- Bitcoin’s Futures Open interest rate fell by 35%, mirroring ETF outflows and shifting sentiment at derivatives markets.

- Lower futures and ETF liquidity can strengthen BTC volatility in the short term, because traders adjust their positions.

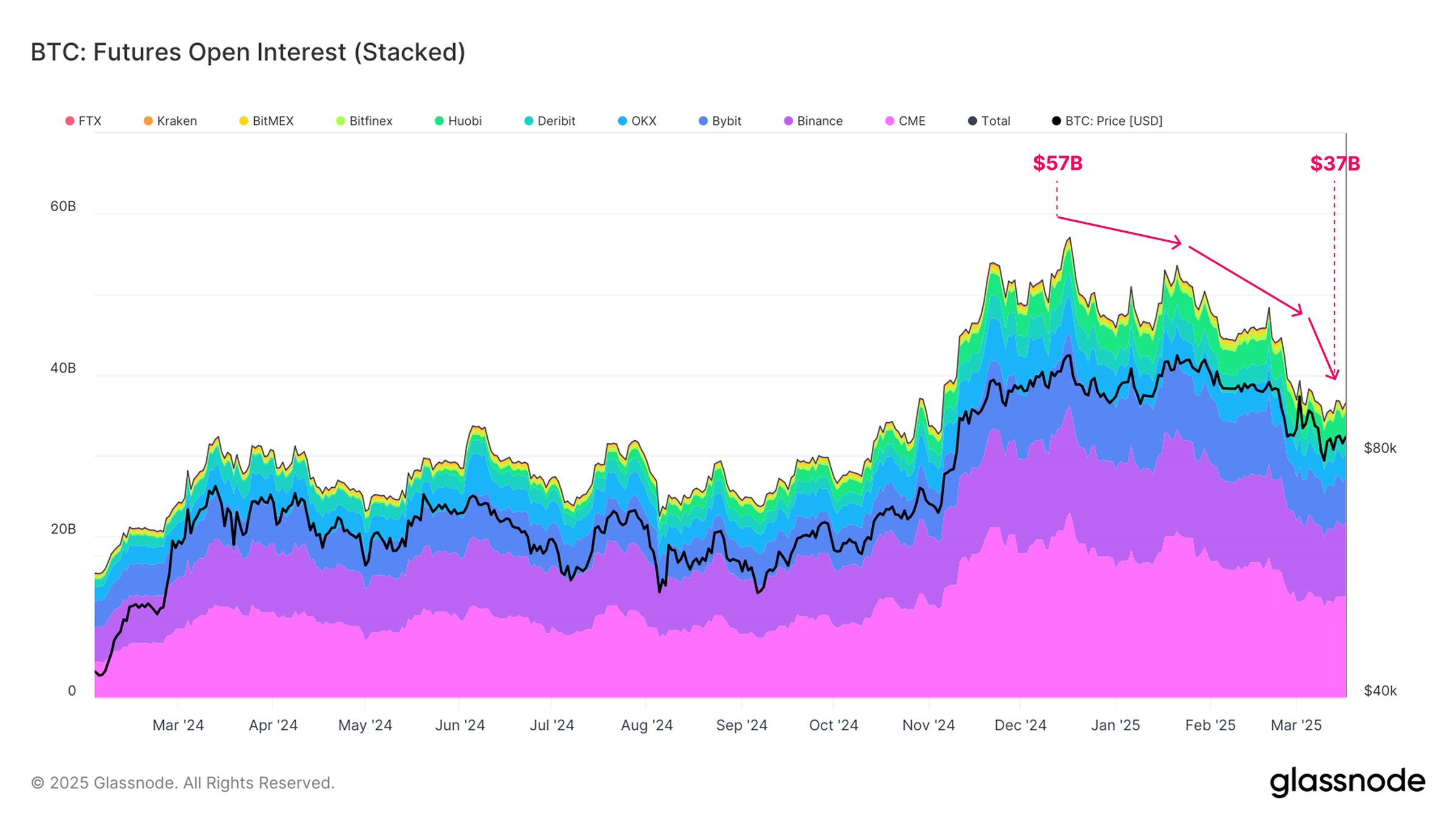

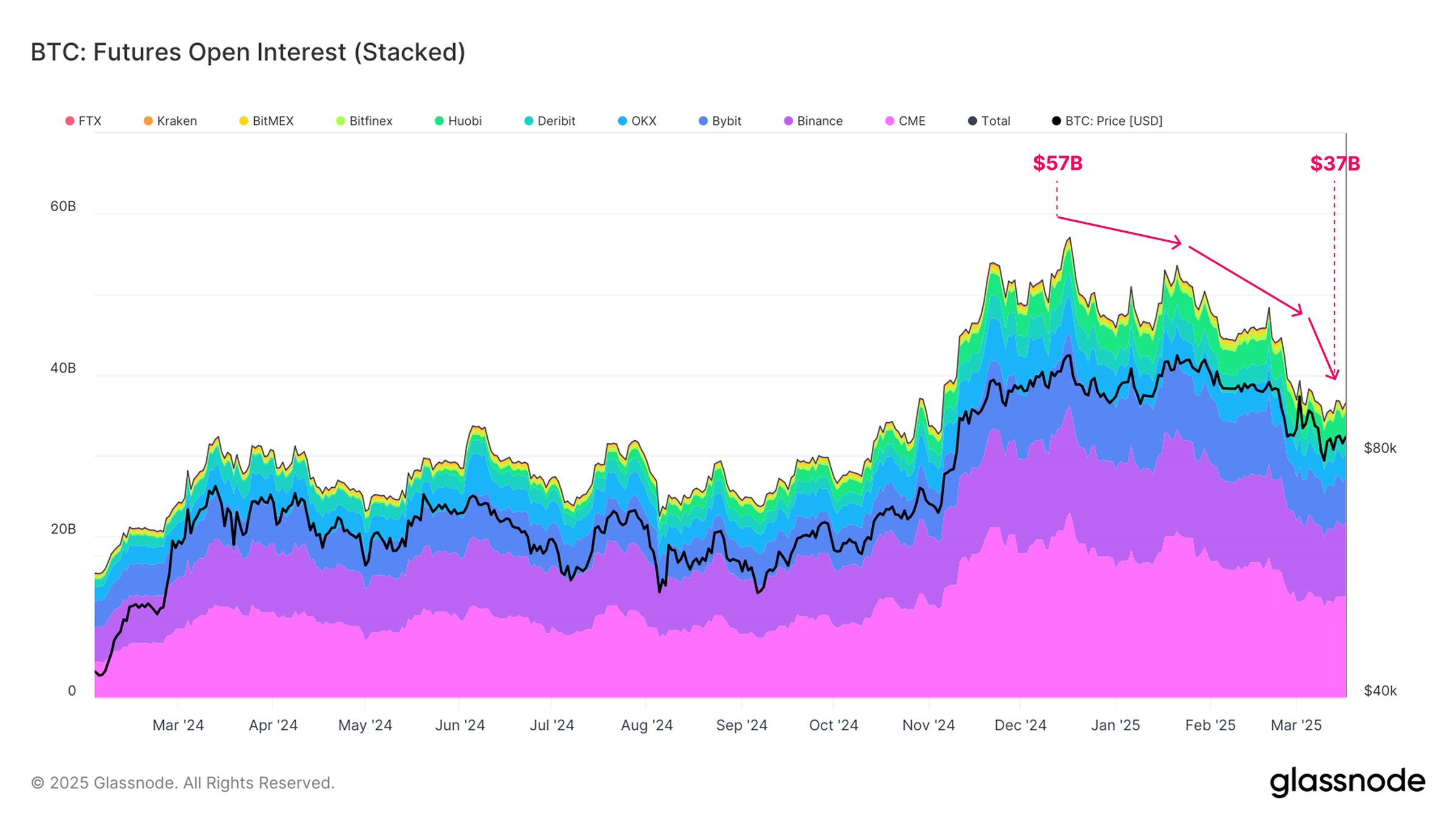

Bitcoin’s [BTC] Futures Market has seen a sharp contraction, with open interest (OI) that dropped from $ 57 billion to $ 37 billion, a considerable decrease of 35% since BTC’s All-Time High (ATH).

This decline of OI, in combination with ETF outflows and decreasing CME Futures -activity, indicates a shift in the positioning of investors.

As liquidity contracts, there are questions about Bitcoin’s ability to maintain stability in the midst of changing market conditions.

Dallen Bitcoin Futures Open interest

Futures OI has traditionally been an important indicator for market speculation and lifting tree positioning.

The steep drop suggests that traders close positions, possibly due to profitable or risk aversion after the Bitcoin Ath. This decrease reflects a wider shift to a more careful market, with reduced speculation and covering activity.

Source: Glassnode

The graph of Glass node illustrates a steady structure of Futures Open interest on 2024, with a peak of $ 57 billion before he starts his downward trend.

The decline is in line with a period of lower BTC volatility, which indicates that leverage traders have shifted positions instead of entering aggressively new transactions.

