- BTC has won 4.0% last week.

- Can these 4 different cyclical signals Bitcoin’s market top?

The last day, Bitcoin [BTC] Saw a strong increase of $ 88.7k that broke out of consolidation. Since then, however, the crypto has been withdrawn to $ 86k that reflects increased volatility.

These prevailing market conditions have speculated stakeholders about a potential market top. As far as Cryptoquant Analyst Burak Kesmeci suggested 4 potential on-chain statistics that signaled a potential end of Bitcoin’s Bullmarkt.

Signal These four cyclicals The Bitcoin market?

Source: Cryptuquant

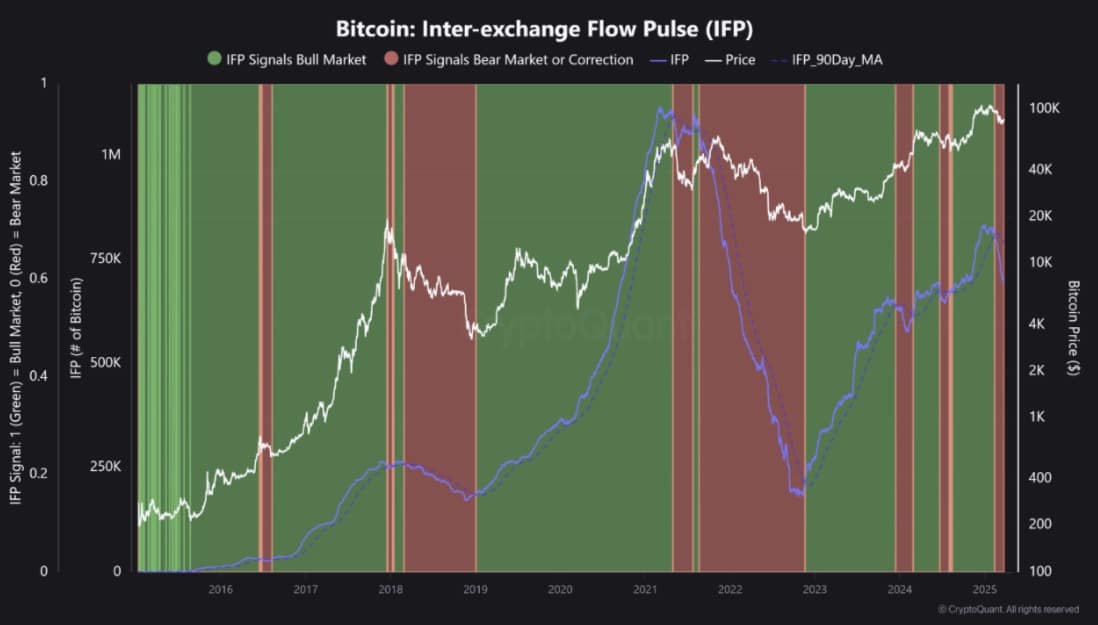

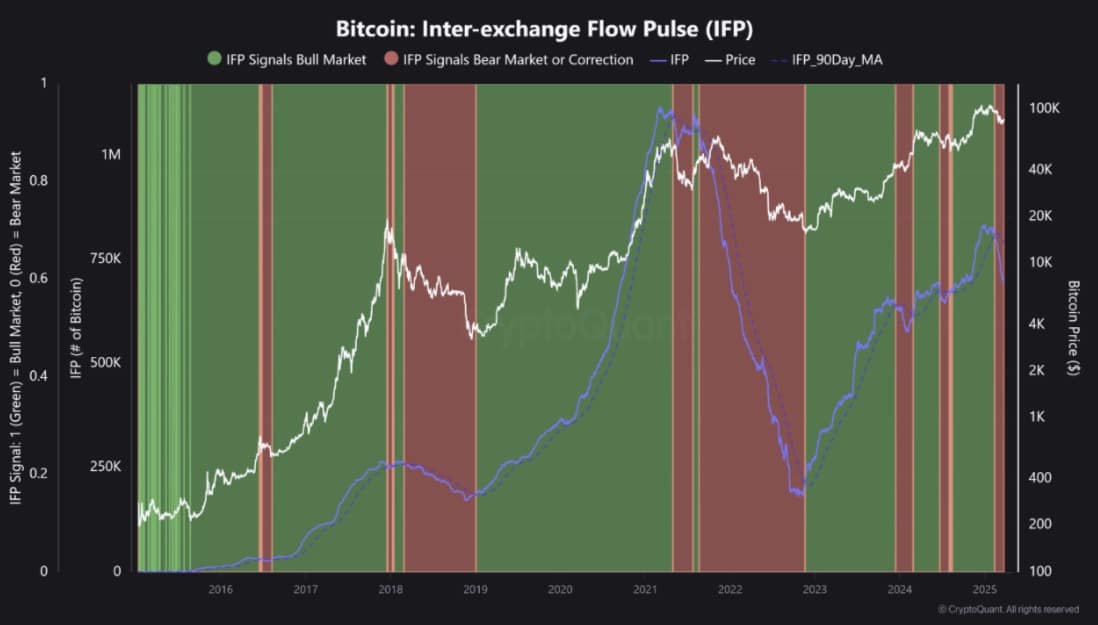

Cryptoquant emphasizes four indicators that suggest a potential market top, including the inter-exchange stream pulses from Bitcoin (IFP), which remains Bearish.

