- BTC was trading around $57,000, with a slight gain.

- Long-term owners were still able to make a profit despite the initial scare.

Recently Bitcoin [BTC] experienced a significant dip, reaching levels that put long-term holders almost on the brink of unprofitability.

This situation highlights the importance of Bitcoin’s current market value to realized value (MVRV) ratio, which is a crucial support line for Bitcoin’s price. If this support line is broken, the market can react in different ways.

Support for Bitcoin ratio tests

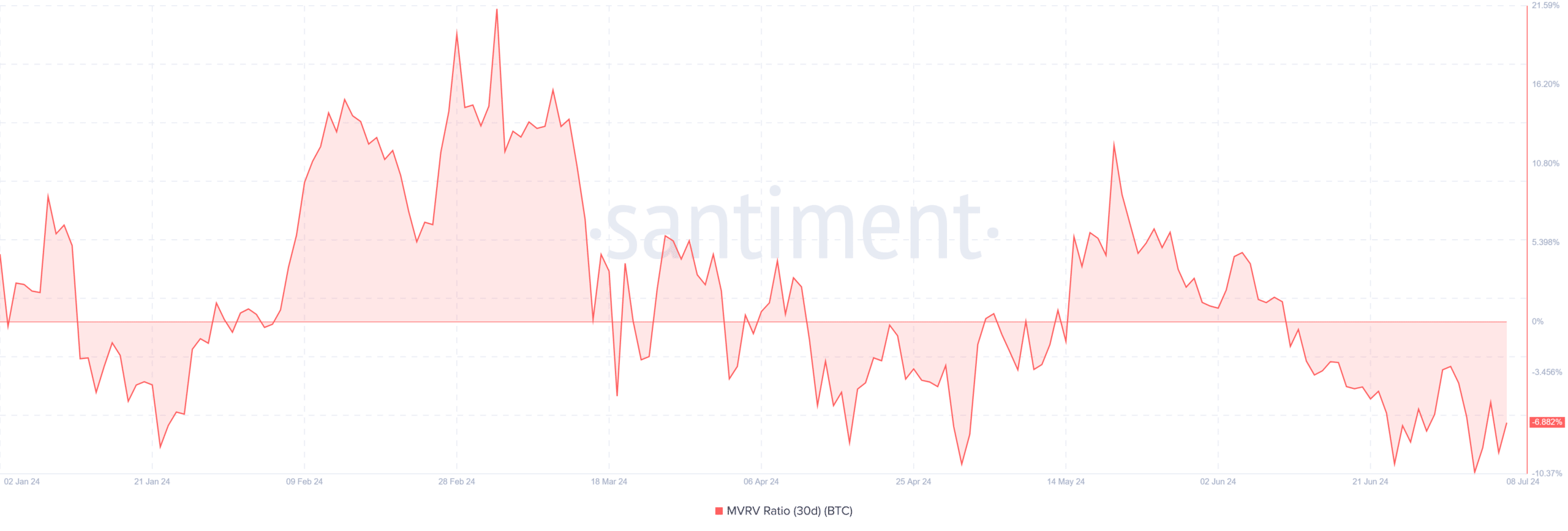

A recent message from Santiment provided insight into the current state of the Bitcoin ratio. The message highlighted the MVRV ratio, focusing on 30-day and 365-day metrics. This analysis is critical in assessing the short- and longer-term financial position of Bitcoin holders.

The 30-day MVRV ratio, which assesses the profit or loss status of those who purchased BTC in the past month, recently fell below zero.

This decline started around June 11 and the ratio has deteriorated to approximately -6.8%. This indicates that holders who purchased Bitcoin during this period are experiencing an average loss of more than 6%.

