- Bitcoin Coinbase Premium Index is now positive.

- This signals a spike in coin accumulation by US-based investors.

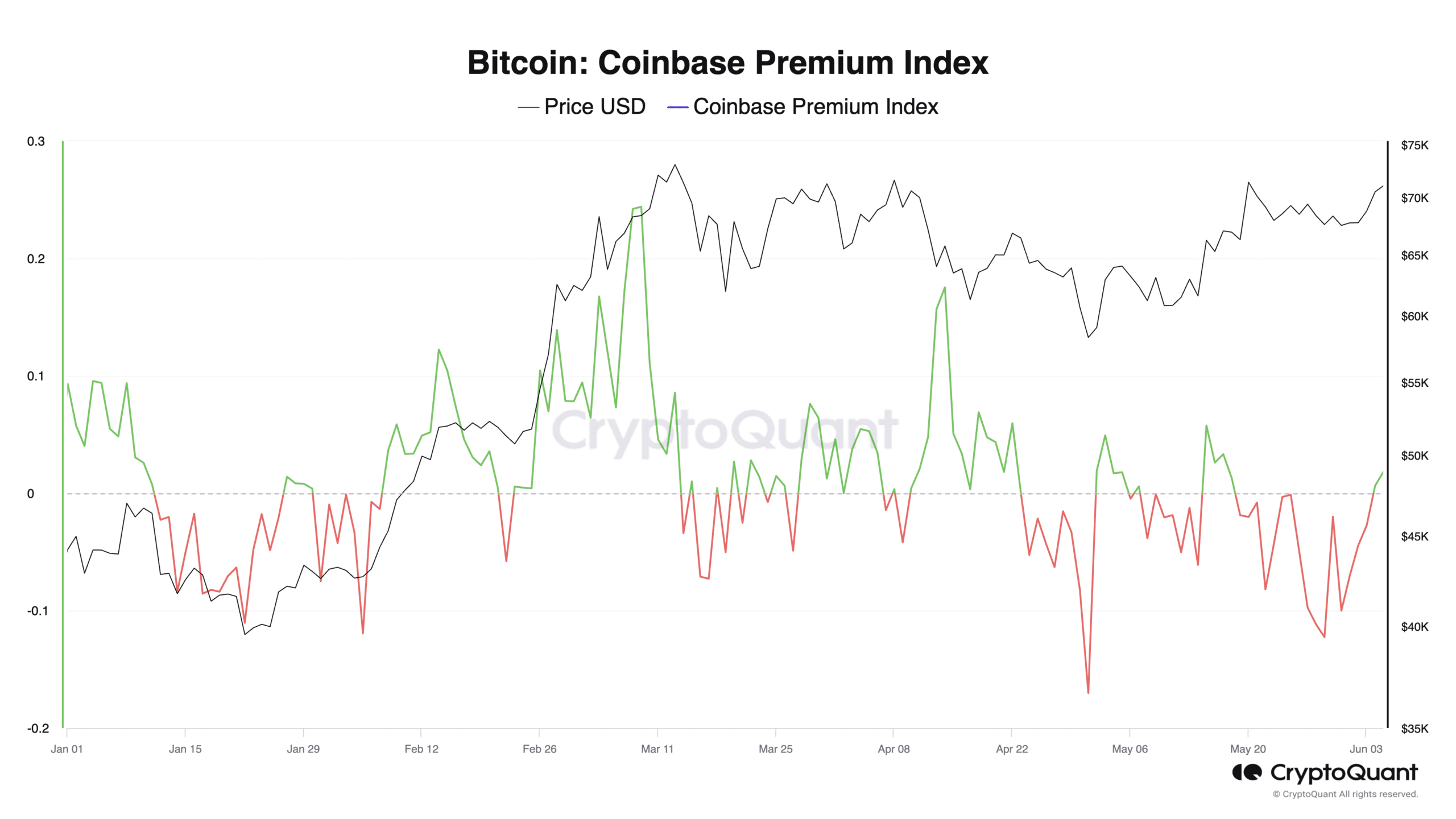

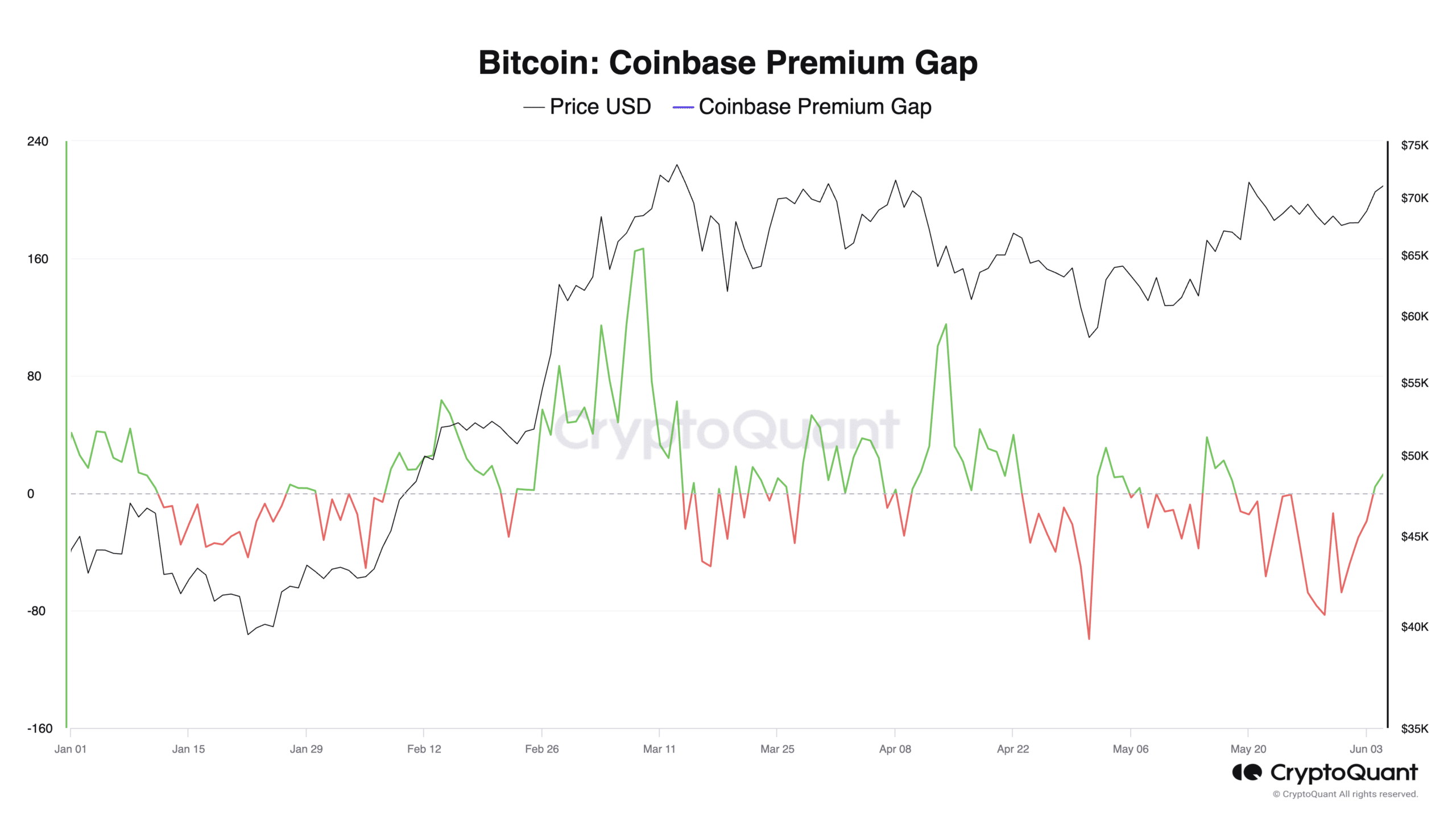

Bitcoins [BTC] Coinbase Premium Index (CPI) has turned positive after returning negative values for about ten days, pseudonymous CryptoQuant analyst BQYoutube has found in a new report.