At the time of writing, IFP was 696K, under the SMA90 of 794K. As long as IFP remains under the SMA90, the market corrections will probably continue to exist.

For example, between December 2023 and February 2024, IFP remained under SMA90. When it crossed above, BTC rose to $ 73k.

Source: Cryptuquant

The Bitcoin or Bull & Bear Market Cycle indicator also indicates bearability. During this upward trend, the rather weak bearish patterns shown, similar to the current signals.

At the time of pressure, DMA365 was 0.18, while DMA30 was at -0.16. With DMA30 under DMA365, it indicates a significant bearish Momentum. A bullish trend shift cannot be confirmed until DMA30 crosses above DMA365.

Source: Cryptuquant

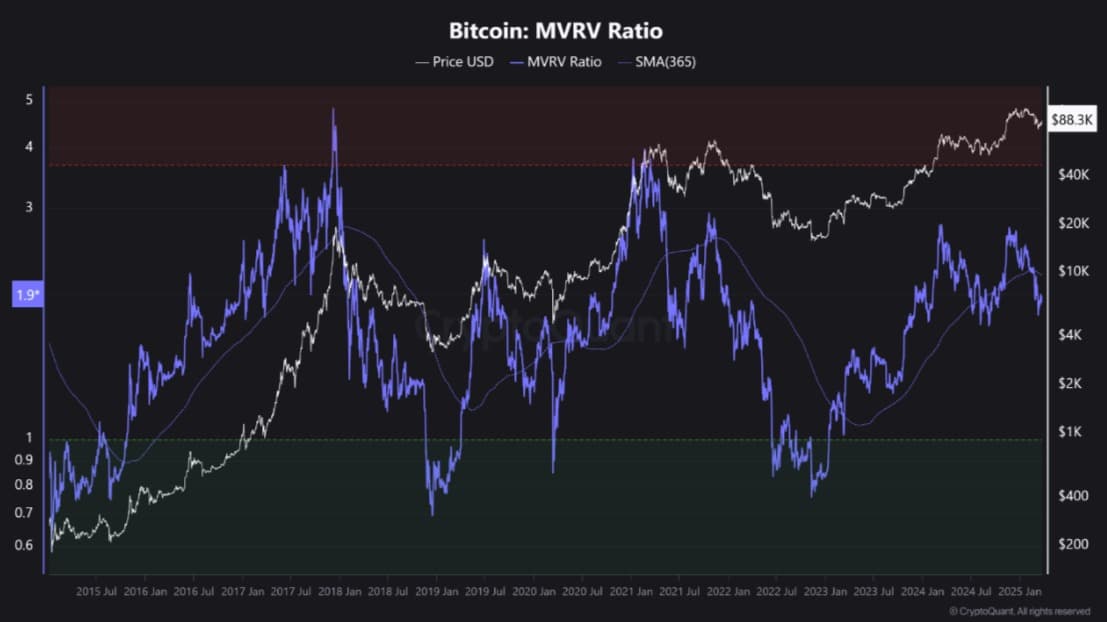

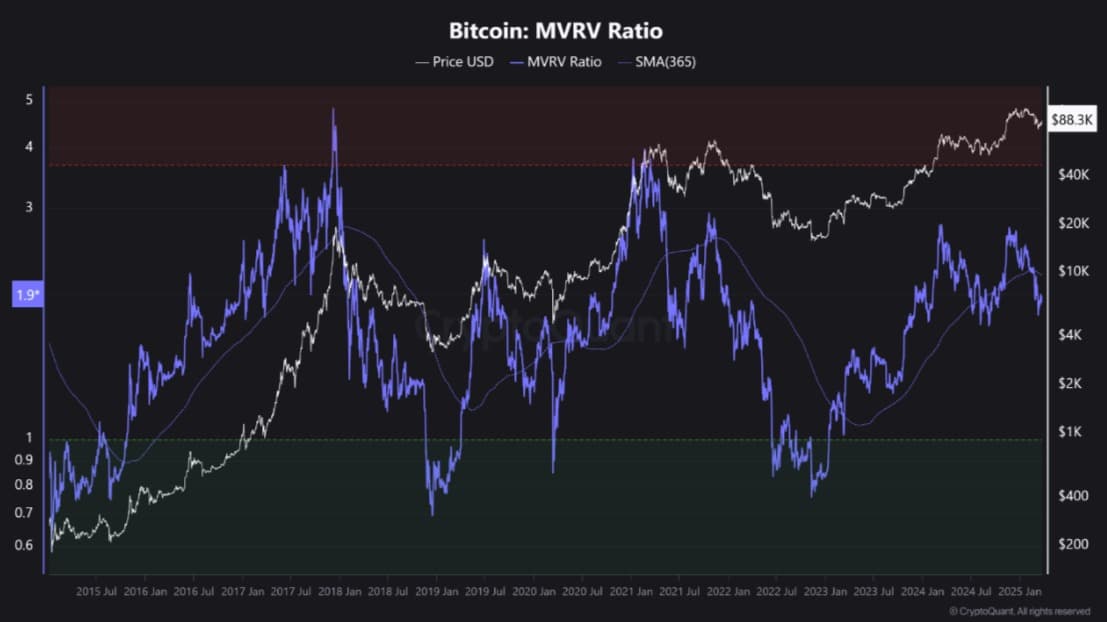

Thirdly, the MVRV score of Bitcoin remained under the SMA365, which indicates a possible continuation of the correction. Historically, when the MVRV score remains under the 365-day advancing average (SMA365), the sales pressure increases.

