- According to the founder of a crypto hedge fund, a drop in BTC to $52,000 or $45,000 would be normal.

- Despite the BTC dump, cycle top indicators indicated there was more room for growth.

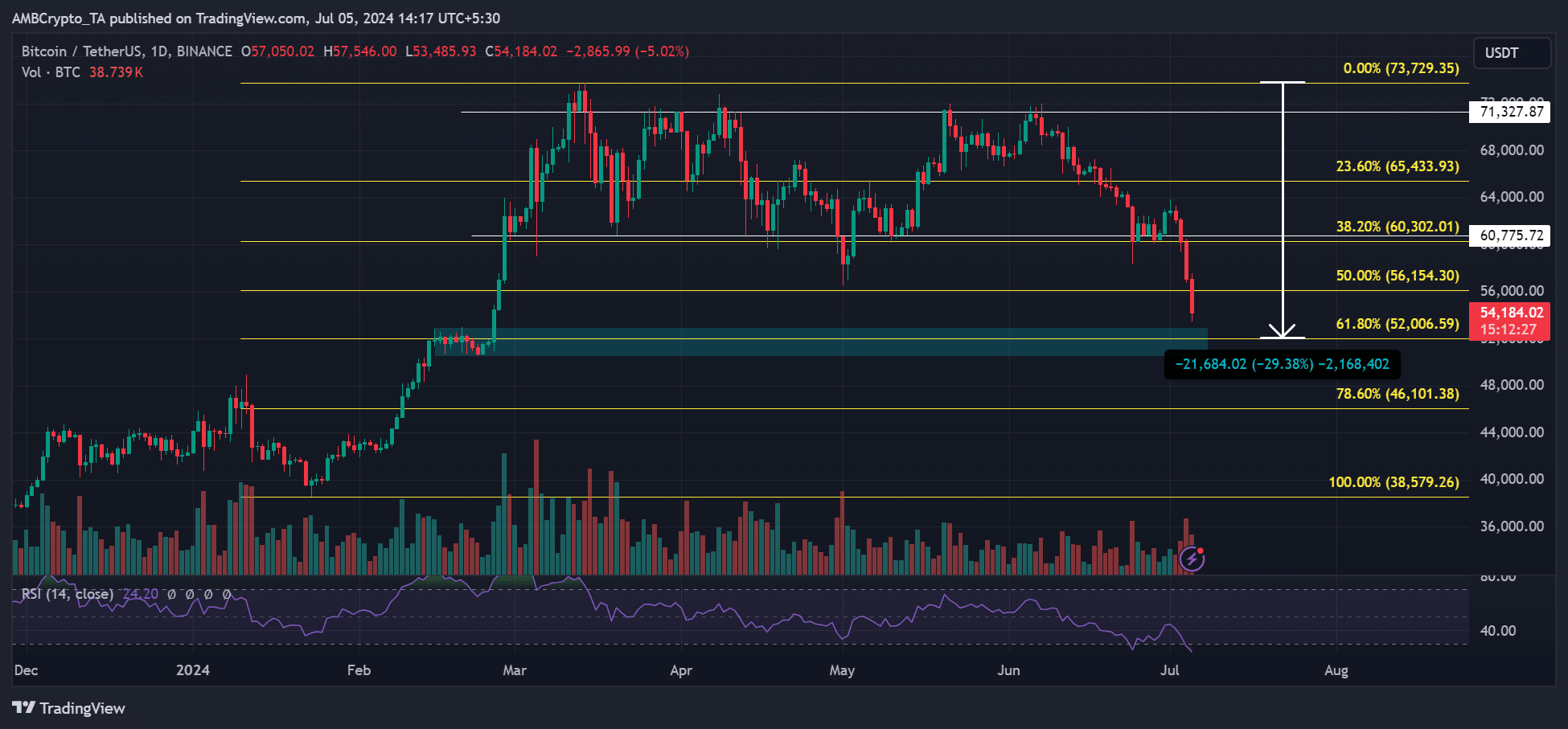

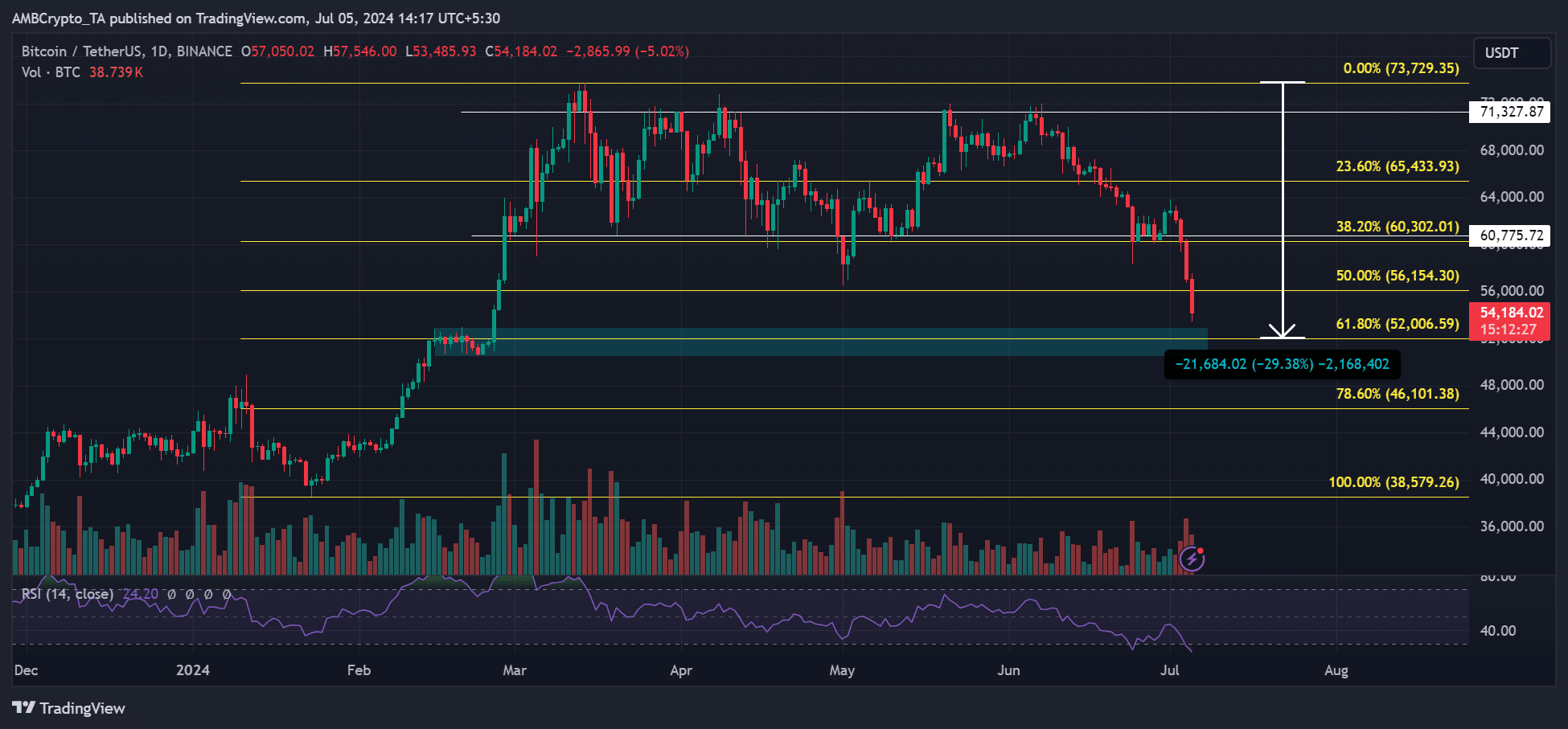

Bitcoin [BTC] fell 13% on the weekly charts and traded below $55,000. This week’s dump wiped out most of the significant gains from the first quarter following the approval of the US spot BTC ETF.

This decline has worried the market, with some insinuating that the bull run may be over.

However, crypto hedge fund Capriole Investments founder Charles Edwards claimed the mess was ‘normal’.

