- Whales collected more than 22,000 BTC and pushed the total number of whale companies further than 3.44 million BTC

- The Netflows of Bitcoin weakened in March and fell by -27.69% for seven days

Large Bitcoin holders and retail investors have recently gathered at an aggressive pace, which indicates strong market confidence.

In fact, data on chains revealed that whales took over more than 22,000 BTC in just three days, so that the total number of whale companies went beyond 3.44 million BTC. The increase in demand coincided with a competitive price increase, pushing Bitcoin [BTC] From $ 82,000 to almost $ 98,000.

Worth to point out that the cryptocurrency was back from less than $ 80,000 at the time of writing.

Source: X

However, that is not all, with a historic peak in the retail trade. Especially with accumulator addresses climb to a record high of 320,000.

This double accumulation by both large -scale investors and smaller holders hinted on a coordinated bullish momentum. Hence the question – is the buys -spree sustainable?

Source: X

“Buy the dip” or whale manipulation?

A further consideration of Ali’s data on the chain showed a steady walk in Whale Bitcoin Holdings in February and early March. In the past month, whales acquired around 60,000 BTC – which marked one of the most aggressive accumulative phases in recent history.

The correlation between whale activity and price movements also seemed clear.

The price of Bitcoin fluctuated between $ 82,000 and $ 98,000, with a dip at the end of February, followed by a strong recovery at the beginning of March. The timing of these purchases suggested that large holders were occasionally strategically collected during corrections.

Do the biggest players leave the table?

Maybe, yes. Data from Glassnode and Intotheblock revealed crucial patterns in accumulation and distribution, which emphasized their impact on the price promotion.