This metric measures the difference between the prices of BTC on Coinbase and Binance. When the value is positive, it suggests that the coin is priced higher on Coinbase compared to Binance. This is interpreted to indicate strong buying interest from US-based investors.

Conversely, when the price falls and the value is negative, it indicates less trading activity on the US-based exchange.

At the time of writing, BTC’s CPI was 0.006.

Source: CryptoQuant

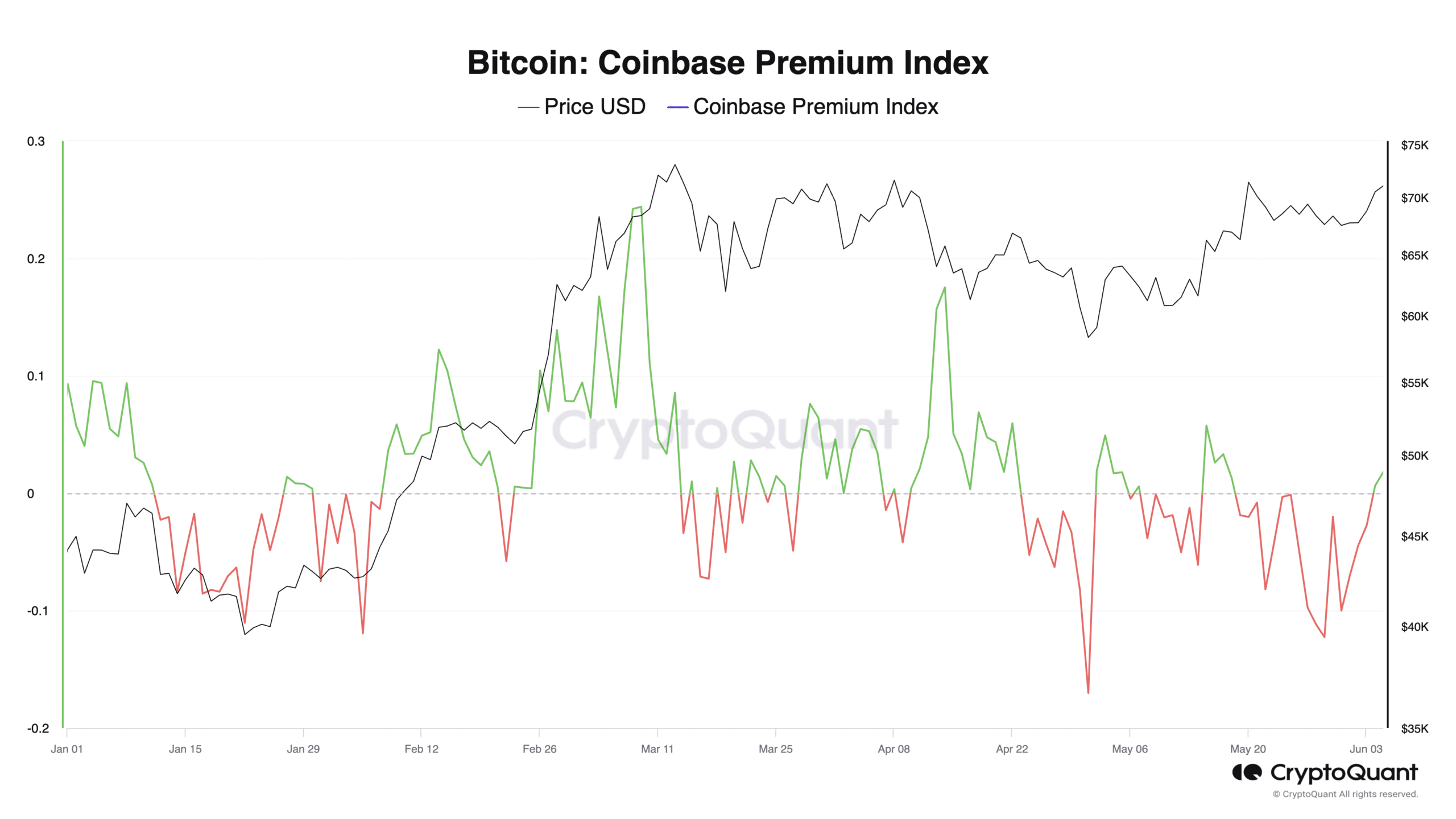

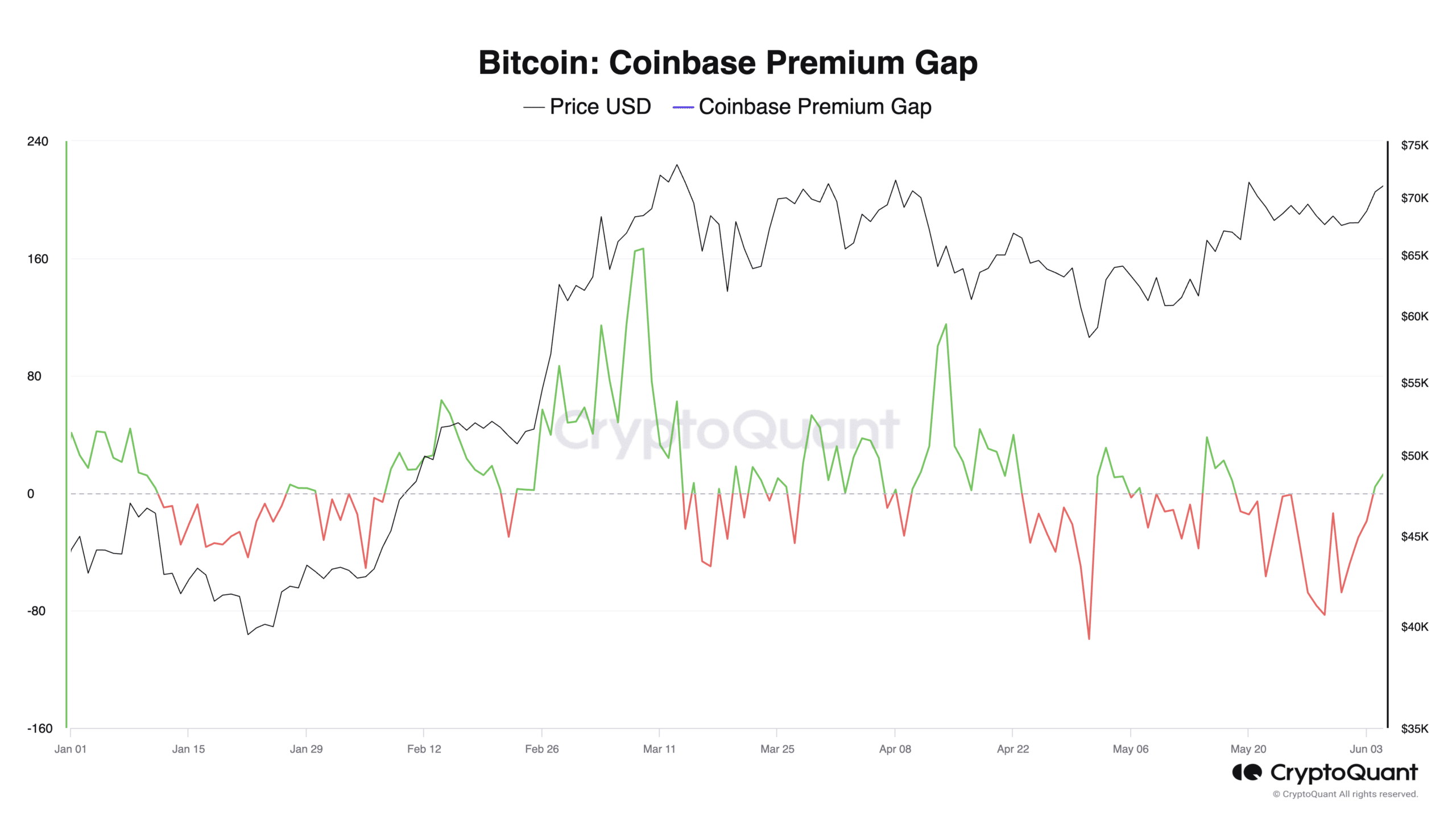

Confirming the revival of activity among US-based BTC holders, BTC’s Coinbase Premium Gap stood at 4.48 at the time of writing.

