- Twitter and media sentiment became negative and signaled a potential reset for the Bitcoin market

- Activity on the chains and the confidence of miners hinted on strong basic principles despite market volatility

With Bitcoin [BTC] Enter a new phase, Recent analysis has unveiled a shift in market sentiment. Both Twitter and the regular media become negative for the first time since December 2024.

Although this now does not guarantee an immediate price, it indicates a broader market set. While Bitcoin navigates in this shift, the question remains – where is it from here?

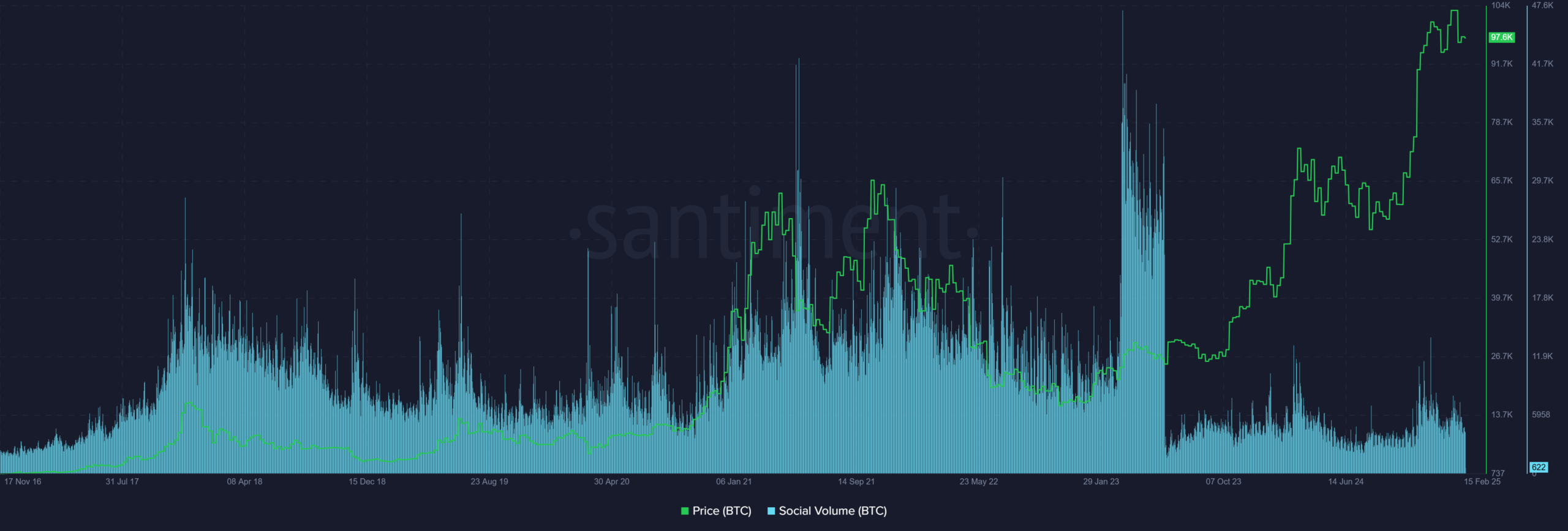

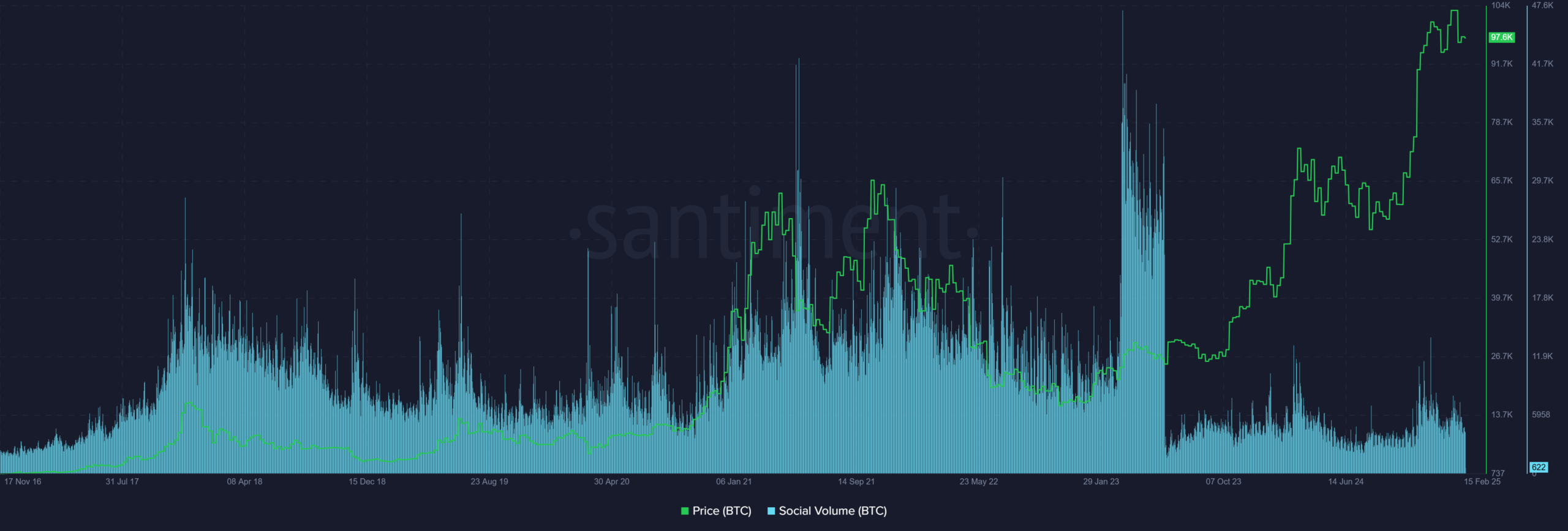

Social Media – Bitcoin – Market sentiment forms

MarktVliment plays a crucial role in shaping the price movements of Bitcoin, and platforms such as X have become important indicators of public perception. Sentiment on social media can act as a powerful prediction tool that influences investor behavior.

Source: Santiment

When the positive sentiment is high, this can stimulate the buying activity, while negative sentiment can cause sales pressure.

Historically, Bitcoin has seen considerable price fluctuations after shifts in the sentiment of social media. In 2017, for example, an increase in positive tweets about Bitcoin preceded his meteorical rise. On the contrary, decline in 2018 and 2022 were reflected by the growth of pessimism online.

