- BTC bulls are targeting $64K and see $68K as the next resistance level.

- Can they overcome four days of failed attempts to push BTC above this major target?

Bitcoin [BTC] Bulls are targeting the $64,000 mark, a key level last reached during the late August rally, making this a crucial turning point.

To avoid repeating past downturns, bulls must counter any bearish pressure. If successful, the next resistance could emerge around $68,000.

Bitcoin: Bull run depends on $64K

Source: Coinalyse

The current cycle is very similar to the trend from early August, which saw BTC rise to $64,000 after returning below $55,000. However, the 18-day rise was then marked by inconsistent bearish pressure.

While this cycle shows more consistent green candles, the growth rate is, on the other hand, less stable, causing volatility among stakeholders.

As a result, instead of rate cuts fueling bullish sentiment, continued volatility has prevented BTC from retesting $64K and is currently trading at $63,543 – marking the fourth day in a row below this benchmark.

Furthermore, this benchmark has been tested five times since March, when BTC reached its ATH of $73K. Interestingly, it wasn’t until July that the bulls avoided a pullback, sending BTC soaring to $68K.

Simply put, the $64,000 mark has been a crucial turning point for Bitcoin.

While volume indicators point to a bullish trend, the real challenge is whether other investors will support a breakout or whether bears will once again block BTC’s rise.