According to data from CryptoQuant, this was the first time since May 18 that the metric returned a positive value.

Source: CryptoQuant

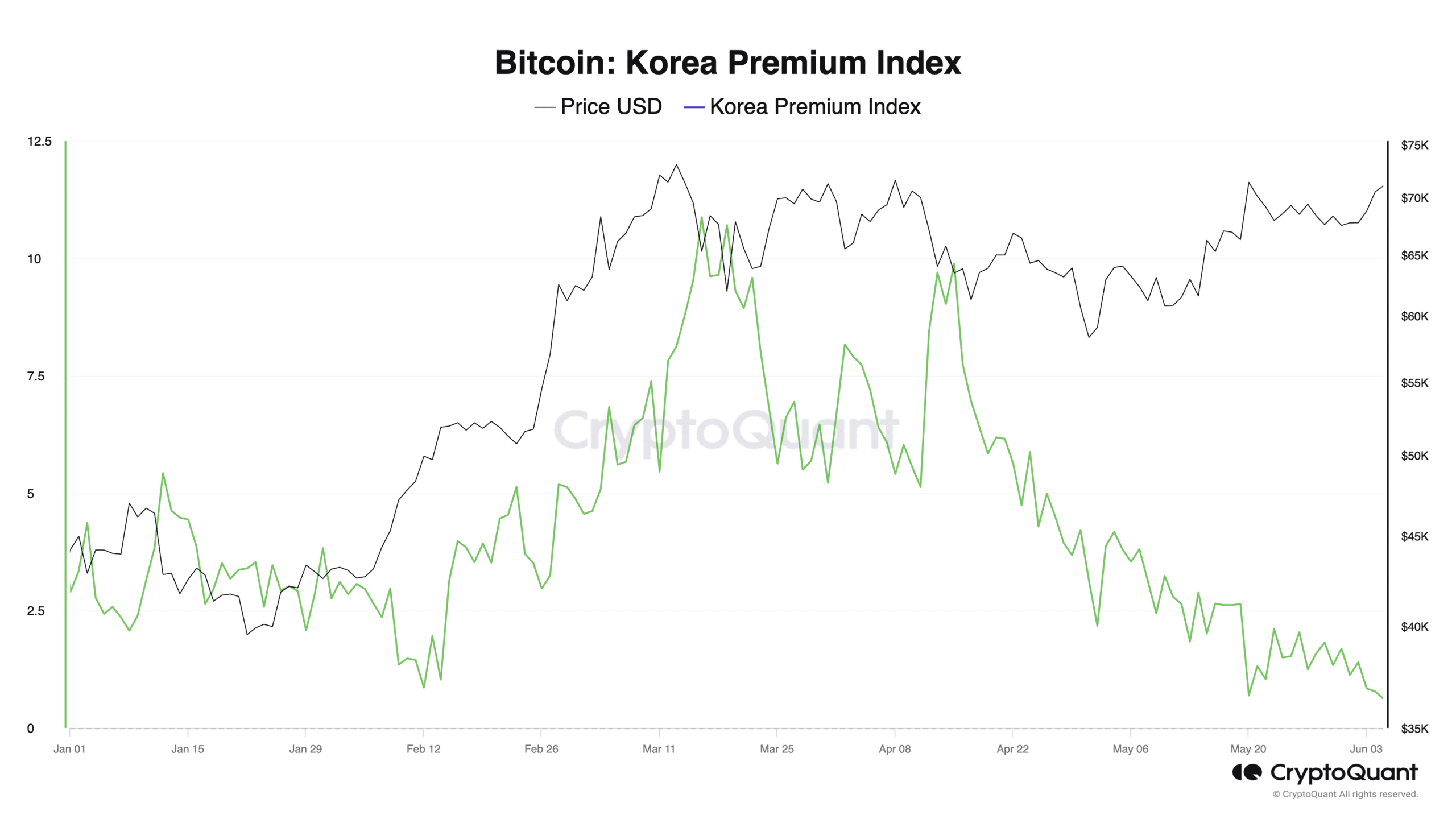

BTC traders in Korea look away

Although BTC’s Korean Premium Index (KPI) has been on a downward trend since April 15, it remains above the zero line. Also called the Kimchi Premium, this index measures the gap between BTC prices on South Korean exchanges and other exchanges.

