- Bitcoin has been in a slump since April.

- Tether and BTC’s dominance charts pointed to a bullish future for crypto’s top dog.

Bitcoin [BTC] was trading at $62.5k at the time of writing, with the New York session just a few hours away. Although cryptos trade 24/7, Monday’s New York session often marks a trend reversal or continuation.

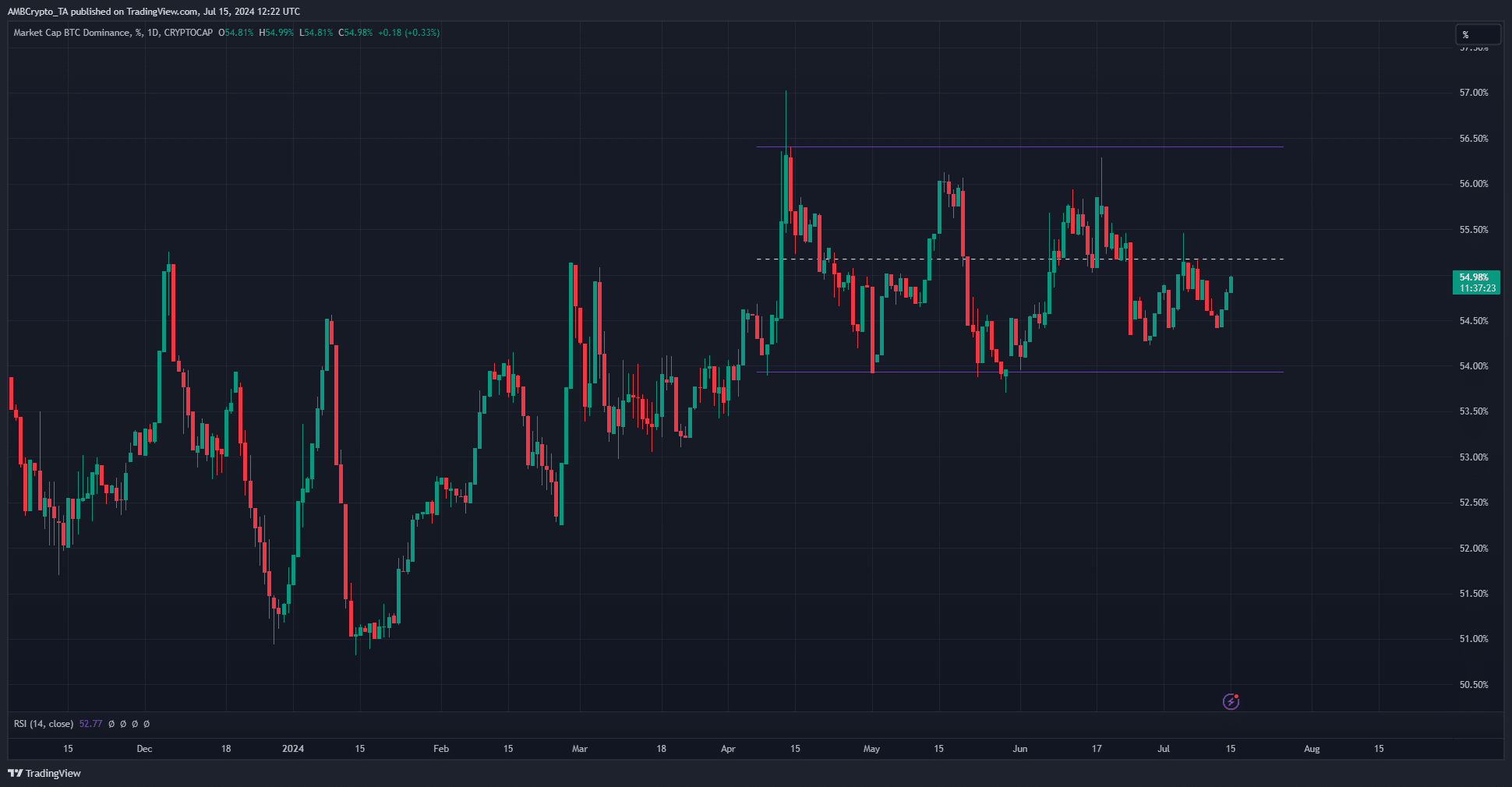

AMBCrypto’s analysis of Bitcoin dominance provided clues as to where the broader market might be heading.

