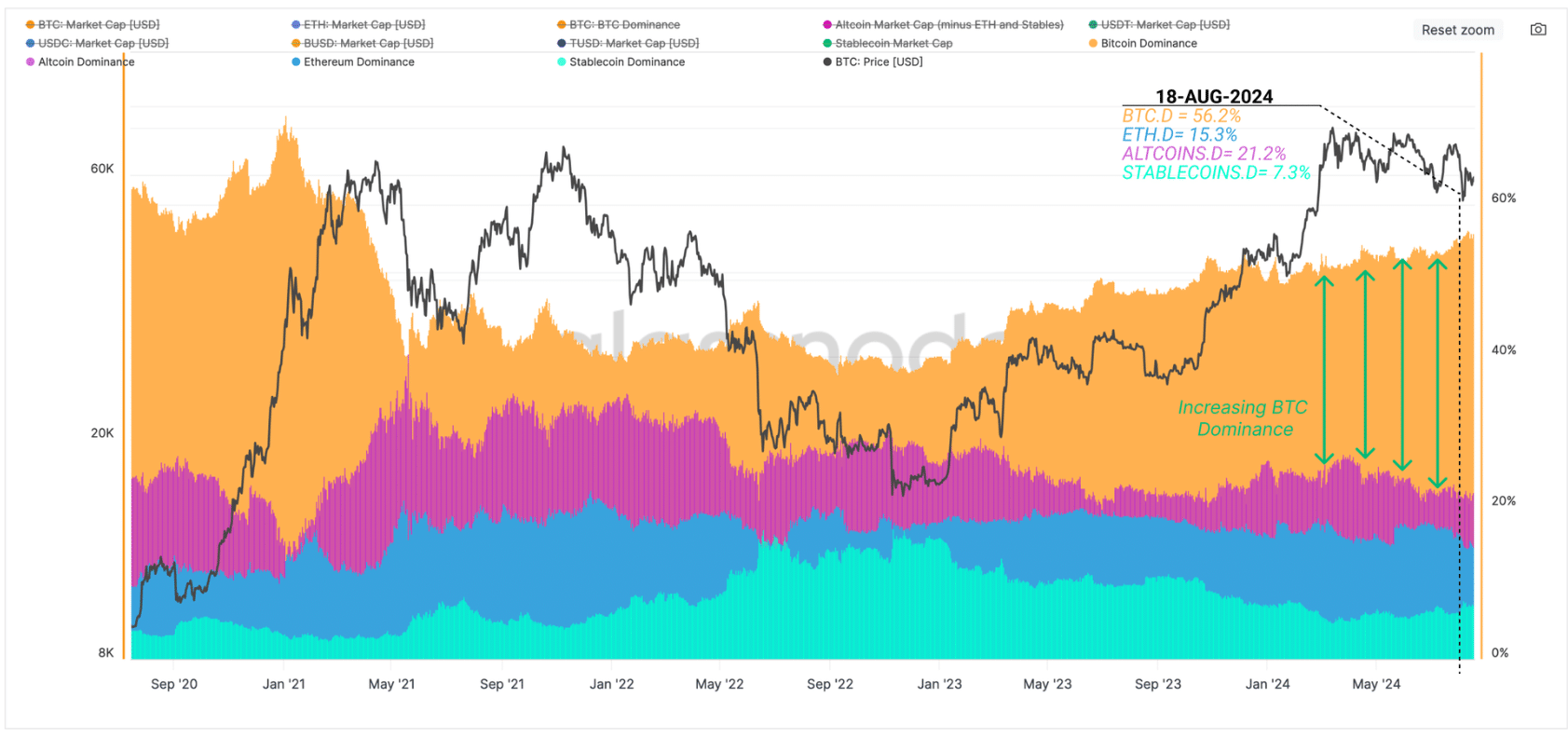

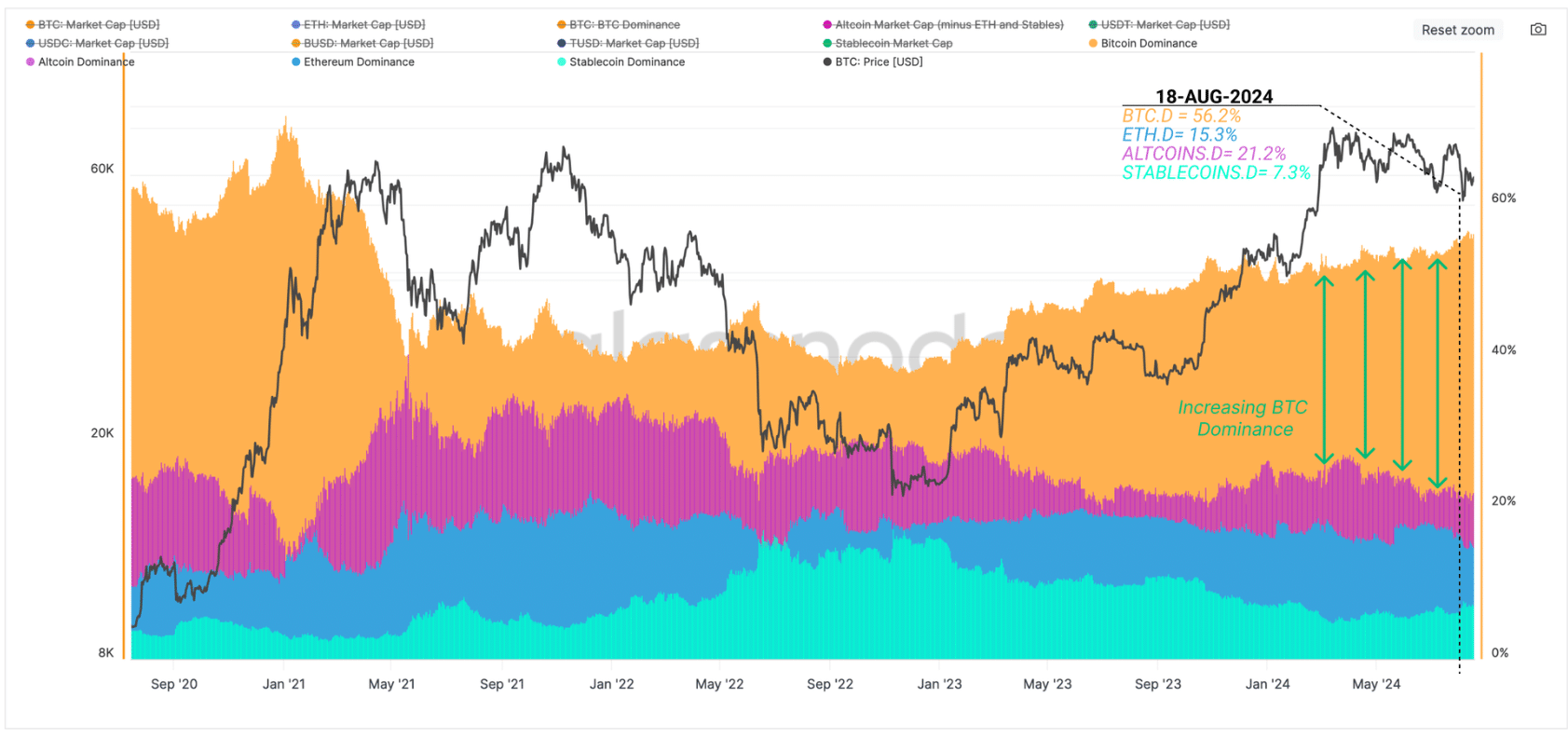

- Bitcoin’s dominance has increased from 38% in 2022 to 56%, largely due to the accumulation of long-term holders.

- Short-term investors are left with unrealized losses, where an overreaction will undoubtedly cause further declines.

Bitcoin [BTC] continues to dominate the cryptocurrency market, accounting for more than half of the $2.1 trillion global crypto market capitalization.

According to the on-chain analytics platform Glass junctionSince the crypto market hit the bottom of the cycle in November 2022, BTC’s dominance has grown from 38% to 56%.

On the other hand, Ethereum [ETH] Dominance has remained relatively flat over the past two years, while altcoins have also lost 6.5% of their market share.

Source: Glassnode

Long-term holders ensure Bitcoin’s dominance

According to Glassnode, Bitcoin’s growth comes amid an increase in capital inflows into the asset as long-term holders show diamond hands.