Source: CryptoQuant

At 0.78 at the time of writing, BTC’s Kimchi Premium was at its lowest point this year, indicating that regional demand for the coin by Korean investors is at its lowest point since the beginning of the year.

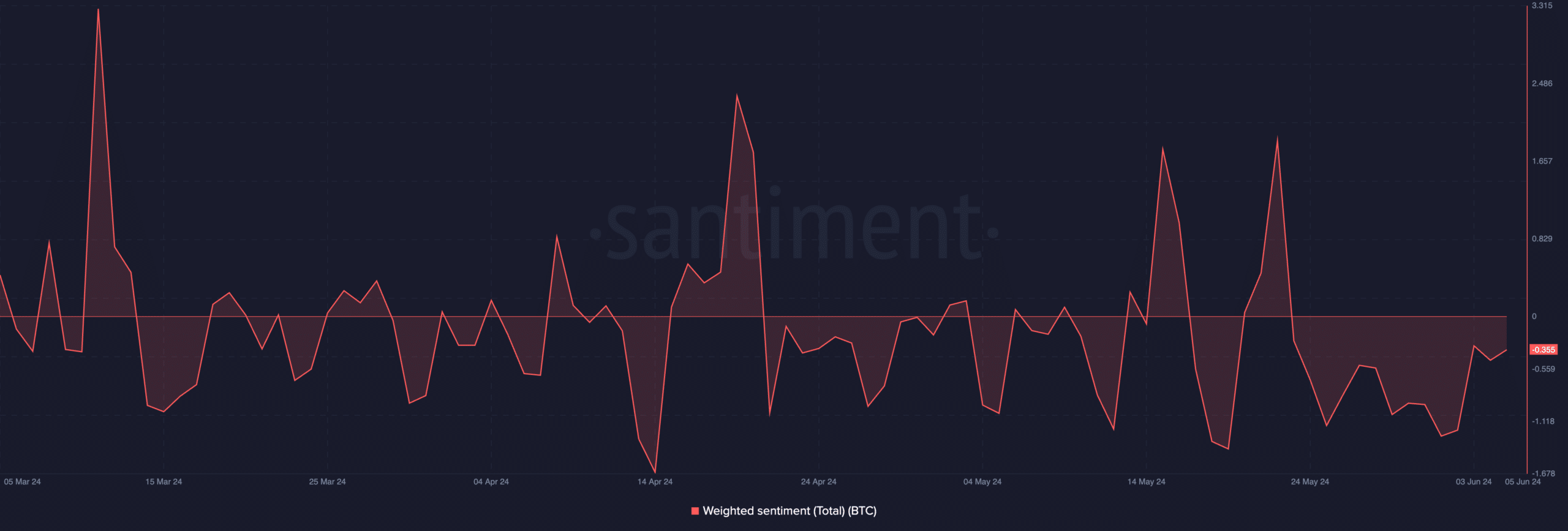

Negative sentiment follows the coin

At the time of writing, BTC exchanged hands at $71,148. The price has increased by 10% in the last 30 days. During that period, the coin briefly traded at $71,315 on May 21 before witnessing a pullback.