Source: Santiment

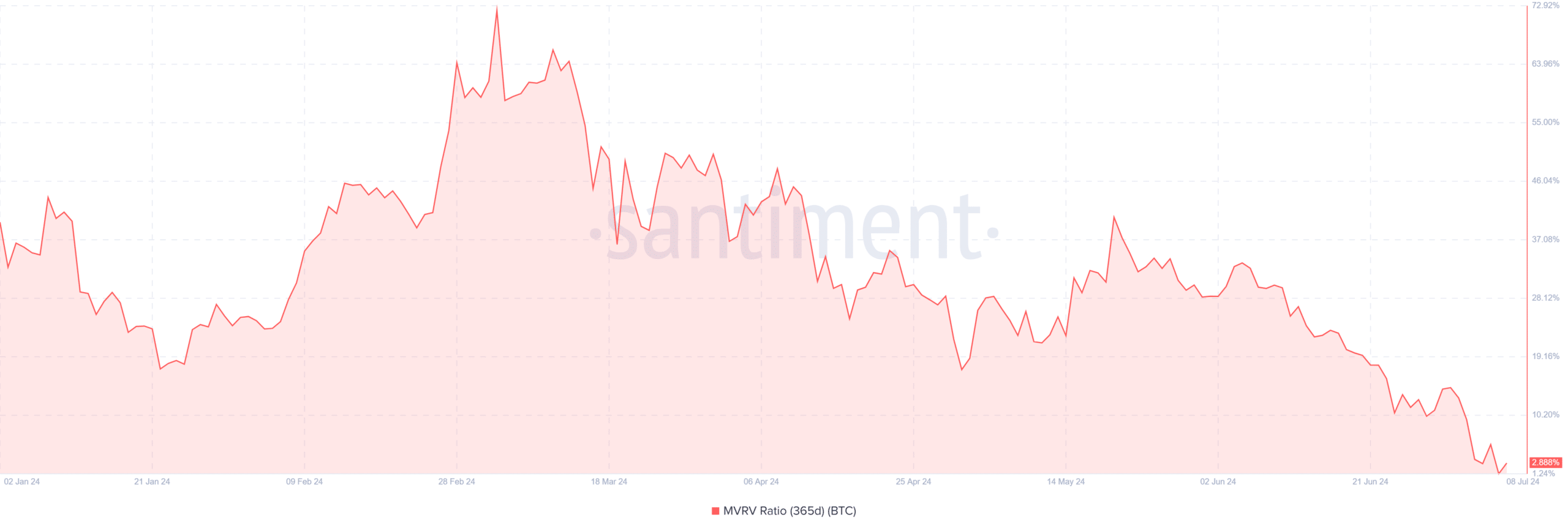

Moreover, on a broader scale, the 365-day MVRV ratio, which reflects the market behavior of long-term holders, showed that these investors were approaching a crucial threshold.

Over time, this ratio has remained above zero, indicating that long-term holders have maintained a profitable position.

Source: Santiment

However, recent data shows a worrying trend: just a few days ago the ratio dropped to around 1.25%, the lowest in months, and as of the last report on July 8, it has been hovering around 2.8%.

How the market might react

This proximity of the long-term MVRV ratio to the breakeven point is significant because it acts as a support level.

If this Bitcoin ratio were to fall below zero, it could signal a shift in sentiment among long-term holders. It could increase selling pressure as these investors look to limit their losses or capitalize on remaining gains.

This could also exacerbate downward pressure on BTC’s price. Conversely, if support continues, it could boost investor confidence. It could stabilize the price or even stimulate the recovery.

The market’s reaction at this crucial point will be crucial in determining BTC’s price trajectory in the short to medium term.

