- Bitcoin’s spot demand is falling sharply, making it vulnerable for further down, with bearish sentiment rises

- The Futures market showed increasing short positions, which strengthens the Bitaris prospects for Bitcoin in the midst of global uncertainties

Bitcoin [BTC] is confronted with renewed sales pressure, because the demand on the spot market is shrinking with the fastest rate since July 2024.

Data on chains Unveils a significant contraction of the apparent demand, reducing liquidity on buy-side and making it active more vulnerable for downward price movements.

In the meantime, traders in the Futuresmarkt are increasingly opening short positions and strengthen a bearish prospect. With both spot demand decreasing and bearish sentiment that dominates the derivatives market, the price of Bitcoin has difficulty finding support.

Spot demand plums

Bitcoin’s spot demand plays a crucial role in maintaining the stability of the prize by guaranteeing a consistent pressure-side pressure.

When the spot demand decreases, fewer buyers are willing to acquire Bitcoin, which increases the risk of downward price movements.

Source: Cryptuquant

The graph shows a sharp fall in apparent demand from the beginning of 2025 and reaches the lowest point in almost a year. This drop appears to be observed on the pattern in July 2024, when a similar decrease in the spot demand is tailored to a price correction.

During the end of 2024, the positive question mainly drove the Bitcoin meeting. However, the recent negative demand reflects a decrease in market confidence. If this trend persists, Bitcoin can experience extra downward pressure in the coming weeks.

Beerarish bets strengthen the downward trend of Bitcoin

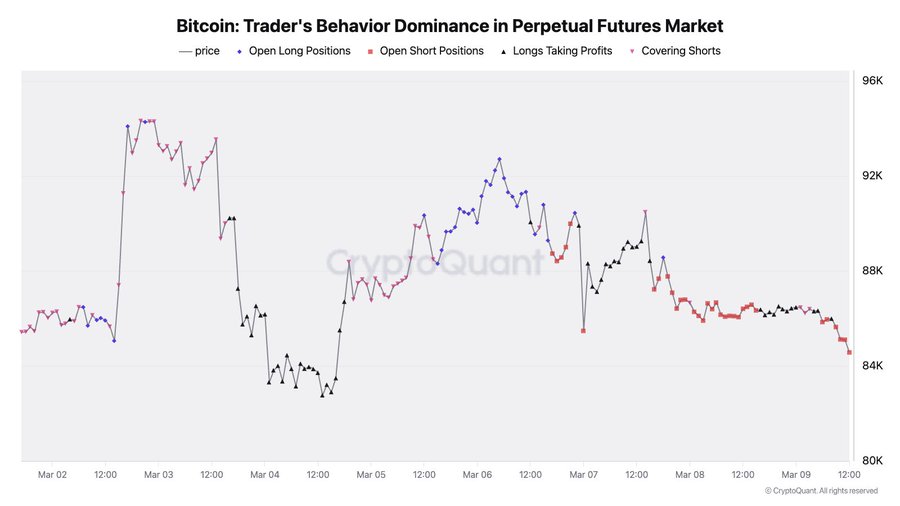

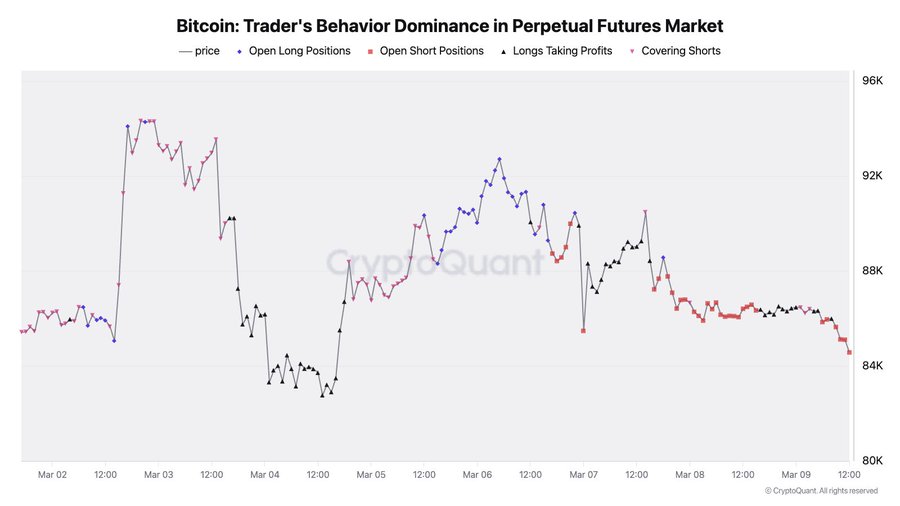

The Perpetual Futures market plays a crucial role in the price action of Bitcoin, because traders use leverage to speculate about price movements.

When long positions dominate, this suggests a bullish sentiment, while an increase in short positions indicates the growing bearish pressure.

Source: Cryptuquant

The data shows that FROM On 3 March there was a noticeable increase in open short positions that matches the price drop of Bitcoin from about $ 96k to less than $ 84k.

This pattern reflects the expectations of traders at further price falls, which strengthens the bearish sentiment. Moreover, the decision of traders with a long position to take a profit indicates that bullish traders close their positions instead of strengthening them.

If short traders do not start covering their positions, the price of Bitcoin will soon continue to experience a downward pressure.

Broader market sentiment

In the past week, Bitcoin’s price fell by around 10.98%and was satisfied with $ 82,211 at the time of writing.

This decline is in line with the increasing global economic uncertainties. President Donald Trump in particular has recognized the possibility of a recession and describes the economy as an important transition.

In addition, escalating trade tensions and worries about China’s deflatory pressure have promoted a risk-averse sentiment, which causes falls on both traditional and cryptocurrency markets.

These factors suggest that the recent price fall in Bitcoin can be part of a broader market trend powered by macro -economic influences instead of an isolated incident.

If these economic uncertainties persist, Bitcoin may be confronted with constant Bearish in the coming weeks. However, positive developments such as favorable changes in the regulations or greater institutional acceptance can restore market confidence and possibly reverse the downward trend.