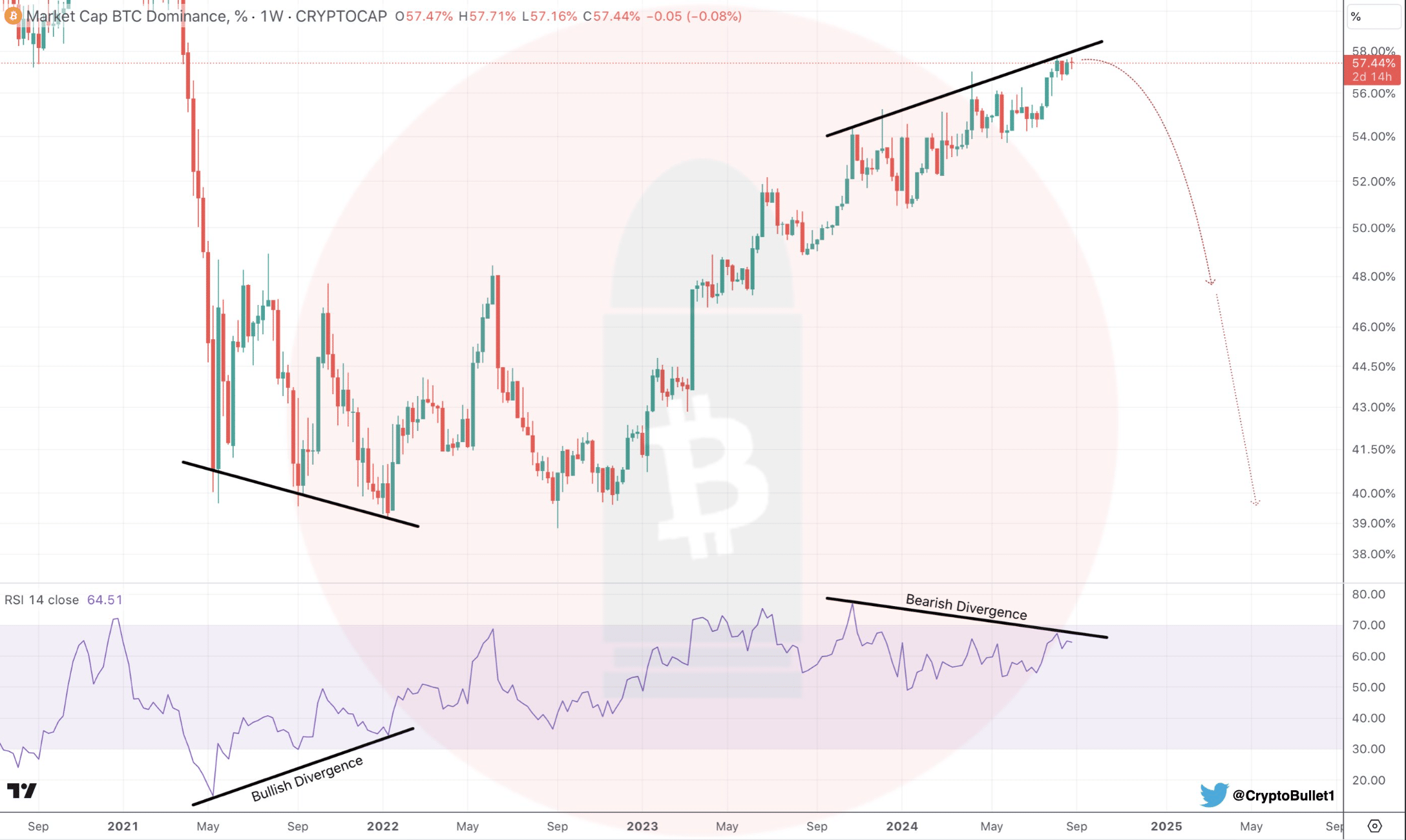

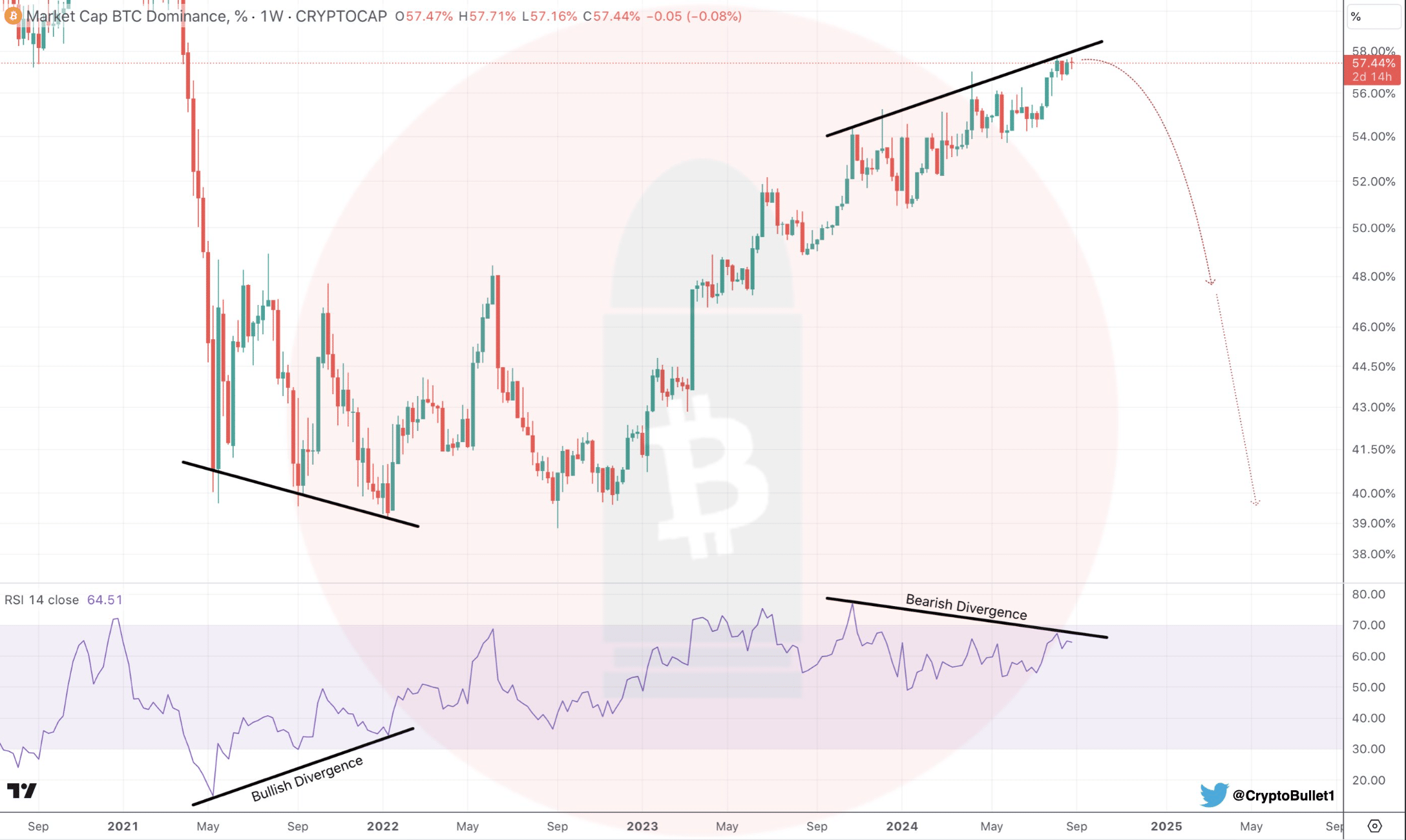

- A bearish divergence appeared on BTC’s dominance chart

- If SOL turns bullish, it could target $187 in the coming weeks

Bitcoins [BTC] Its dominance has been increasing for several weeks now, suggesting that altcoins may have to wait longer for a rally. However, the situation could change quickly as a bullish divergence seems to appear on the charts. This allows altcoins such as Solana [SOL] to gain bullish momentum soon.

