- BTC acted in a rising wedge, with $ 86,400 as a crucial resistance level.

- An outbreak above $ 86,400 could push BTC to $ 90,000, while a rejection can lead to a drop below $ 80,000.

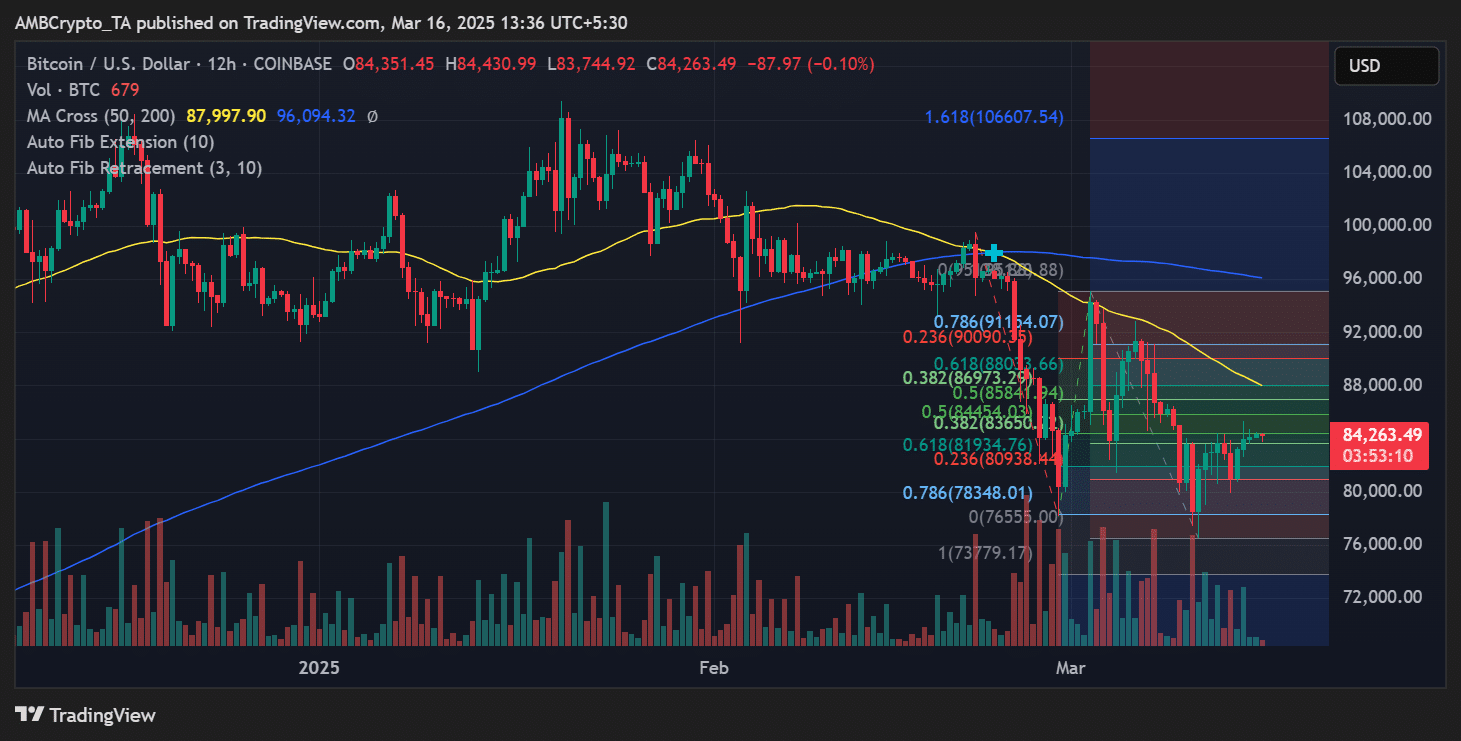

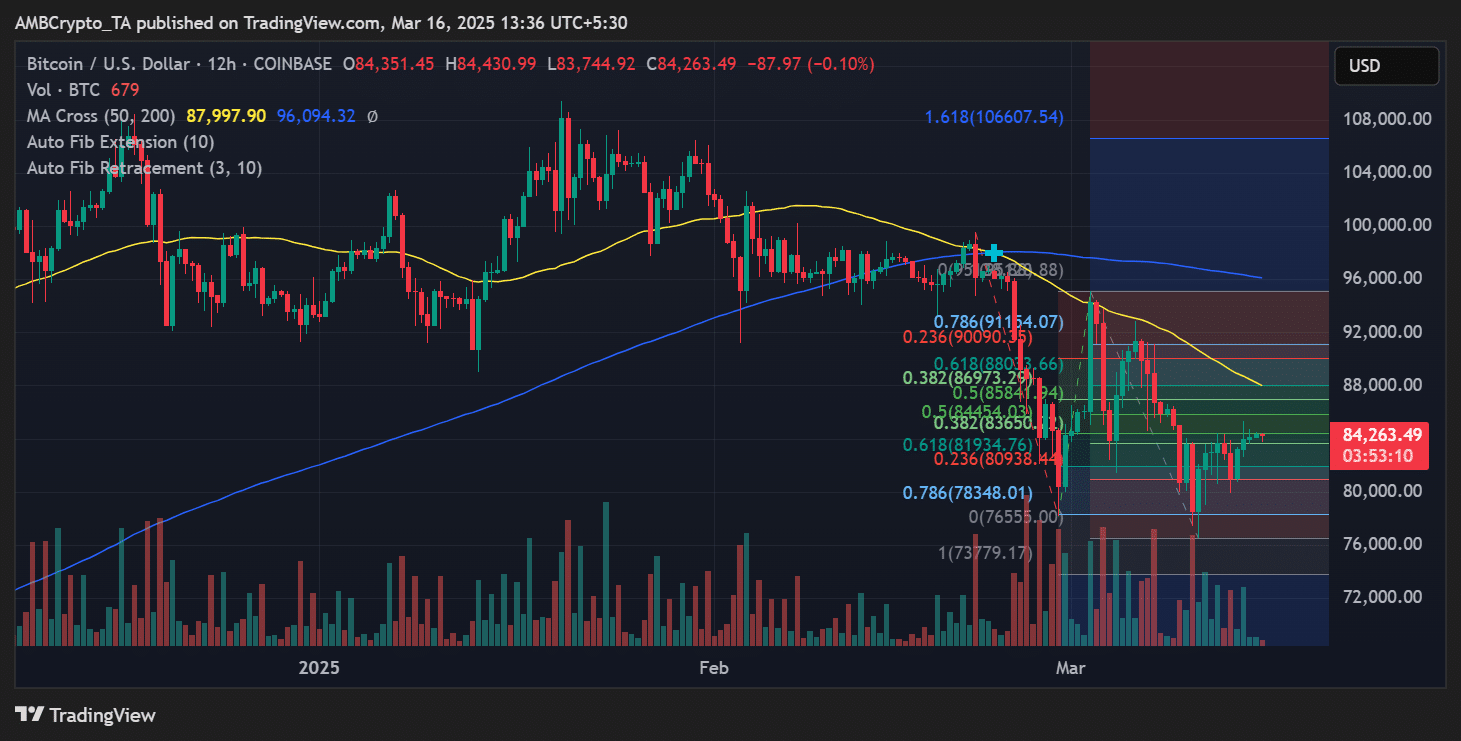

Bitcoin [BTC] Is consolidating within an increasing wedge pattern, with a critical resistance zone that looms up at $ 86,400. The price recently surpassed the resistance level of $ 83,800 and successfully tested it as support.

This level now serves as an important pivot point for the next major movement of BTC.

Traders look closely in the vicinity of the $ 86,400 region, which could dictate the short -term Bitcoin, or confirm an outbreak to higher price levels or cause a reversal of $ 80,000.

Bitcoin’s position in the emerging wedge

The rising wig pattern, visible on the lower timetables, shows Bitcoin trade within an increasing structure. Although this set -up may indicate bullish continuation, it often precedes Bearish Breakouts.

The press price of BTC was $ 84,263, still within the WIG but approached the upper limit. Volume analysis showed a falling activity, which suggests that buyers may lose momentum if Bitcoin approached the resistance.

The RSI [Relative Strength Index] floated around neutral territory, which means that there was no strong overbough or sold -to -sold signal.