The current price may be out of reach

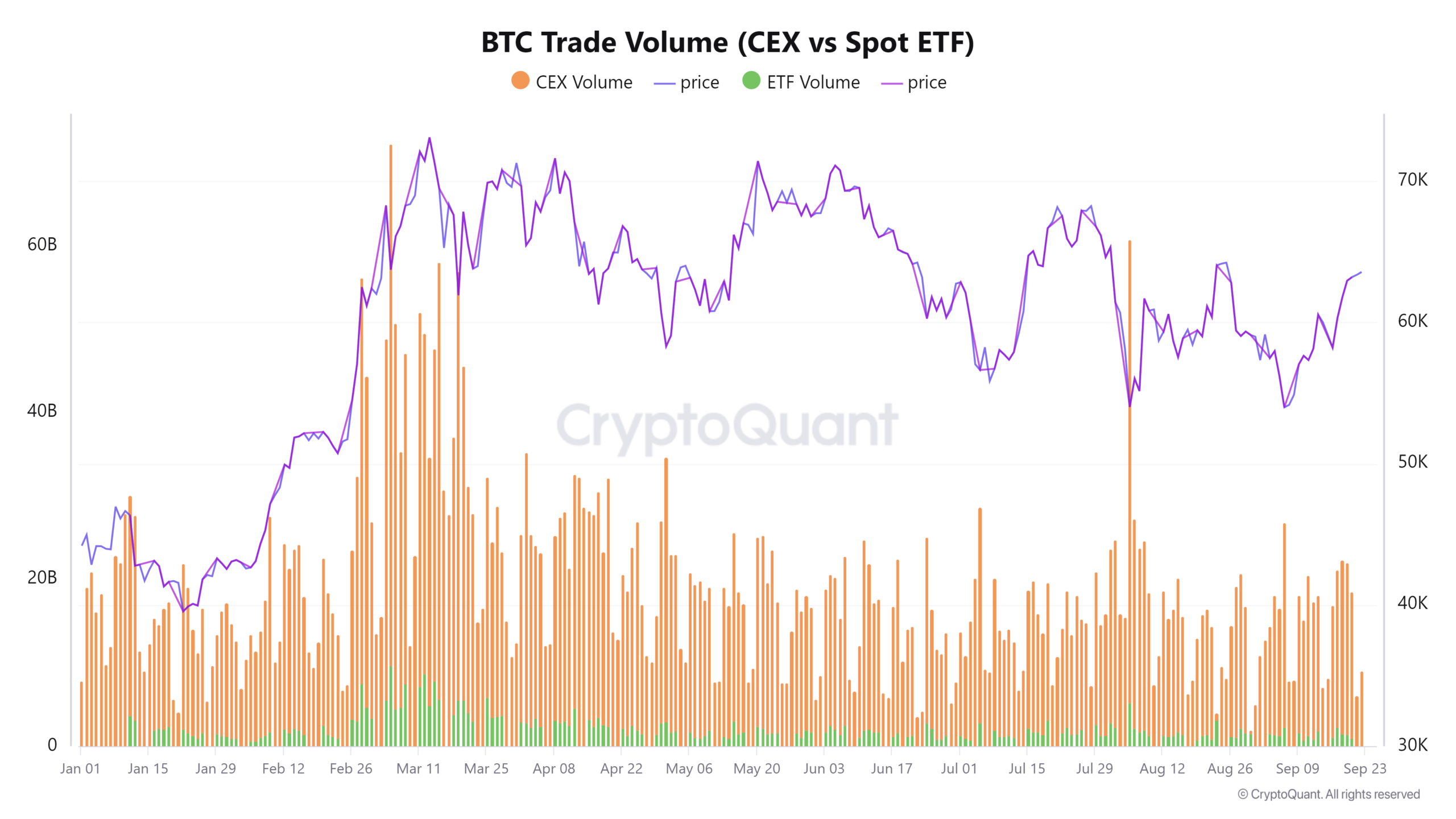

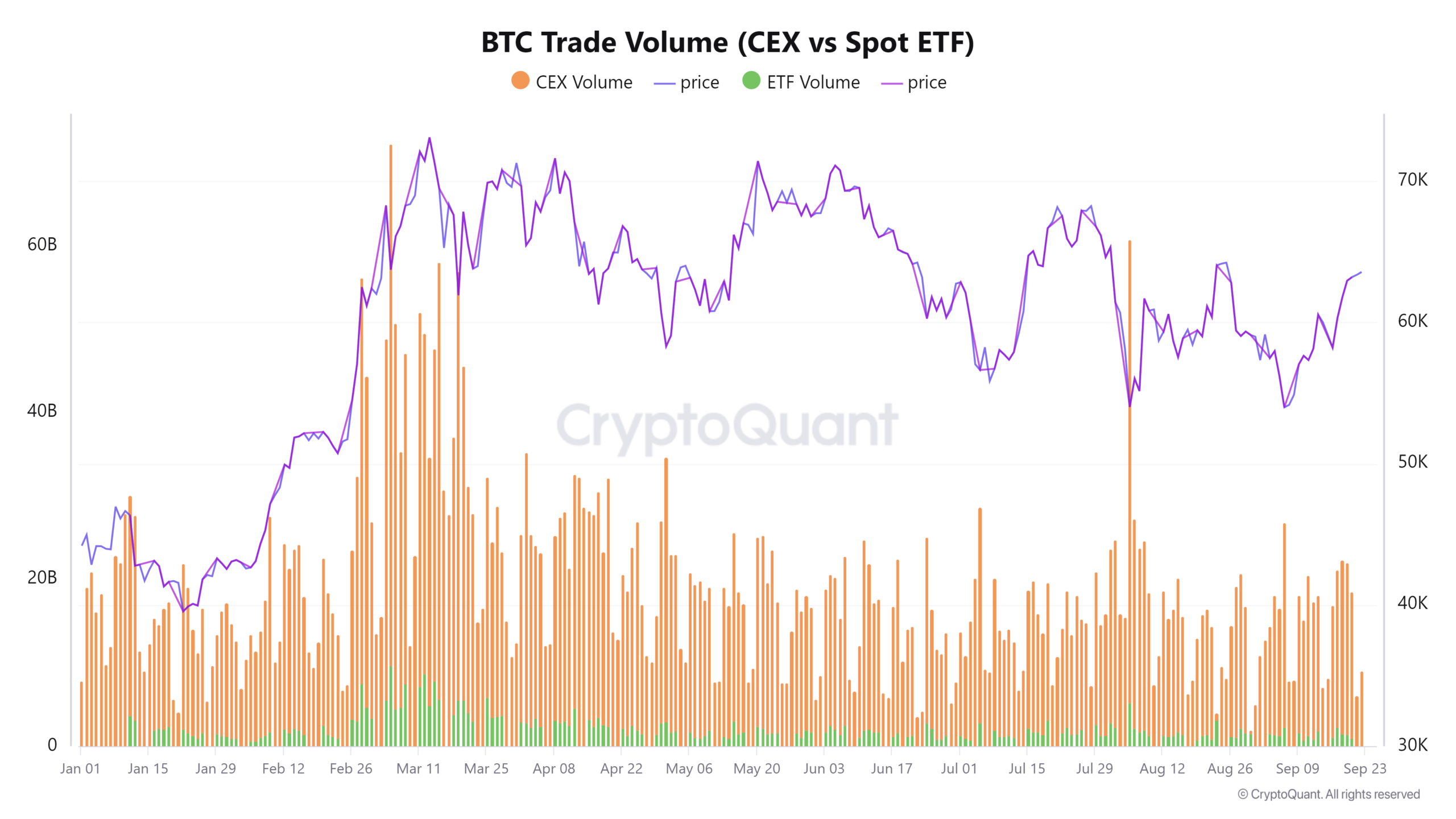

Over the past two days, BTC trading volume on CEXs has fallen from $17 billion to $6 billion. This sharp decline could increase volatility, shaking investor confidence in a possible trend reversal.

The chart below may indicate a potential market top, which often coincides with reduced trading activity on CEXs.

Conversely, when stock market volumes spike during sharp declines in BTC, it often provides an ideal dip buying opportunity.

Source: CryptoQuant

According to AMBCrypto, the reduced stock market activity could suggest two possibilities: either investors cash in on the gains from the September cycle, or they wait for a dip to buy BTC at a lower price.

If this trend continues, it could certainly pave the way for a resurgence in positions short circuit Bitcoin. Consequently, the chance of an outbreak may decrease. However,