That’s why it’s worth taking a look at the chances of an altcoin summer.

Bitcoin Dominance Will Fall Soon?

BTC dominance has consistently remained well above 50%. When this measure rises, it indicates that the likelihood of altcoins gaining upward momentum is low. At the time of writing: BTC’s dominance stOD at 54%, according to Coin statistics.

Furthermore, AMBCrypto’s assessment of the Altcoin Season Index revealed that the indicator had a value of 20. Generally, a value below 25 indicates a Bitcoin season.

Source: Blockchain Center

However, the situation can change quickly. CryptoBullet, a popular crypto analyst, recently shared one tweet which highlights a bullish and bearish divergence on BTC’s dominance chart. As BTC’s dominance increased, a bearish divergence appeared on the Relative Strength Index (RSI) chart.

This could indicate a possible dip in the cryptocurrency’s dominance in the future.

Interestingly, the opposite happened at the end of 2021, with the same resulting in a rise in BTC dominance in the following months. If the bearish divergence pattern is tested, investors could soon see altcoins flourish across the board.

Source:

Will Solana benefit from this?

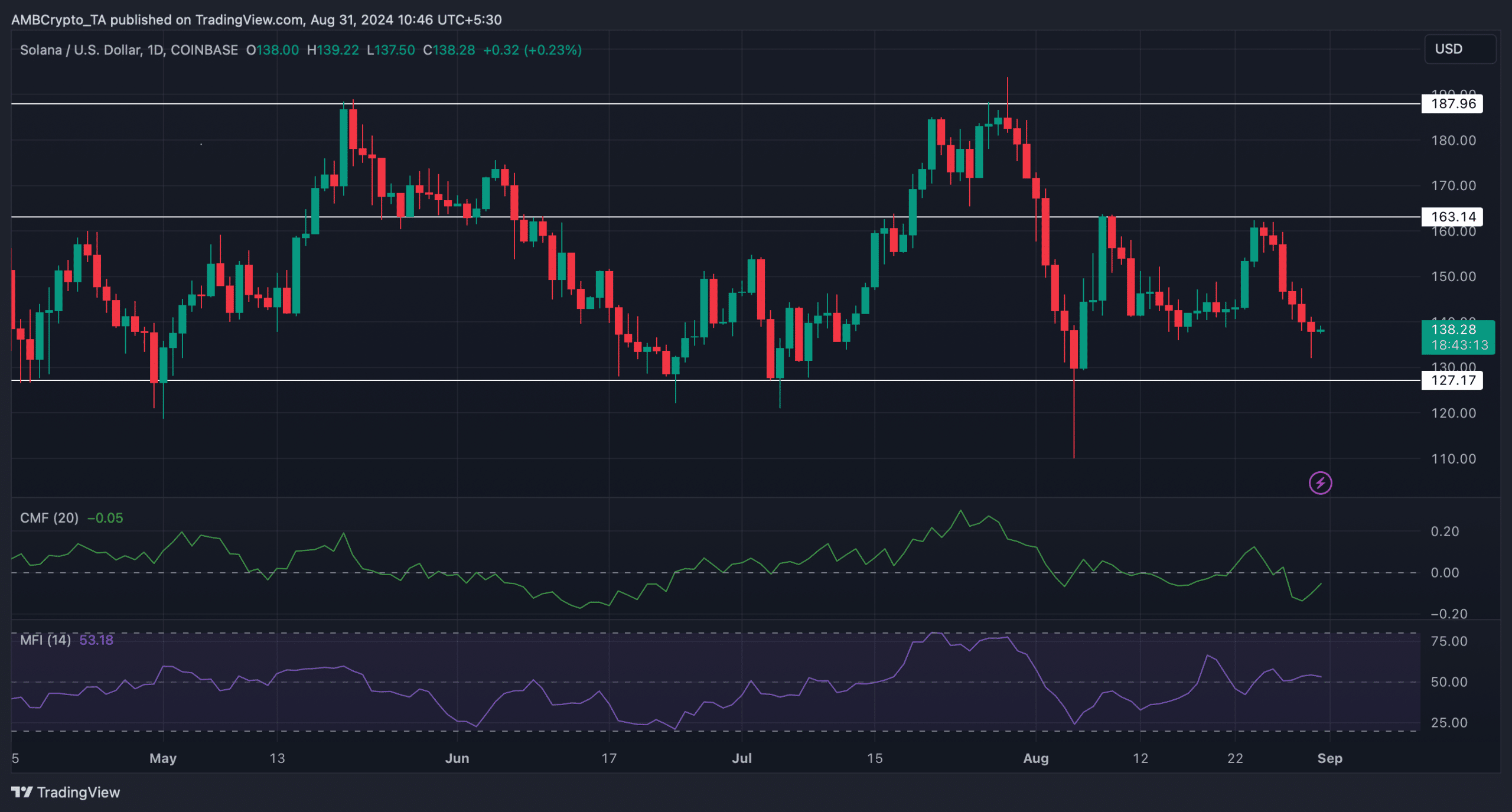

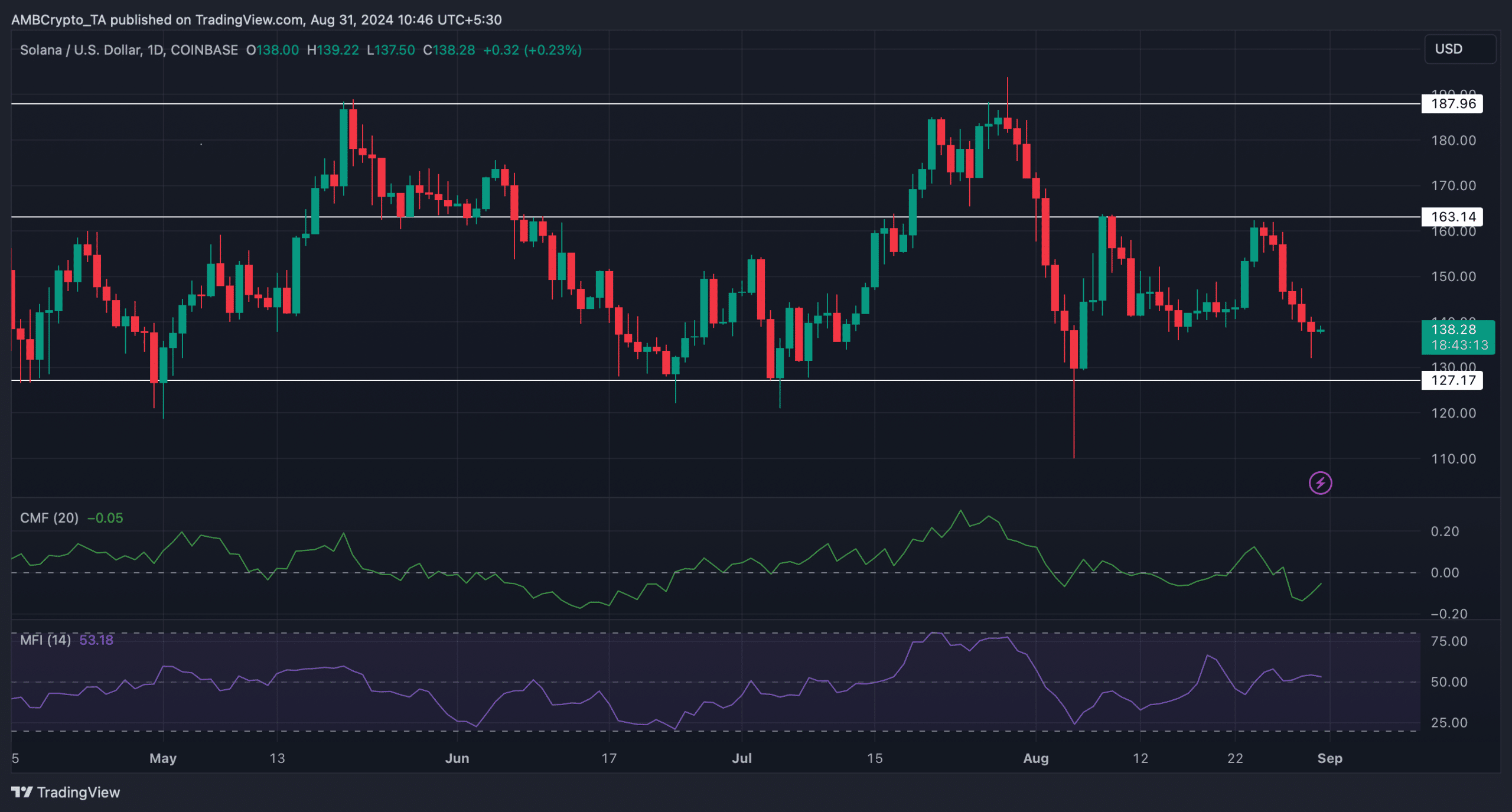

Since a decline in BTC dominance could result in an altcoin rally, AMBCrypto planned to monitor Solana’s state to see if it showed signs of a bull rally. According to CoinMarketCapThe value of SOL has fallen by more than 10% in the past seven days.

At the time of writing, it was trading at $138.57 with a market cap of over $64 billion.