The supply of Bitcoin among these traders has increased significantly. The report noted that the majority of these traders became long-term holders after purchasing BTC near its all-time high in March.

“Despite the choppy and choppy price action, the resolve of long-term holders remains firm, with a clear preference for HODL and acquiring coins,” Glassnode said.

These holders have a profit of approximately $138 million per day. This increases risk on the sell side, but profit-taking activity has cooled.

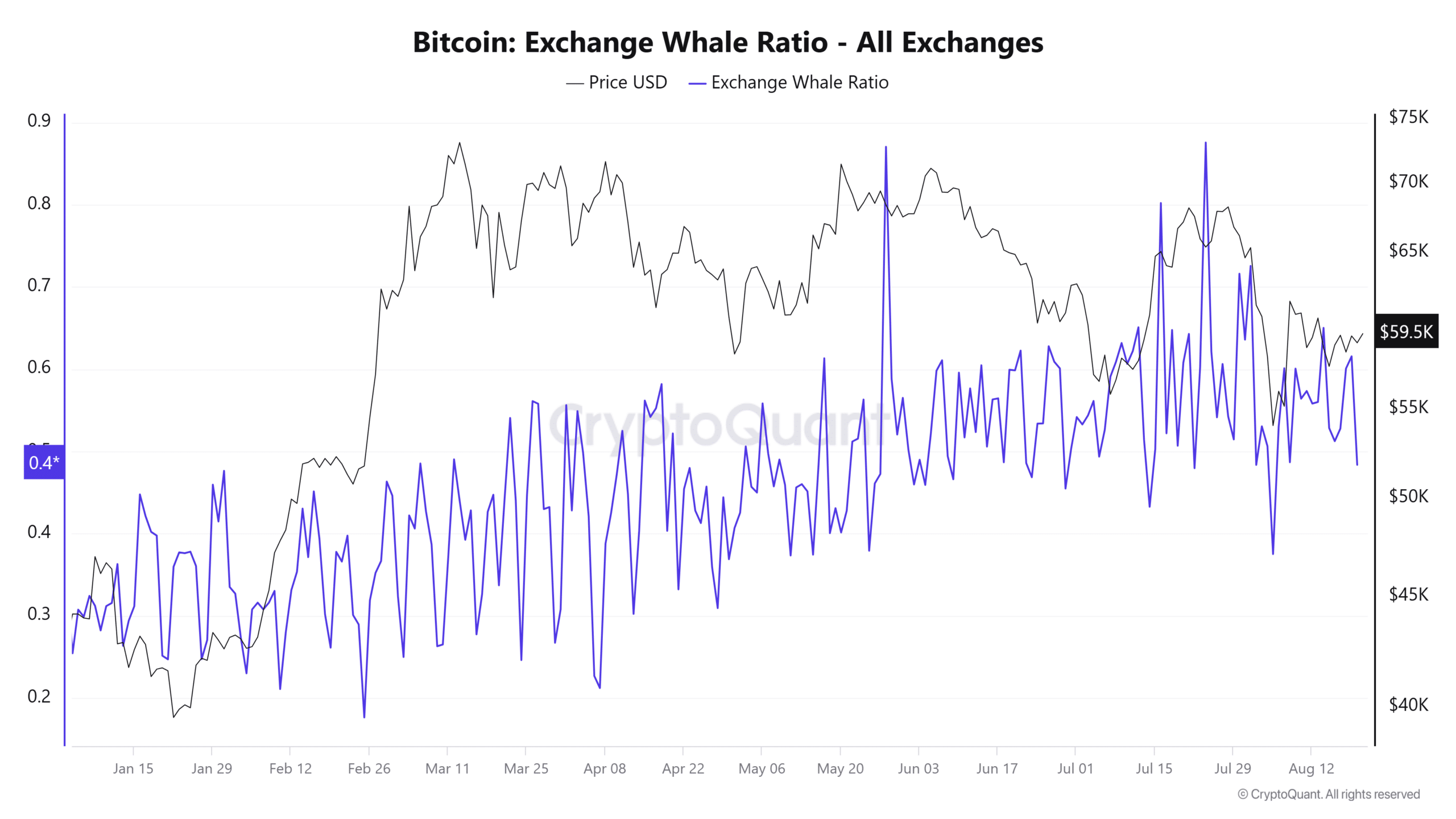

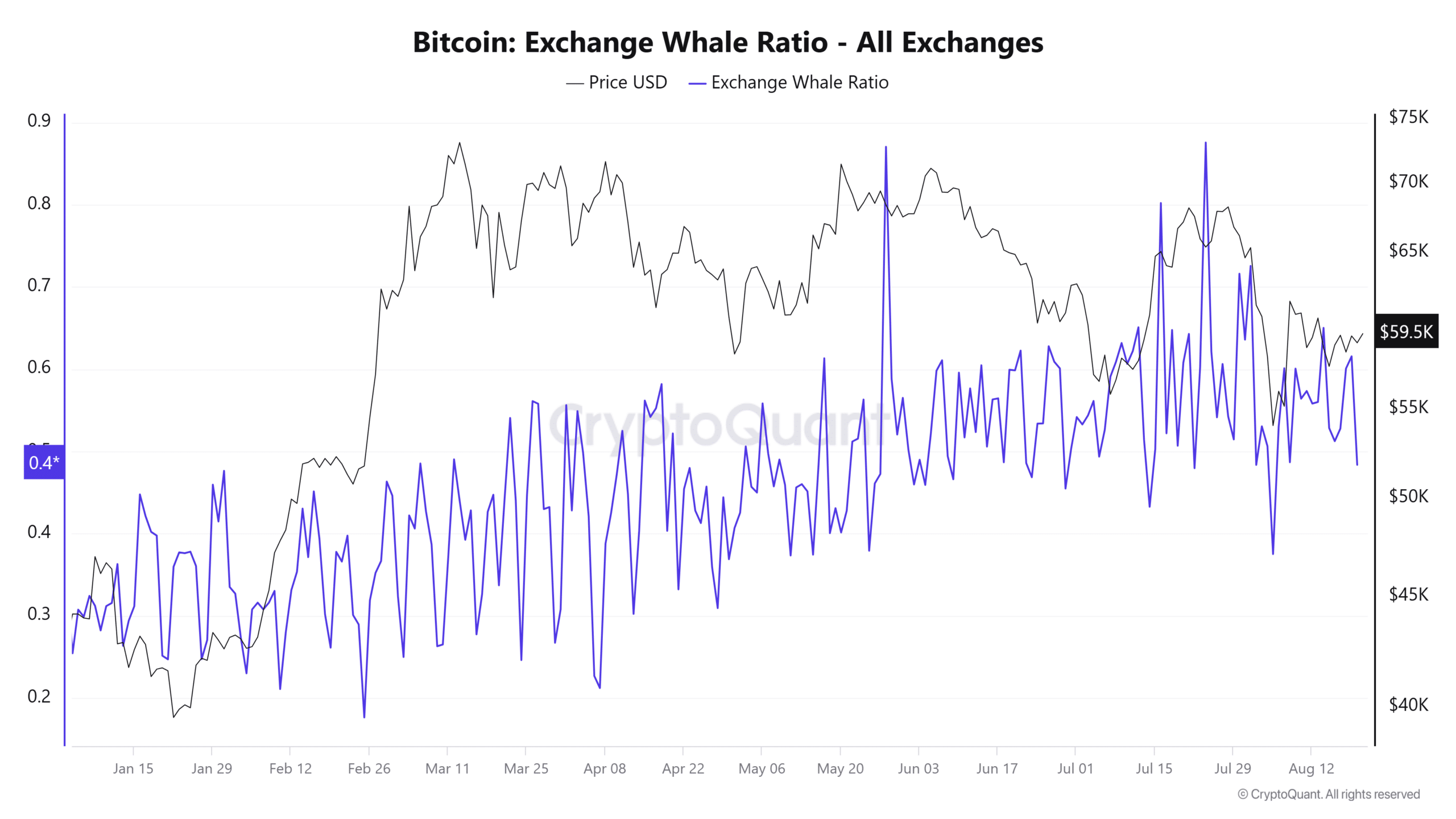

This observation is further reinforced by data from CryptoQuant showing that after intense profit-taking by whales in May and July, the Exchange Whale Ratio is now declining.