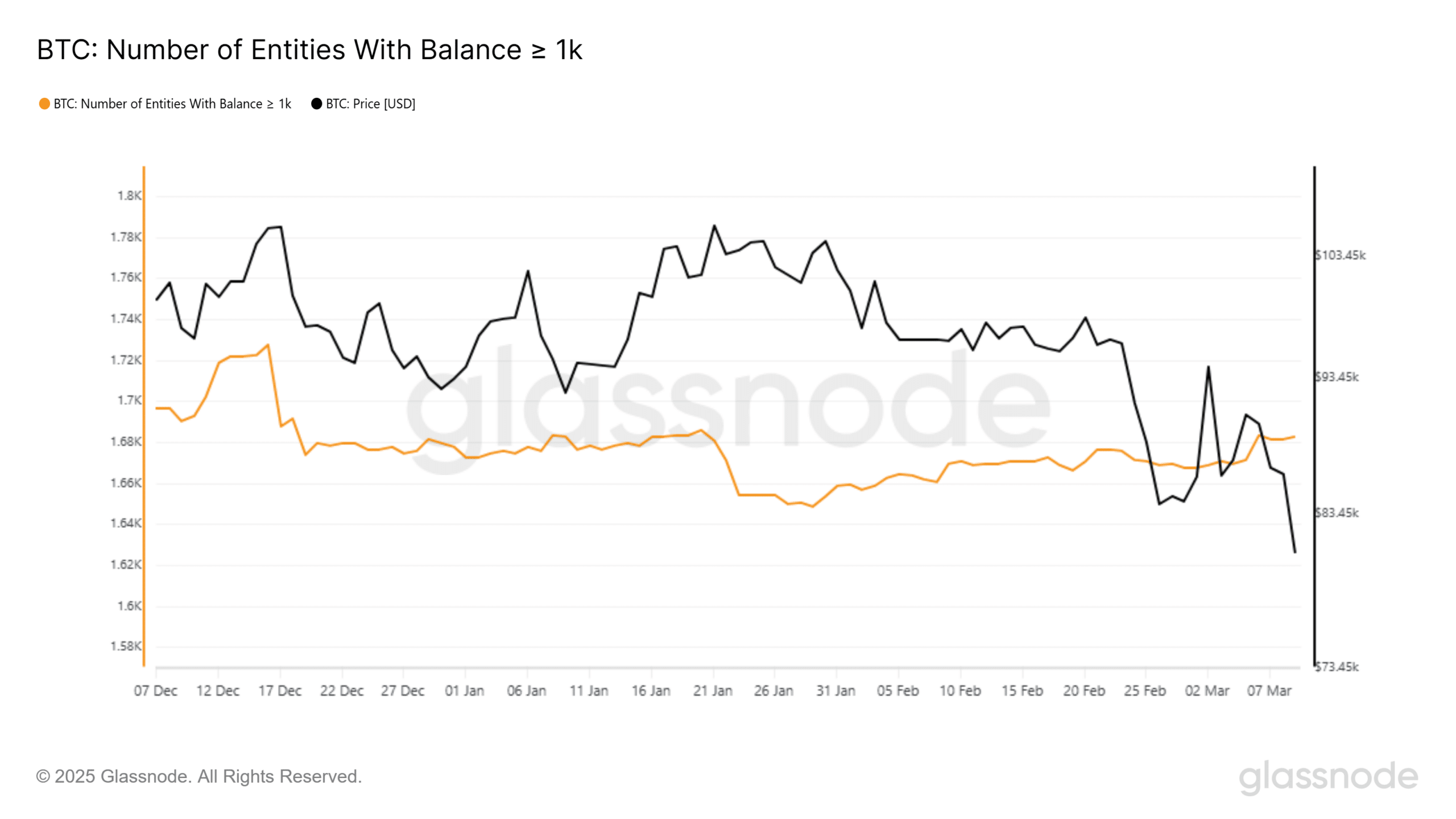

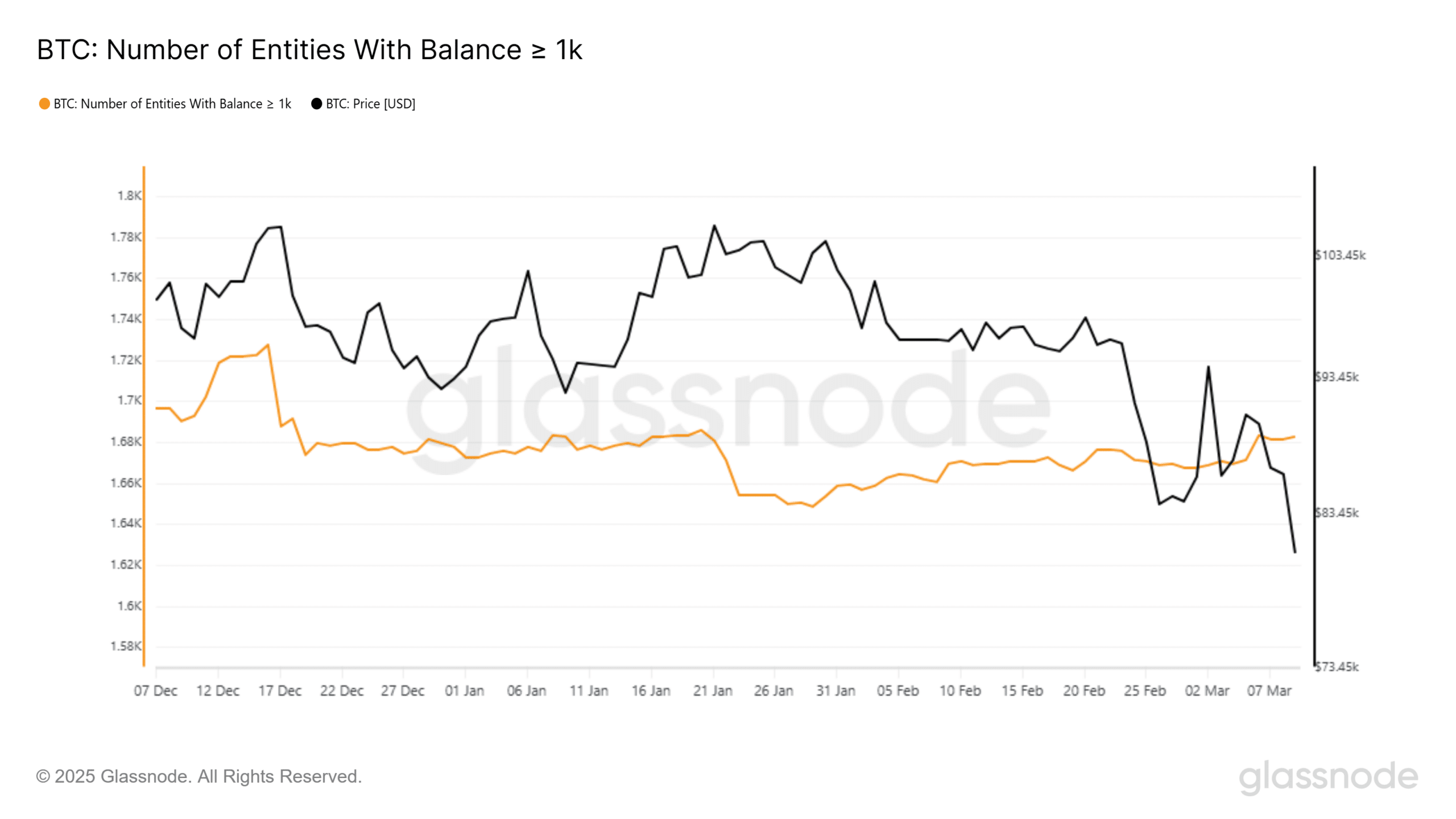

Source: Glassnode

Entities with ≥1,000 BTC have reduced their participations since Bitcoin reached a peak in January at $ 106,159. The number of such entities fell from 1,720+ in December to 1,683 by March – a decrease of approximately 2.14% for three months.

This seemed to be in line with the price of Bitcoin and fell from $ 106k in January to $ 80k in March. Such a reduction suggested that whales took a profit or reinvented their participations.