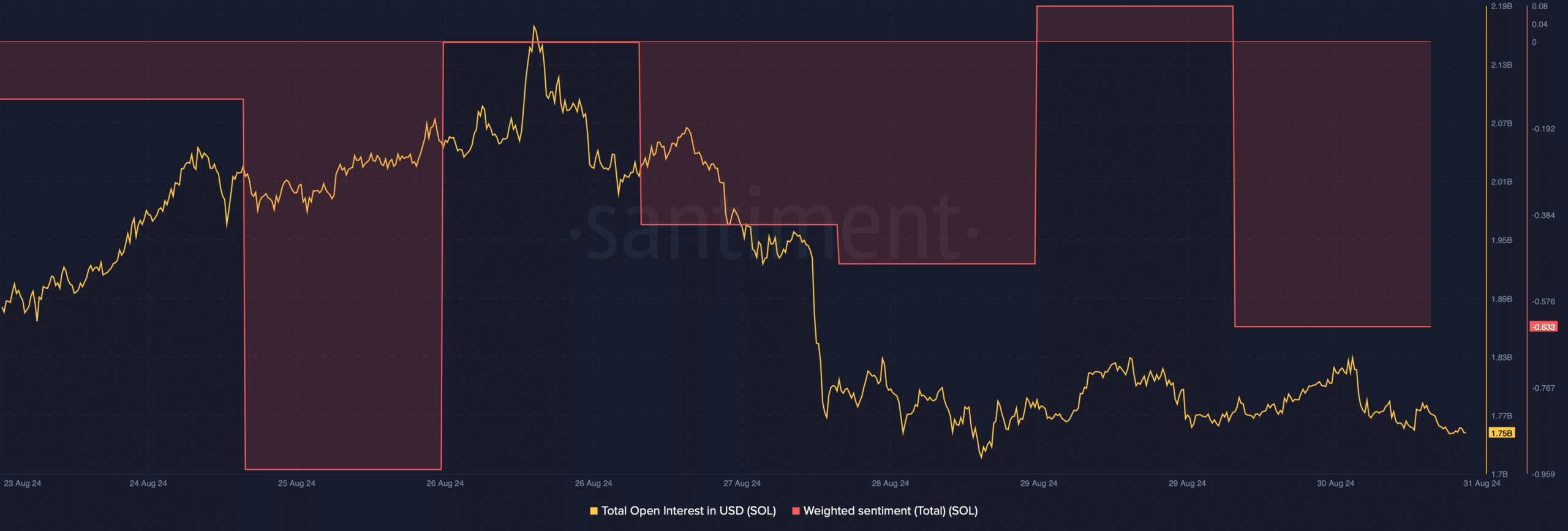

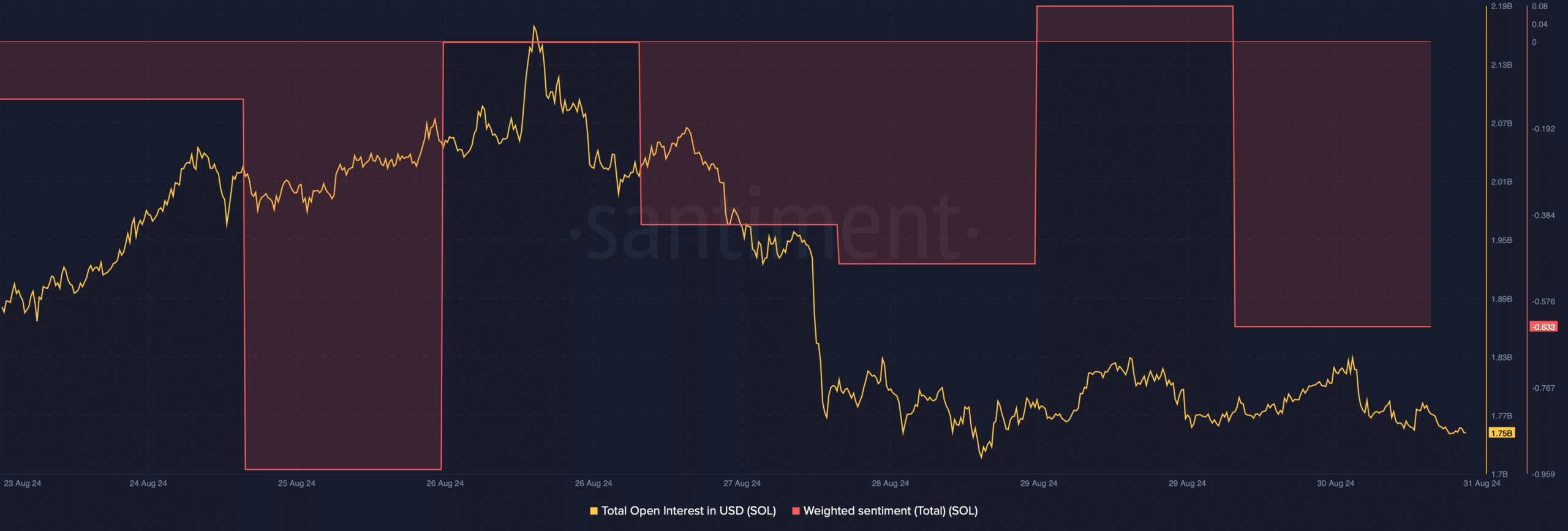

The bad news was that SOL’s trading volume spiked while its price fell, legitimizing the downtrend. The token’s weighted sentiment also plummeted sharply, meaning that bearish sentiment around SOL was dominant.

Source: Santiment

Nevertheless, SOL’s Open Interest declined. Typically, a decline in this measure indicates that there are chances of the ongoing price trend changing. Therefore, AMBCrypto checked the daily chart of SOL to find out what the technical indicators were suggesting.

The Money Flow Index (MFI) recorded a decline, indicating a continued decline in prices. If that happens, investors could see the SOL fall to $127.

Is your portfolio green? View the SOL profit calculator

On the contrary, the Chaikin Money Flow (CMF) went north. Furthermore, if BTC’s dominance wanes, SOL might as well turn bullish. In the event of a bullish takeover, SOL could target $163 before beginning its journey towards $187.

Source: TradingView