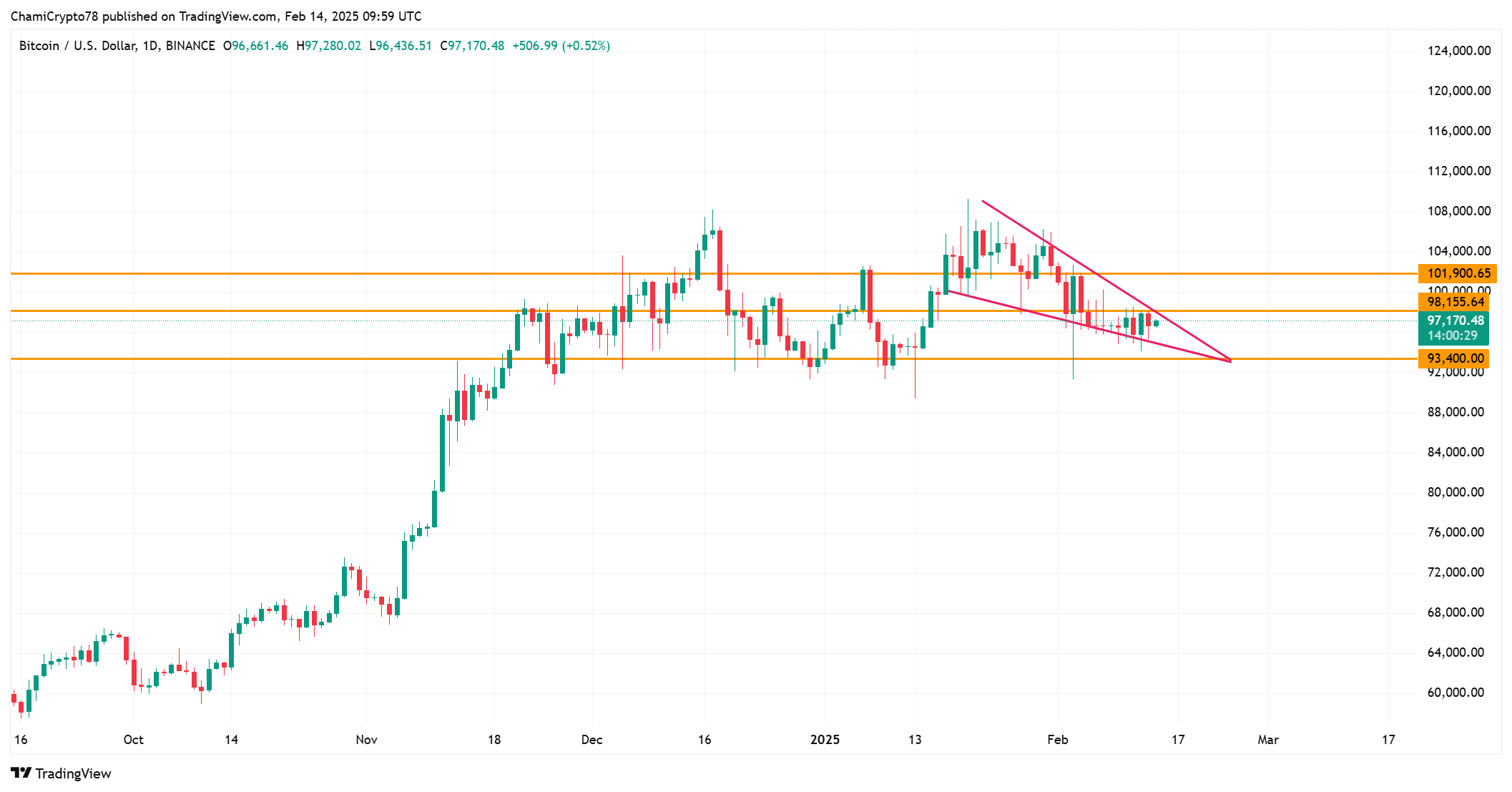

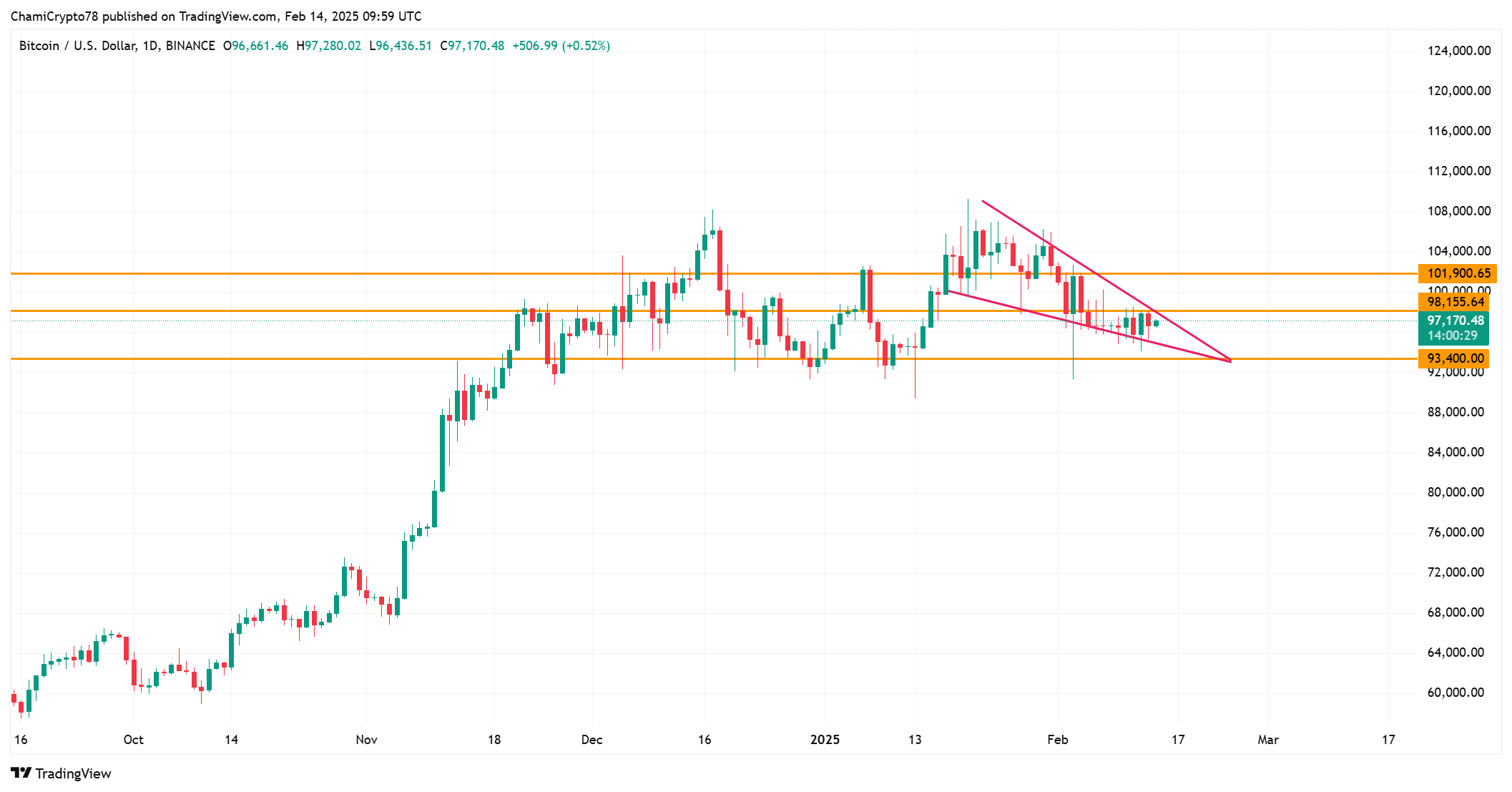

- Bitcoin seemed to consolidate under $ 101,900 and formed a symmetrical triangle for potential outbreaks or reversal

