- Bitcoin maintains its strength above the key level despite signs of potential downside.

- Shorts are facing the sharp edge of the knife as the price remains stuck around $58,000.

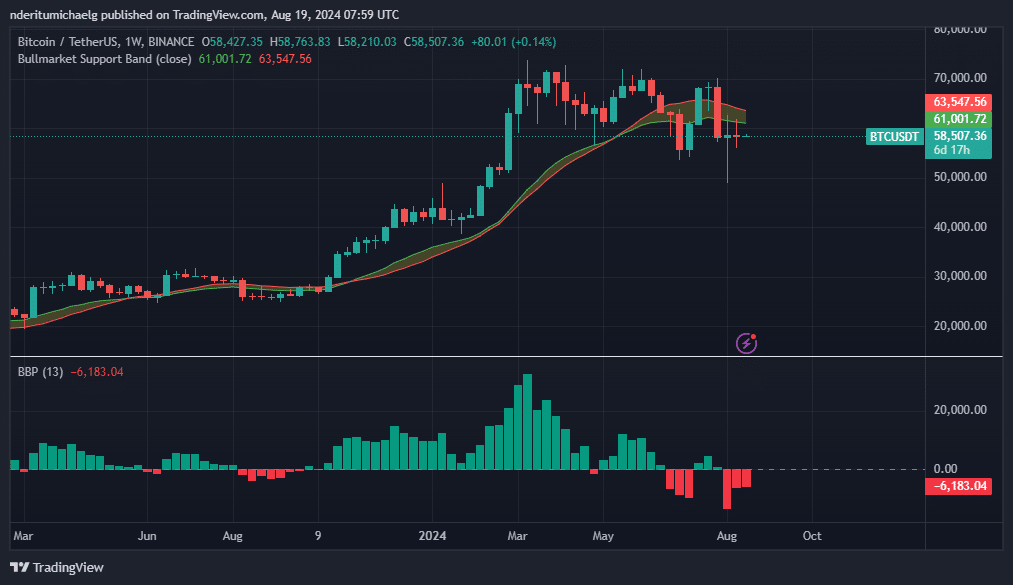

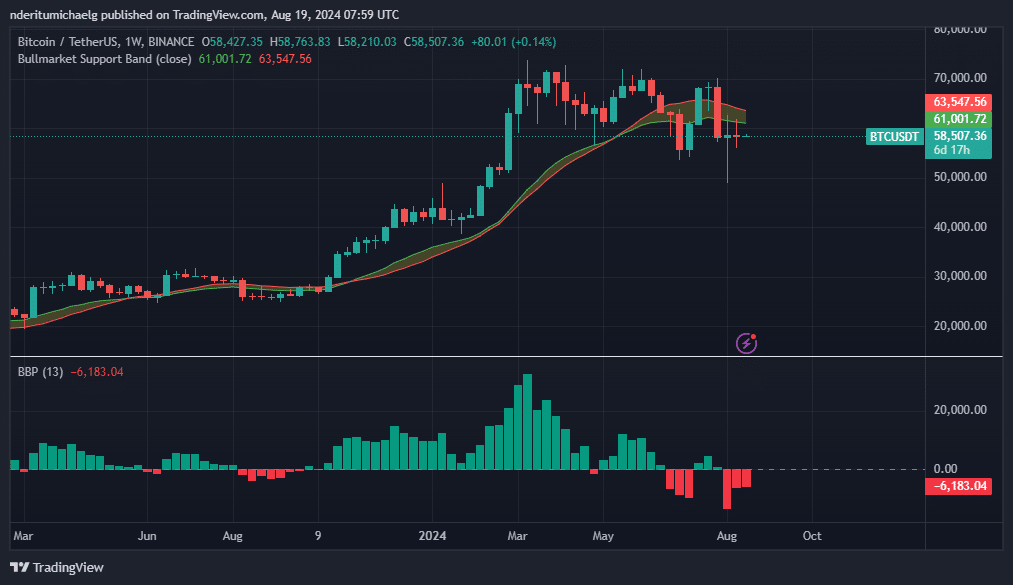

Bitcoin [BTC] has just closed another week below the bullish market support band within a one-week time frame. As a result, more and more traders are turning bearish, but despite this, things have been quite unsettled for leveraged short traders.

