- Whale activity around Bitcoin has remained high over the past seven days

- Technical indicators pointed to a few days of low volatility

After a significant increase in value on April 19 Bitcoin [BTC] within hours of the much-anticipated fourth halving, it flashed red again. In the meantime, however, the whales have stepped in by increasing their accumulation and building on their existing holdings.

Bitcoin whales are active

Hours before the halving, the crypto’s price action turned bullish as its value rose above $65,000. However, the scenario changed soon after the episode took place.

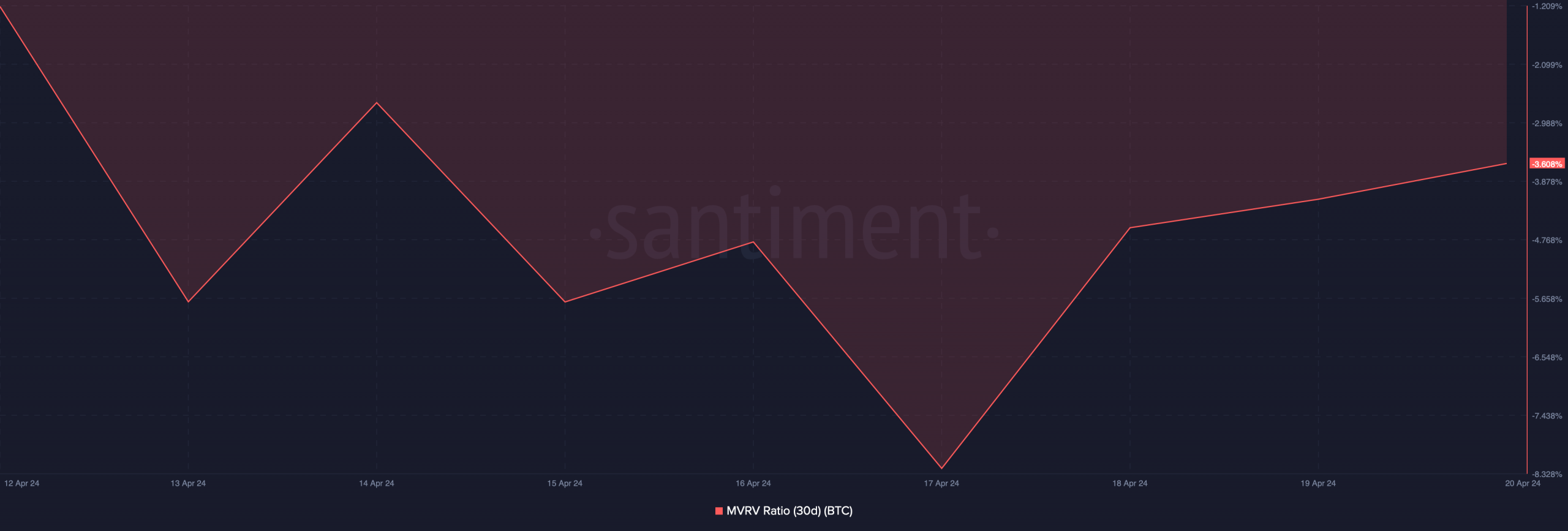

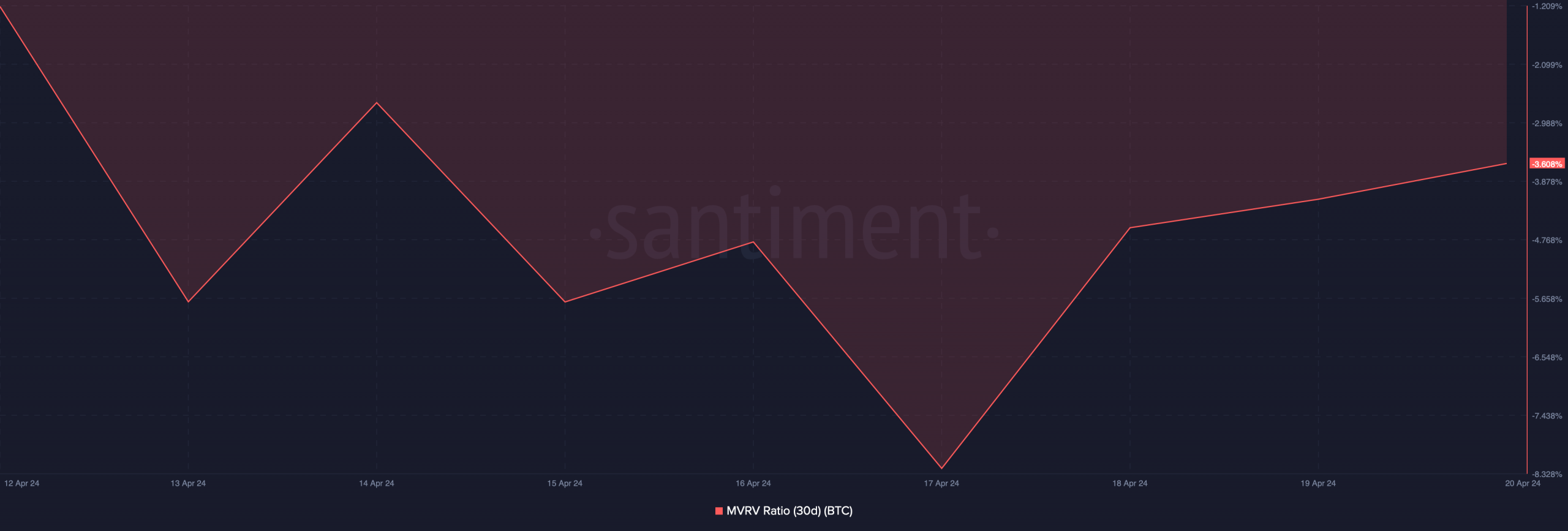

At the time of writing, Bitcoin was trading at $63,777 with a market cap of over $1.2 trillion. Here it is interesting to note that BTC’s MVRV ratio has increased in recent days, which means more investors are now making profits.

