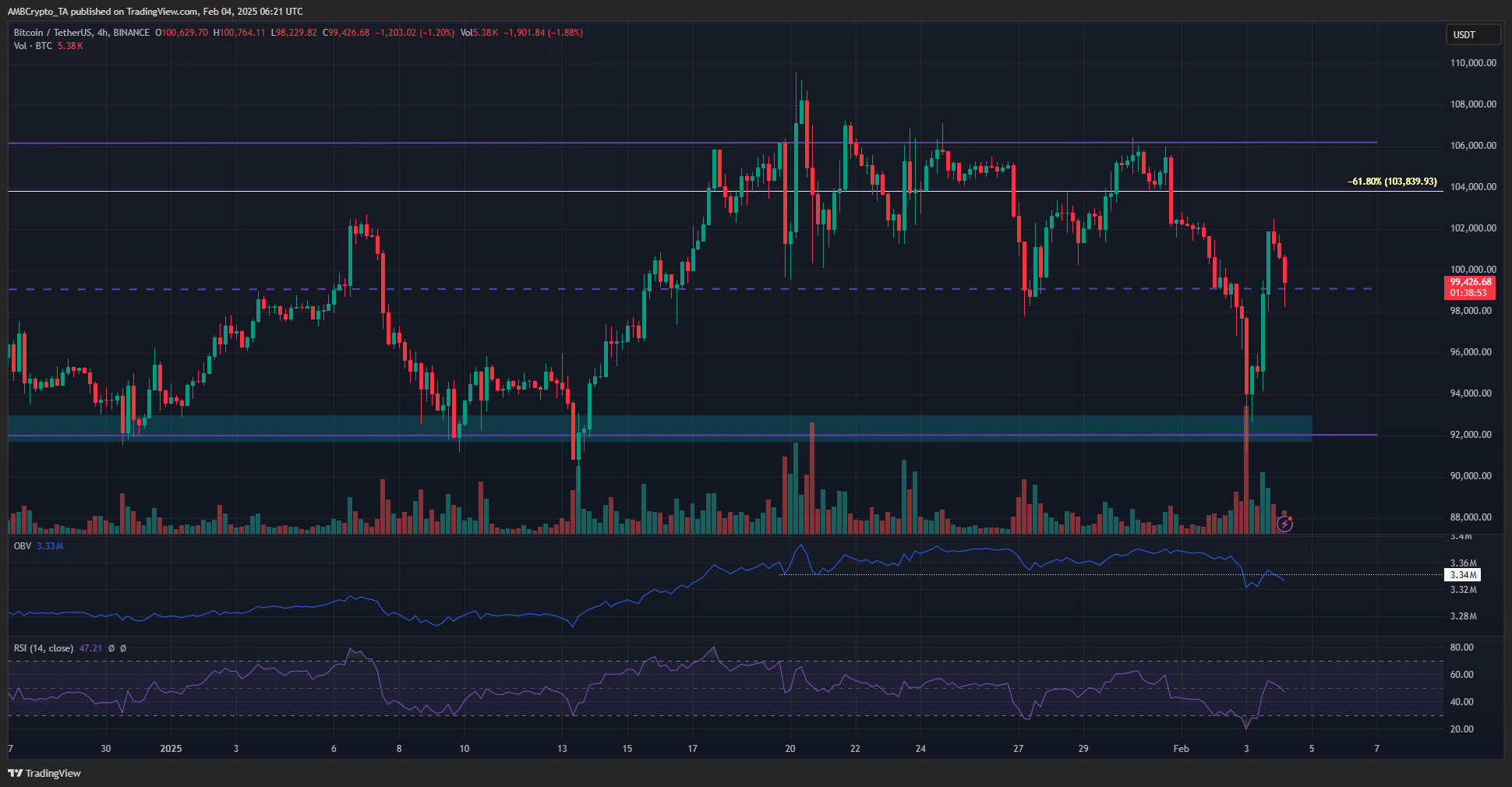

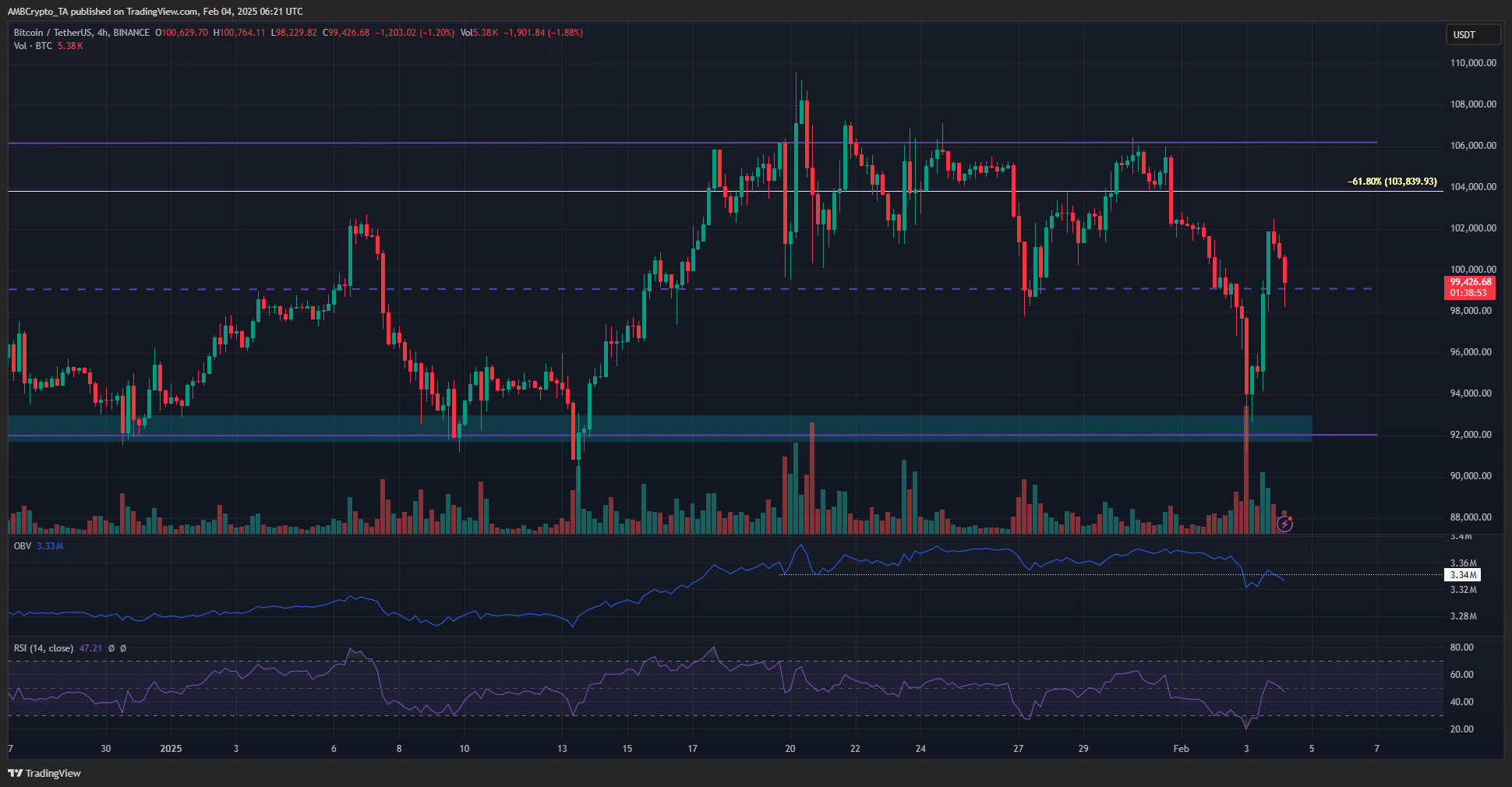

- The Bitcoin 4-hour RSI dived to levels that have not been seen since August.

- The quick response to jump above $ 100k was good for scalp traders.

According to Bybit CEO Ben ZhouThe entire cryptomarkt probably saw a real total liquidation of round $ 10 billion. Bitcoin [BTC] Saw a price fall of 6.6% on 3 February, with the entire crypto market capitalization being destroyed by 11.7%.

Trump’s trade rates rattled the financial markets and the frightening investor sentiment fluctuated the crypto world. However, BTC has since been bounced with just over 8%, so that an important level of support is recovered.

Bitcoin’s RSI can be the designation for …

Source: BTC/USDT on TradingView

The relative strength index (RSI) measures the momentum of an active in the past 14 trade sessions. A RSI above 70 indicates overbought conditions, while lower than 30 sold over.

On January 3, the 4-hour RSI plummeted to 19.76. Earlier the reading fell under 25 in December and until 16 until the beginning of August after BTC fell from just below $ 60k to $ 49k.

Bitcoin’s reaction in the last 24 hours was encouraging. The range of the past two months between $ 92k and $ 106.2k was respected. At the time of the press, the medium -range level functioned at $ 99.1k as support.

After falling to test the $ 92k support zone, Bitcoin quickly bounced higher and got $ 102.5k. The RSI went back above neutral 50. In the past hours it has immersed 3%, but it remains above the center range.

