- Bitcoin signaled a bullish reversal after retesting the $63,193.80 support level.

- Demand for Spot Bitcoin ETF exceeded new supply.

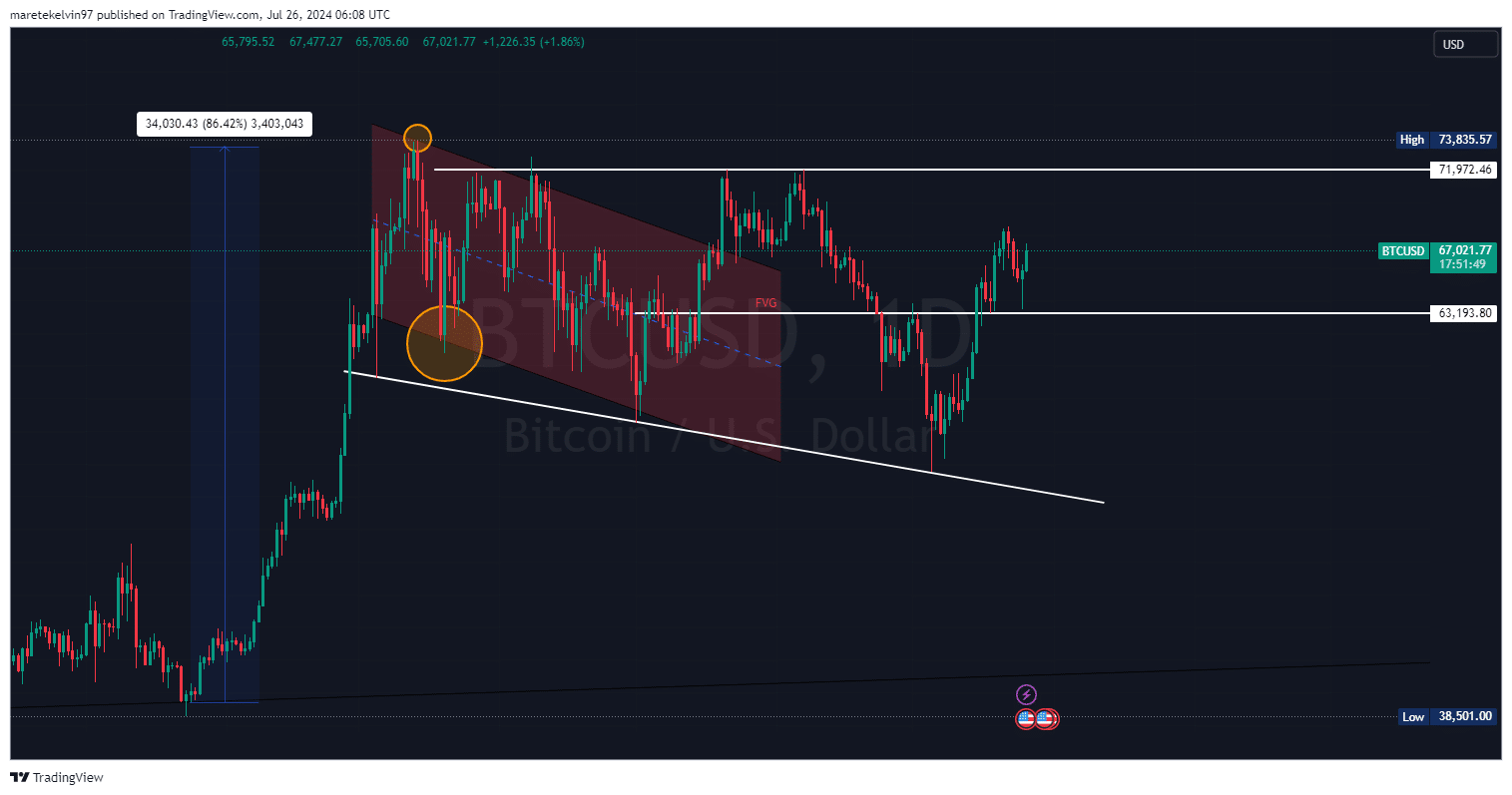

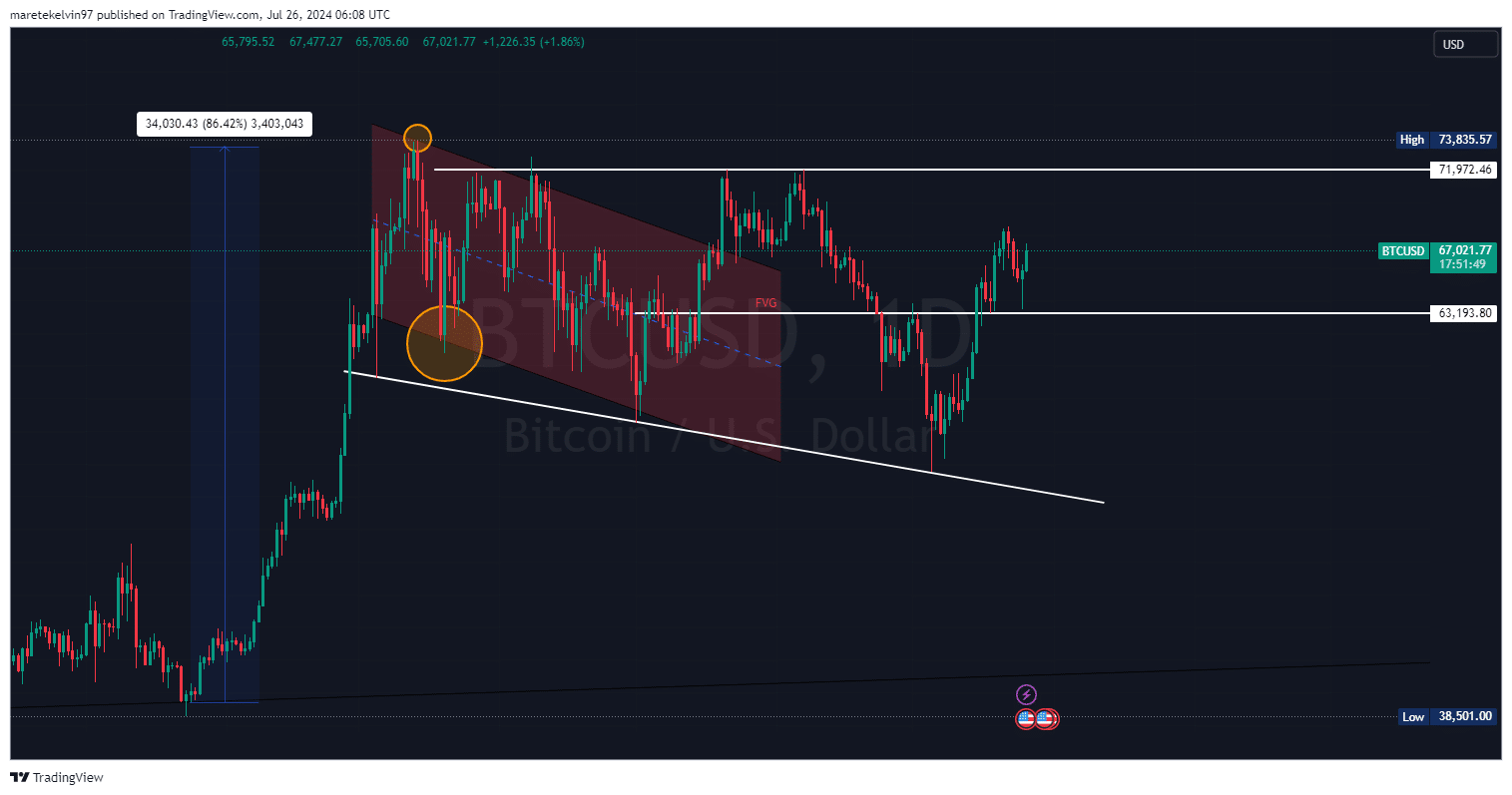

Bitcoin [BTC] has retested a key support level at $63,193.80. This level previously acted as strong support, and the king coin’s ability to bounce off it suggested a potential bullish reversal.

The price movement suggested that Bitcoin had laid a strong foundation for a potential bullish rally.

Bitcoin price was trading at $71,972.46 at the time of writing, which is the next major support level.

Source: TradingView

As can be seen from the chart, BTC could potentially challenge its all-time high of $73,835.57 if the aforementioned resistance level is broken.

Demand for Spot Bitcoin ETF Outpaces New Supply

There are a number of bullish indicators that support the uptrend. One notable indicator has been the rapid growth in demand for spot Bitcoin ETFs, which have outpaced the market supply in this period after the halving.