Source: Santiment

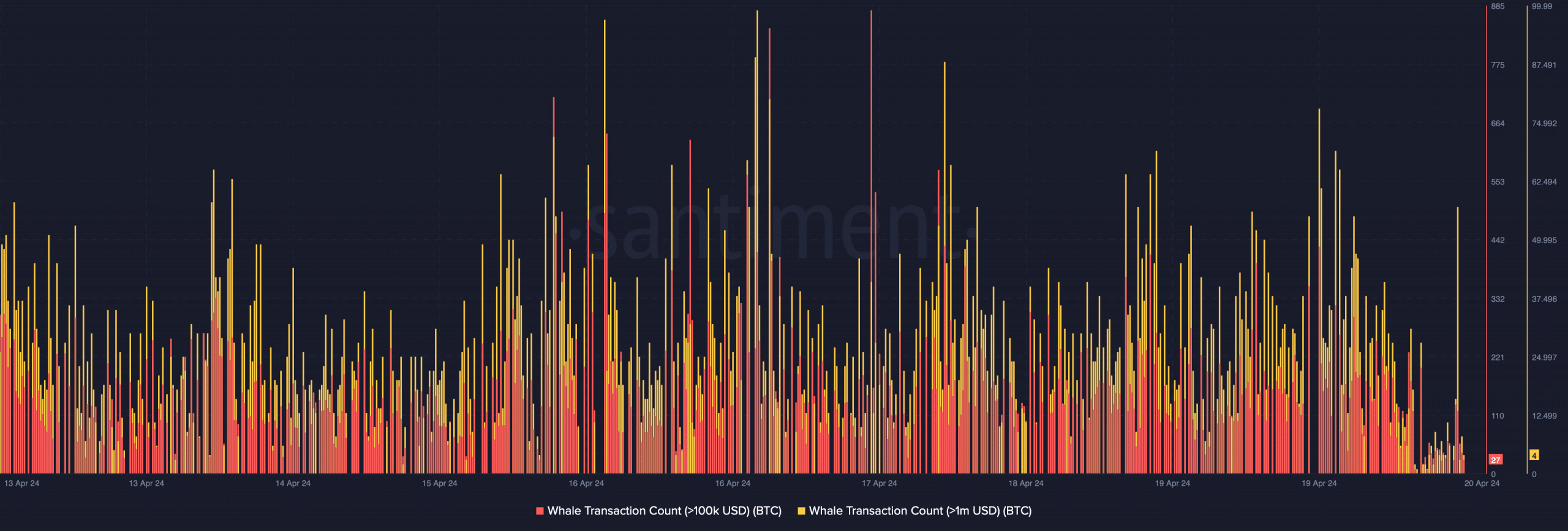

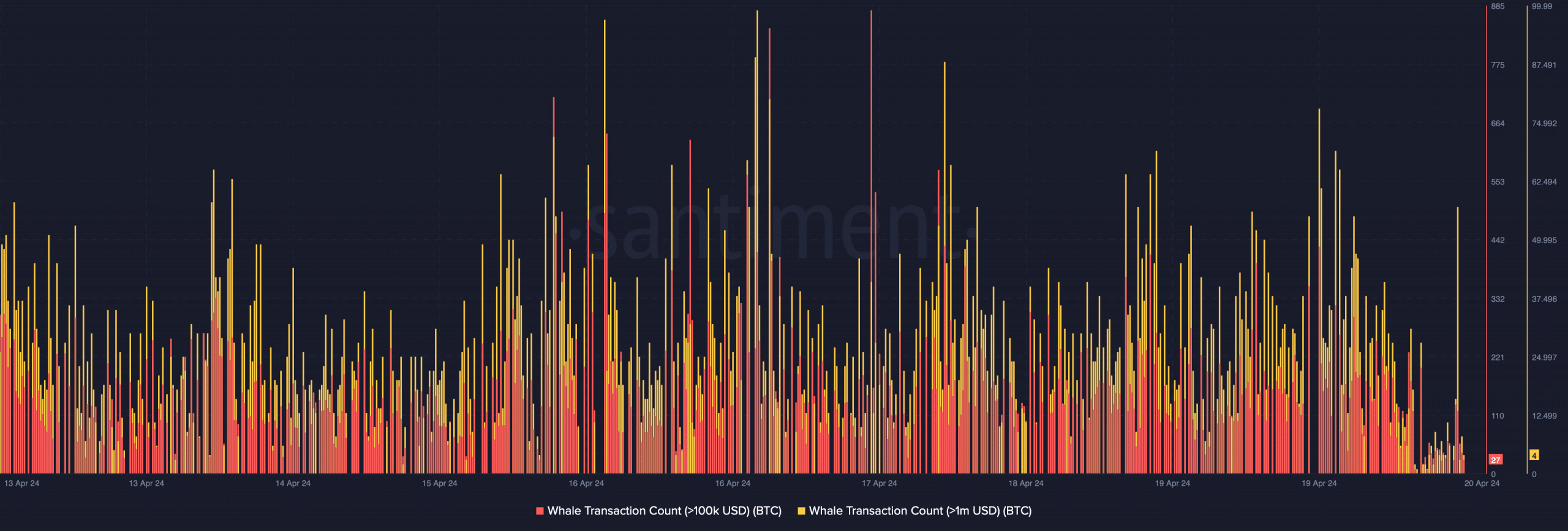

As the price remained volatile, the top players in the crypto space took advantage of the opportunity to buy. In fact, according to a recent one tweet from IntoTheBlock, the largest Bitcoin holders, who control more than 0.1% of the total supply, have collectively added 19,760 Bitcoins to their holdings at an average price of $62.5k.

AMBCrypto’s analysis of Santiment’s data also revealed that whale activity around BTC soared, as evidenced by the increase in whale transactions.

Source: Santiment

Will Buying Pressure Make BTC Turn Bullish?

