- Why does Bitcoin sold out right before and at every open American market?

- Bitcoin and its ETFs are set to boom.

Bitcoins [BTC] A recent phenomenon during the opening of the US market has attracted the attention of traders and analysts.

The King Coin has experienced consistent sell-offs just before and during the opening of the US market, with prices initially rising to shake out shorts, followed by a gradual decline to shake out longs, before the actual market move occurred.

This pattern can be caused by factors such as pre-market trading, market sentiment, supply and demand dynamics, and the trading behavior of institutional investors.

This phenomenon has particularly affected Bitcoin ETFs in the US

Source: TradingView

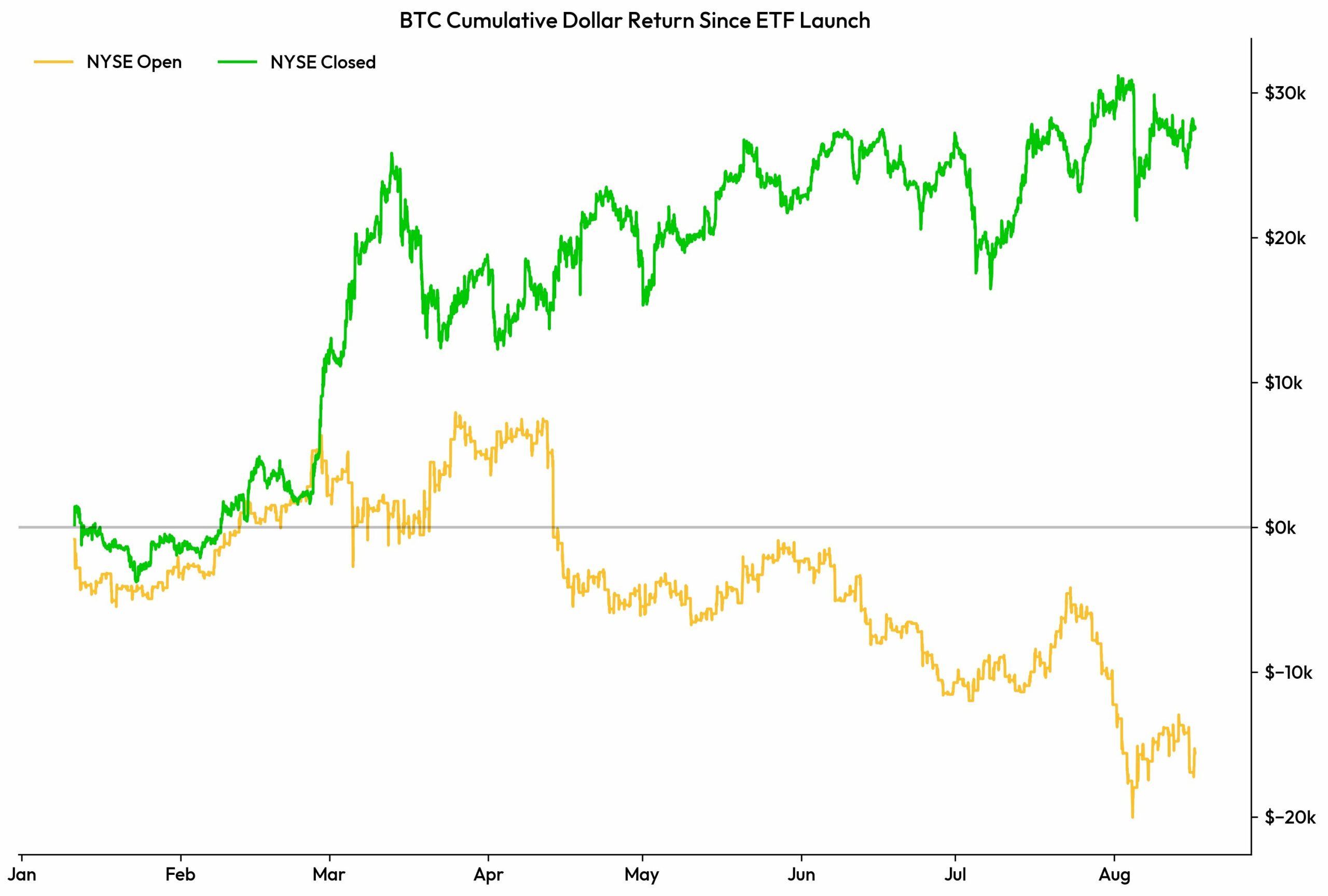

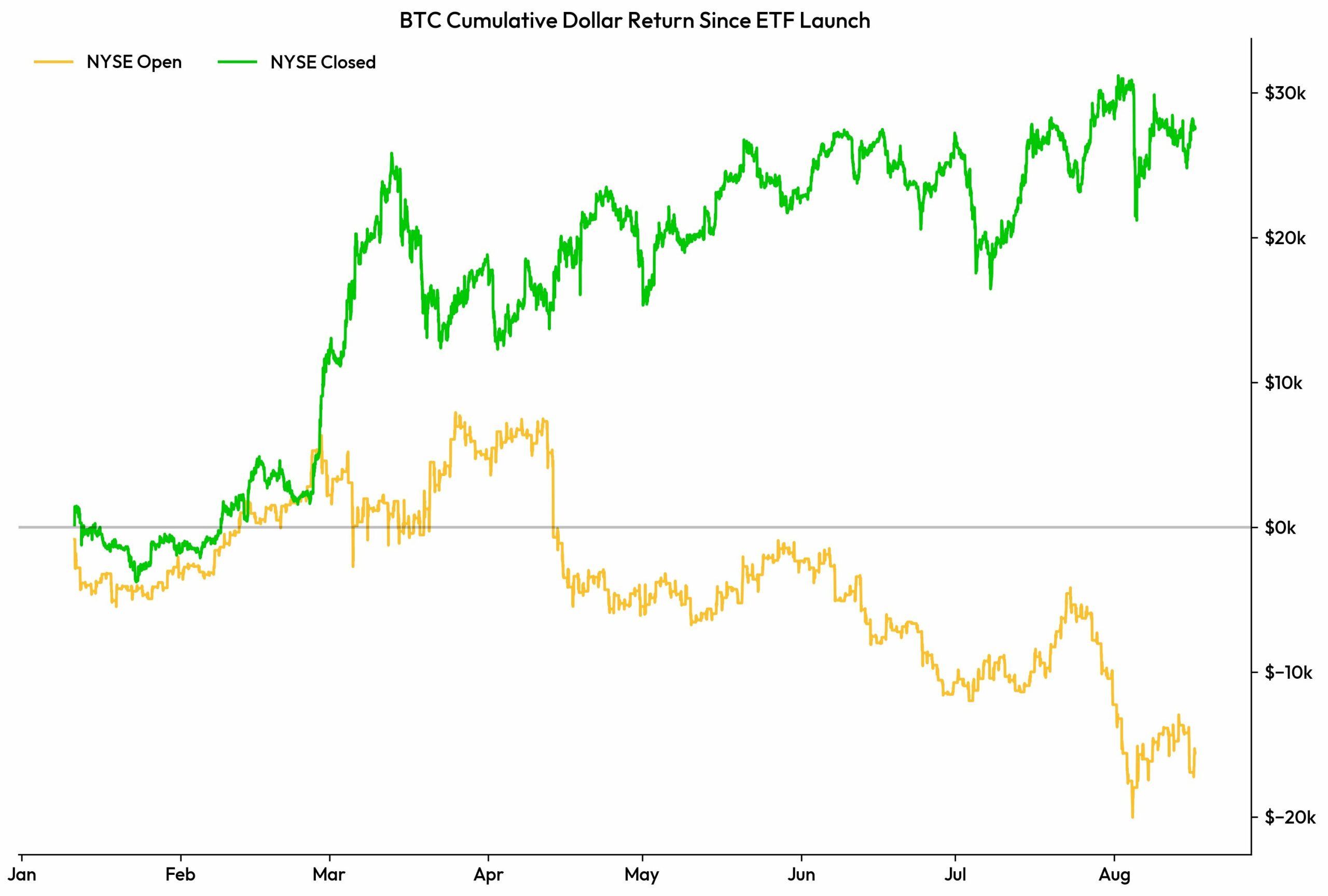

Bitcoin’s cumulative dollar returns since the ETF’s launch

Since the launch of these ETFs, Bitcoin’s cumulative dollar return has shown a clear pattern: it tends to fall when the NYSE is open and rise when the NYSE is closed.

Traditional finance, which is now heavily involved in crypto markets, has likely contributed to this trend of Bitcoin’s price movements during market hours influencing the performance of ETFs.