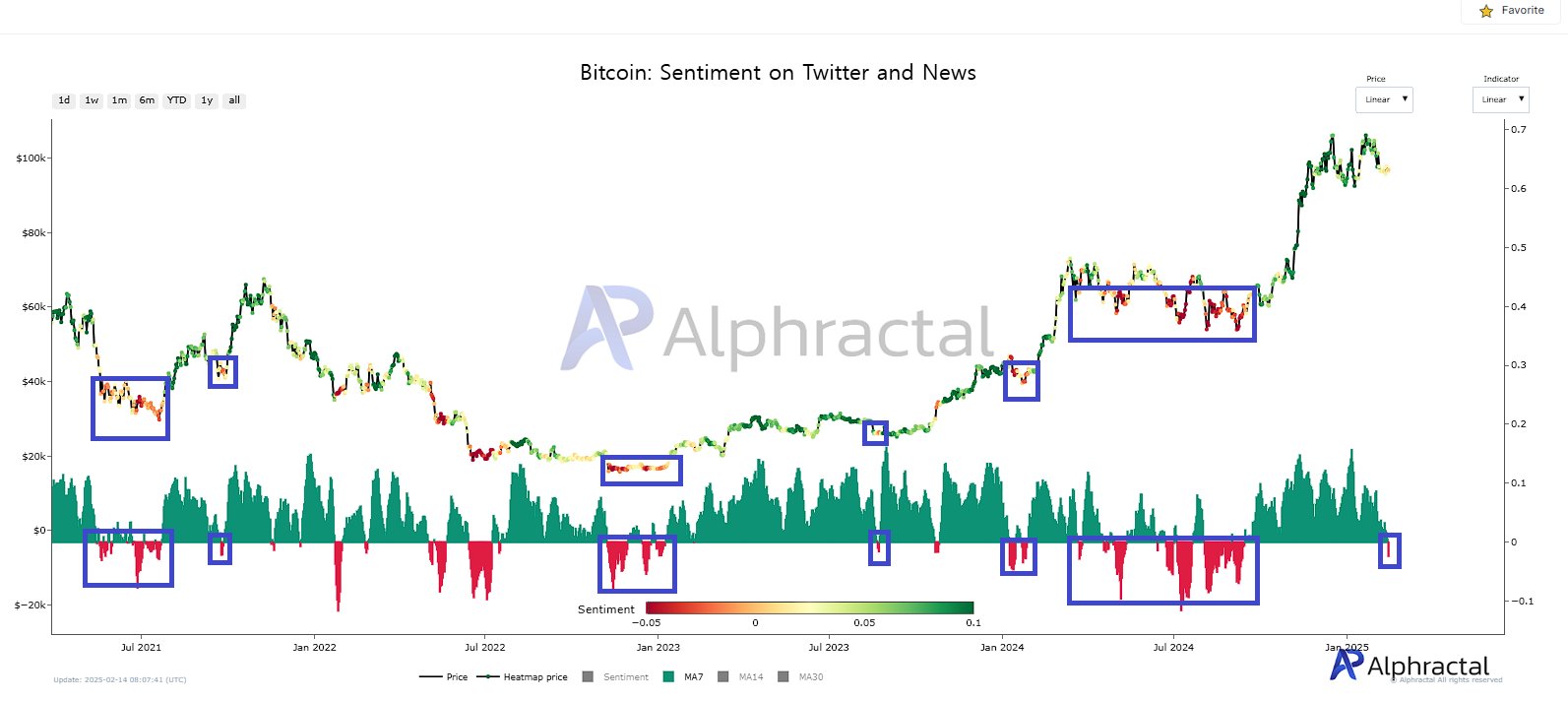

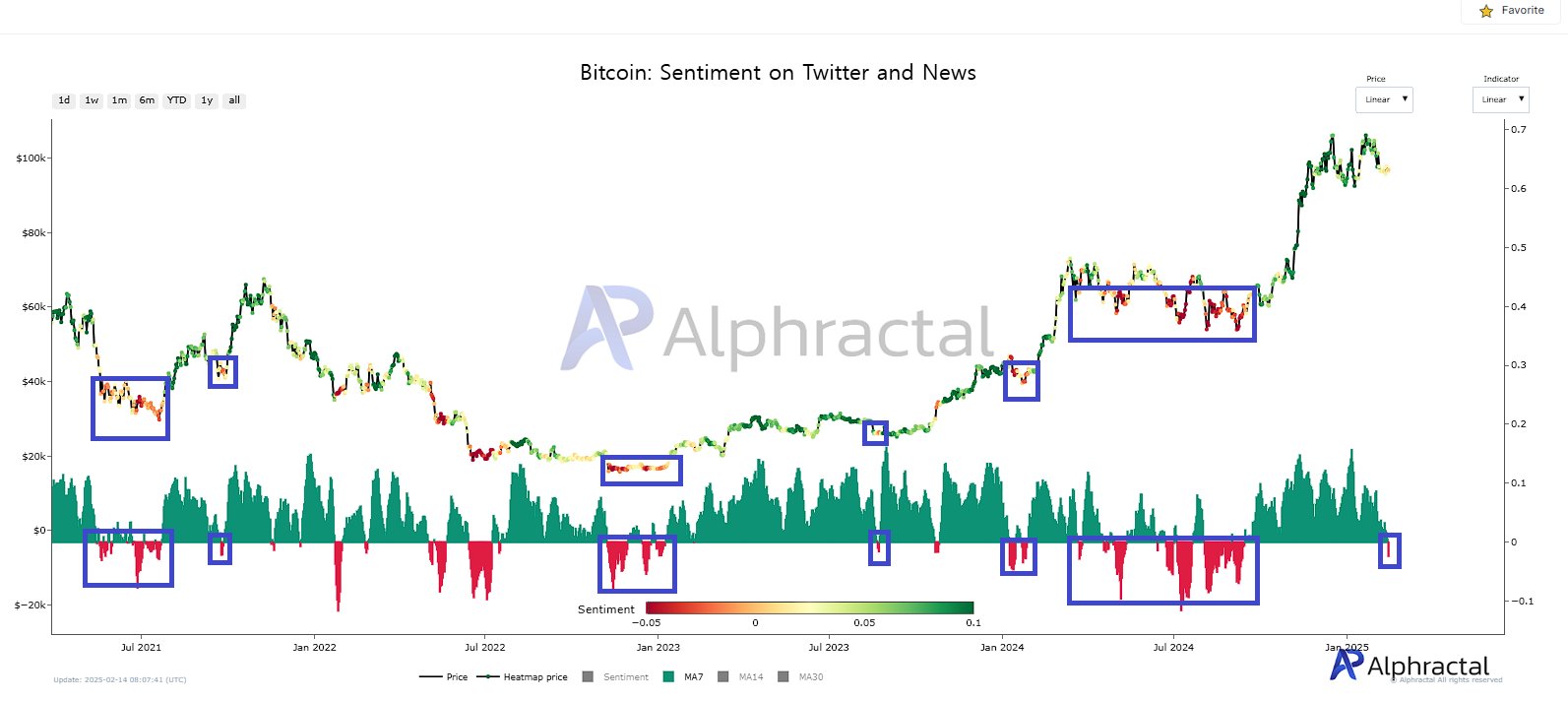

A warning or a chance?

Bitcoin’s sentiment has been negatively reversed for the first time since December 2024, which marks a stark contrast with the euphoria that has fueled its recent highlights.

Historically, such decline in sentiment has acted as bending points prior to extensive consolidation, as can be seen in mid-2024, or the stage for a sharp rebound, such as the beginning of 2023.

Source: Alfractaal

The critical collection meals Is not only that sentiment became negative; It is that the emotional cycle of the market reset. This phase often sees weak hands, while institutional and deep investors quietly accumulate. Selling anxiety has historically created asymmetrical opportunities for contrary investors.

Instead of treating this as a definitive soil signal, traders must use this moment to re -assess their positioning. Following derivatives and data about the chains is crucial to determine whether Bitcoin is preparing for a recovery or making a deeper shake-out.

Bitcoin is approaching $ 100k in the midst of rising activities on the chains and hashrate

Bitcoin’s daily map underlined a consolidation phase, in which the price fluctuated almost $ 97,600 in the charts. The 50-day SMA at $ 98,762 seemed to act as immediate resistance, while the 200-day SMA had to hint on $ 79,836 with long-term support.

Source: TradingView

The RSI at 46.89 referred to Neutral Momentum, which is a reflection of indecision in the market. In the meantime, the MacD was negative, with weak bullish divergence to a possible trend shift.

If Bitcoin wins $ 100k, this can activate a renewed bullish sentiment. However, not breaking the most important resistance levels can lead to further consolidation or a retest of lower support zones.

Source: Santiment

There has also been an increase in daily active addresses and whale -scanning actions – a sign of growing institutional and retail participation.

Historically, such spikes preceded large price movements and can be interpreted as a high market interest.

Source: Cryptuquant

In the meantime, the Bitcoin hashrate has also increased, indicating the trust of miners and long -term network protection. The resilience of miners at these price levels means reduced sales pressure – emphasizing the power of Bitcoin.

The Bitcoin meeting has strong Fundamentals, despite all the negative sentiment, which means that this might be a temporary phase. However, whale activity must be checked for potential profit making nearly $ 100k. A decisive breakout could cause a momentum, but the volatility remains an important risk.