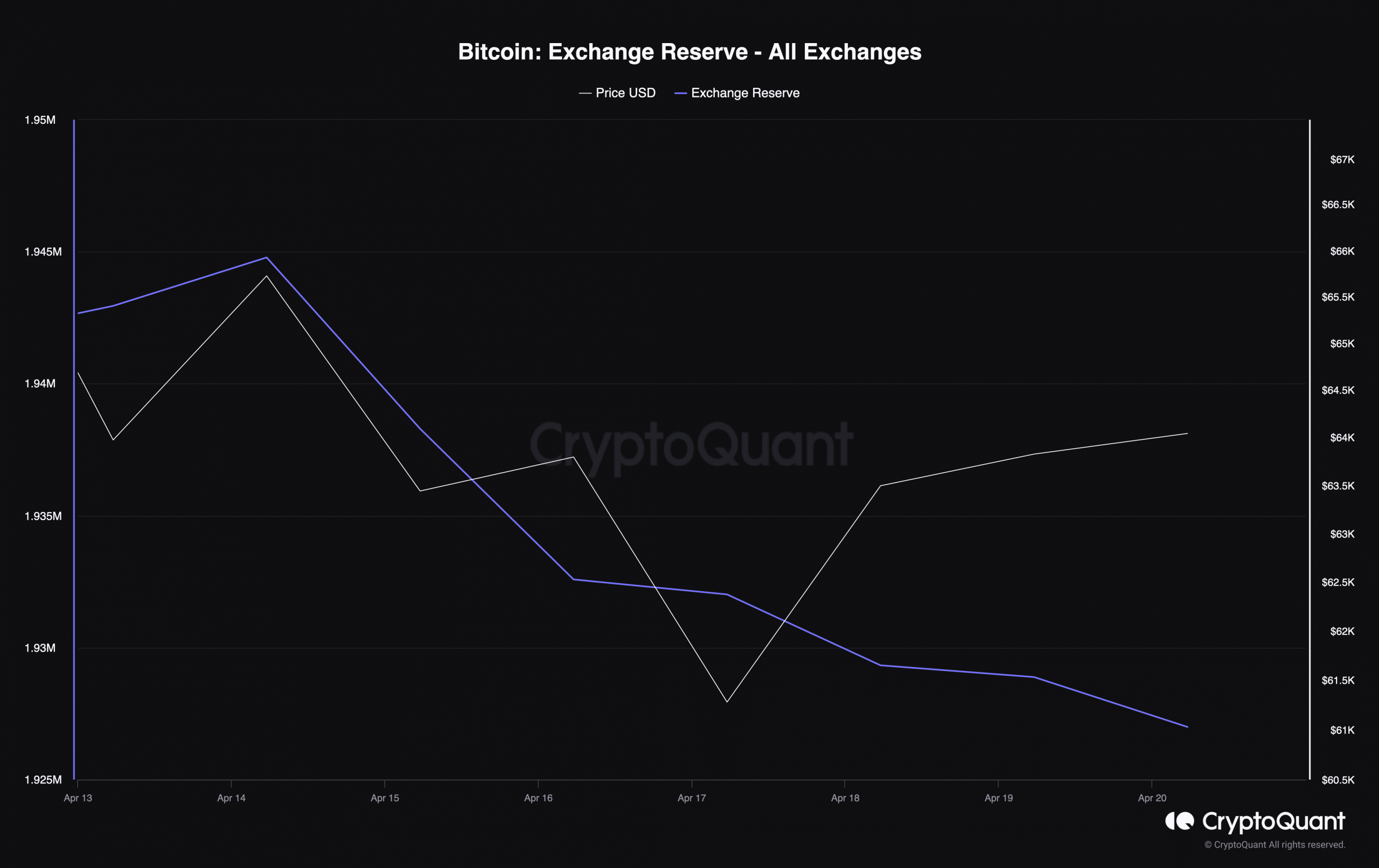

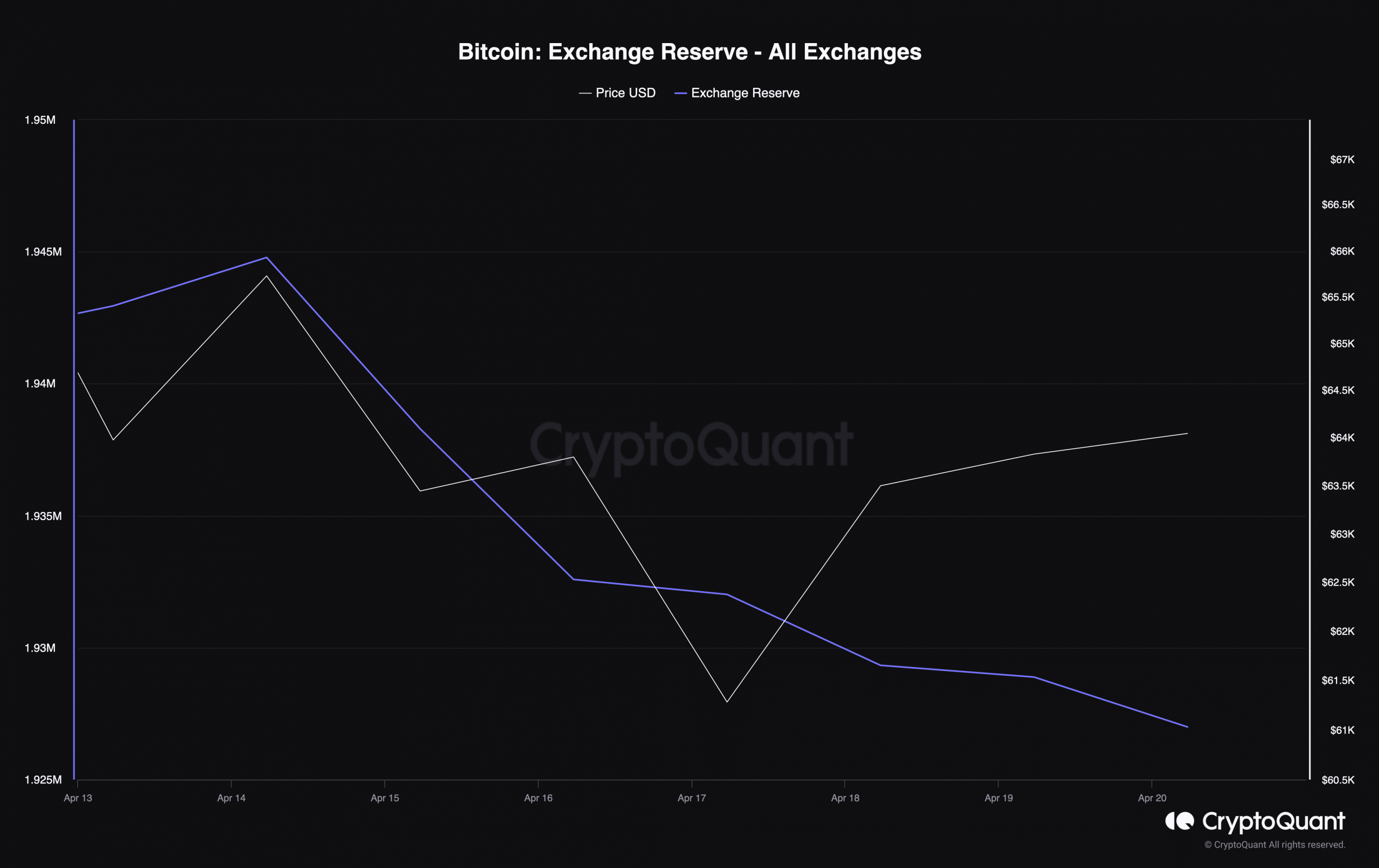

AMBCrypto then looked at CryptoQuant’s facts to find out whether the buying pressure on BTC is high or not. We found that Bitcoin’s foreign exchange reserves have fallen sharply over the past seven days.

At the time of writing, Bitcoin’s foreign exchange reserves stood at 1.92 million BTC.

Source: CryptoQuant

Additionally, both Coinbase Premium and BTC’s Funds Premium were green, meaning buying sentiment was dominant among US and institutional investors. However, it may take some time for rising demand to translate into a bull rally as some other data looked bearish.

