- Bitcoin’s offer at stock exchanges fell by 7.53%, which indicates an increased trust of investors and reduced liquidity.

- Rising network activity and technical indicators suggested that Bitcoin could enter a bullish phase.

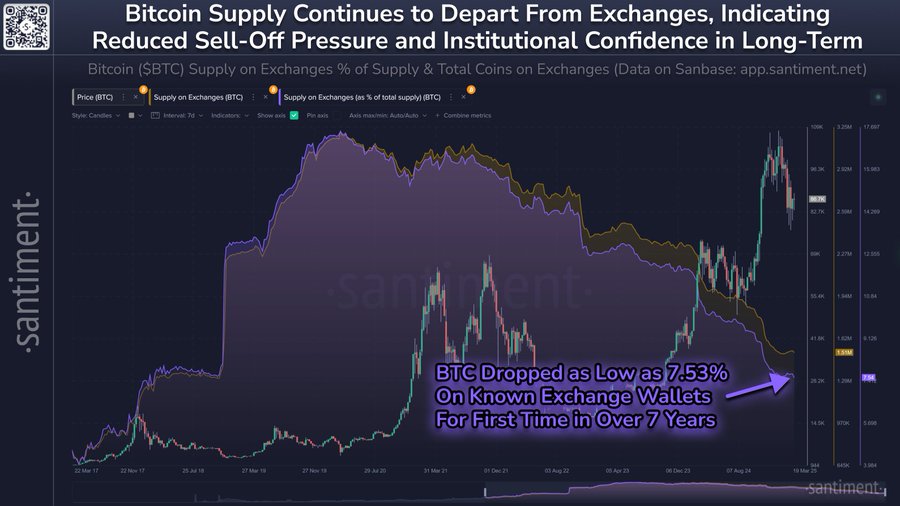

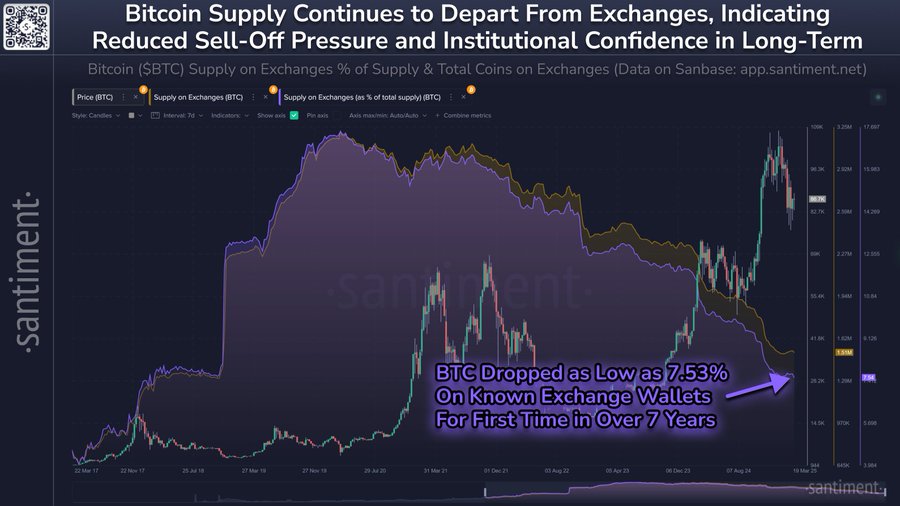

Bitcoin’s [BTC] The range on exchanges has fallen to only 7.53%, which marks the lowest level since February 2018. At the time of the press, Bitcoin traded for the past 24 hours at $ 87,075.28, a decrease of 0.95%.

As more investors choose to ‘HODL’ their BTC, this shrinking stock reflects an increasing institutional confidence in the long -term value of Bitcoin. With fewer people who want to sell, BTC was able to see increased volatility because of the decreasing liquidity in the market.

Why does Bitcoin’s Exchange Supply shrink?

The sharp decrease in Bitcoin exchange supply reflects a shift in the sentiment from investors to keeping instead of selling. This indicates growing confidence in the future potential of Bitcoin.

With reduced availability, price fluctuations can occur if the supply exceeds the supply. Increased market confidence means that fewer holders are willing to sell, so that Bitcoin’s exchange provision is further limited.

Source: Santiment

How active is the Bitcoin network?