In the current bull cycle, Bitcoin last dropped below this level of support during the 5 August 2024, trade crisis. After the crisis was over, the MVRV score score SMA365, which indicates a recovery.

Source: Cryptuquant

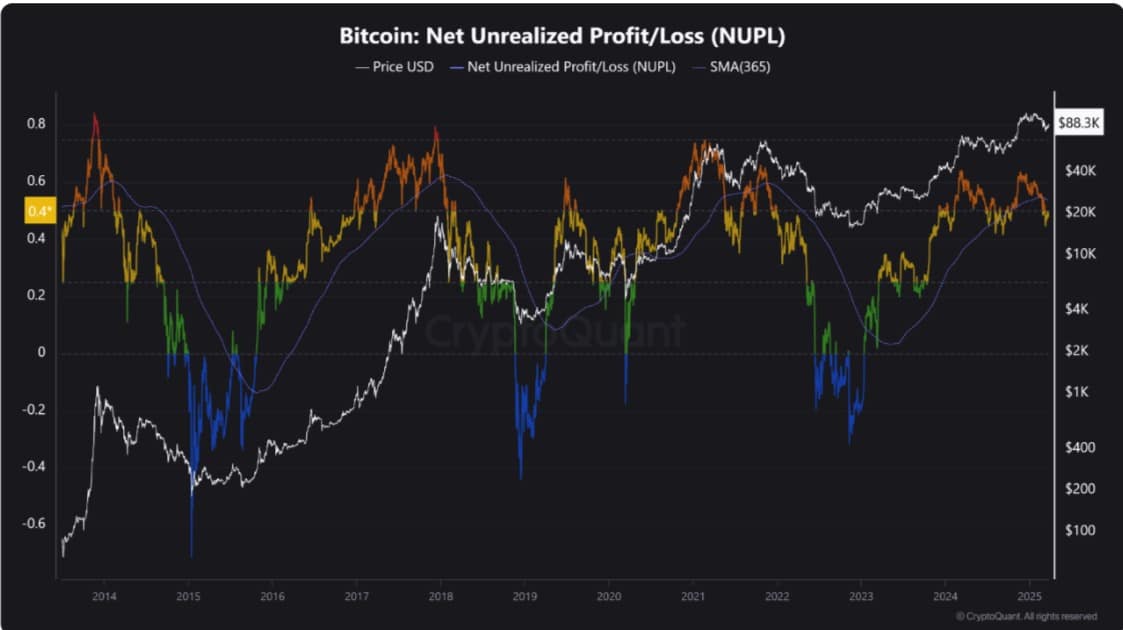

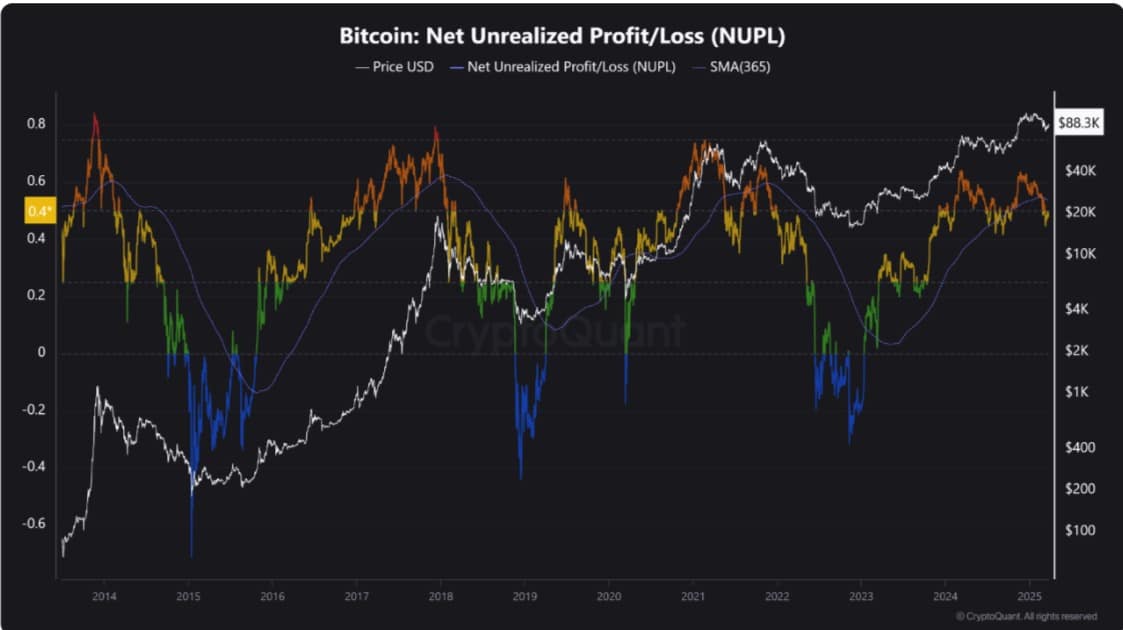

Finally, Bitcoin’s Nupl remained under the SMA365, which indicates continuous areas. Although NUPL cannot confirm the end of the bullish trend, a NUPL recovery should require to climb above SMA365.