According to a recent tweet According to crypto analyst Ali, this increase in demand indicated a strong accumulation phase.

This imbalance between the number of coins available and the increased purchasing pressure have created a favorable environment for further price increases.

Source:

Strong foundations

The momentum around the Bitcoin Market Value to Realized Value (MVRV) further supported the positive view.

This indication, according to Glassnode, suggested a continuation of BTC 2024 as investor profitability remained positive. MVRV indicated healthy market sentiment towards BTC in the long term.

Source: Glassnode

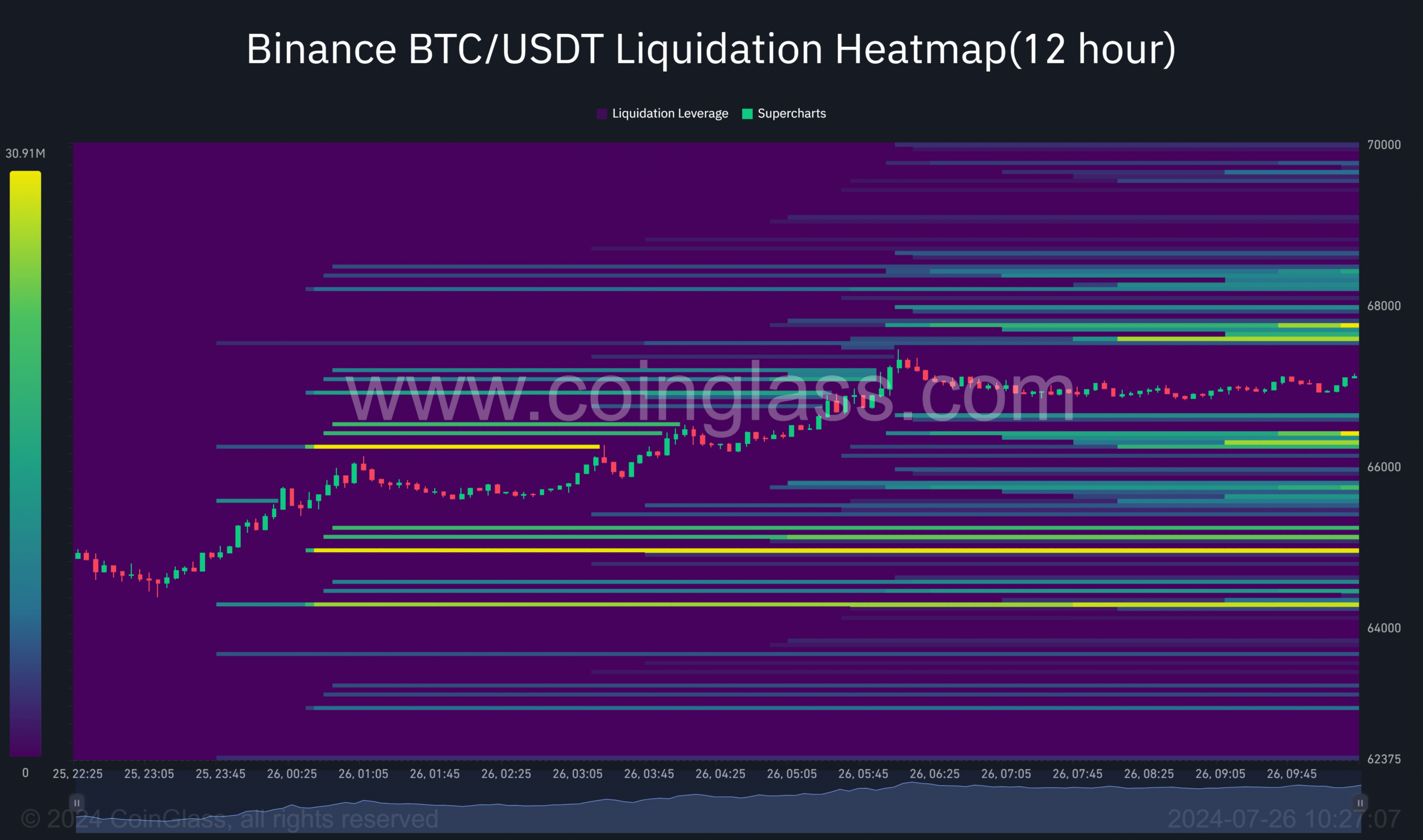

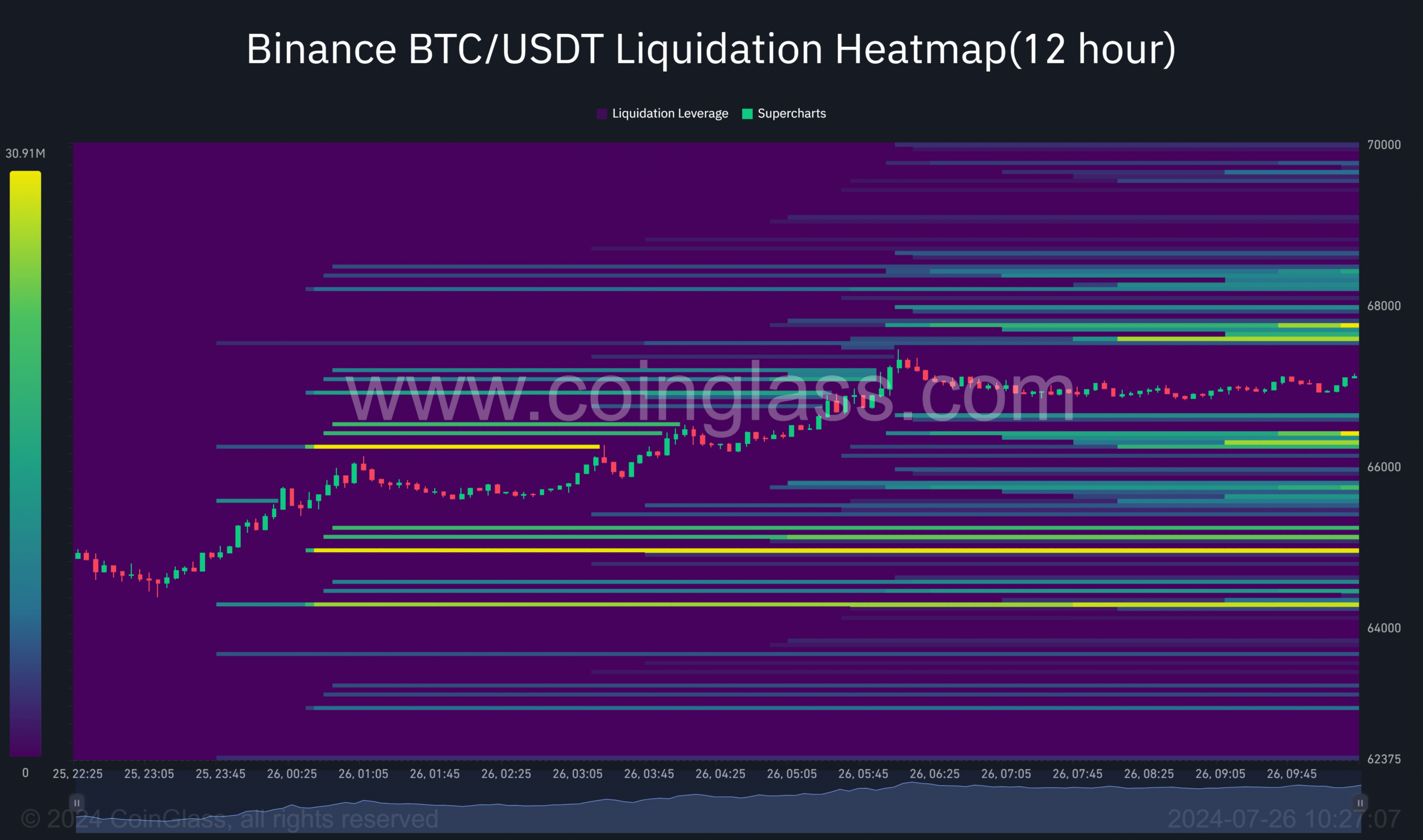

The same analyst had previously reported that Bitcoin could bounce back to $65,200 to liquidate $42.16 million in the short position. These predictions have now come true.

Read Bitcoin’s [BTC] Price forecast 2024-25

At the time of writing, the liquidation heat map showed a bullish bias in the market, showing a potential bullish rally for the King Coin.

Source: Coinglass

Bitcoin’s current price movements, along with strong demand and positive investor sentiment, indicate a bullish phase ahead. The support level at $63,193.80 is a solid stage for further gains.