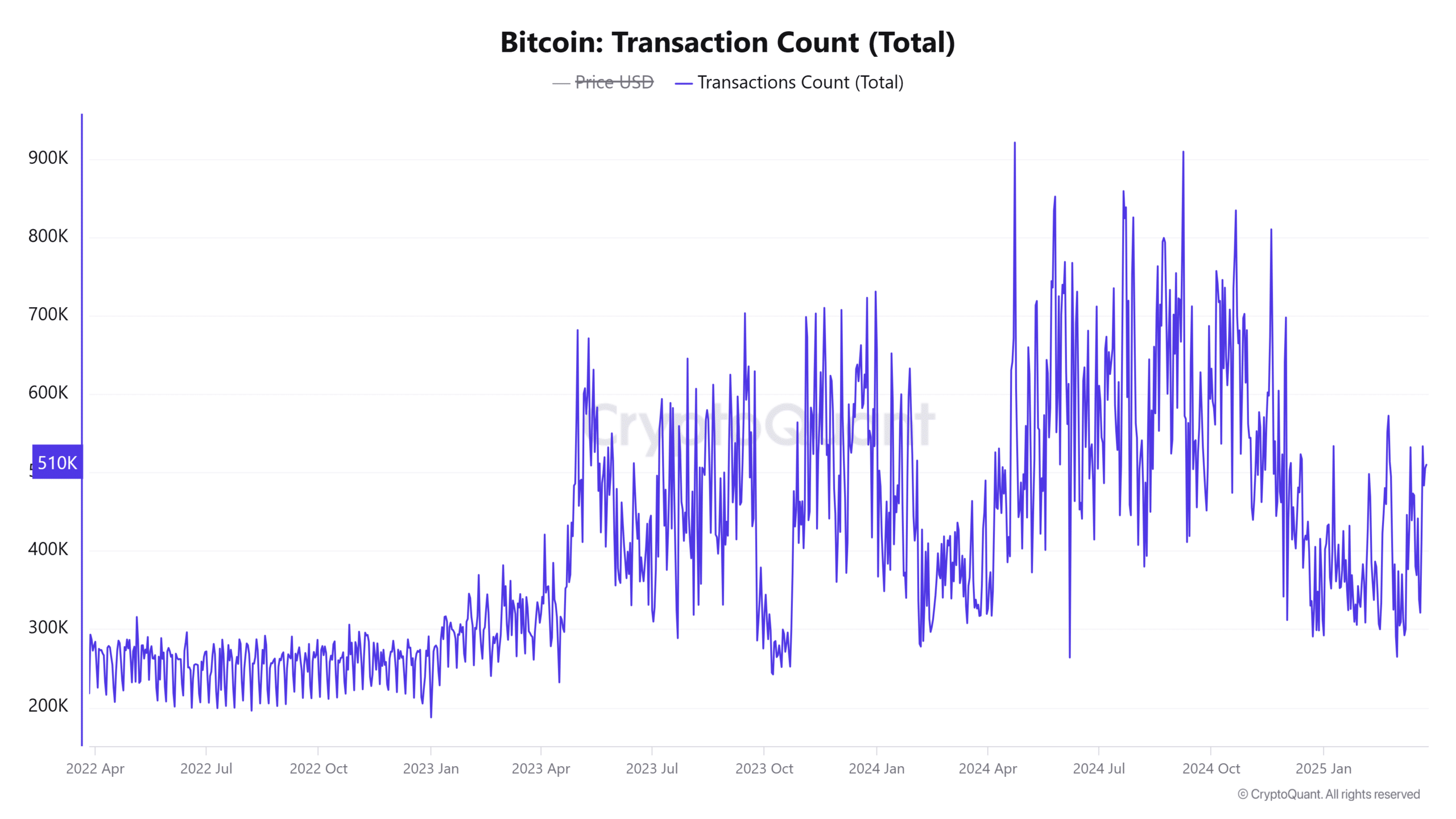

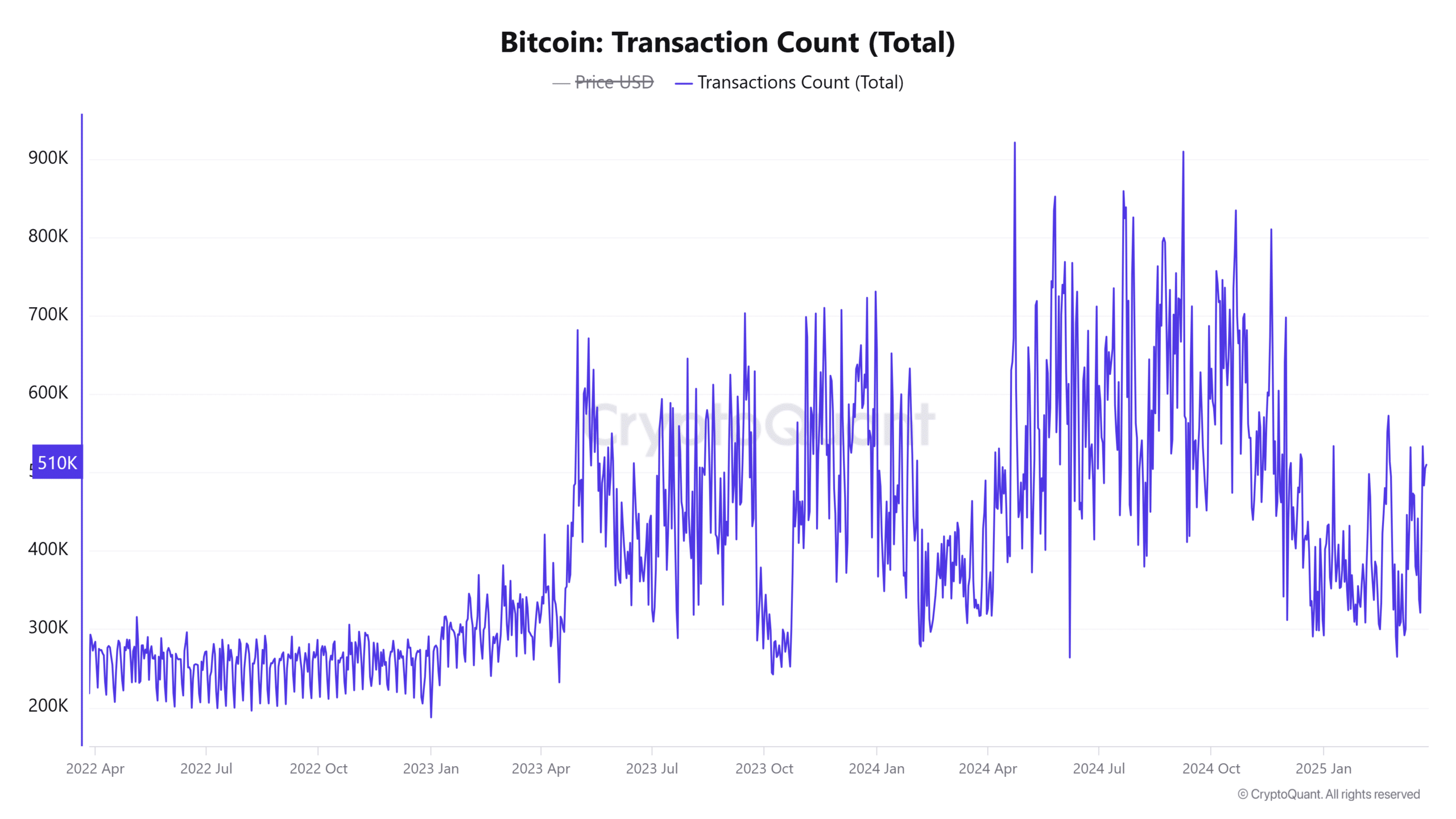

The network activity of Bitcoin also reflects the growing interest of investors. Active addresses have increased by 1.16%and reached up to 10.17 million. This turnout shows more users who interact with the BTC network, whether it is about sending or receiving funds.

Moreover, the number of transactions has increased by 0.74%, in total more than 418,000 transactions. This increase in network activity indicates that more people become involved in BTC, which could lead to a higher demand and, possibly, upward price pressure.