Combining this with Tether dominance showed that altcoin bulls could face some complications in the coming weeks.

Bitcoin Dominance shows judgment

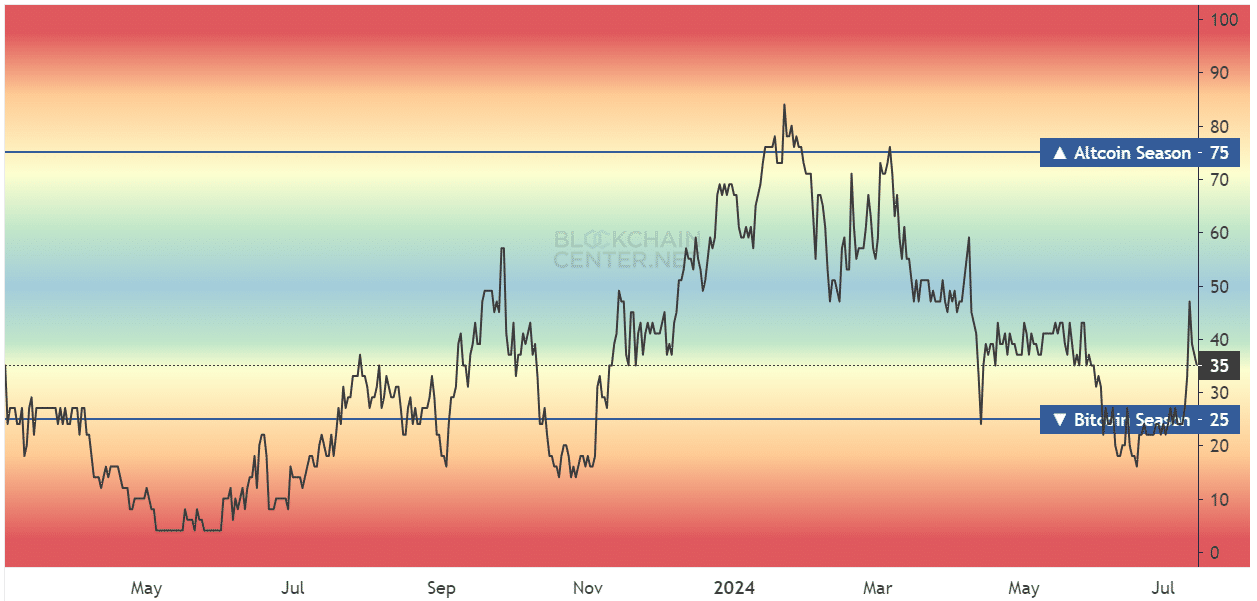

In June, altcoin season index scores were around 25, indicating a strong Bitcoin season. Over the past two weeks, this trend has begun to reverse. The index rose to 46 on July 12, but fell to 35.

This indicated that an altcoin season could be upon us, but other metrics disagreed.

Source: BTC.D on TradingView

AMBCrypto’s look at the Bitcoin dominance chart on the daily time frame showed a range formation between 54% and 56.4%. Last month the statistic was below the mid-range.

The implication was that the dominance chart, like prices, was also not showing a strong trend. It showed that the altcoin market has suffered alongside Bitcoin.

The higher time frames showed BTC.D trending higher. This was a sign that BTC bets are likely to outperform the broader market in the third quarter of 2024.