Source: Velo data

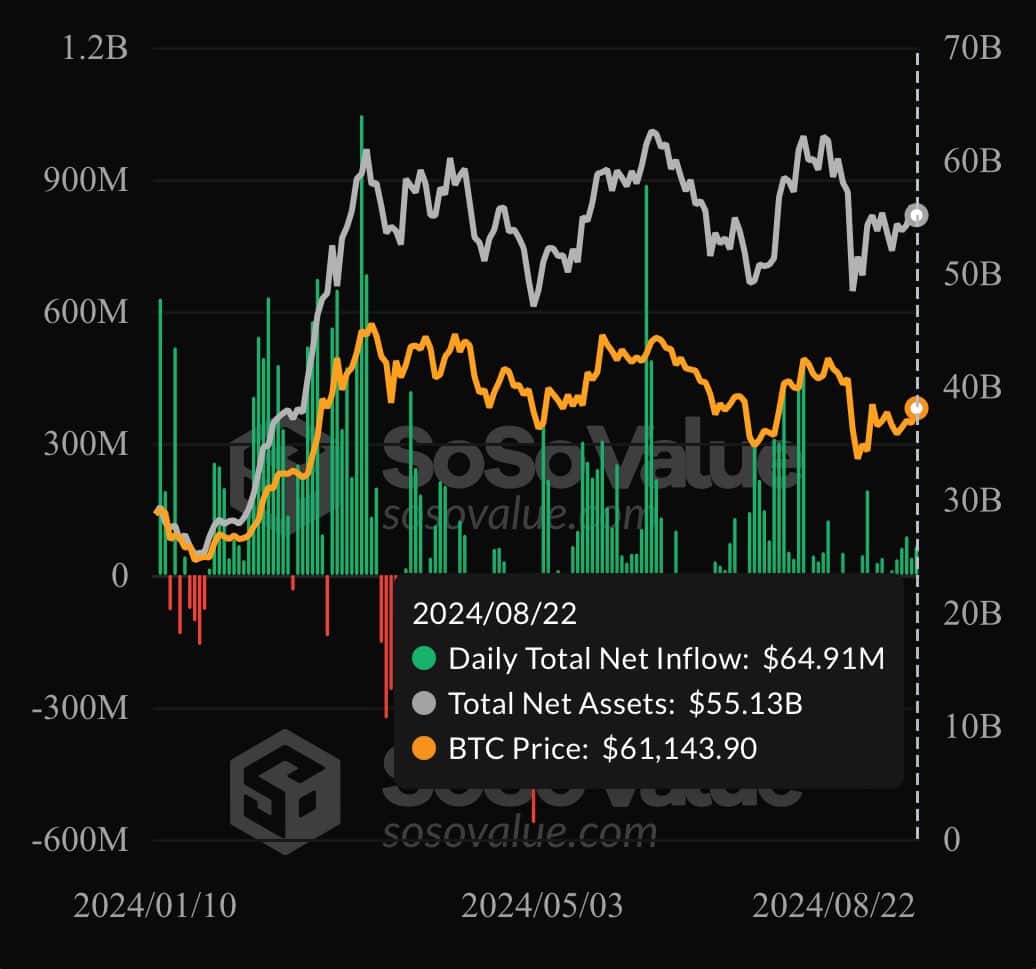

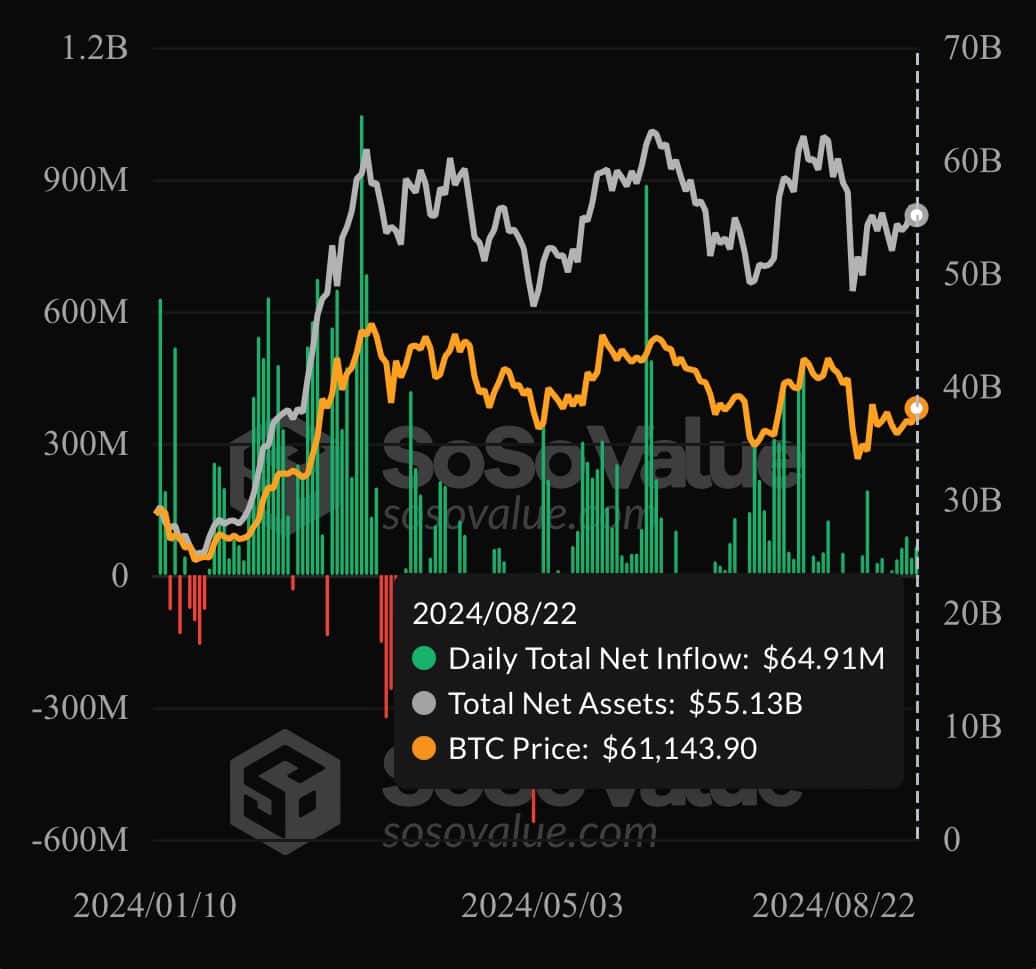

Bitcoin ETF flow and daily trading volume

Bitcoin ETFs recorded $65 million in daily net inflows yesterday, marking the sixth consecutive day of inflows.

This trend highlighted an increase in both net flows and daily trading volumes, with total net assets now reaching $55.13 billion.

For example, recently the BlackRock spot Bitcoin ETF ($IBIT). included a trading volume of $758 million, contributing to a total daily volume of $1.4 billion for ETFs, such as Bitcoin Archive noted on X (formerly Twitter).