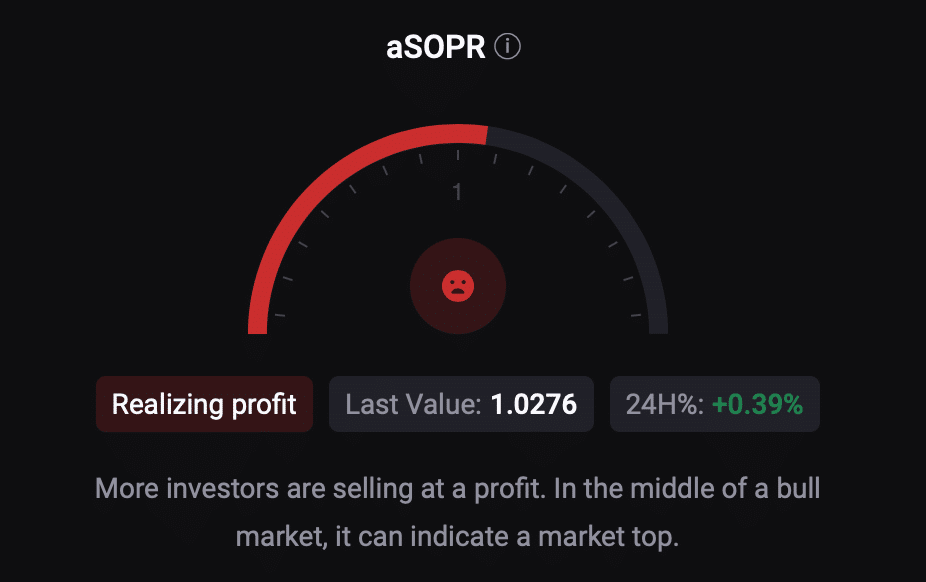

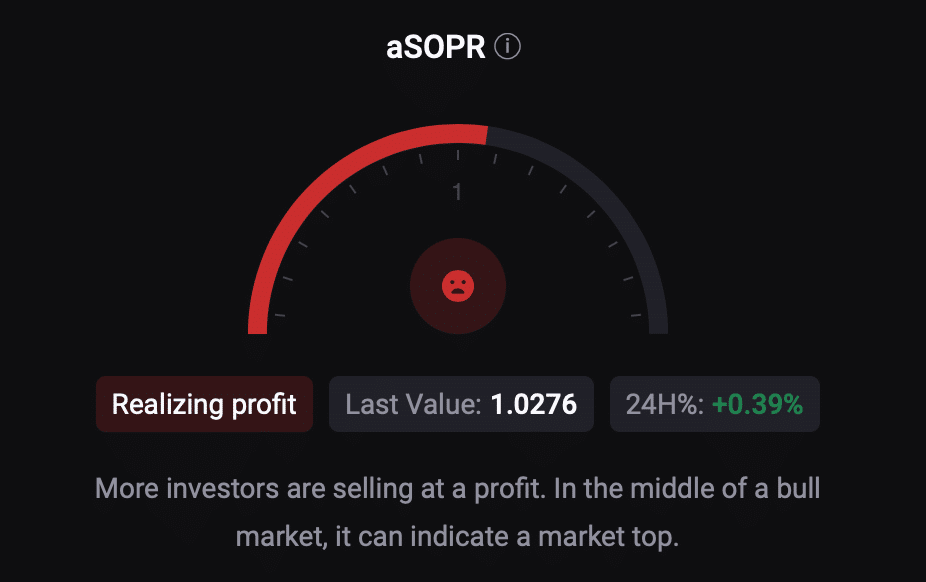

For example, BTC’s Net Unrealized Profit and Loss (NUPL) suggested that investors are in a “faith phase” where they are in a state of high unrealized profits. Moreover, the aSORP was in the red at the time of going to press. This implied that more investors were selling at a profit.

In the middle of a bull market, this could indicate a market top.