Source: Cryptuquant

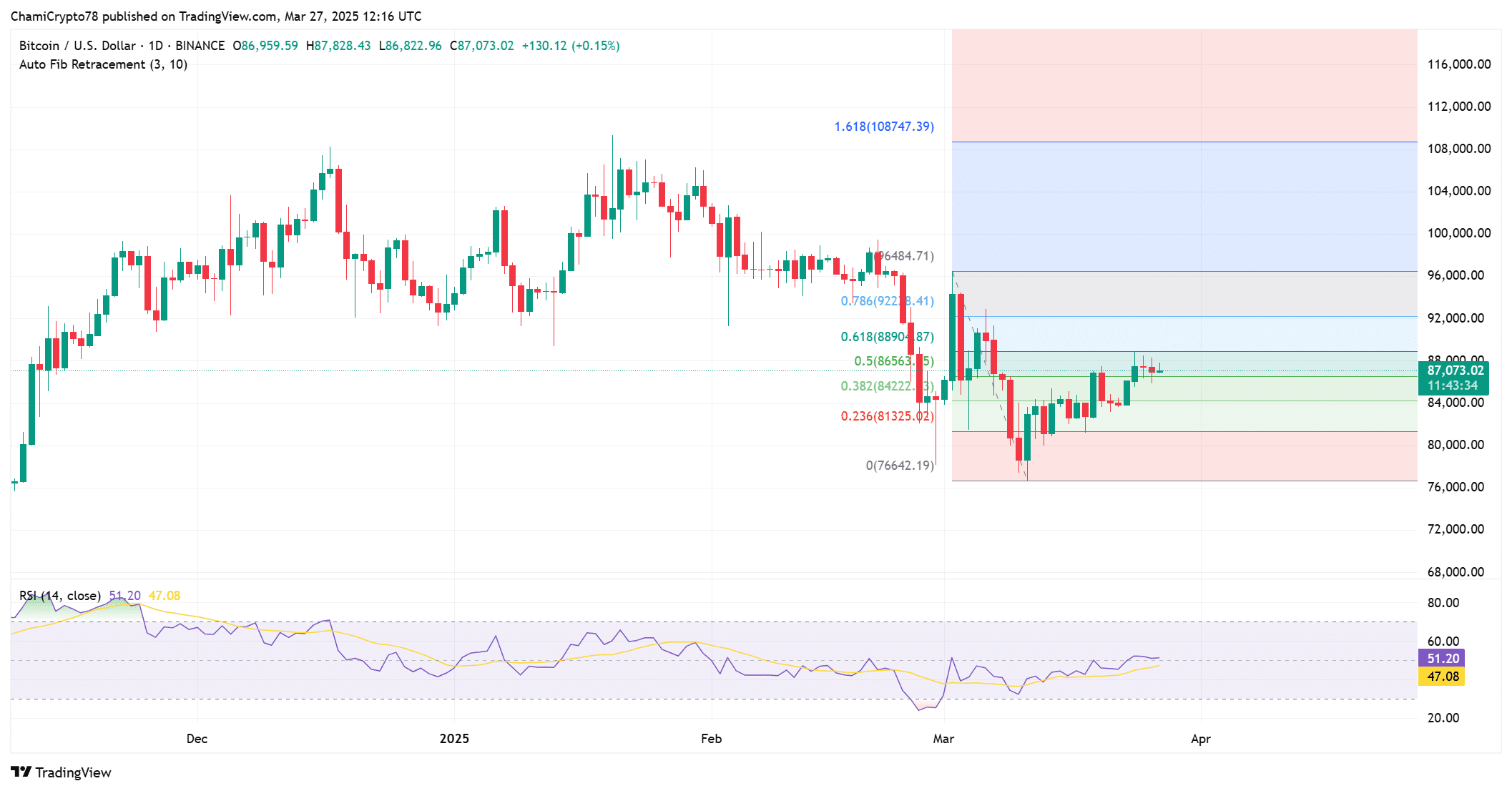

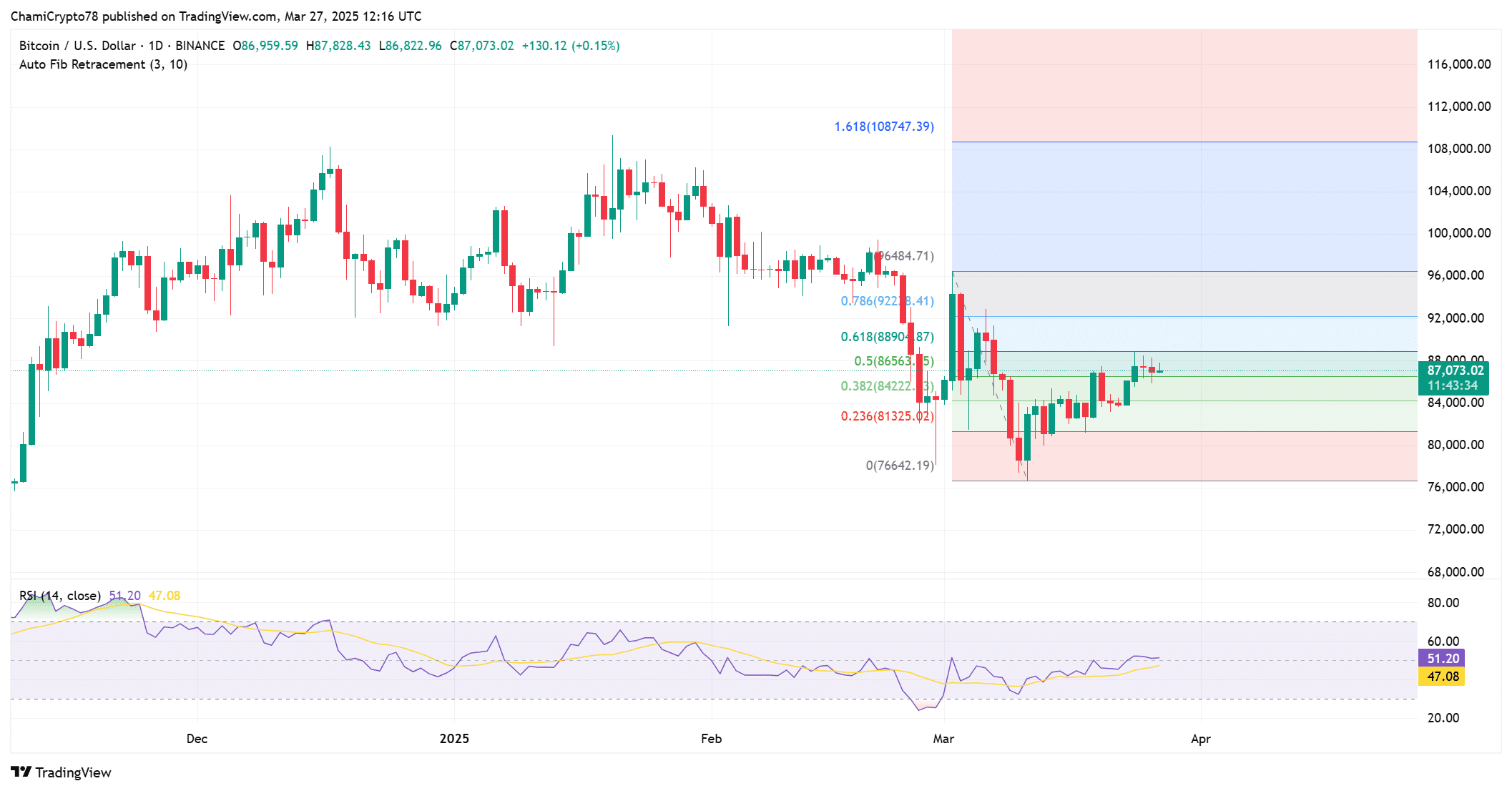

Technical indicators: Is BTC ready for an outbreak?

Looking at technical indicators, the price diagram of BTC shows encouraging signs. At the time of the press, the Fibonacci retracement levels that Bitcoin found support at the level of 0.236, around $ 81,325 suggested.

Moreover, the RSI was 51, which indicates that neither BTC is neither overbought nor sold. This suggests that BTC still has room to move in both directions, with a potential outbreak on the horizon if it retains the most important support levels.