ETF outflows and cme futures -closures contribute to sales pressure

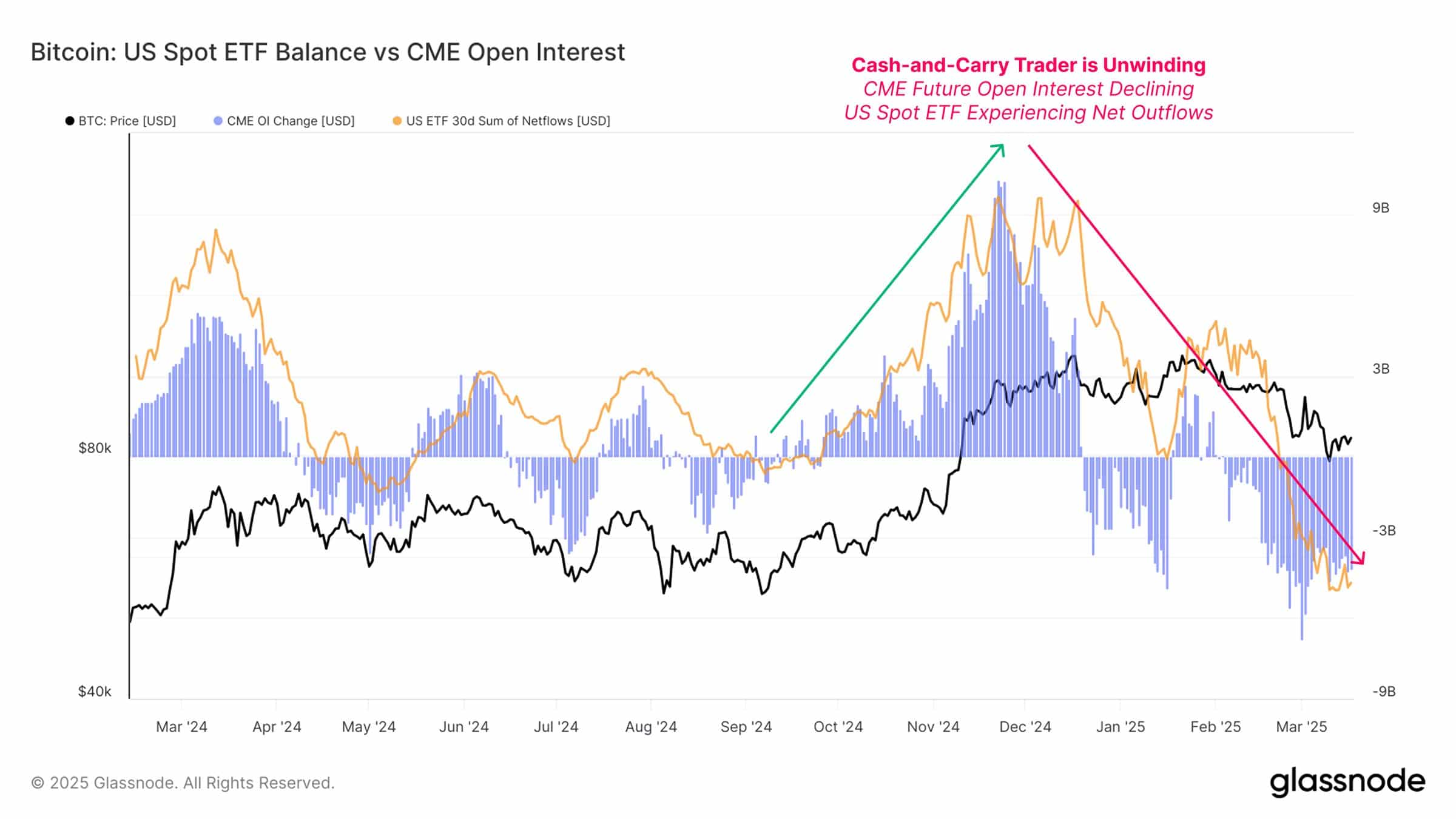

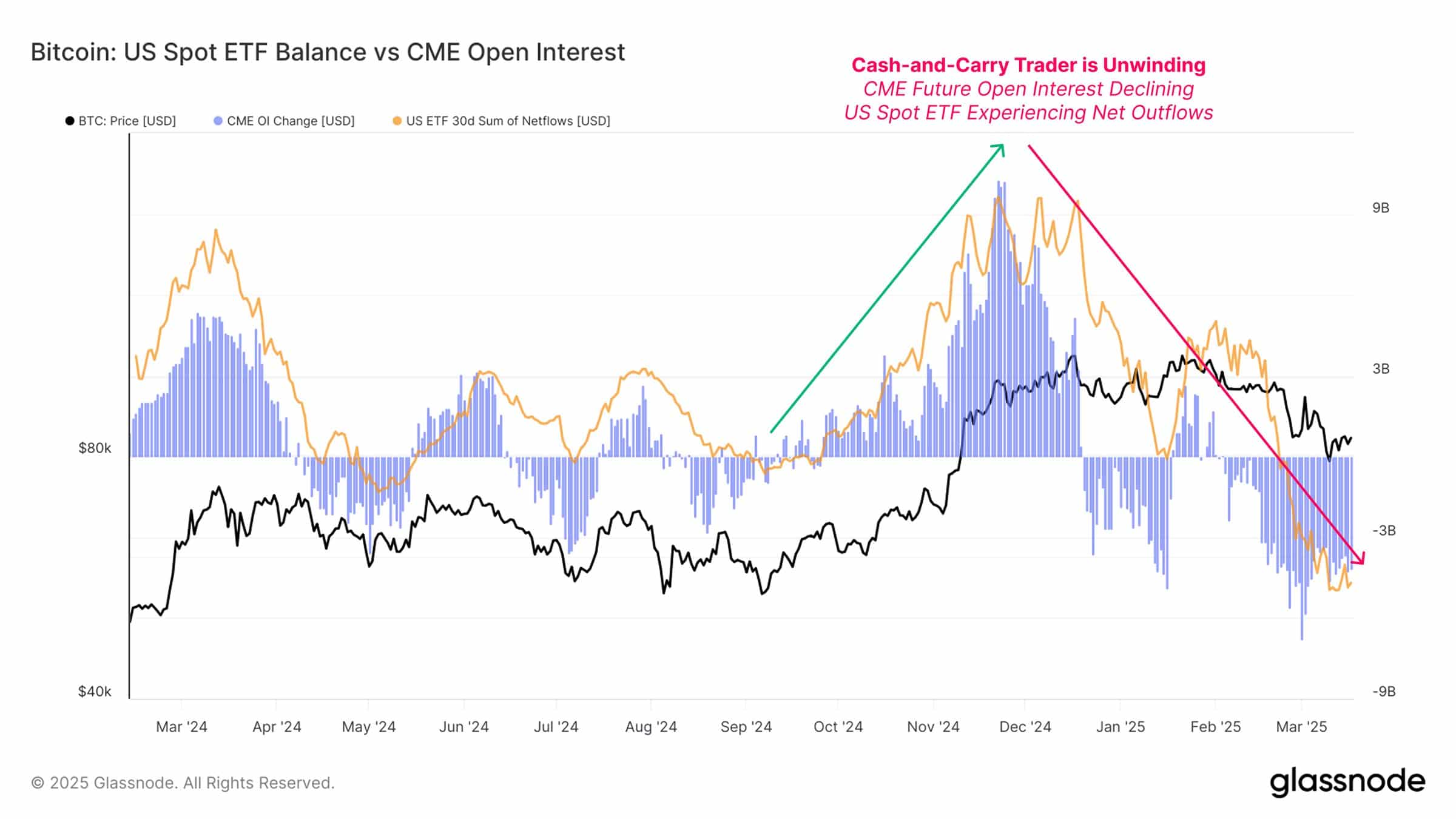

In addition to the Futures market contraction, the Bitcoin ETF space has also experienced net outflows. The settlement of the Cash-and-Carry trade, a strategy that traders use to use the distribution between futures and spot prices, has contributed to the ETF liquidity drainage.

This suggests that settings and major players can be moved from Bitcoin in the short term.

Source: Glassnode

CME Futures data also show a falling open interest, which signals historically institutional hesitation.

The correlation between CME -Futures and BTC price movements has been strengthened in recent months, making this decrease a crucial factor to look at. Bitcoin might have difficulty reclaiming the most important resistance levels if the outflows continue.

What this means for the price of BTC

Bitcoin traded at $ 83,918 at the time of the press, under the 50-day advancing average (MA) at $ 85,386 and considerably below the 200-day MA at 95,340.

Source: TradingView

The lack of liquidity driven by Futures suggests that BTC may experience problems with retaining bullish momentum. The most important support is near $ 80,000, while resistance of $ 85,000 remains a crucial threshold for every upward movement.

With Futures OI Krimpen and ETF -Liquidity drying up, the price of Bitcoin can enter a phase of increased volatility.

Whether BTC stabilizes or experiences further disadvantage can depend on whether long -term intervention intervenes to absorb the sales pressure. Traders must look forward to renewed accumulation signals before they expect a persistent rally.