- Bitcoin is a weekend CME Gap, which feeds speculation on potential post-summit volatility and regulatory results.

- Regular clarity on stablecoins or Bitcoin reserves can stimulate bullish momentum, whereby key resistance is bridged near $ 87,000.

Bitcoin have seen Bitcoin in recent weeks [BTC] Loss steam on the way to the weekend, but this time Bitcoin wore the momentum from Friday to Saturday.

Crypto analyst Daan Crypto Trades marked An unusual step in the Bitcoin price action that could influence the coming trade week.

Source: X

It indicated a potential gap that is in between Bitcoin’s Friday cme close from $ 84,258 and the current price, against the press of around $ 86,000 – an increase of approximately 2% at the weekend.

This shift is only a few days for The very first Crypto summit of the White House, planned for March 7, where President Donald Trump will organize Top Crypto leaders and policy makers to discuss the Stablecoin regulation, Bitcoin reserves and digital assets supervision.

Although markets are always looking for catalysts, the question remains whether this event is really the Bitcoin process, or is it just another policy meeting with little immediate impact?

Stablecoin & Bitcoin Reserve Regulation are central

Although specific details about the top agenda remain scarce, Stablecoin regulation and a potential American Bitcoin reserve are important policy themes.

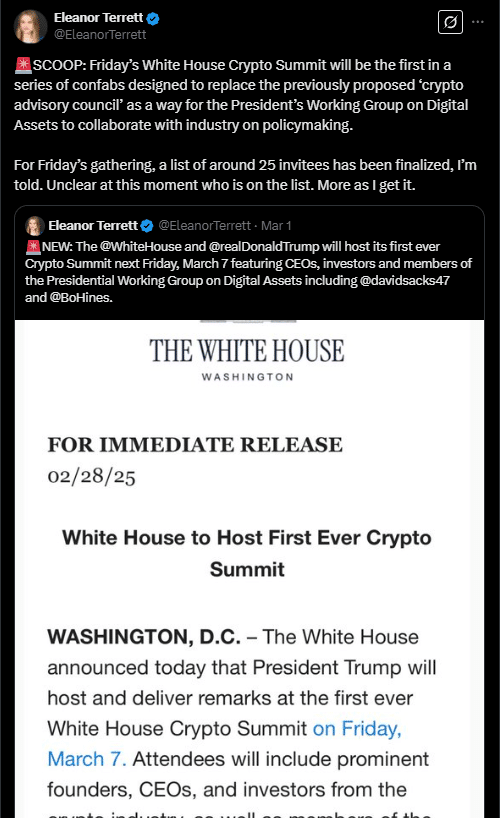

According to Fox Business Journalist Eleanor TerrettThe top will not be a one -off event. Instead, it is the first in a series of meetings to replace the proposed ‘Crypto Advisory Council’.

Source: X

The White House event follows a phone call from Jeremy Allaire, CEO of Circle, who recently argued that Stablecoin must be manditents to register in the US

His comments came when Senator Bill Hagerty introduced legislation aimed at regulating Stablecoins. A movement that could have important implications for USDT and USDC -Dominance in the global markets.

In addition, Paolo Ardoino, CEO of Tether, tweeted Cryptic,

“Excited for next week. Something is going to change. “

Stablecoins are already central to the crypto economy of Brazil. President of the Central Bank Gabriel Galipolo states that 90% of the crypto transactions of the country include Stablecoins.

If the US reinforces supervision, the market can see a shift in liquidity flows, especially since Tether (USDT) continues to dominate the volumes of the Stablecoin worldwide.

In the meantime, the idea of a Bitcoin reserve at state level wins. According to Miles Deutscher, 18 US states are actively working on Bitcoin Reserve proposals, with 13 already under legislative assessment.

Source: X

The top could indicate whether the federal government will embrace a similar policy – whether Bitcoin leaves adoption to the state legislators.

Market speculation builds at the top

The price promotion of Bitcoin that leads to the event was Volatile.

From 25 to 27 February, Bitcoin fell from a peak of approximately $ 86,000 to a low of $ 78,000, which represents a significant decrease of 9.3% in just 48 hours.

Source: TradingView

This sudden decline led to concern among investors and led to a wave of sales pressure. However, the bearish sentiment was short -lived.

On February 28, Bitcoin organized a remarkable comeback, which increases from his $ 78,000 low back to the $ 86,000 reach – a stunning recovery of 10.3% in one day.

While the calendar changed to March, Bitcoin entered a consolidation phase and traded in a narrower reach between $ 84,000 and $ 86,000.

This period of relative calmness saw trade volumes return to more normal levels, about 30-40% lower than during the volatile days of the end of February.

Now, with CME openings that forms and uncertainty about the clarity of the regulations, the market could react strongly, depending on the results of the top.

If clearer guidelines for Stablecoin arise or if the US indicates openness for Bitcoin reserves, Sentiment Bullish can shift.

Conversely, a lack of substantive action can strengthen the idea that markets are about real policy changes – no political meetings.

What is the next step for Bitcoin?

Bitcoin traders are now confronted with two important scenarios. If the momentum persists, Bitcoin can break more than $ 87,000, an important resistance level that has concluded recent meetings.

A decisive movement that goes beyond this threshold could activate further upside down, making it possible for an extensive rally, because traders anticipate a continued bullish momentum.

On the other hand, if the market sentiment weakens, Bitcoin may have difficulty retaining its current levels.

A failure to keep above $ 86,000 can increase the chance that a withdrawal to the CME gorge could increase $ 84,258, a level that traders often look forward to retracements.

The cryptomarkt is no stranger to hyped political events that do not translate into immediate price action.

However, with the pro-Crypto attitude of Trump, Bitcoin adoption guided by the State and continuous legal shifts, this top can, however, mark the start of a broader policy shift that takes place in the coming months.