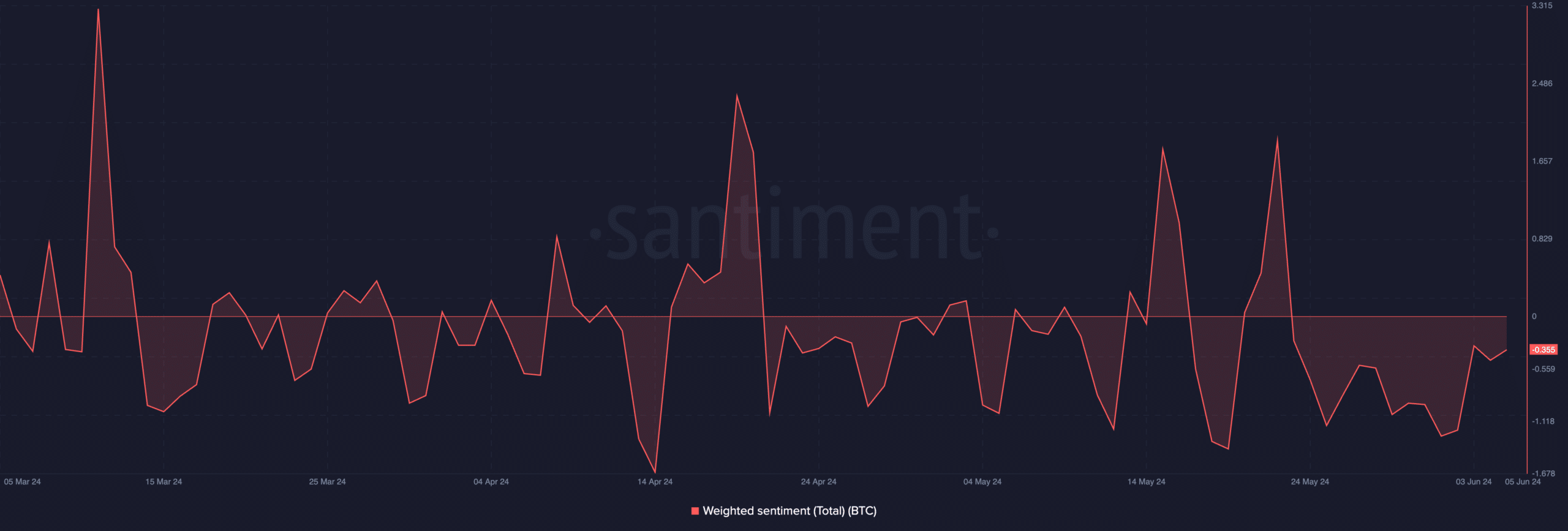

However, despite BTC’s recent price rise, negative sentiment follows the coin. At the time of writing, the weighted sentiment was -0.355. In fact, the value of this statistic has been negative since May 24.

Source: Santiment

This indicates that despite the price appreciation in recent weeks, there is still a bearish bias towards the leading currency among market participants.