From this letter, NUPL was 0.49, while SMA365 was at 0.53. Without an upward flip, corrections will probably continue to exist.

Together these four metrics suggest that Bitcoin is confronted in a short to medium term in a considerable turbulence. However, nobody indicates an overheated market or a cycle top scenario. This situation reflects the trade crisis of 5 August 2024, when macro -economic conditions ran Bitcoin lower.

Trump’s rate policy and the growing uncertainty are weighed in the same way on macro indices and Bitcoin. A similar pattern was seen a year ago – once that the macro pressure was relaxed, Bitcoin made a recovery.

If history repeats itself, improving macro -economic conditions can release the way for a persistent Bitcoin -Rebound.

What suggest BTC graphs

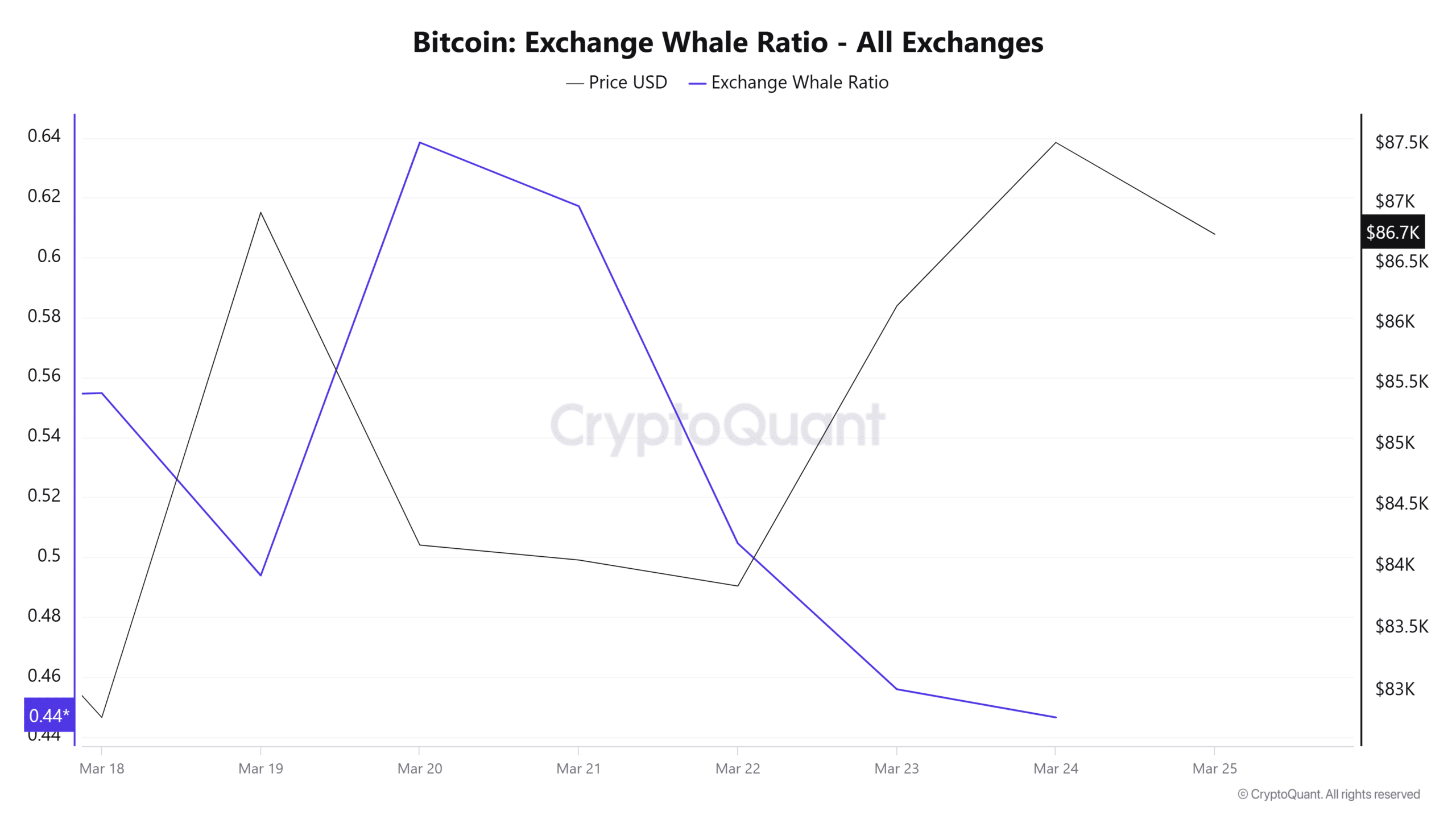

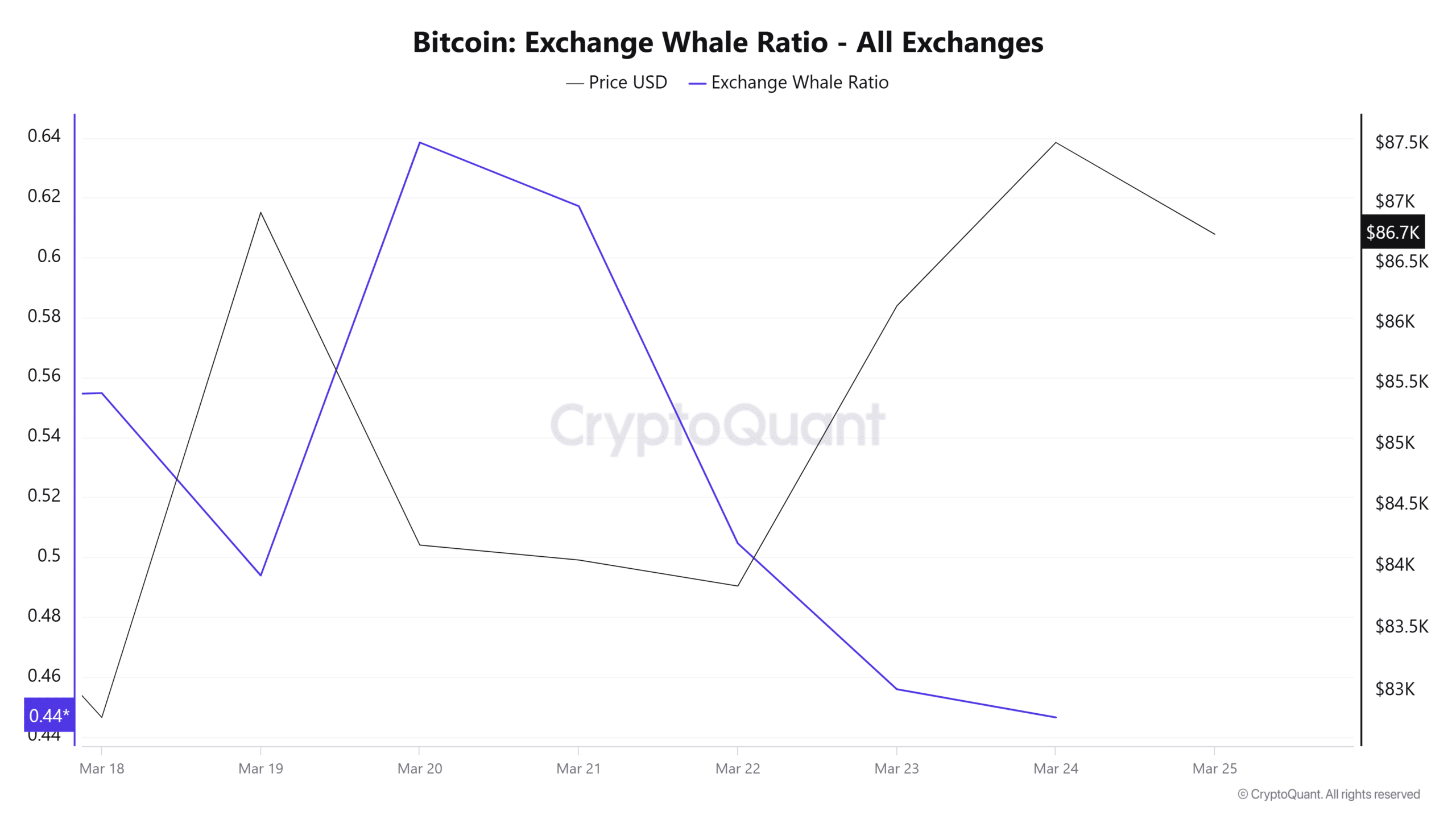

Although the cryptoquant analysis shows a worrying trend, the analysis of Ambcrypto suggests that the market top is not yet and that important players remain bullish.

Source: Cryptuquant

To begin with, Bitcoinwalvissen Bullish remain as evidenced by a falling whale exchange ratio. When this sees a sharp dip, this suggests that whale holds their positions and do not transfer BTC to exchange to sell.

This reflects optimism, with large entities expecting the prices to rise further.

