have remained relatively low. This supports the idea that Bitcoin is in an accumulation phase.

The BTC RSI breakout indicated a recovery

Furthermore, Bitcoin’s Relative Strength Index (RSI) recently recorded its second significant breakout during this bull cycle, which could set the stage for another rally.

Like Bitcoin [BTC] If the price falls further below the $53,000 level, it could trigger panic selling, potentially leading to a recovery.

The RSI breakout, similar to a previous event that led to a major bullish rally, suggested that BTC may be gearing up for another wave northward.

Source: TradingView

Post-halving history from last quarter

Historically the last quarter of the year after a Bitcoin [BTC] The halving has been bullish. This trend could continue into 2024.

Despite a frustrating and stagnant summer market, Bitcoin investors and traders should remain patient as the market has a history of rewarding those who persevere during such periods.

This could be a good time to accumulate more BTC in anticipation of a possible rally in the last quarter of the year.

Source: Titan by Crypto/X