Why Bitcoin will be in the spotlight

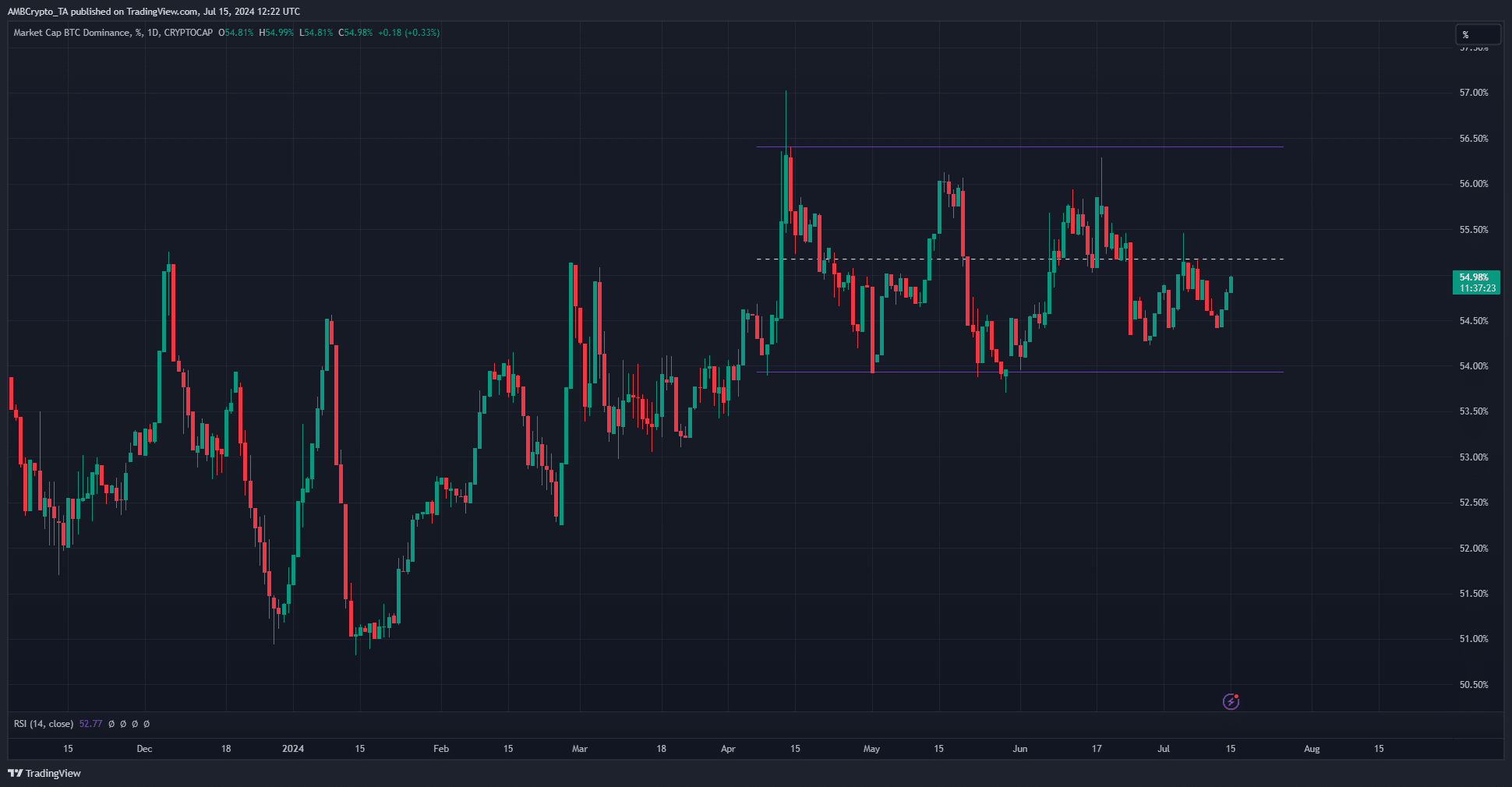

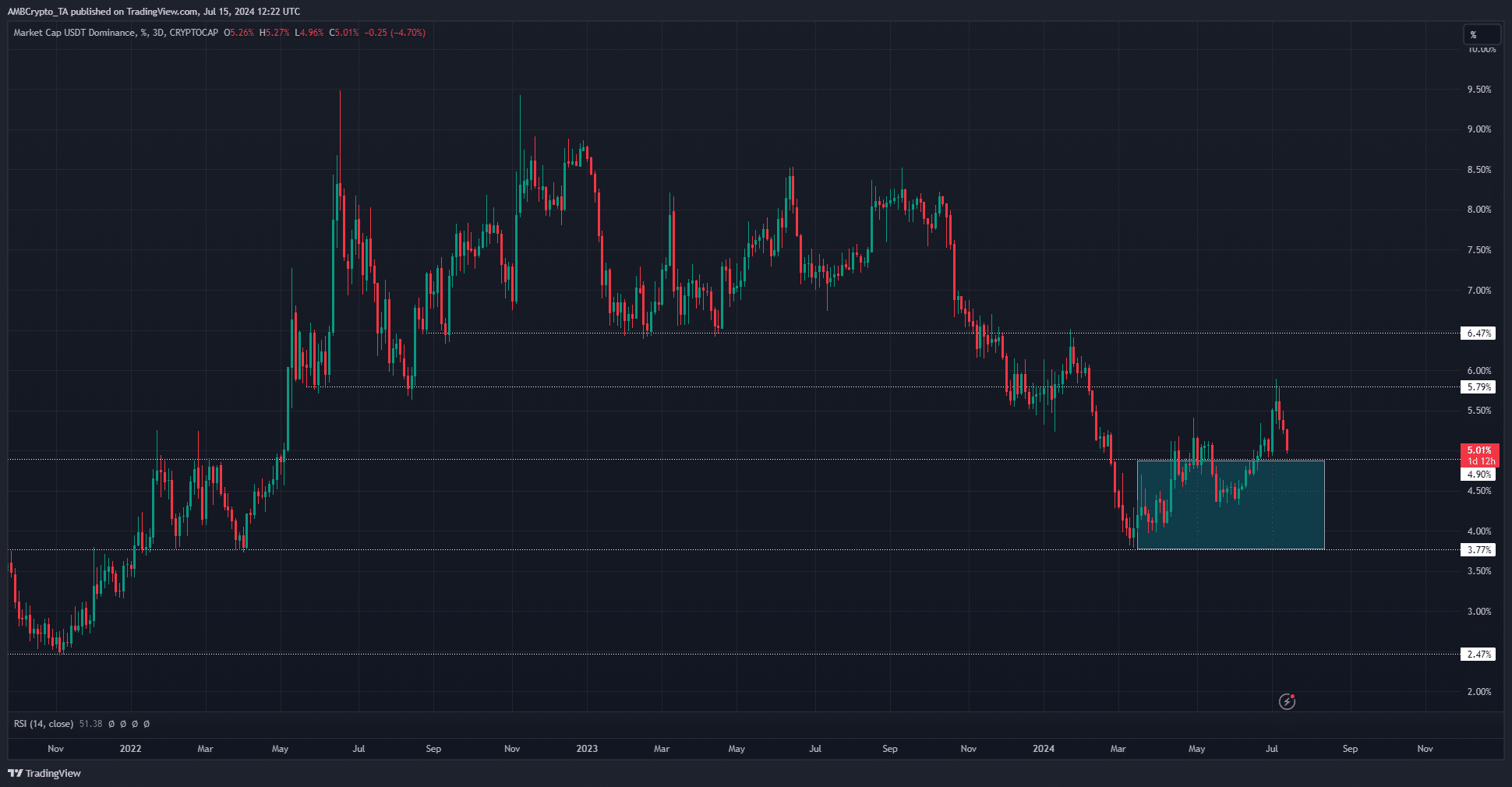

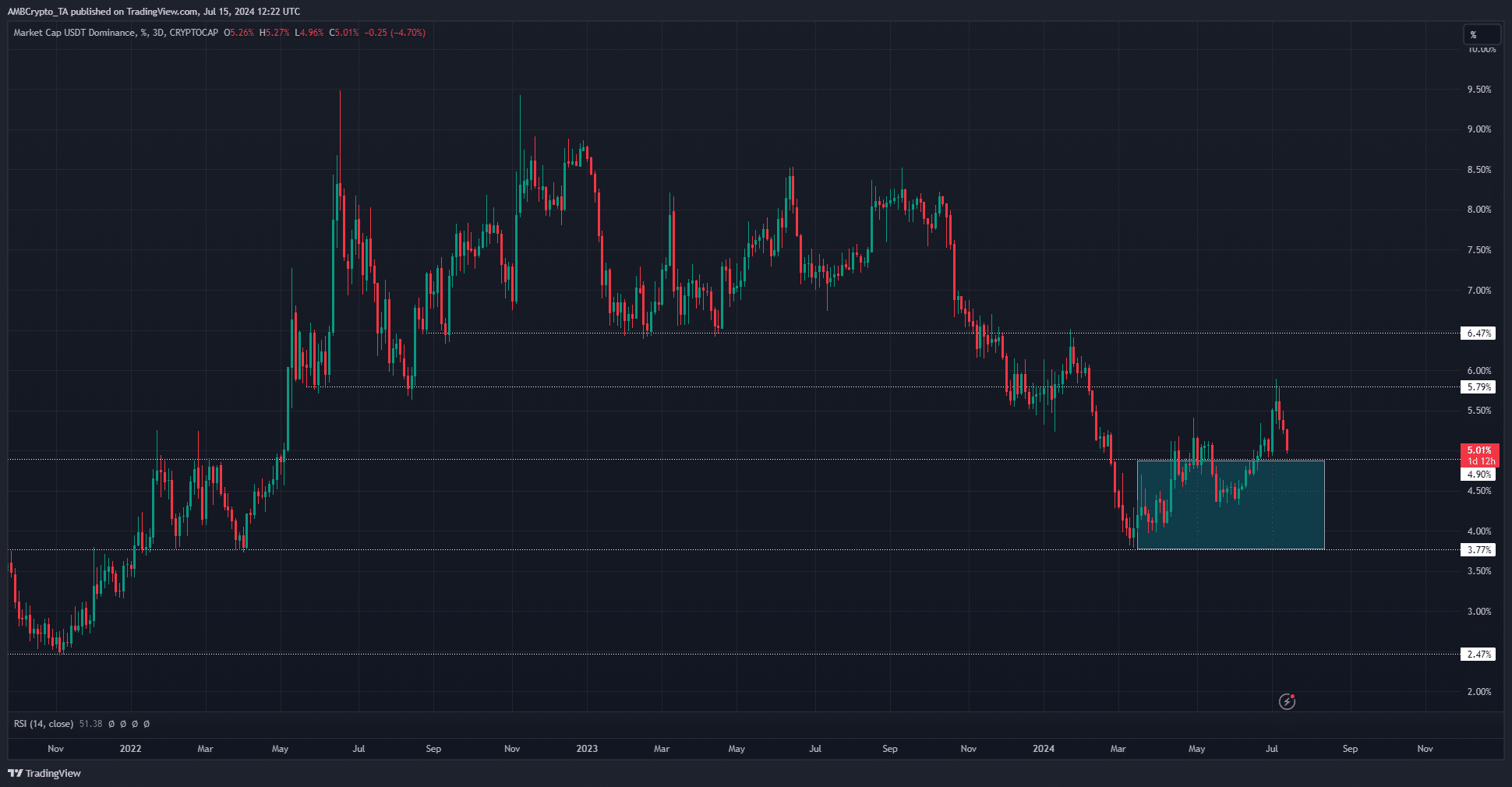

Source: USDT.D on TradingView

Bitcoin is the king of cryptocurrencies and is the most important weather vane for understanding market sentiment.

It takes a large influx of capital into BTC before it can be converted into altcoins, leading to the legendary altcoin season.

The Tether dominance chart saw a retracement as BTC prices rose over the past three days. This indicated a market-wide price rally over the weekend.

However, USDT.D is expected to resume its downward trend after this rebound, which could be great news for Bitcoin prices.