Source: Cryptuquant

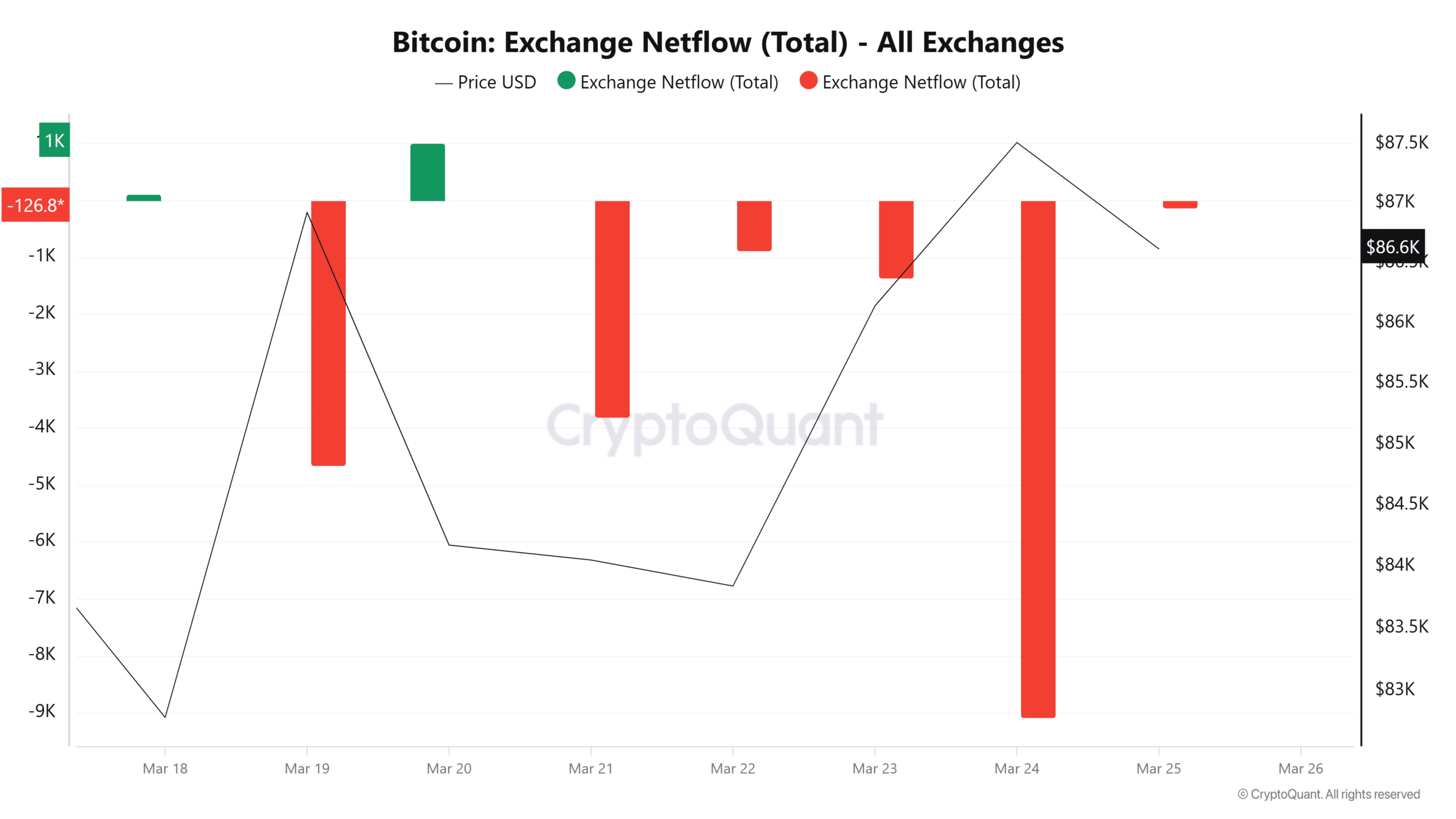

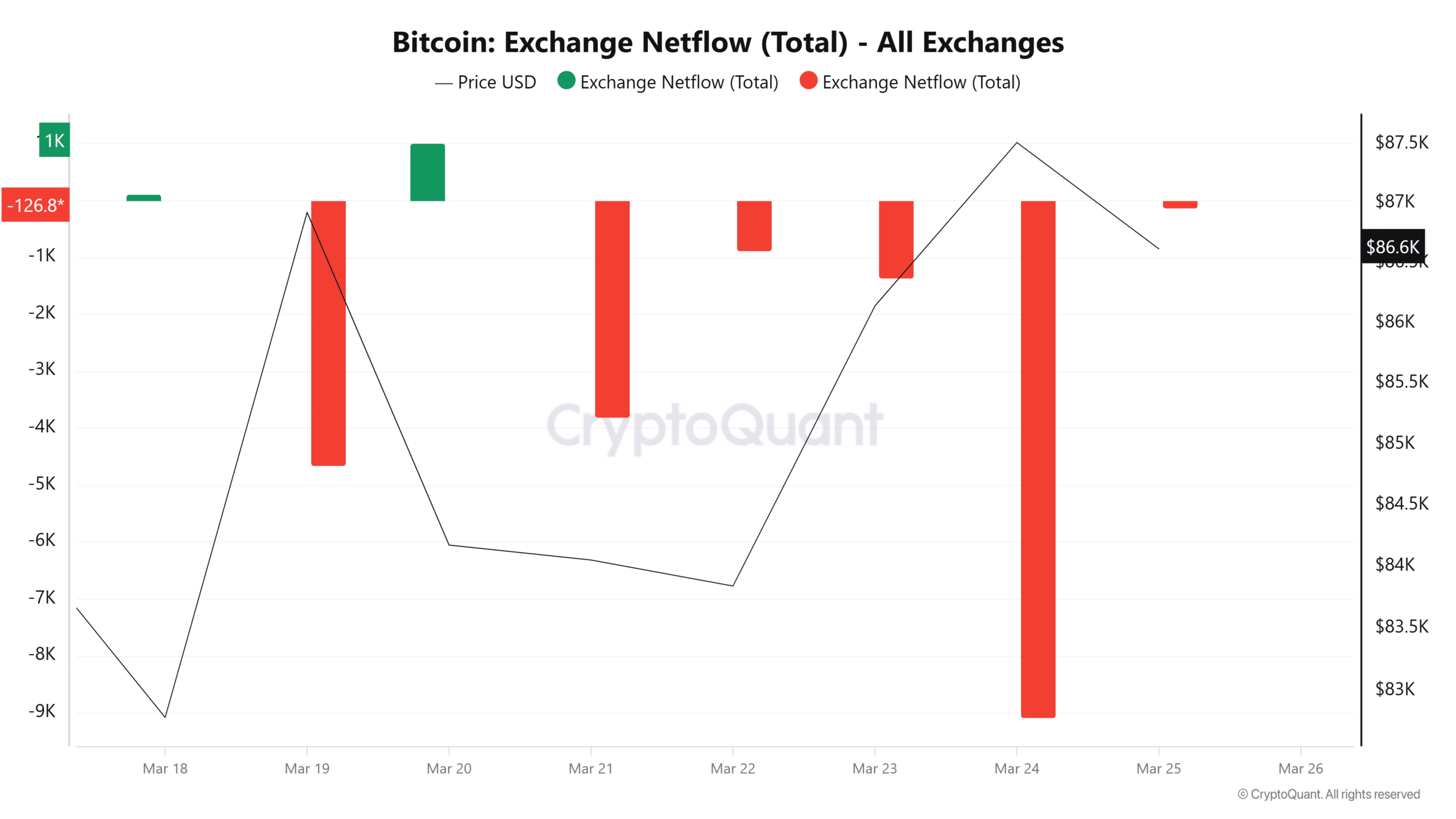

This trend is observed at the participants in the market. We can see this because Bitcoin’s Exchange Netflow has remained negative for five consecutive days.

A five -day series of negative Netflow suggests that buyers have recorded the market, with BTC experienced an increase in collecting addresses. If buyers feel that the market is approaching the top, they will behave differently.