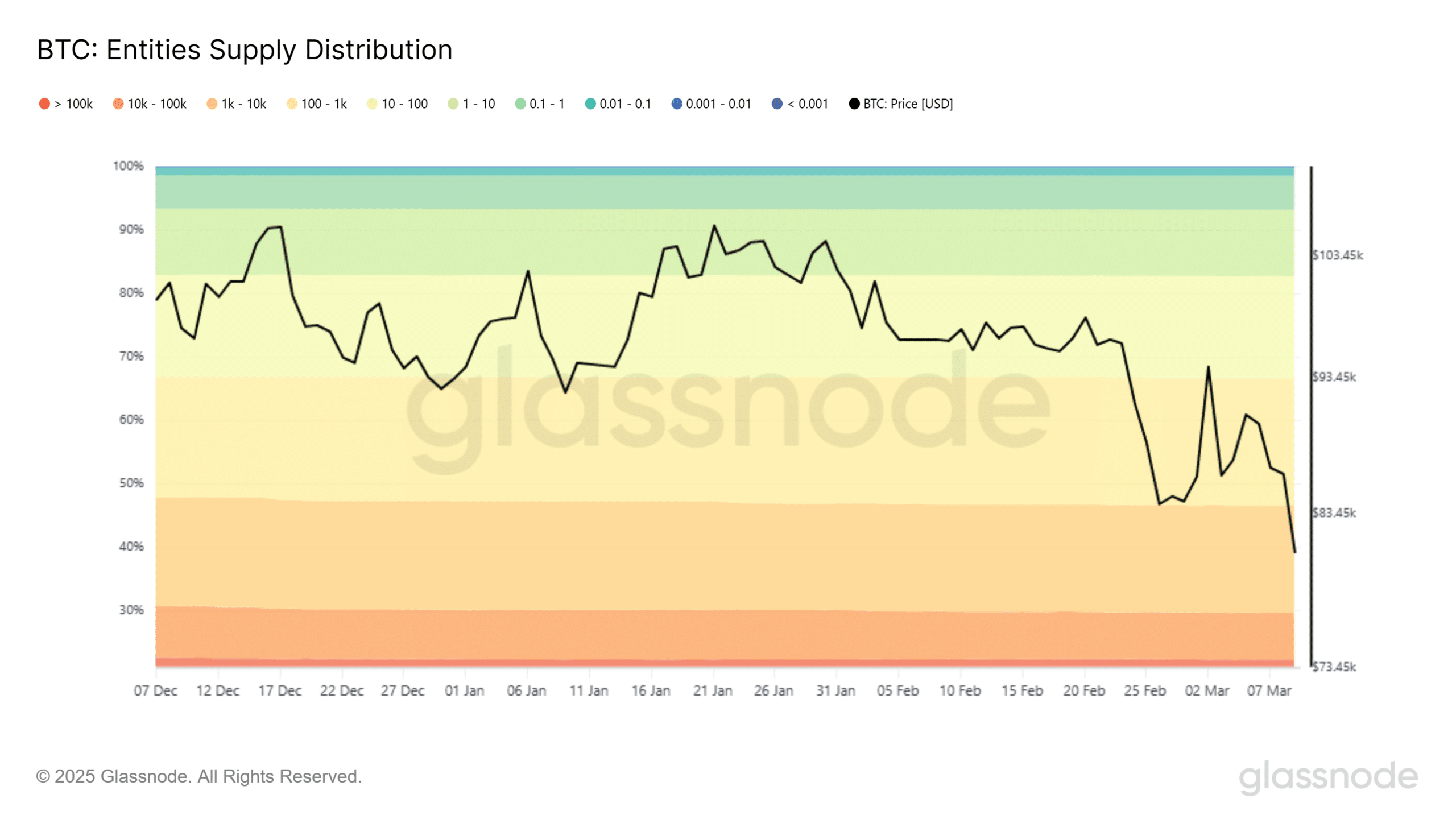

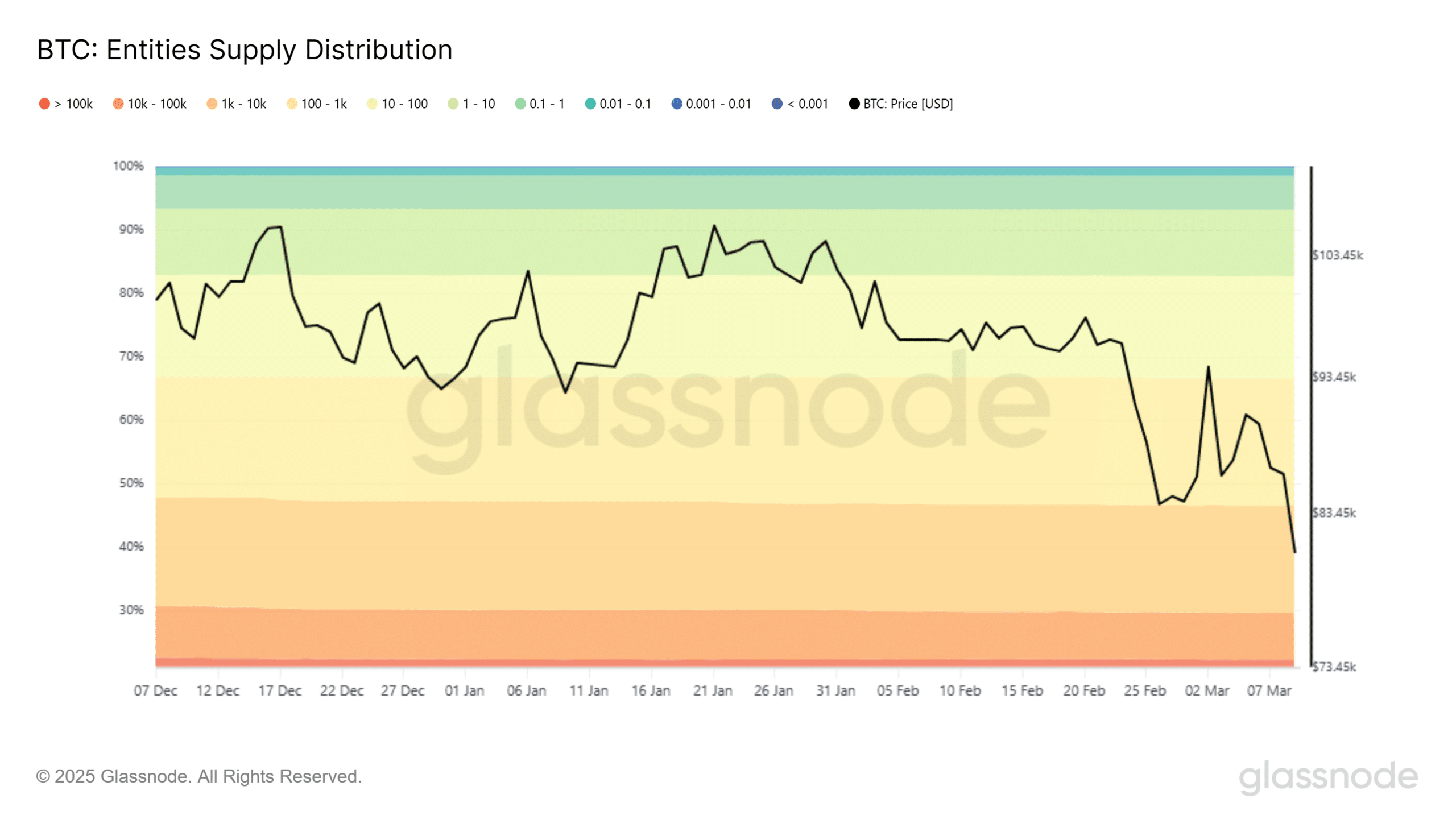

Source: Glassnode

A sharp fall in the whalevistities took place between 7-9 March, which was related to the price of Bitcoin that dropped from $ 84,197 to $ 80,795. Historically, such falls indicate significant sale or capital rotation in other assets.

The December stability in whale companies, tailored to a price range of $ 68k – $ 72k, which shows minimal volatility before the January -rally.

The stock in the hands of whales (≥100k btc) varied from 22.261% in February to 22.173% in March – a small but noticeable reduction.

Who really has control?

The 1K-10K BTC-COHORT saw a larger shift, which in February fell to 16.192% from 16.963% in March, which suggests that medium-sized whales have sold more aggressively.

Bitcoin continued to collect retail addresses (<1 BTC), which showed consistent growth despite the volatility. The 10-100 BTC category remained stable, indicating that holders of medium-sized size are less reactive to price changes than whales.

The data confirmed a traditional accumulation distribution cycle, in which large whales took profit after the rally and smaller players who enter.

