- Last month, miners sold less than 1/3 of the total coins sold in February

- HODLing can also be motivated by the negative state of the market currently

The countdown to Bitcoin [BTC] The halving has begun and the highly anticipated event will take place in less than 12 hours.

Miners, who monitor the network and earn incentives in the form of block rewards, will take a big hit to their revenues in the aftermath of the event. Typically, miners start liquidating their holdings before the halving to capitalize before the revenue hits later.

However, this time it was different.

Miners reduce selling pressure

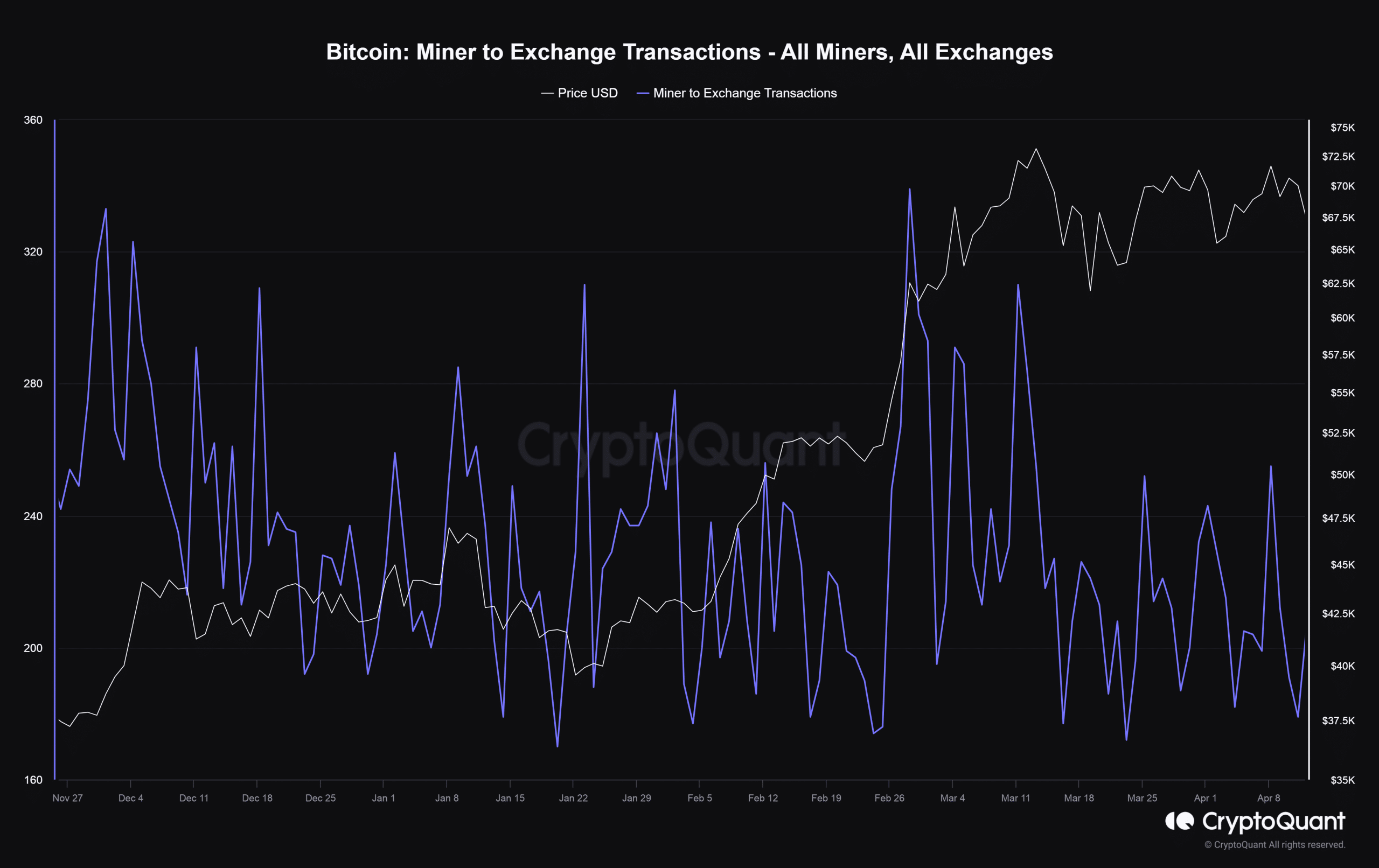

According to a researcher at an on-chain analytics company CryptoQuantOver the past month, an average of around 374 BTCs were sent to spot exchanges by miners every day – less than a third of the daily average recorded in February.

Source: CryptoQuant

The researcher claimed that this action helped prevent additional downward pressure on the king coin.

“It is possible that selling pressure has already been applied in advance by miners, which could benefit the market in the short term, especially when there is already significant pressure on the market due to the sense of risk aversion.”

Weak returns encouraging HODLing?

Furthermore, the HODLing may have been motivated by the ongoing market decline, which has caused BTC to lose more than 12% of its value over the past week. Miners may be waiting for a post-halving rally to get a better return on their sales.

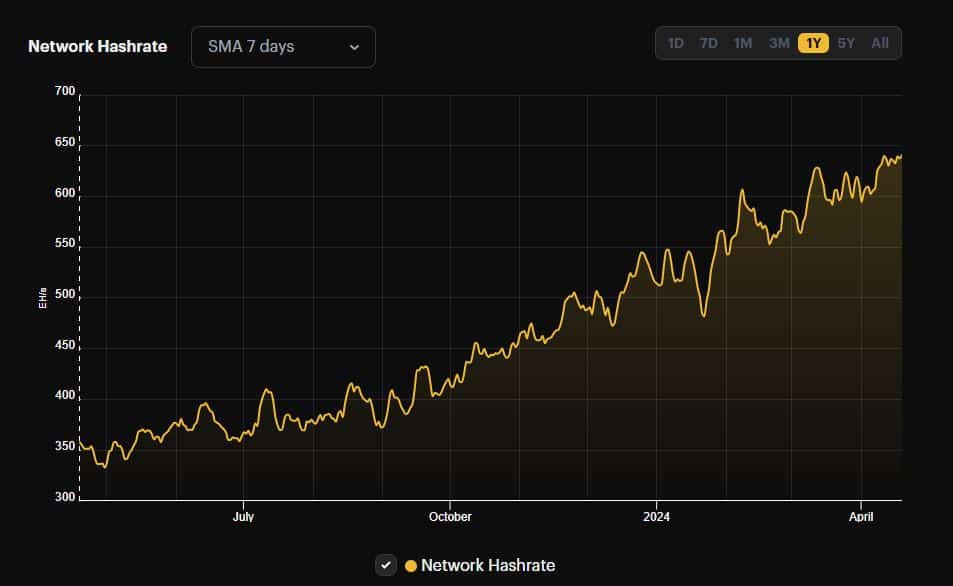

Machines running at full capacity

Meanwhile, the network hash rate, a measure of miners’ overall computing power, rose to 641 exahashes per second (EH/s) at the time of writing. The hash rate has skyrocketed prior to the halving, indicating that miners are trying to maximize their earnings before they are ultimately halved.

Source: Hashrate index

Is your portfolio green? Check out the BTC profit calculator

Here it is worth noting that Bitcoin fell below $60,000 during trading hours in Asia on Friday due to the rising prices. geopolitical tensions in the Middle East. However, digital assets recovered to $62,000 at the time of writing as opportunistic traders took advantage of the dip to accumulate more.