Although Bitcoin attempted a recovery after the crash earlier this year, weak bullish momentum fueled more bearish sentiments.

Meanwhile, the price remained stuck within a narrow range that is clearly visible in the weekly time frame. Furthermore, Bitcoin’s price remained below the bullish support band, fueling even more bearish speculation.

Source: TradingView

The support band reversal in the Bitcoin bull market is just one of several bearish signals that indicate more potential downsides lie ahead. Short traders have doubled their positions.

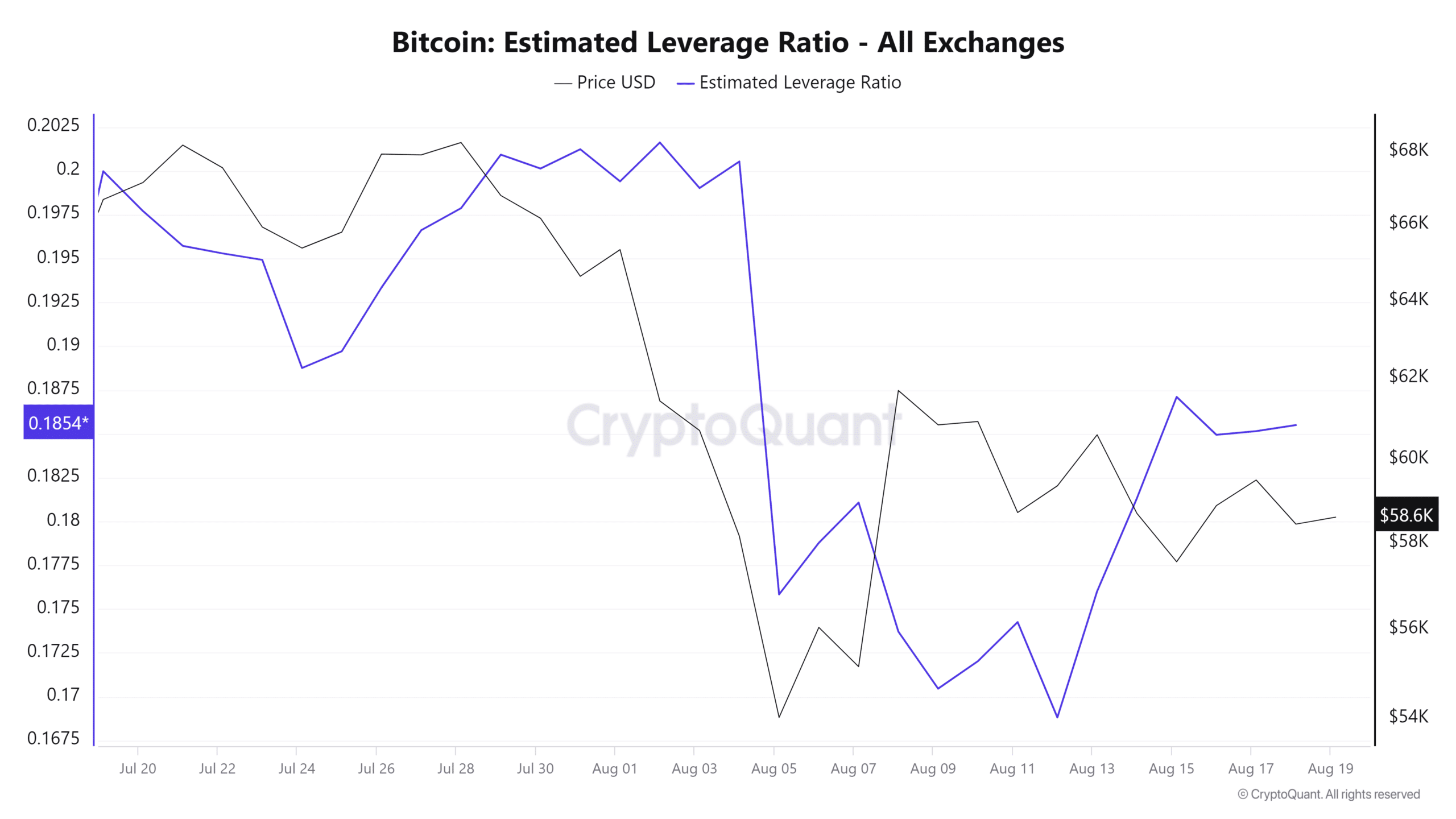

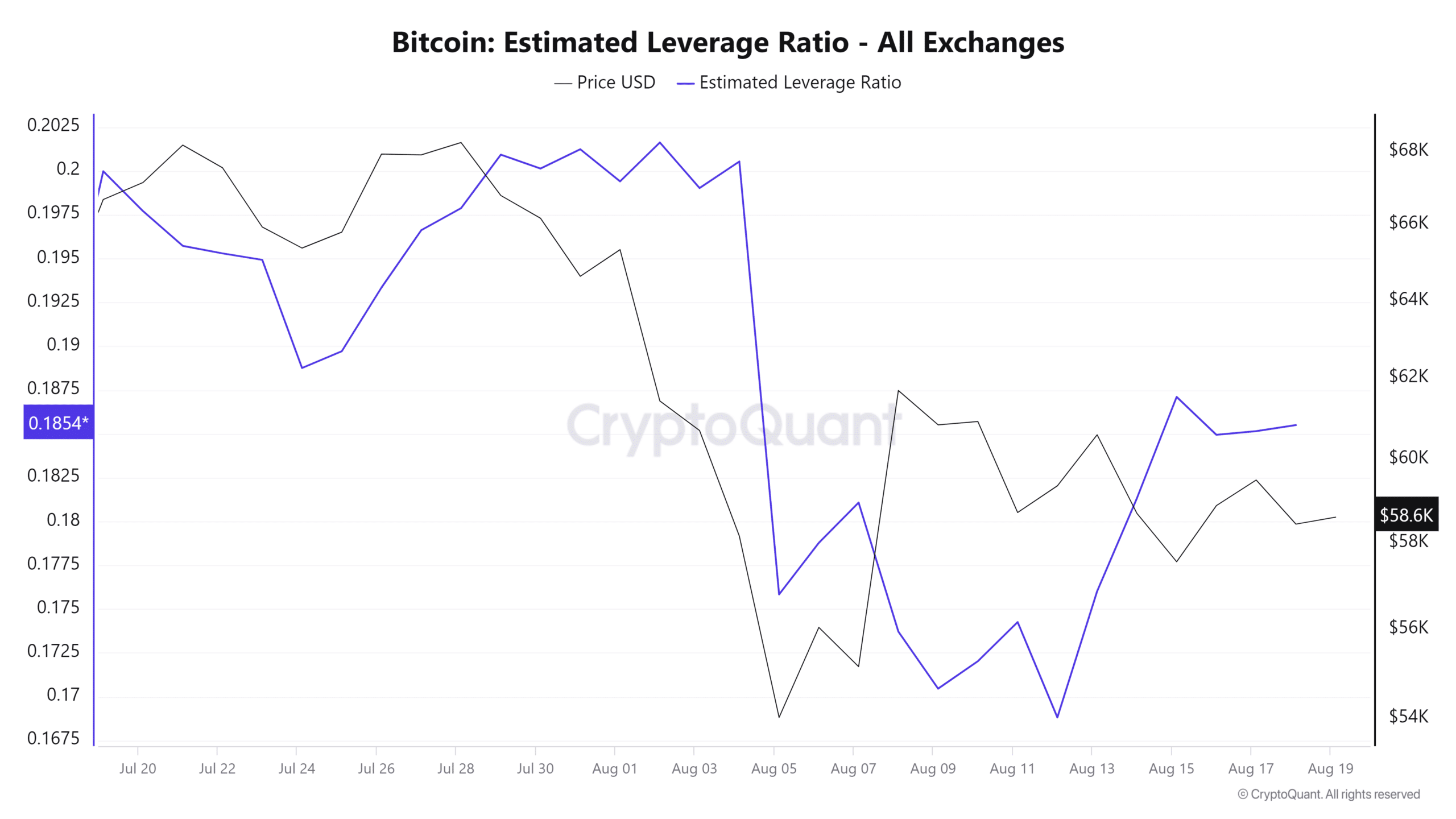

Interest in leverage has increased in the past week. This is evident from the estimated leverage ratio, which bottomed out on August 12. This suggests that the market expects more volatility in the coming days.