Source: CryptoQuant

Is your portfolio green? look at the BTC profit calculator

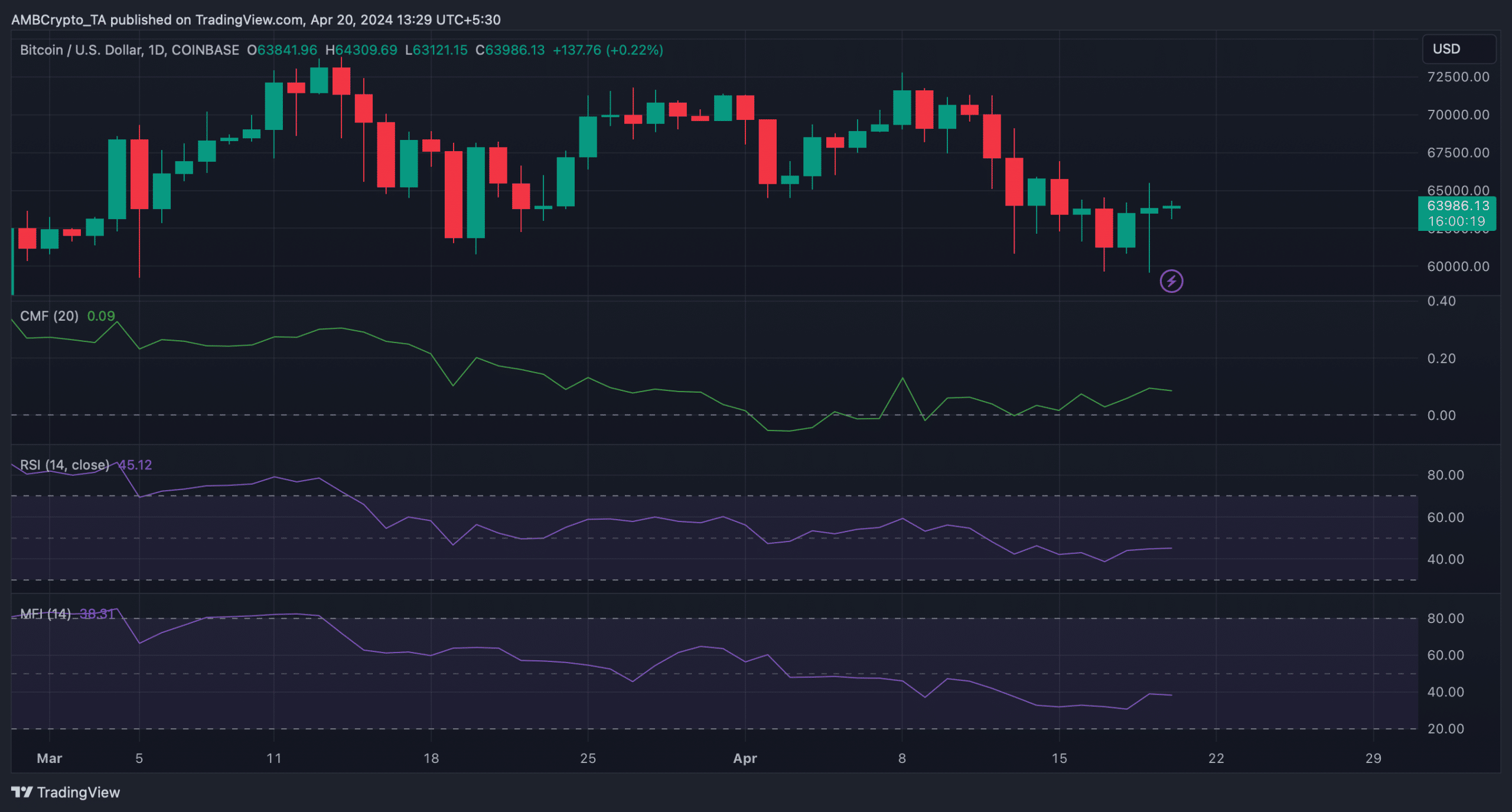

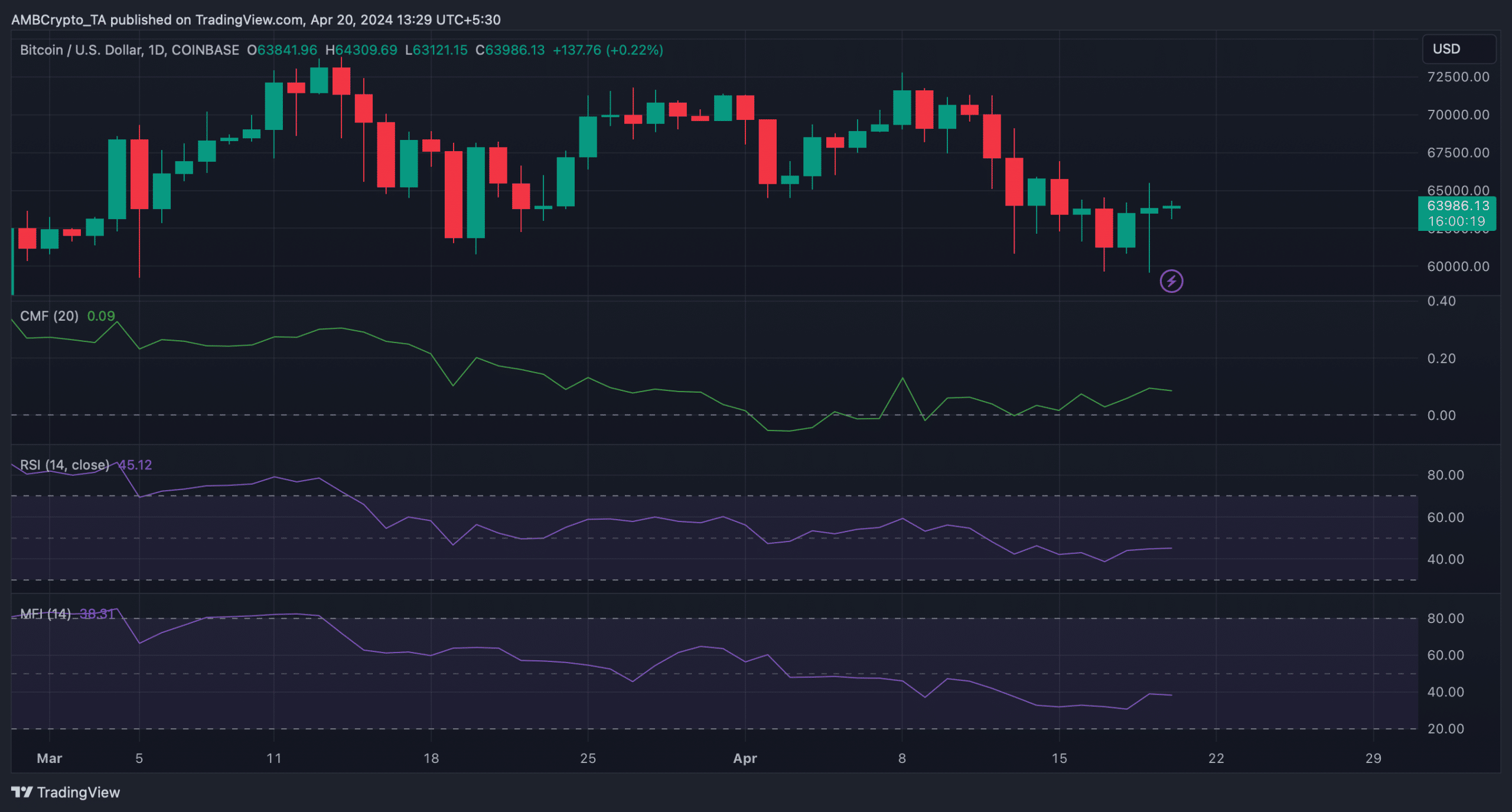

AMBCrypto then analyzed BTC’s daily chart to see if the cryptocurrency will give green signals soon. We found that both the Relative Strength Index (RSI) and the Money Flow Index (MFI) trended sideways below their equilibrium levels.

Moreover, the Chaikin Money Flow (CMF) also recorded a slight decline.

All these indicators suggested that investors may wait a few more days before Bitcoin’s price becomes volatile again.

Source: TradingView