However, a rejection can be more likely if BTC pushes to $ 86,400 and the RSI goes to Overbought levels.

Main resistance and support zones

Immediate resistance was at $ 86,400, which remains the most important obstacle. A successful break above this level could see that Bitcoin extends to $ 90,000 and possibly $ 95,000 as the momentum persists.

Large support was at $ 83,800, which was recently tested as support and was crucial for holding the bullish structure of Bitcoin. If this level fails, BTC can visit $ 81,700 again and possibly below $ 80,000 dives.

Source: TradingView

Fibonacci levels indicate that the 0.618 retracement level is in line with almost $ 86.900, which further strengthens the resistance zone.

On the other hand, the level of 0.786 at $ 78,300 can serve as strong support if BTC does not hold above the WIG.

What happens when BTC breaks the WIG?

A clean outbreak above $ 86,400 would make Beerarish invalid, which leads to a bullish run to $ 90,000 or higher.

However, if BTC does not retain the wedge structure, this can lead to a sharp fall, with initial adhesive goals near $ 81,700 and $ 78,300.

Market participants must keep a close eye on the volume of volume and RSI behavior to assess the breakout strength.

Bitcoin is currently at a crucial point, with traders pending a confirmation of whether the resistance will hold or break. In the coming days, it will be crucial in determining the next Grand Price Movement of BTC.