Source: SosoValue

This surge in trading activity has supported Bitcoin’s price, allowing it to retest key levels. This means that if a higher low is made around $67,000, the King Coin could continue its uptrend and target $70,000.

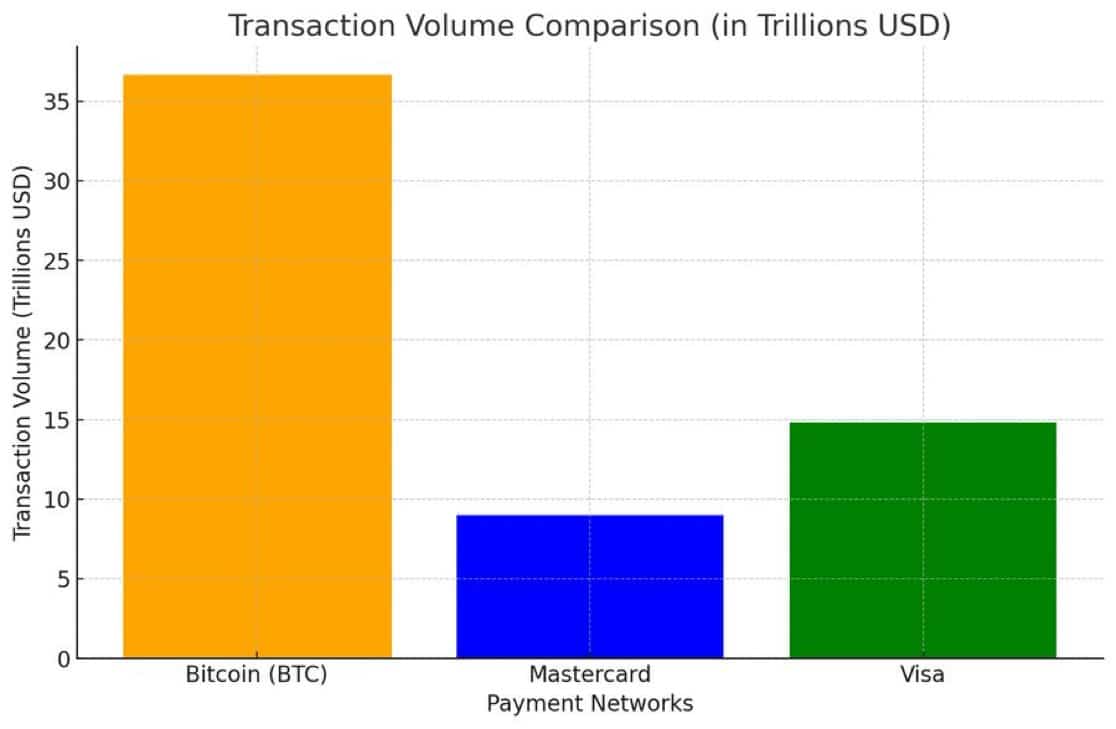

Comparison of transaction volumes

Additionally, Bitcoin’s transaction volume also remained robust, with the network processing $36.6 trillion in 2023, surpassing both Visa and Mastercard combined.

Source: Bitcoin Archive/X

However, ETF holders miss out on this direct participation in Bitcoin’s transactional growth because their holdings are tied to custodians and represented by paper shares.

This limitation in ETF structures needs to be addressed, but it does not detract from Bitcoin’s long-term prospects.