Read Bitcoin’s [BTC] Price forecast 2024-25

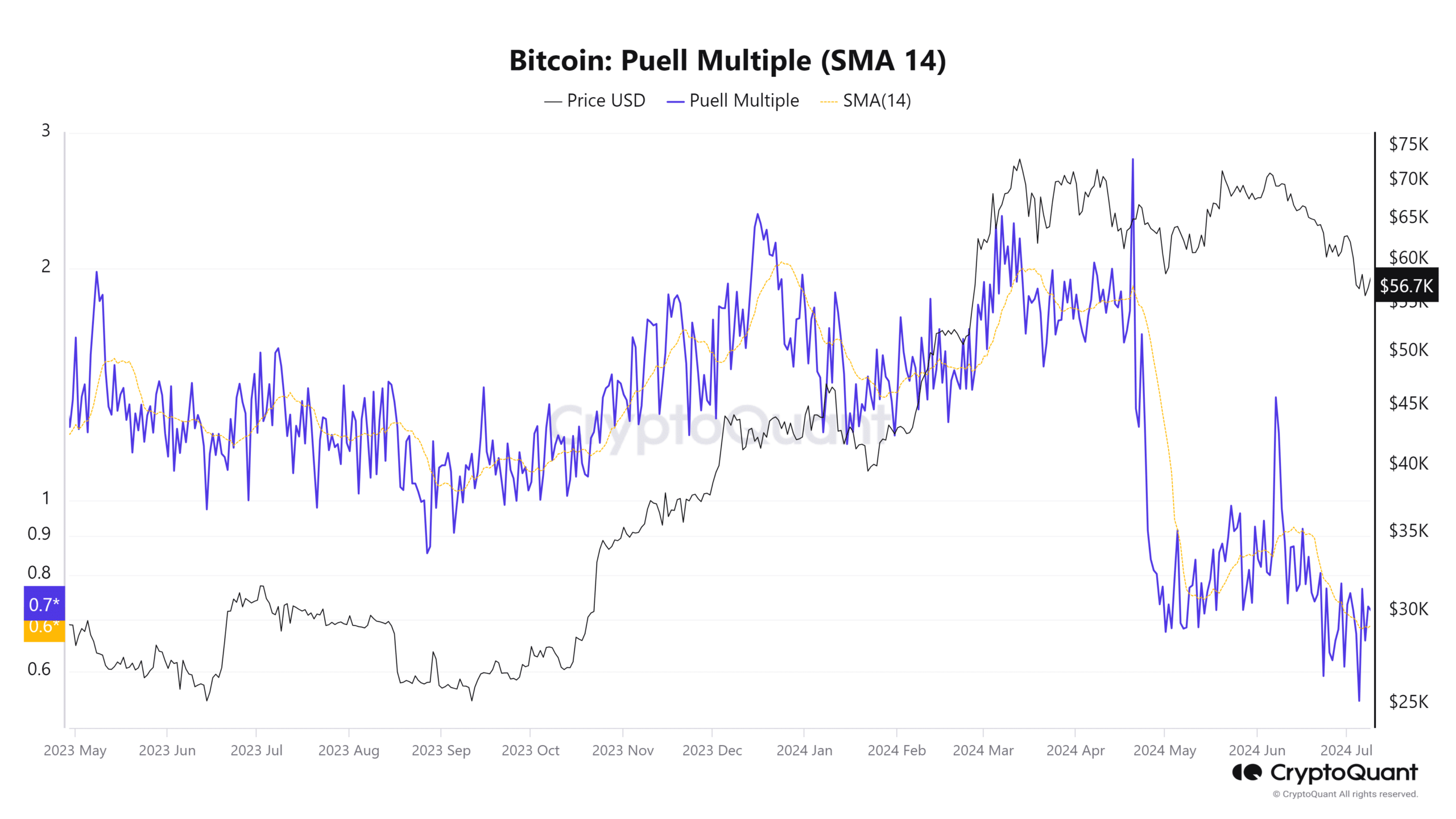

The Puell Multiple is a measure of how profitable mining pools are compared to the previous year. At the time of writing, the statistic stood at 0.72. A reading of 0.5 or lower would be a strong buy signal.

This was another sign that Bitcoin is in for a price increase in the coming months.