- Bullish sentiment is rising as the halving approaches.

- However, some indicators point to the possibility of a further decline in the value of BTC.

As the market awaits a price increase following Bitcoin’s halving, pseudonymous CryptoQuant analyst Gaah noted in a new report that a further decline in the value of the currency is still possible.

The halving event, scheduled for April 19, is expected to reduce the number of BTC in circulation by halving the rewards for miners, from 6.25 BTC to 3.125 BTC.

History books tell us this about the coin’s next move

Historically, the price of the coin has risen dramatically following halving events. According to Bloombergs According to data, BTC’s price rose 8,691% a year after the 2012 halving, 295% after the 2016 event, and 559% after the 2020 event.

Despite recent market problems, these precedents have led to a spike in bullish sentiment. However, according to Gaah, some indicators point to the possibility of a further decline in the price of BTC.

Gaah assessed BTC funding rates based on a 30-day moving average and noted that it has increased,

“To all-time highs in 2021.”

When an asset’s Futures Funding Rate shows an increase and is significantly positive, it indicates strong demand for long positions.

It is considered a bullish signal and a precursor to an asset’s continued price growth.

Is your portfolio green? Check out the BTC profit calculator

However, excessively high financing rates increase the risk of prolonged liquidations, often leading to high market volatility and unpredictable price fluctuations.

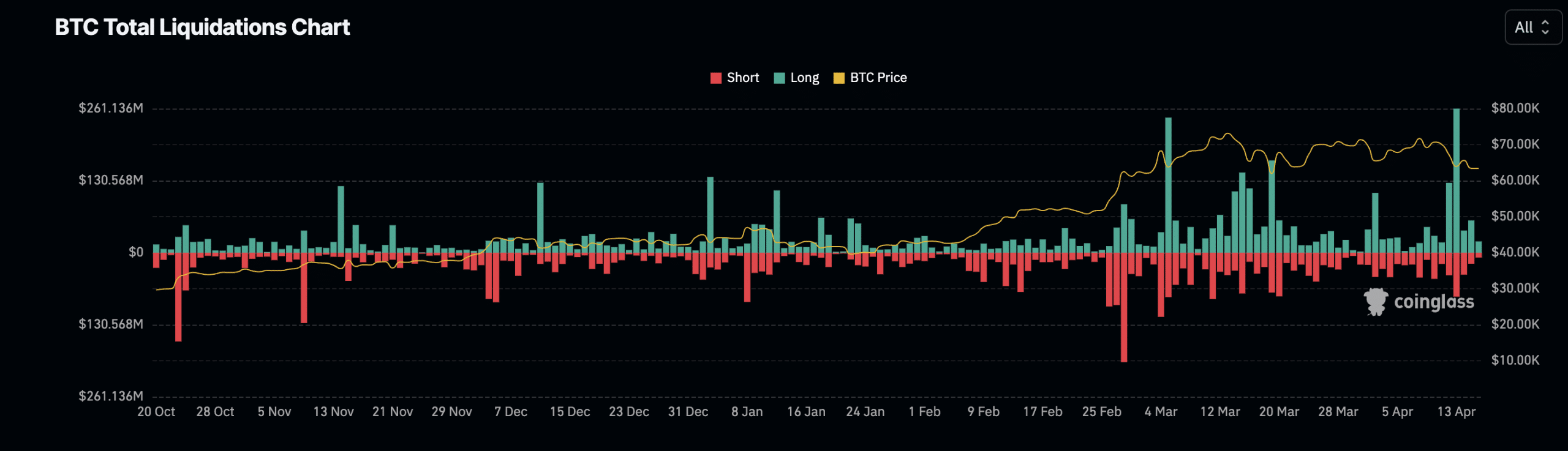

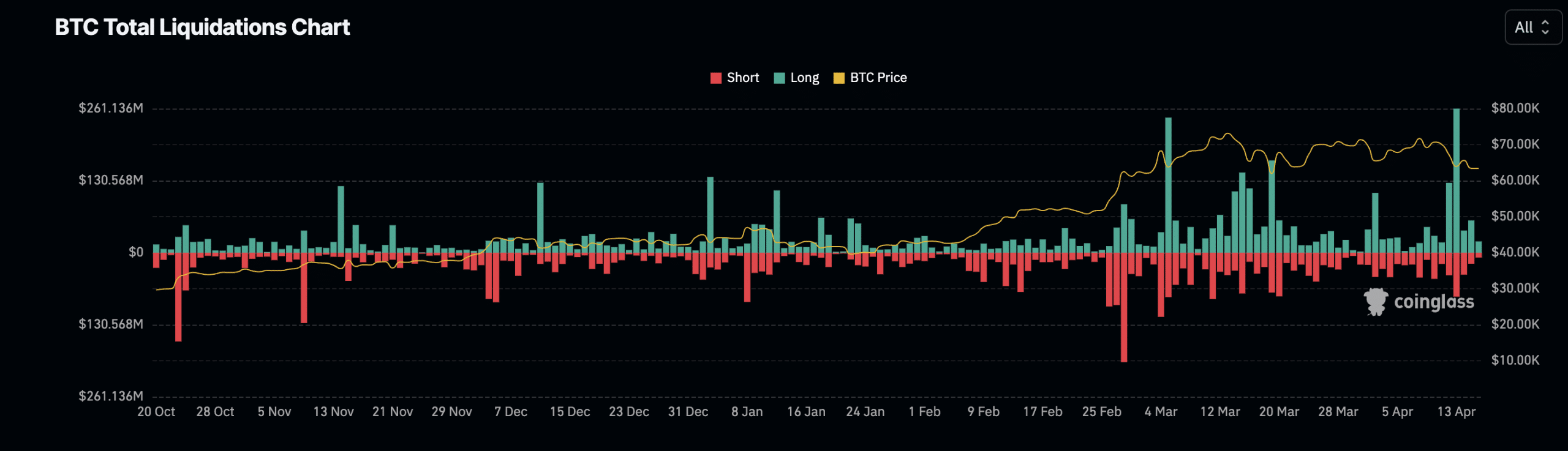

This happened on April 13, when the price of the coin suddenly dropped from the $67,000 price area to end the day at $62,000.

On that day, long liquidations rose to a multi-month high of $261 million, according to AMBCrypto’s look at Mint glass’ facts.

Source: Coinglass

Gaah noted that BTC’s current all-time high, $73,750, represents:

“The biggest resistance ever.”

This means that there is high selling pressure at this price level, making it difficult for the price to rise past it and reach new highs.

Furthermore, Gaah found that the price increase of BTC since October 2023 has increased retail activity in the market, saying:

“It is the first time in three years that retail flows have not reached values above the mid-range, which strongly indicates the presence of this category of investors in the market.”

Based on BTC’s historical performance, the analyst noted that a spike in BTC’s retention activity –

“It means a potential summit is in the making.”

So a price drop may be in the offing.