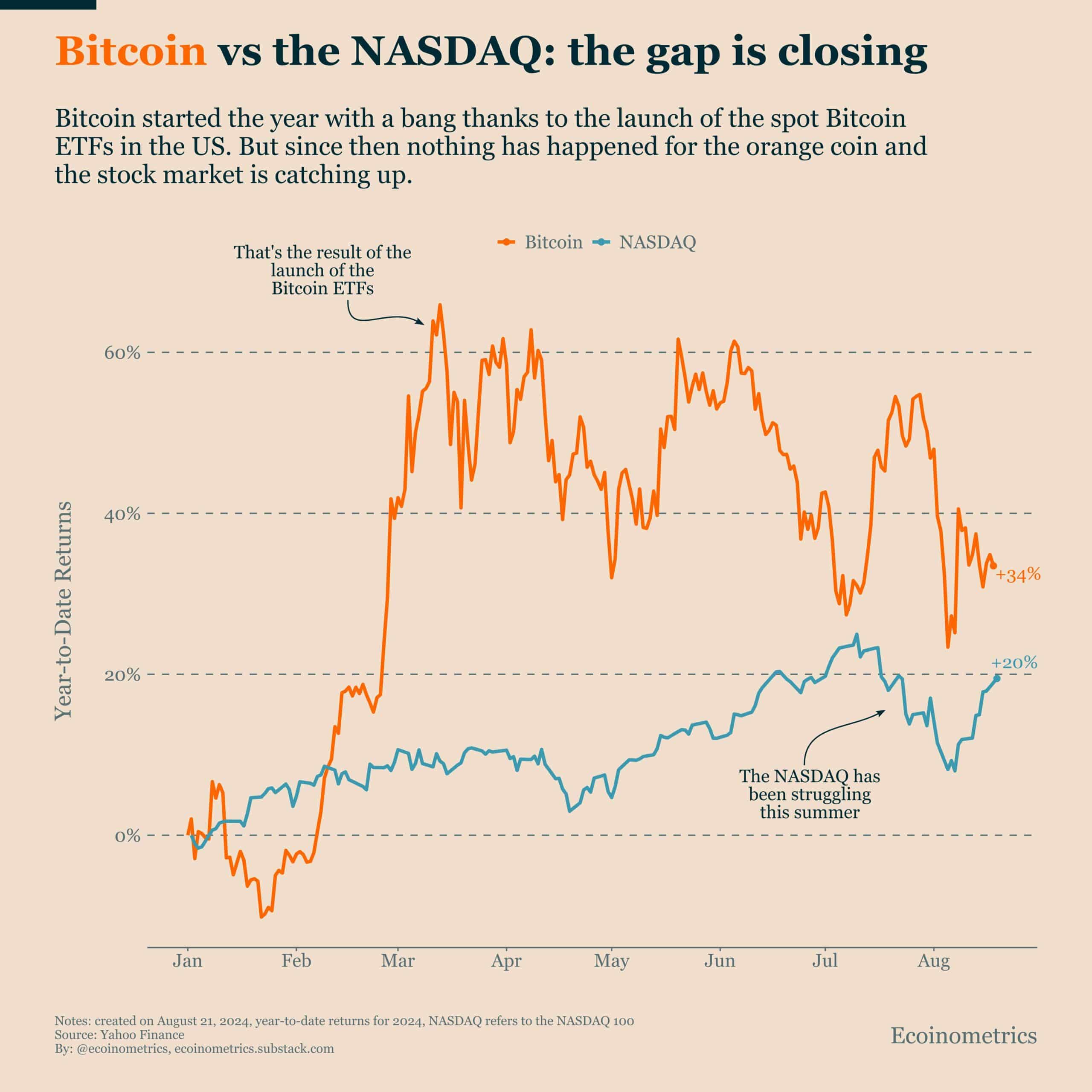

Bitcoin is still outperforming stocks in terms of returns this year

Additionally, Bitcoin continued to outperform traditional stocks in terms of returns this year, with a 34% gain compared to NASDAQ’s 20%.

Read Bitcoin’s [BTC] Price forecast 2024-25

While the gap has narrowed recently, the continued recovery in the crypto markets suggests that Bitcoin’s future gains could be substantial, especially if more bullish drivers emerge.

Source: Econometrics

Despite a relatively quiet year, the early momentum from the ETF launch and the potential for further market catalysts indicate that Bitcoin’s price could rise significantly in the near future.