“$52,000 or $45,000 would be a normal bull market pullback of 30-40%.”

BTC has lost nearly $20,000 from its March high of $73.7K to its recent low of $53.4K. That’s a decrease of about 26%.

A further decline into the consolidation zone (indicated in cyan) in February would translate into a 30% decline.

Source: BTC/USDT, TradingView

In the stock market, a decline of 5-10% can be considered a pullback. Anything above that would confirm a downtrend.

However, according to Edwards, this may not be the case for BTC. As such, the $50,000 psychological level could be a key target to keep an eye on.

Will the bull get run over if Bitcoin falls towards $50,000?

Interestingly, according to market observers, the negative market sentiment was related to the sell-off of Mount Gox and German Bitcoin.

Some have welcome the sell-off as a great way to mop up the impending supply glut for an even bigger tailwind in the third quarter of 2024.

“As we get to the end of Q3/Q4, with seasonality, elections and liquidity, presumably on the crypto side, there will no longer be large supply gluts that have been looming over the market for years.”

But it appears that Mount Gox’s distribution may be delayed. A update on July 5 indicated that other creditors could wait longer for refunds.

The defunct Japanese exchange has 141.6K BTC, worth about $7.6 billion based on current prices, to offload. The time has come on July 5 moved $2.7 billion and forwarded BTC worth $148 million to Bitbank.

Source: Arkham Intelligence

Will the market see relief if Mount Gox delays repayments to other creditors? That remains to be seen.