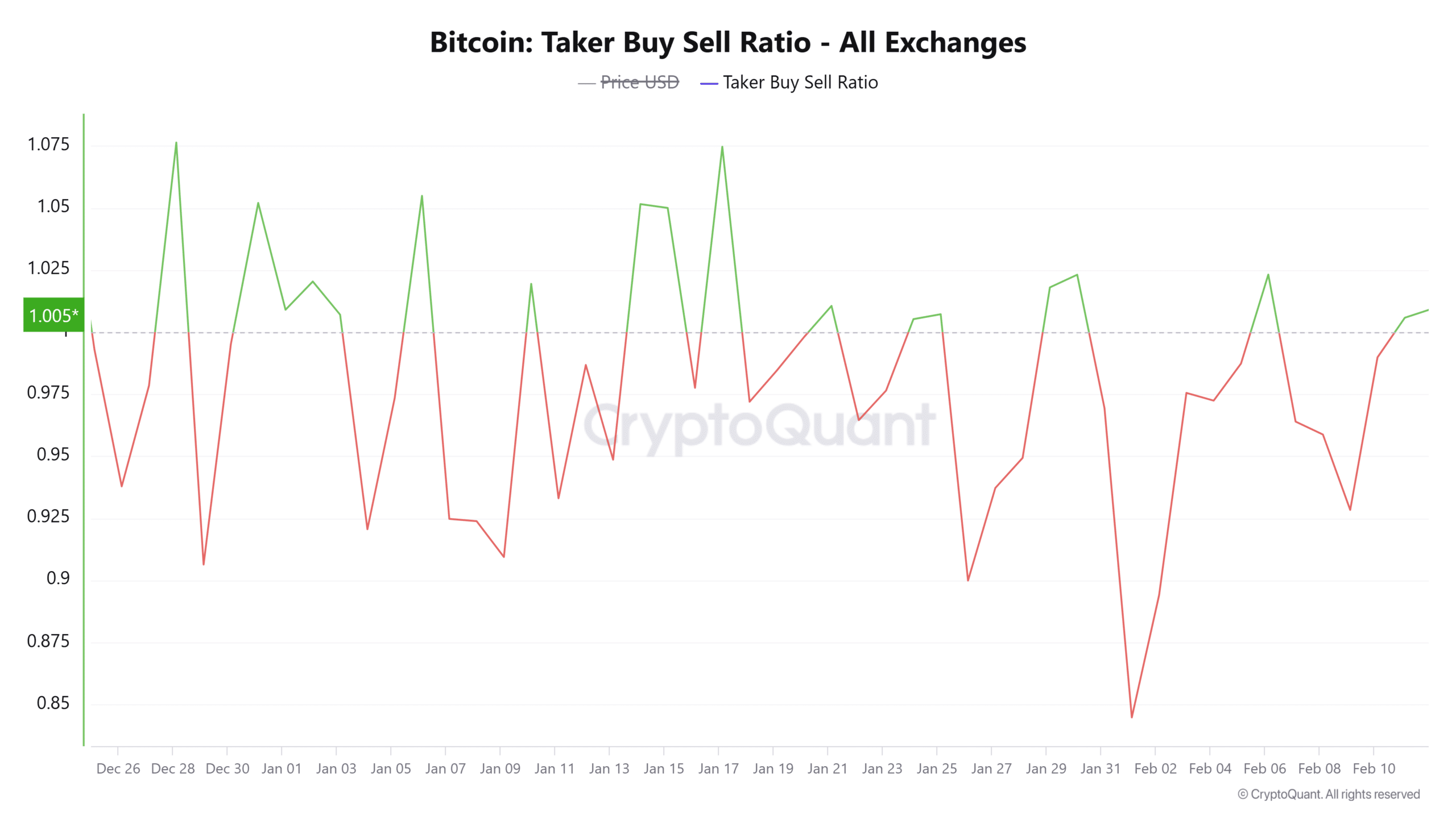

- N/A Golden Cross and Taker Buy/Sell Ratio suggested against Overbought conditions and moderate buying pressure

Bitcoin [BTC]at the time of writing seemed to be Testing crucial support levels, in which traders are now closely monitoring signs of a potential outbreak or withdrawal. With a value of $ 97,183, the world’s largest cryptocurrency has been increased by slightly less than 1% in the last 24 hours.