(Source: CryptoQuant)

Furthermore, buyers appear to be absorbing the coins sold, which explains why Bitcoin’s price has remained range-bound in recent months since its ATH value dropped.

Short-term holders caused a $50,000 dip

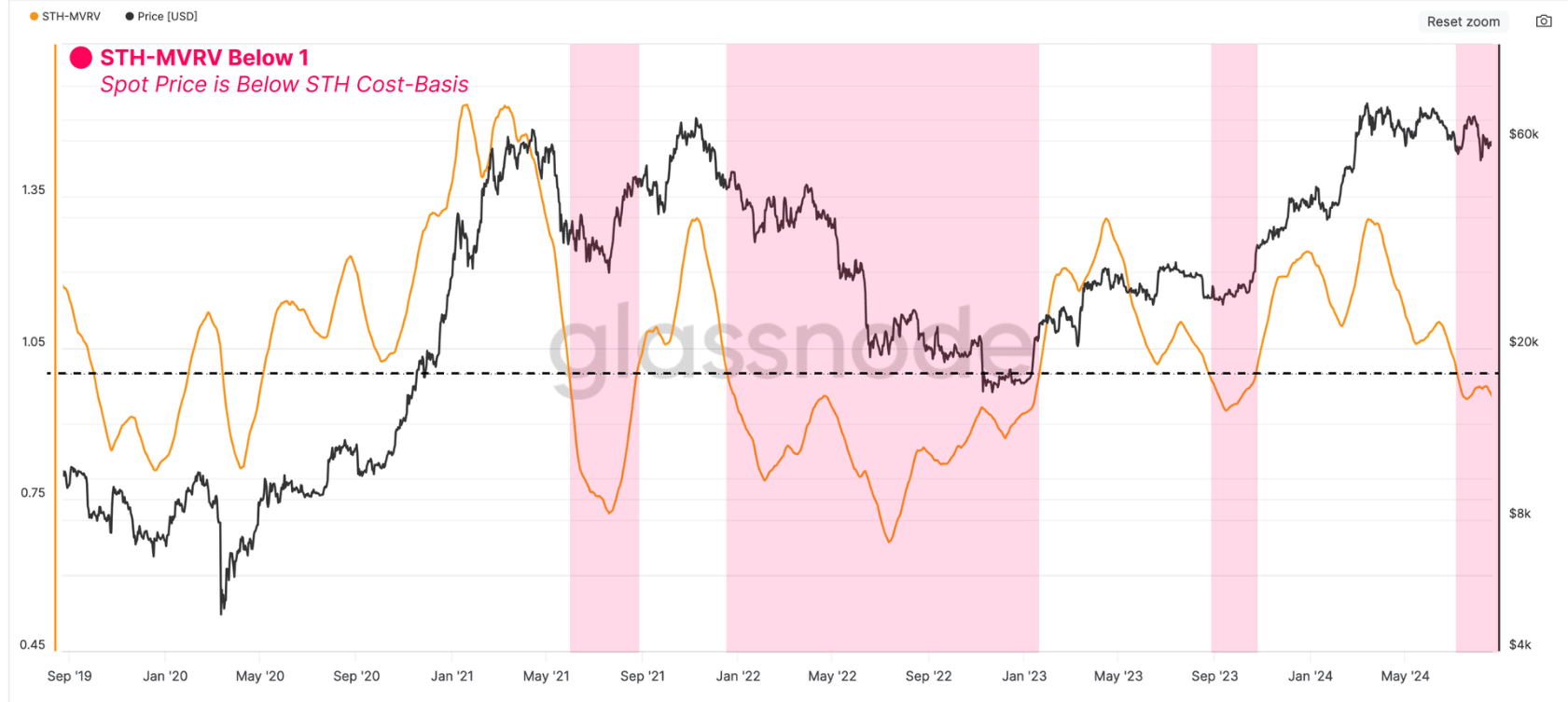

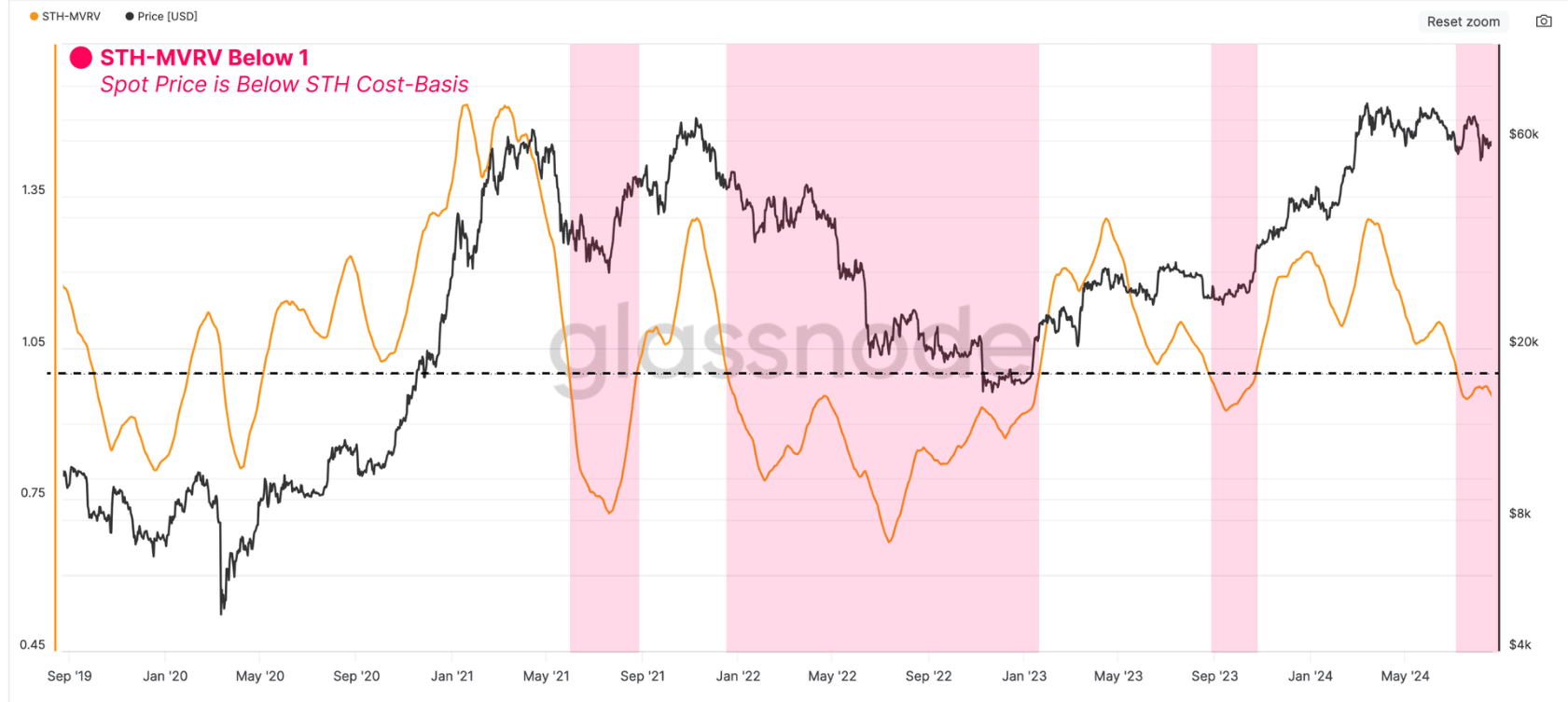

Glassnode also argued that an “overreaction” from short-term holders caused Bitcoin’s drop below $50,000 earlier this month.

The market value to realized value ratio (MVRV) for the short-term holder is below 1, indicating that these investors are suffering unrealized losses. This ratio has been below the equilibrium point for the past 30 days.

Source: Glassnode

Unlike long-term holders, short-term Bitcoin holders are much more reactive to price movements, with their responses lagging behind local tops or bottoms, according to Glassnode. This is what happened on August 5 when BTC crashed to a multi-month low at $49,000.

Read Bitcoin’s [BTC] Price forecast 2024-25

If these investors continue to suffer losses below $59,000 for extended periods, the analysts say it will increase the likelihood of market panic and serious bearish momentum.

A look at leveraged trading indicates a slight shift to the bullish side. The long/short ratio is on Mint glass showed a gradual increase in long positions since August 18.