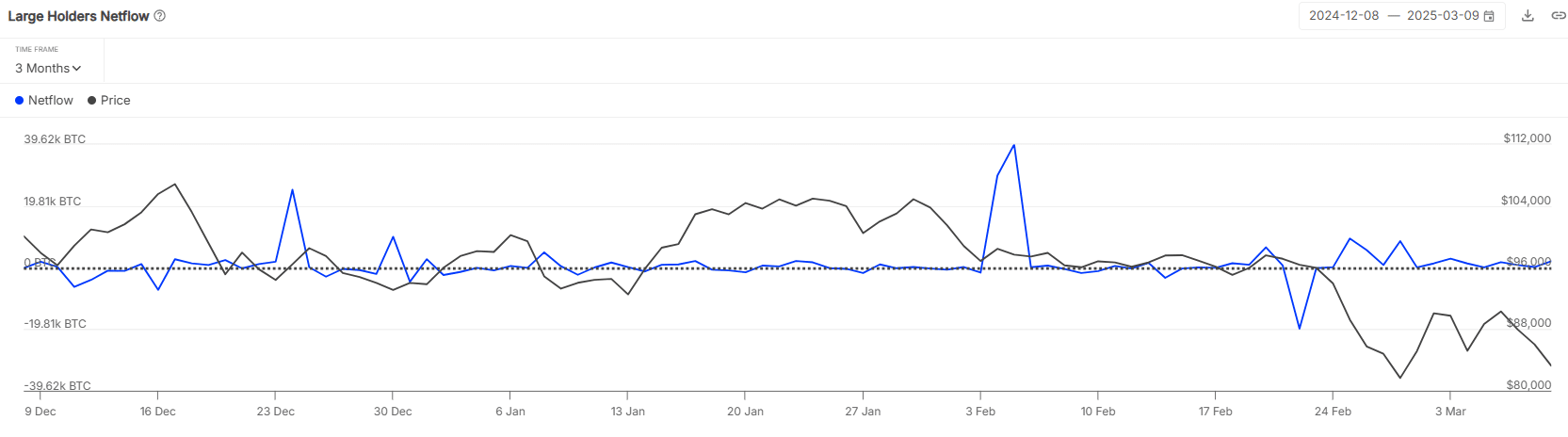

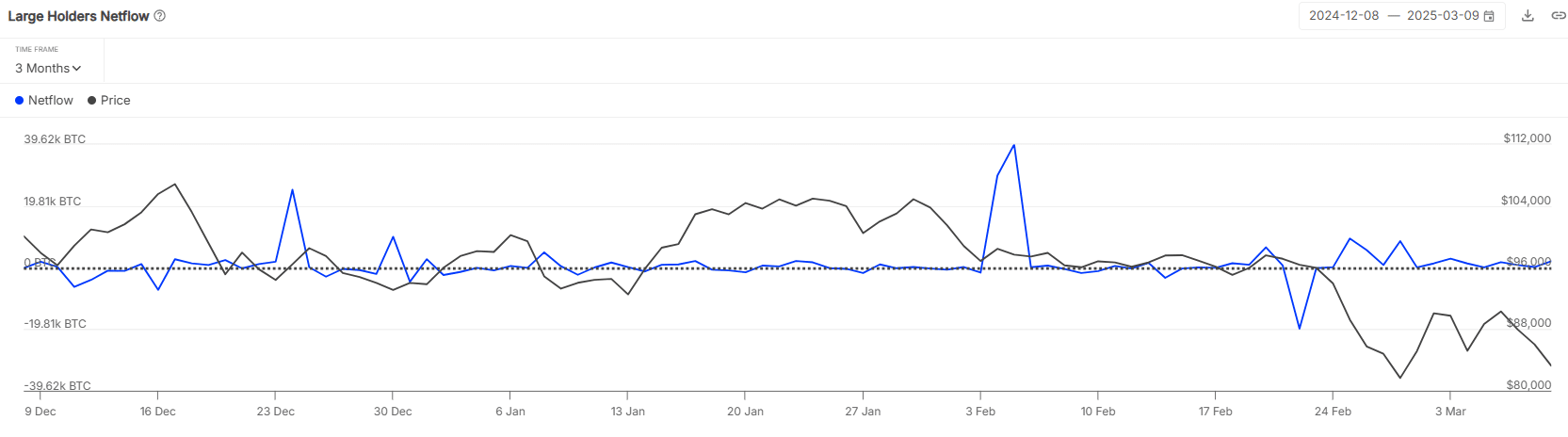

Netflow data from IntotheLlock gave further confirmation of whale behavior.

The largest net entry took place on 5 February, with +39.62k BTC that came in the portfolios of large holders at $ 97,692. This meant that whales accumulated at high prices, anticipating further profits.

Source: Intotheblock

A decrease in the Netflows followed, however, with only +2.08k BTC on March 9 – a sign of reduced demand from large holders.

The price decrease of Bitcoin from $ 97k at the beginning of February to $ 80k in March in line with the sharp decrease in its Netflows.

The 7 -day Netflow change fell by -27.69%, while the 30 -day Netflow fell by -546.90% -on possible exhaustion at institutional accumulation.

And yet, looking at the bigger picture, the 1-year-old Netflow on the press had risen by +714.19%. This indicated that although short -term whale interest can fade, long -term convictions have not completely disappeared.

A ticking time bomb or a bullish setup?

Whale activity has been the driving force behind the recent price promotion of Bitcoin. Large holders gathered aggressively before the January peak of $ 106,000, but started distributing in February. The reduction in the Netflows and the decrease in holders of 1,000-10,000 BTC suggested that some whales already cash in.

The decline of Bitcoin to $ 80,000 and lower tailored to this distribution trend. If whales keep loading, Bitcoin could be confronted with further corrections. However, the continuing growth of retail trade and long -term network flows means that not all investors lose confidence.

Whether the next move by Bitcoin is another rally or a deeper withdrawal will depend on one important question – are the remaining whales still prepared to buy?