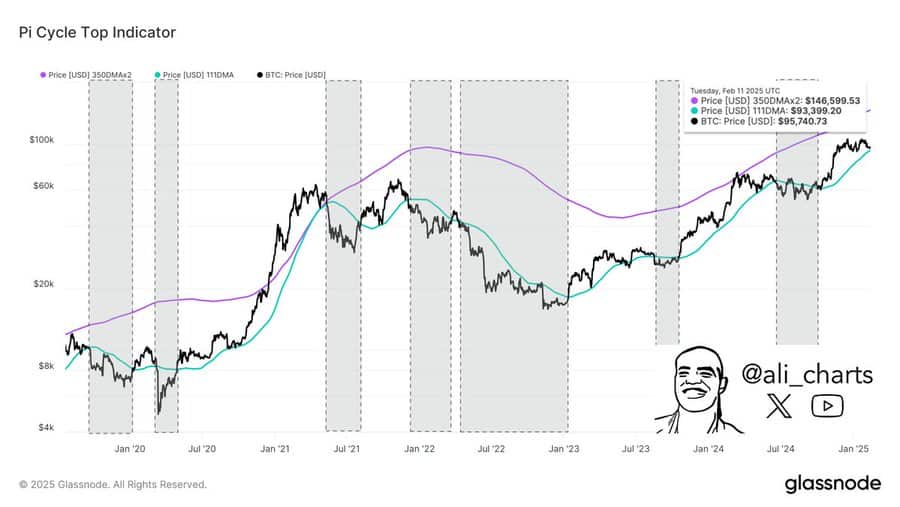

In the charts, the $ 93,400 level is marked by the 111-day advancing average. This level has historically seen as an important support and its behavior could determine Bitcoin’s next step. Will Bitcoin keep stable with this threshold, or is it ready for another wave?

What is the next step for Bitcoin’s price?

Bitcoin currently consolidates under the $ 101,900 resistance zone. Despite different attempts to break this level, Bitcoin has not been able to retain a price above in recent weeks. As a result, Bitcoin has formed a symmetrical triangle – a pattern that often refers to a considerable price movement.

If Bitcoin breaks above $ 101,900, this can quickly rise to higher resistance levels, which may start a different rally.

However, not breaking this resistance can lead to a pricebackback, testing the support zones of $ 93,400 and $ 97.170. That is why traders must follow these levels closely on an indication of an outbreak or a reversal.

Source: TradingView

N / a golden cross – should traders be careful?

Bitcoin’s NVT Golden Cross -indicator climbed 28.21%for the past 24 hours, according to Cryptuquant analysis. Such a change means that Bitcoin may entail overbought territory. Especially since the values of the NVT had also exceeded 2.2.

Historically, such levels have often indicated local tops that can be followed by price corrections.

Nevertheless, Bitcoin could continue his bullish momentum if the demand remains strong. So this indicator alone may not be enough to predict an immediate reversal. Although caution is needed, Bitcoin can also continue his rise, depending on the strength of the market.