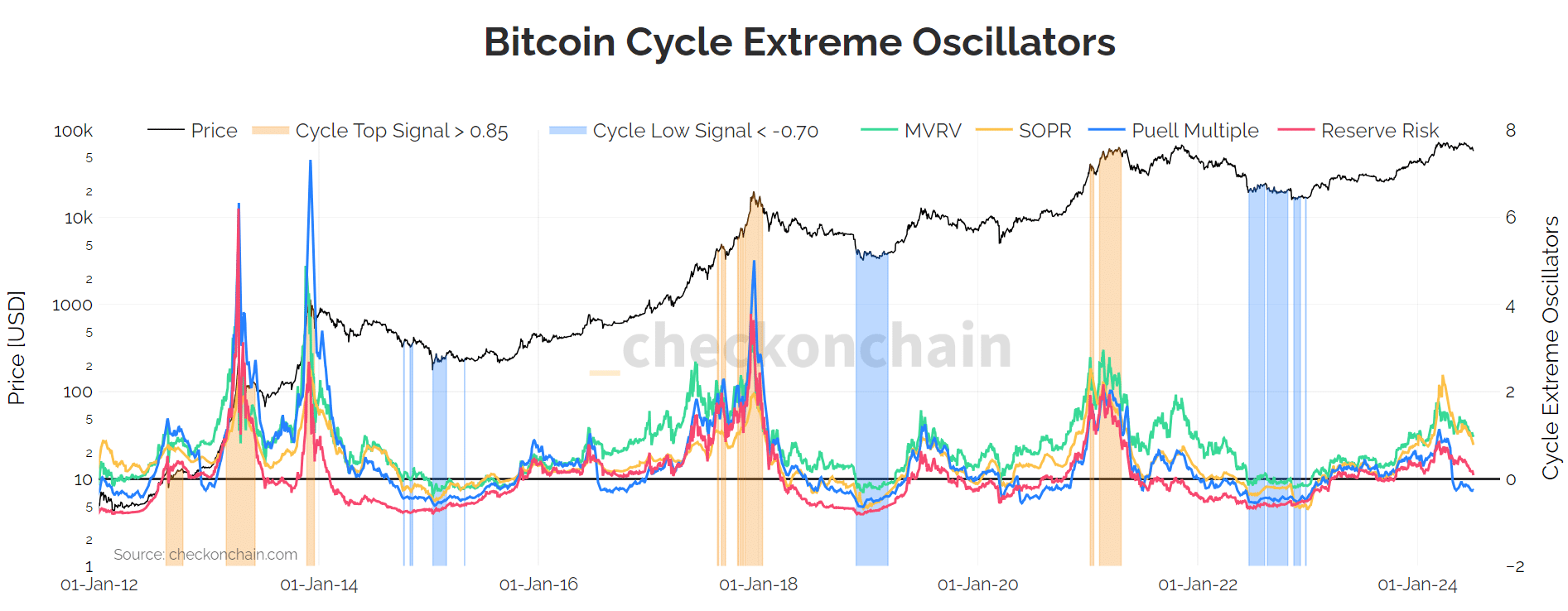

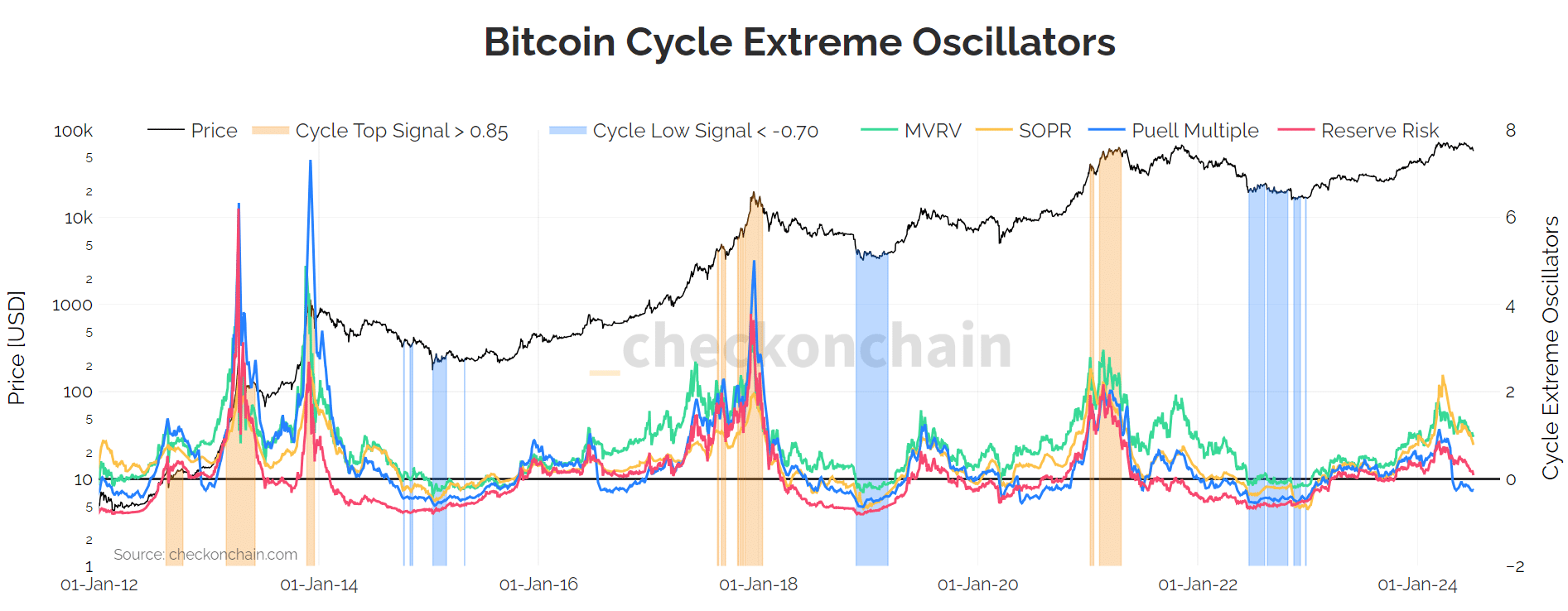

In the meantime, despite the negative sentiment, BTC still has some room to grow. Historical price chart data indicated that a market top could be likely in late 2025.

By the way, a collective of major BTC cycle top indicators was not yet overheated to indicate that the top was in.

Source: checkonchain

Key metrics like MVRV (Market Value to Realized Value) and even Puell Multiple, which measures miners’ profitability, were not at extreme levels. As such, it suggested that BTC had a little more room for upside potential.