There may still be hope

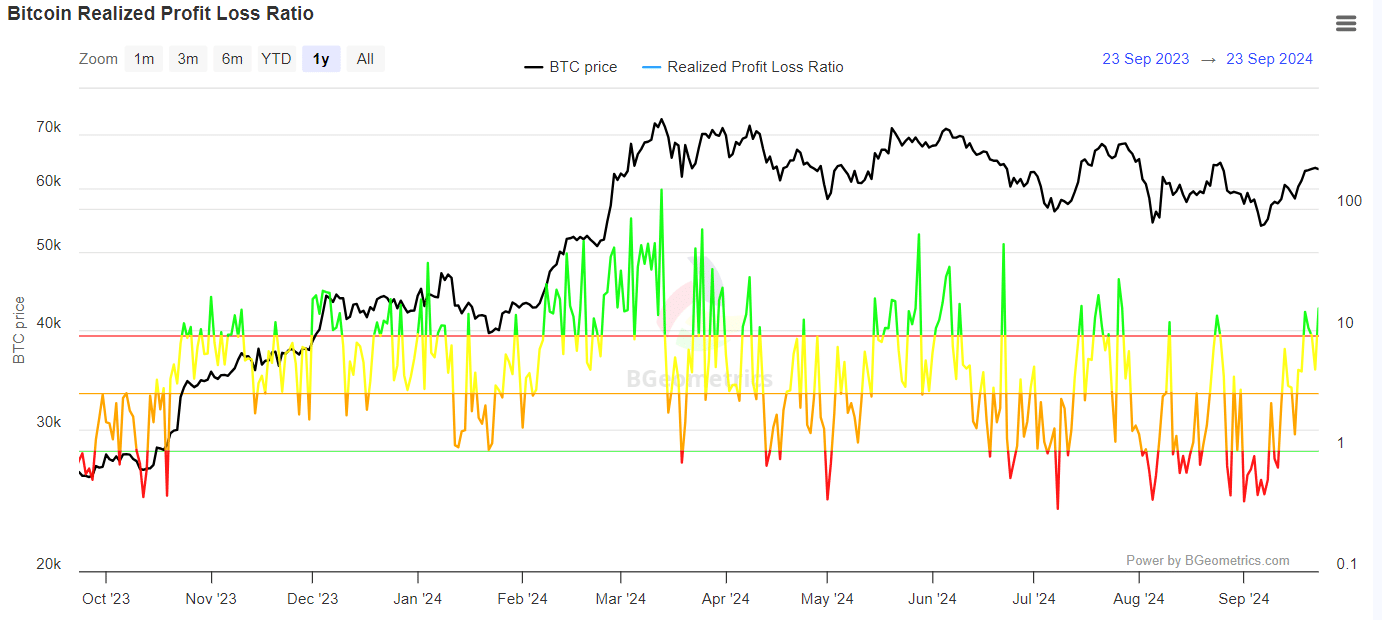

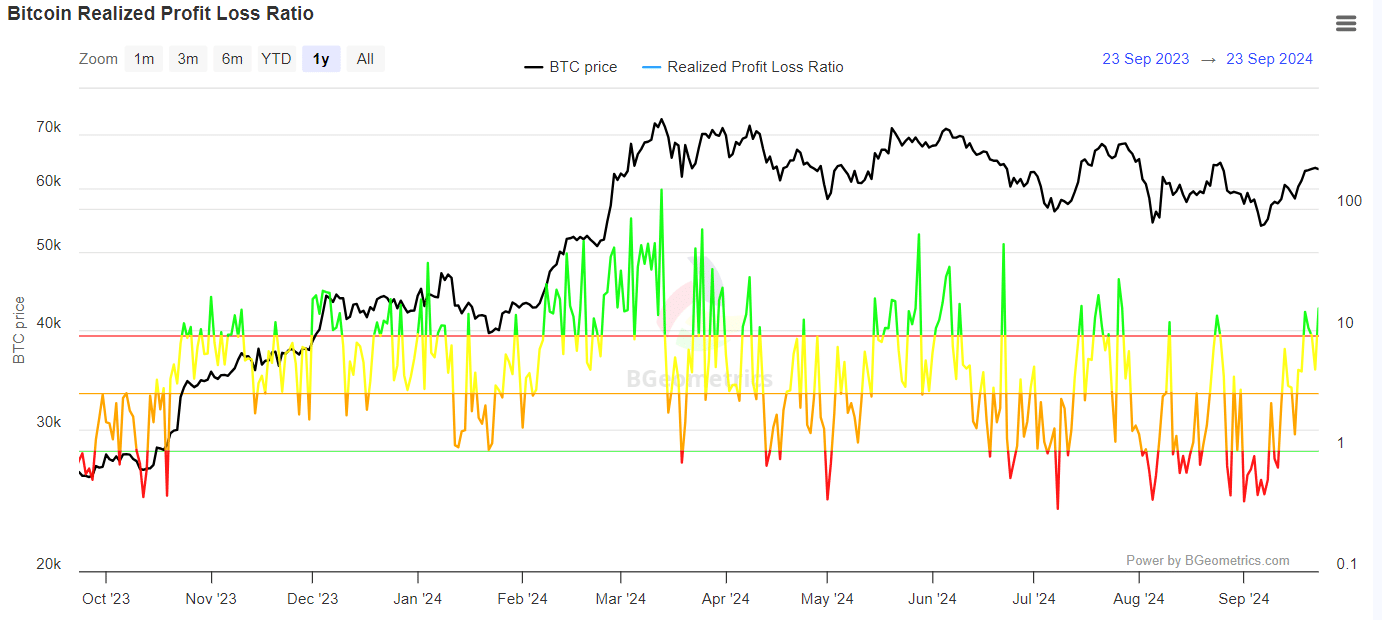

As the most volatile month draws to a close, the potential for “Uptober” could mark a bullish turning point for the market, a glimmer of hope illustrated in the chart below.

On the day Bitcoin saw a small decline of 0.37%, the RPL ratio dropped, indicating losses. However, since then the majority of transactions have occurred above the original purchase price.

Source: BGeometrics

In addition to this analysis, there are also large transaction volumes rosewith transactions over $100,000 showing significant activity.

Clearly, bulls are bucking the resistance that has kept Bitcoin below the $64K benchmark. Currently, the sharp decline in CEX volume is strengthening short dominance and acting as a barrier.

Read Bitcoin’s [BTC] Price forecast 2024-25

However, if the market stabilizes, as evidenced by sellers making profits, FOMO could encourage a longer-term commitment.

Ultimately, monitoring CEX volume alongside speculative market activity is critical. If their dominance is not checked, BTC could fall back below $60,000.