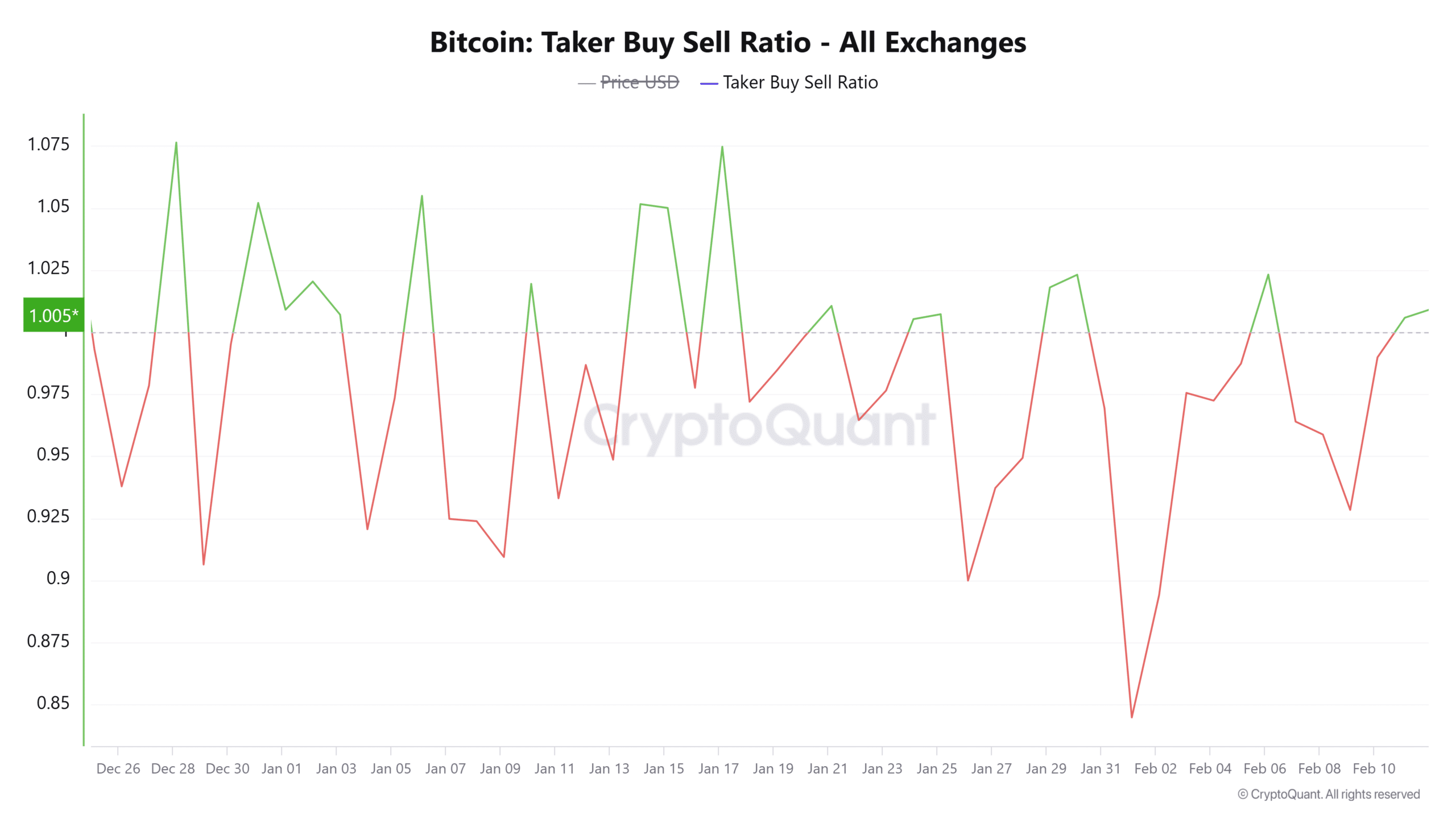

Taker Buy/Sell Ratio – Is buying pressure structure?

The Taker Buy/Sell Ratio also rose by 0.95% in the last 24 hours and showed a slight increase in purchasing pressure. Although the ratio was lower than 1, it suggested that more than sales activities.

If this trend continues, Bitcoin can see Opterse Vaart on the charts. However, if the sales pressure intensifies, Bitcoin can be confronted with a reversal, so that the most important support zones are re -tested. That is why Marktson’s will play a crucial role in determining the next step of Bitcoin.