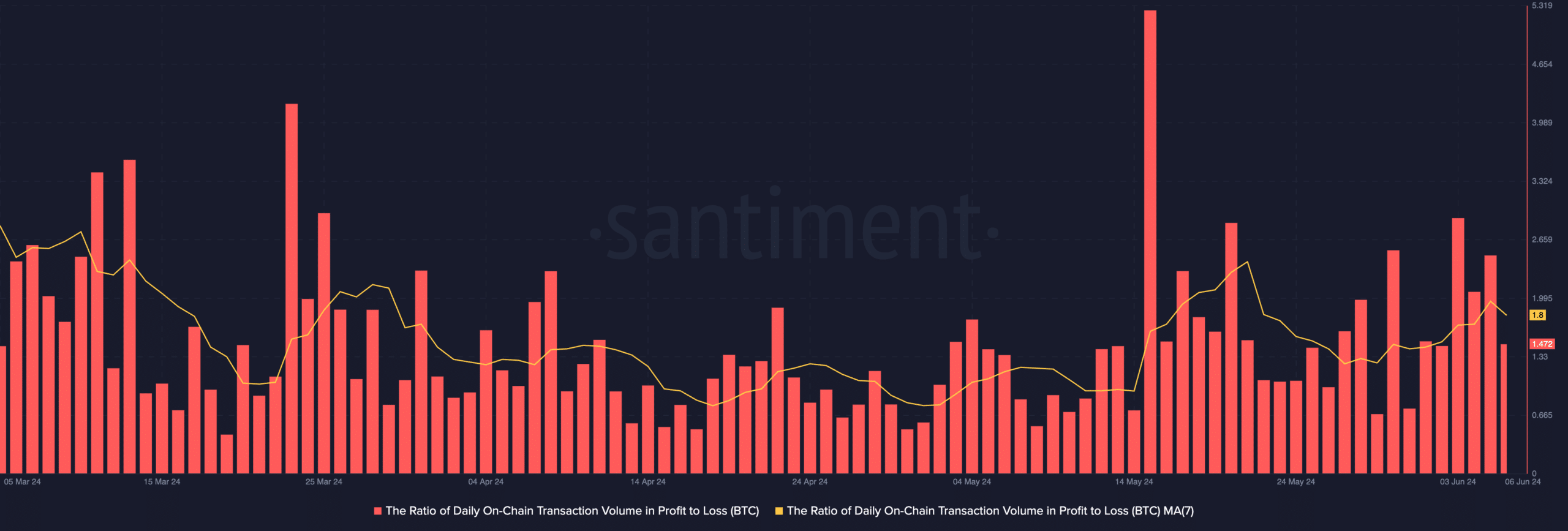

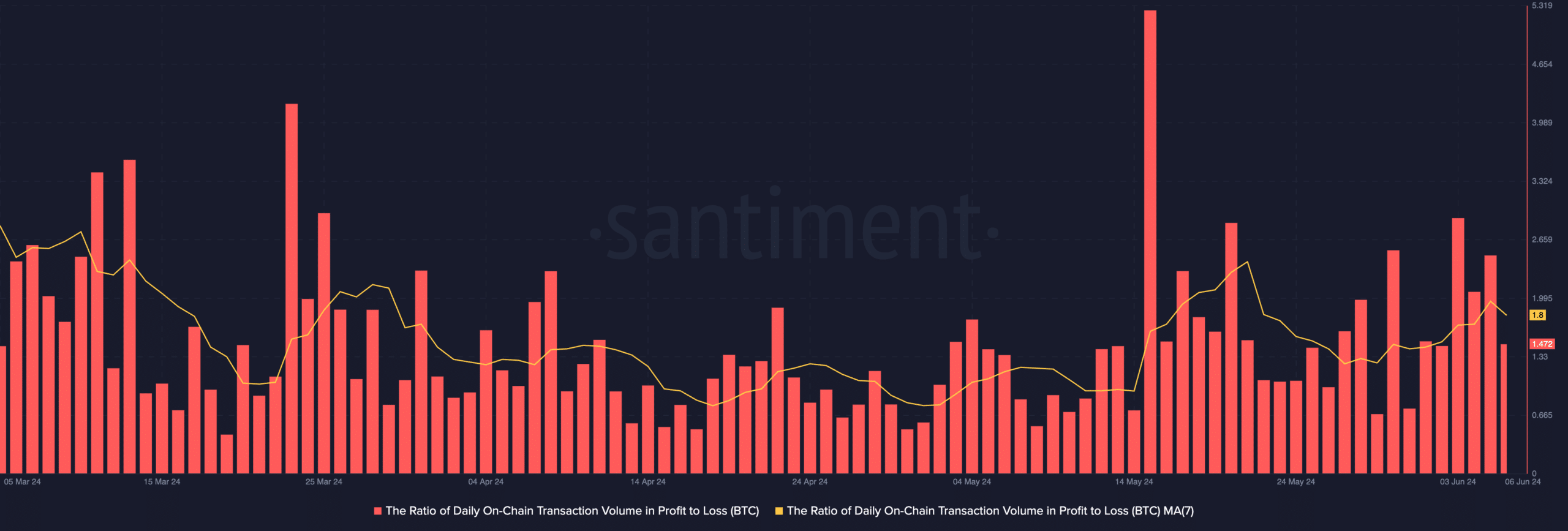

This has even been the case with the daily profits made by coin holders.

Read Bitcoin’s [BTC] Price forecast 2024-2025

AMBCrypto assessed the daily ratio of BTC transaction volume in profit to loss (using a seven-day moving average) and returned a value of 1.8.

Source: Santiment

It showed that for every BTC transaction that ended in a loss in recent weeks, 1.8 transactions returned a profit.