The current trend of BTC

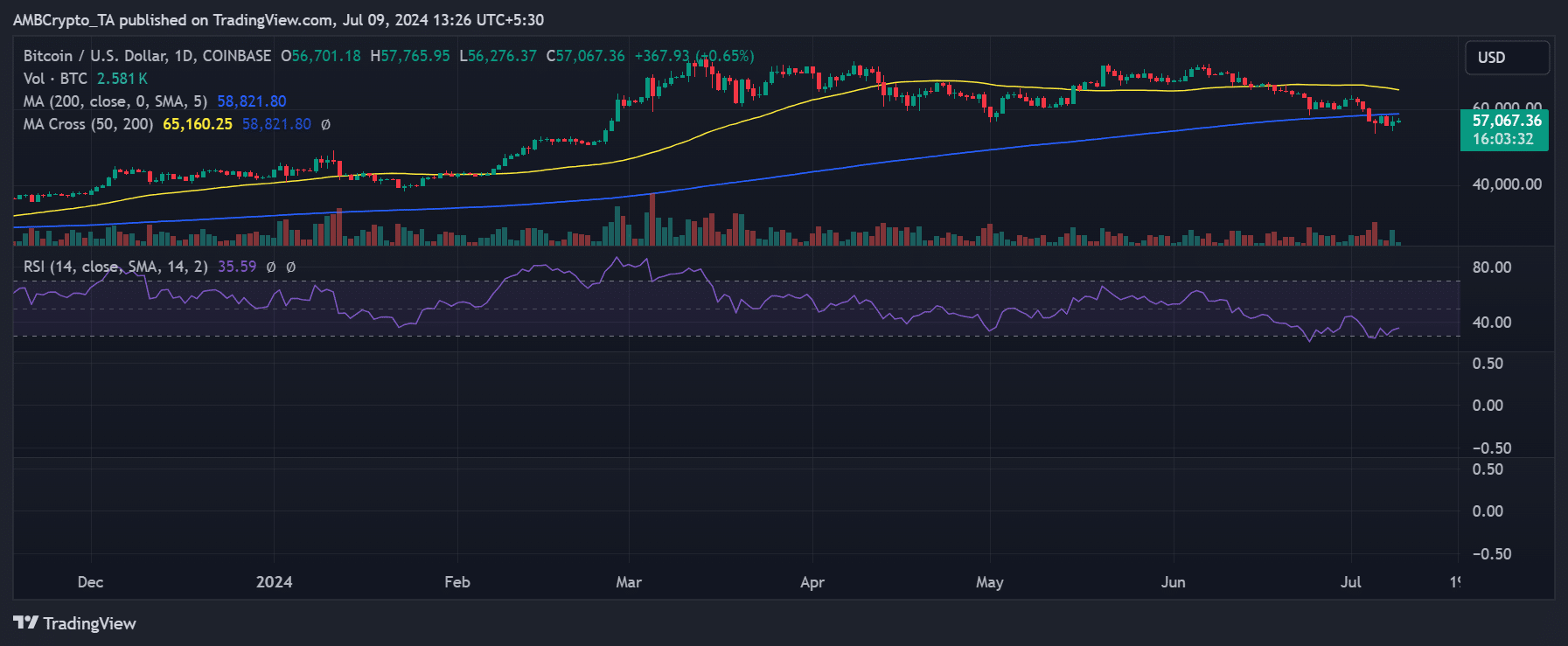

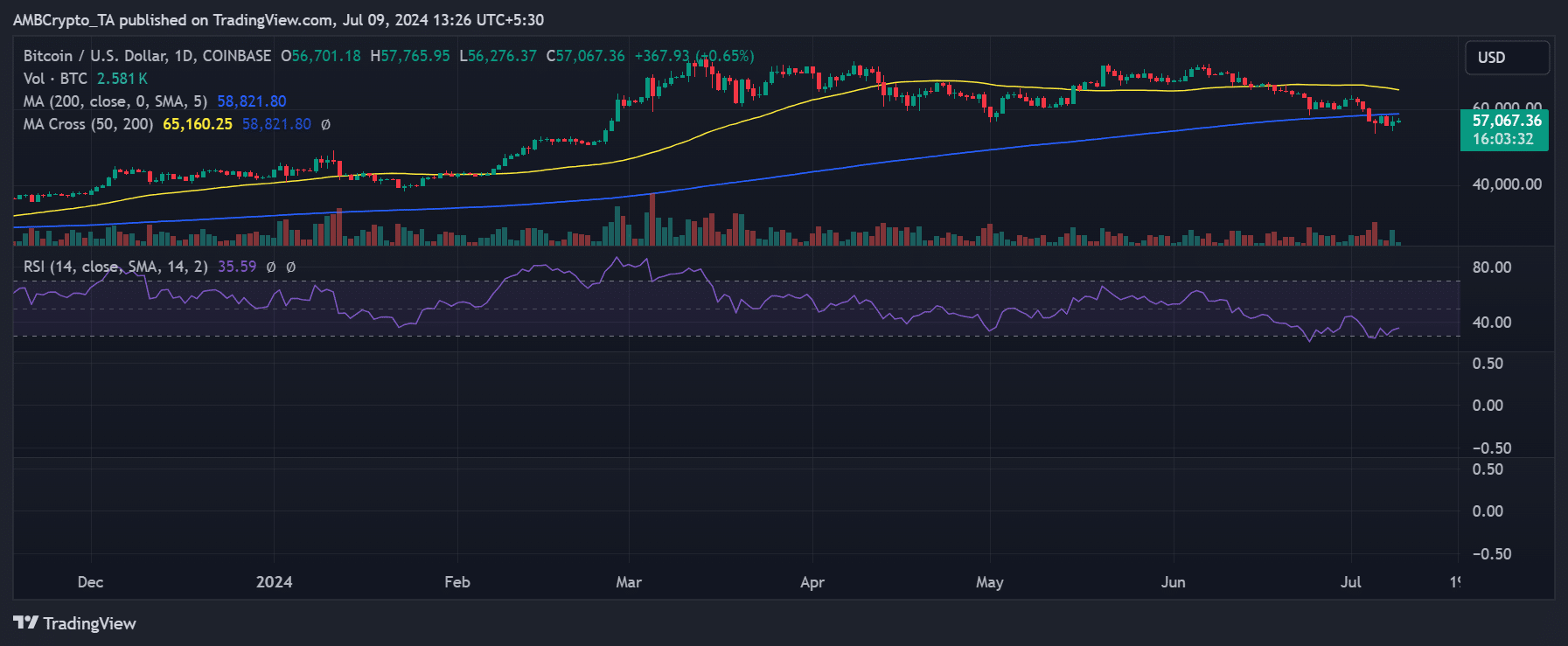

Bitcoin’s analysis on a daily timeframe provides a nuanced view of recent market movements. BTC initially experienced a notable decline during the previous trading session, reaching a low of around $54,278.

This downturn briefly heightened concerns about the potential for a breach of key support levels within the Bitcoin MVRV ratio – a metric closely watched for signs of market stability or stress.

Source: TradingView

Read Bitcoin (BTC) price prediction 2024-25

Despite the decline in the first sessions, the session ended with an increase of more than 1%. At the time of writing, the stock was also trading at over $57,000, up about 0.6%.