Source: Cryptuquant

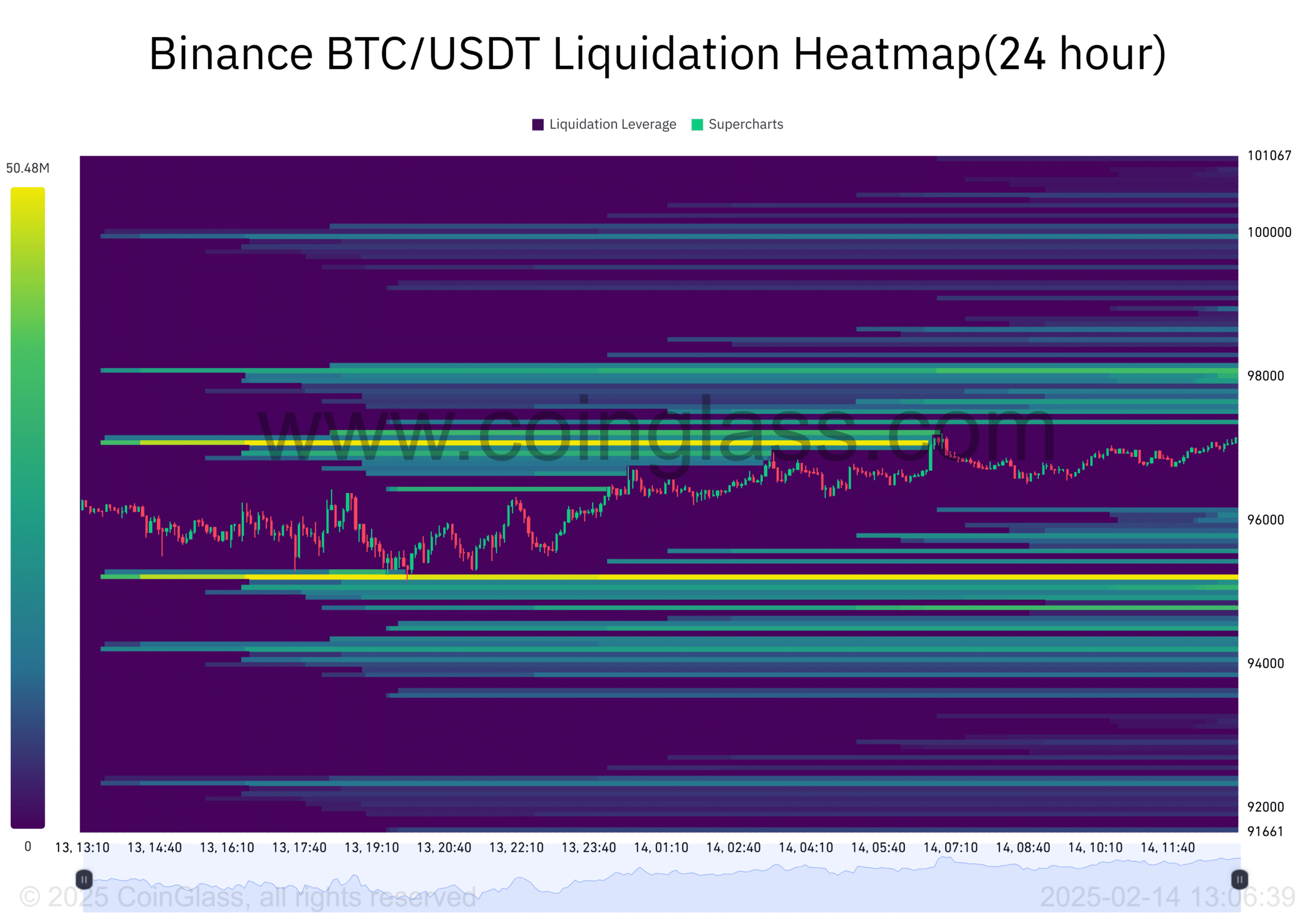

What do you reveal liquidations?

Bitcoin’s liquidation heat revealed a considerable concentration of liquidations on the support level of $ 93,400 and the resistance of $ 97,170. If Bitcoin falls further, liquidations can accelerate, so that a potential rebound is fueled.

On the other hand, a push above the resistance of $ 97,170 can cause long liquidations, increasing the upward price pressure.

Source: Coinglass

At the time of the press, Bitcoin remained close to the crucial level near $ 97.170, with several indicators pointing to possible volatility. The NVT Golden Cross also seemed to warn about overboughtal conditions, whereby the Taker Buy/Sell Ratio underlines that underlines a moderate buying pressure.

Given the liquidation heat jap and current market conditions, Bitcoin is more likely to test his support before he decides. That is why Bitcoin’s next step will be a test of the most important support levels, with potential for a rebound or an outbreak shortly thereafter.