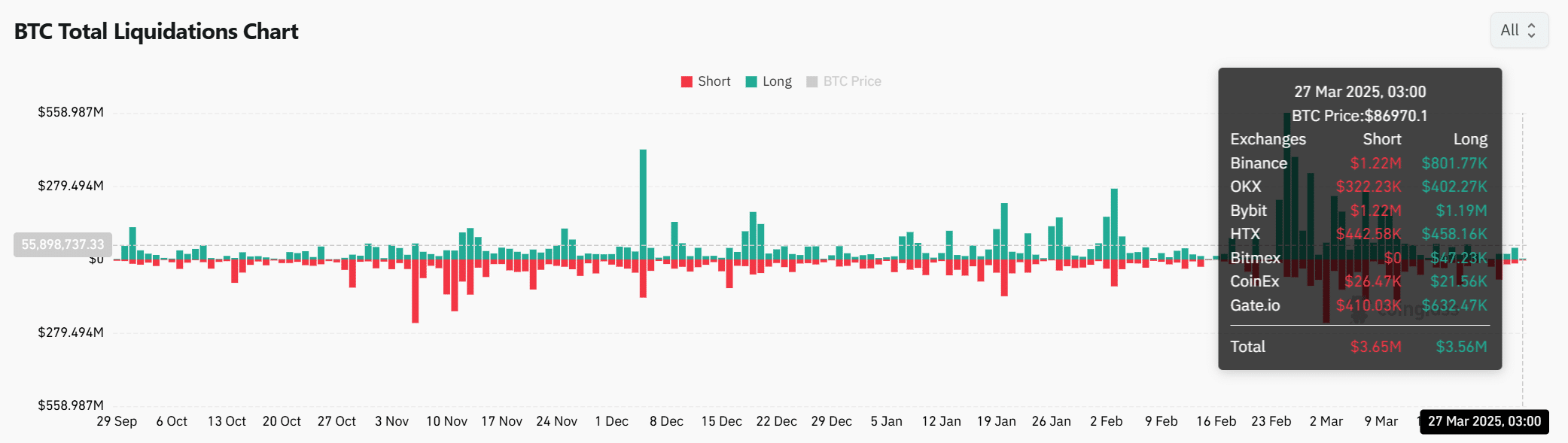

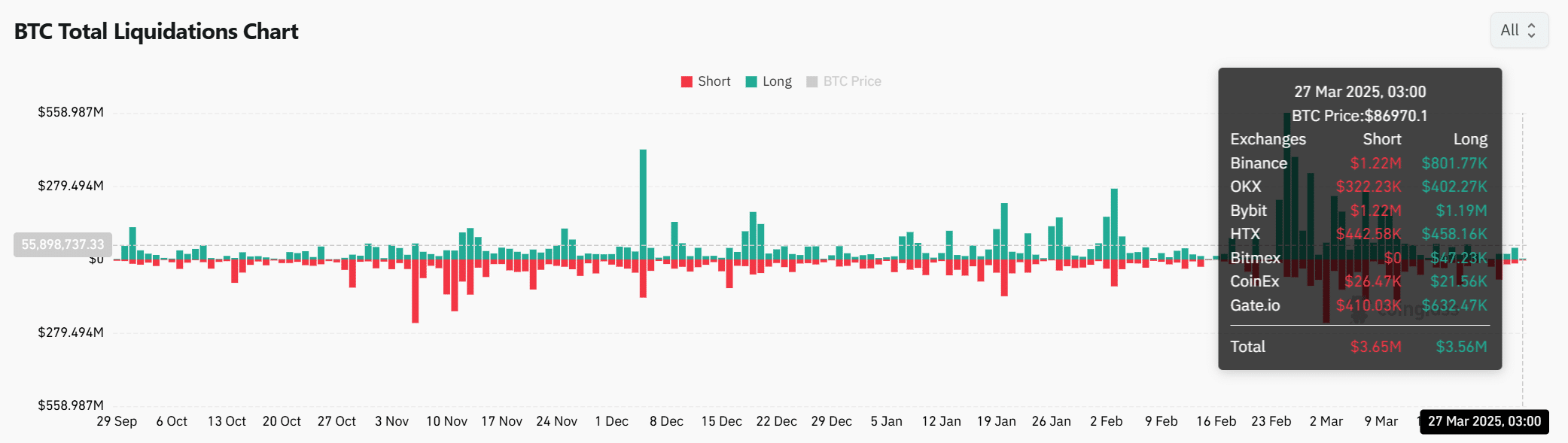

Long versus short liquidations

The BTC liquidation data shows that long and short liquidations are almost the same, with $ 3.65 million in long liquidations and $ 3.56 million in short liquidations.

This suggests that the market is in balance, whereby both optimistic and careful traders adjust their positions. The balanced liquidations indicate a balance in the market, awaiting the next Grand Price Movement.

Source: Coinglass

In conclusion, the low supply of BTC suggests at trade fairs, rising network activity and promising technical indicators that BTC could enter a new bullish phase.

The growing number of holders, combined with important support levels, points to Opwing Momentum.

That is why it is likely that BTC will continue to see a positive price action, although short -term volatility can still influence the market.