Read Bitcoin’s [BTC] Price forecast 2025-26

Although the price promotion remained above the most important support zones, the OBV has made a new lower low compared to the past month.

This showed that the increased sales volume has shifted the bias in favor of the bears for the past 36 hours.

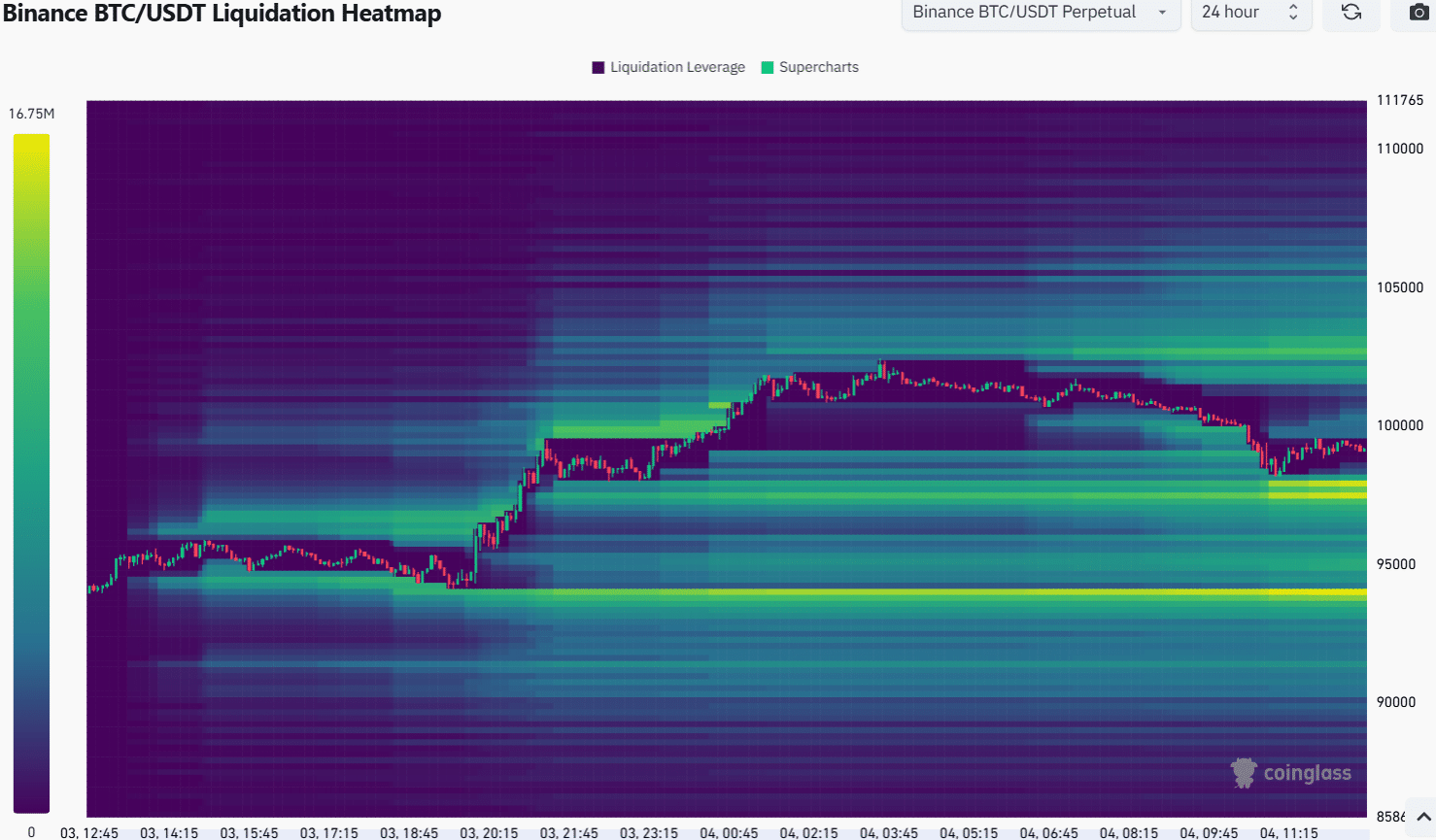

The 24-hour liquidation heat showed that the $ 97.5k and $ 94k were the direct goals. In general, Bitcoin’s fast bullish reaction was a positive sign for investors.

Yet a decrease up to $ 94k $ 95k was still possible and traders have to be prepared.

Disclaimer: The presented information does not form financial, investments, trade or other types of advice and is only the opinion of the writer