Source: CryptoQuant

The number of leveraged Bitcoin shorts has grown, with expectations of more price weakness. However, BTC’s price action appears to be showing strength towards the downside near the $58,000 price range.

Recent findings revealed that recently liquidated more than $1.65 billion in leveraged short positions.

Despite these findings, the number of short liquidations was still low compared to what we saw earlier this month. But the main question on most Bitcoin holders’ minds is whether the cryptocurrency will continue to decline.

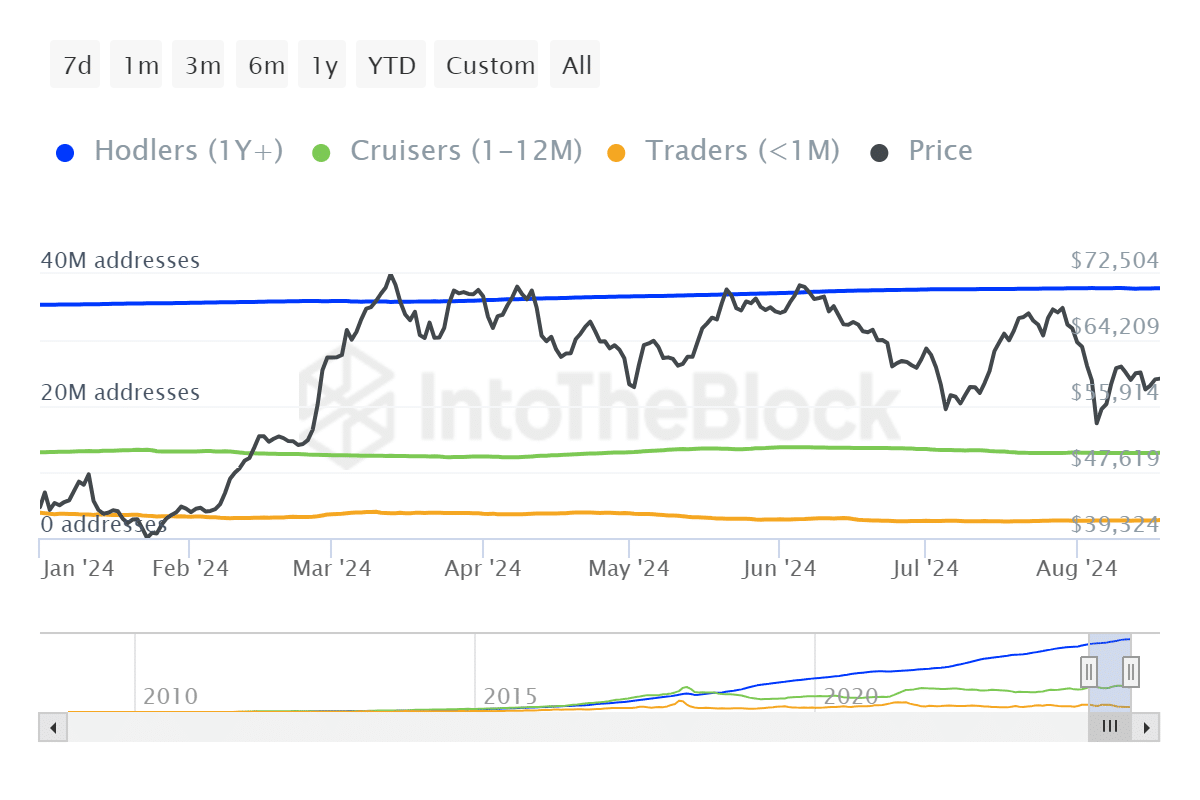

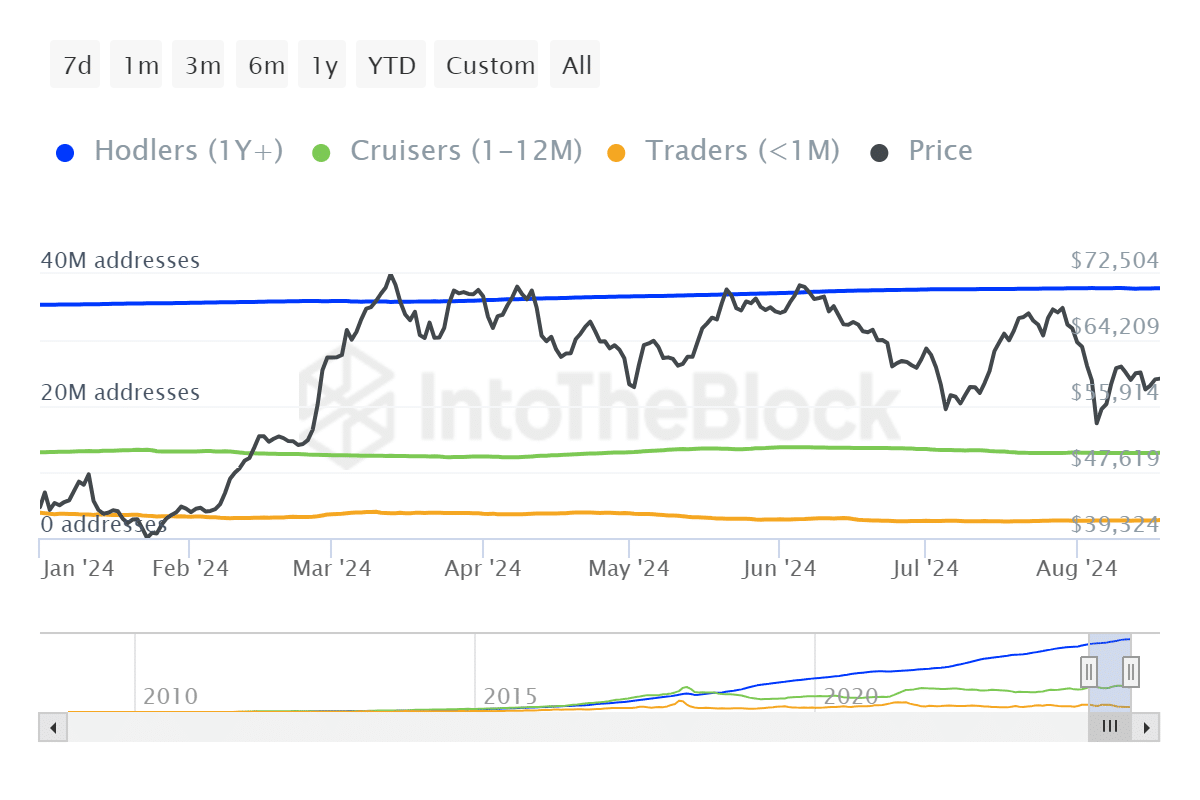

Some important observations to note. The narrow price range suggests that Bitcoin holders still choose to hold on to their coins.

Bitcoin ownership stats over time show that whales continue to HODL. For example, the number of whales HODLing BTC in a YTD time frame grew from 35.33 million addresses to 37.88 million addresses according to the latest statistics.

Source: IntoTheBlock

The fact that whales are holding Bitcoin is a good sign, because collectively they have a significant impact on the market. However, the same data also indicates that the retailer category has declined over the same period.

Read Bitcoin’s [BTC] Price forecast 2024-25

A possible reason for the above could be that higher costs of living and market uncertainty have forced retailers to sell.

Meanwhile, the whales choosing HODL suggest that long-term bullish expectations remain strong despite near-term headwinds. Every dip so far has been accompanied by robust accumulation, which has protected Bitcoin from even more downsides.