Source: Cryptuquant

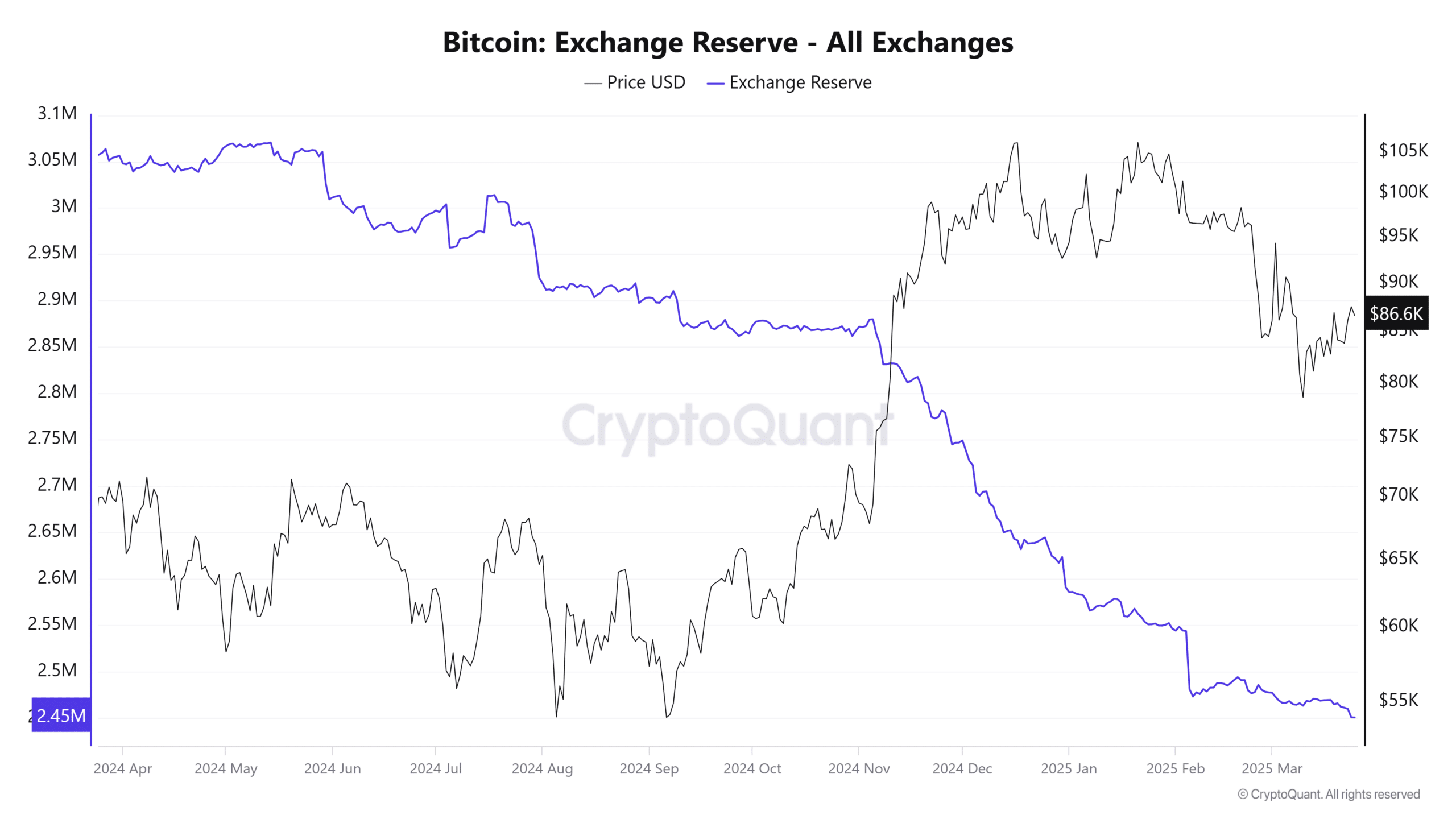

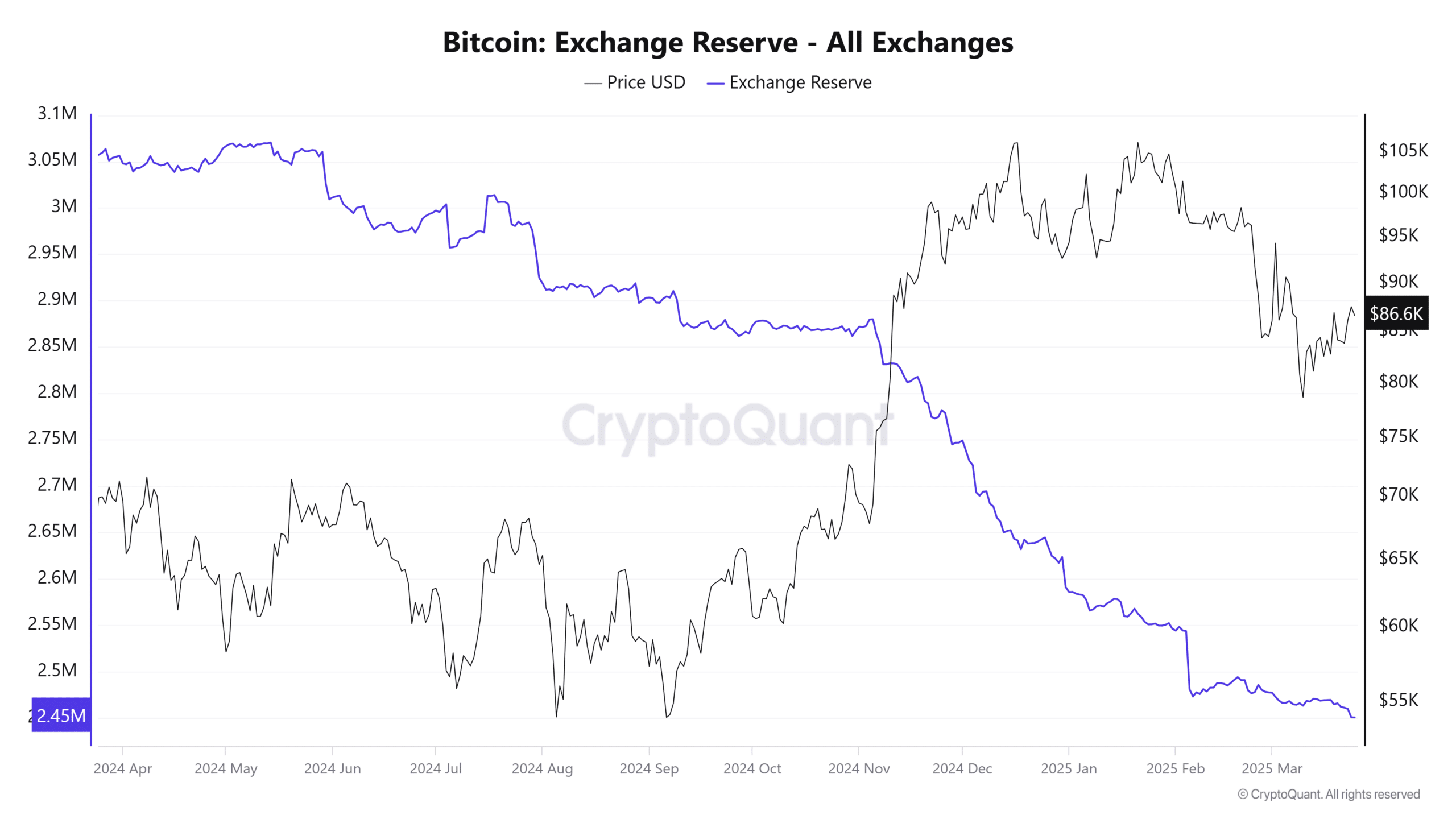

The increased outflow has led to the exchange reserves of Bitcoin fell to an annual low. This decline suggests fewer transfers in stock markets, as noted earlier. As long as the inflow of the exchange remains low, prices are expected to recover when market conditions improve.

In summary, although some indicators indicate a potential end of the bull market, we are not there yet. There is still room for growth, where both whales and retail investors retain a bullish prospect.

If this will persist, BTC could win the $ 90k level. However, if a correction occurs, BTC can fall to $ 85,222.