- The influx of institutional demand has likely been one of the key factors explaining why Bitcoin hovered around the ATHs of the previous cycle.

- Investors should not fear lower volatility over the time frame as the numbers support a buy-and-hold strategy.

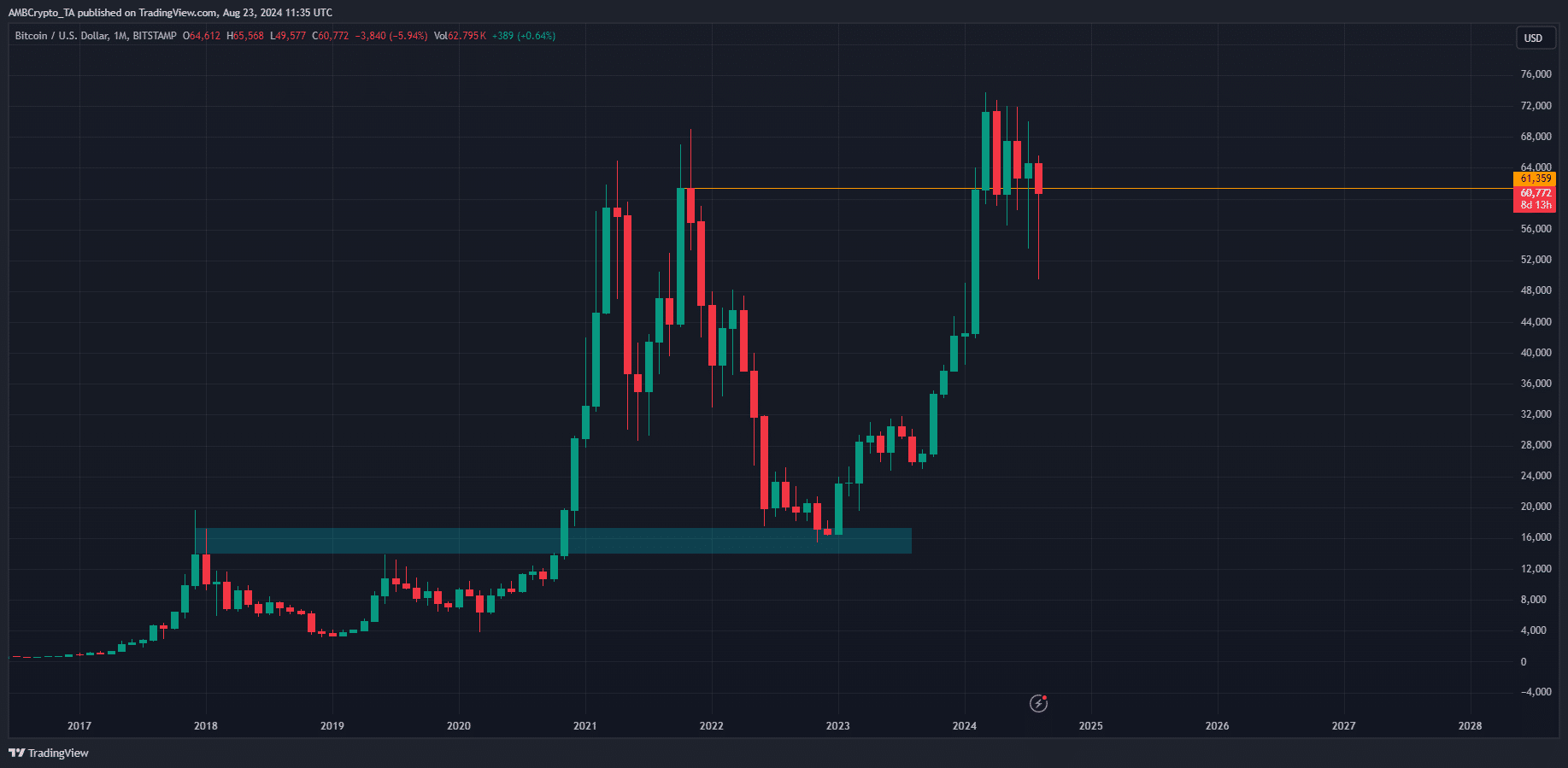

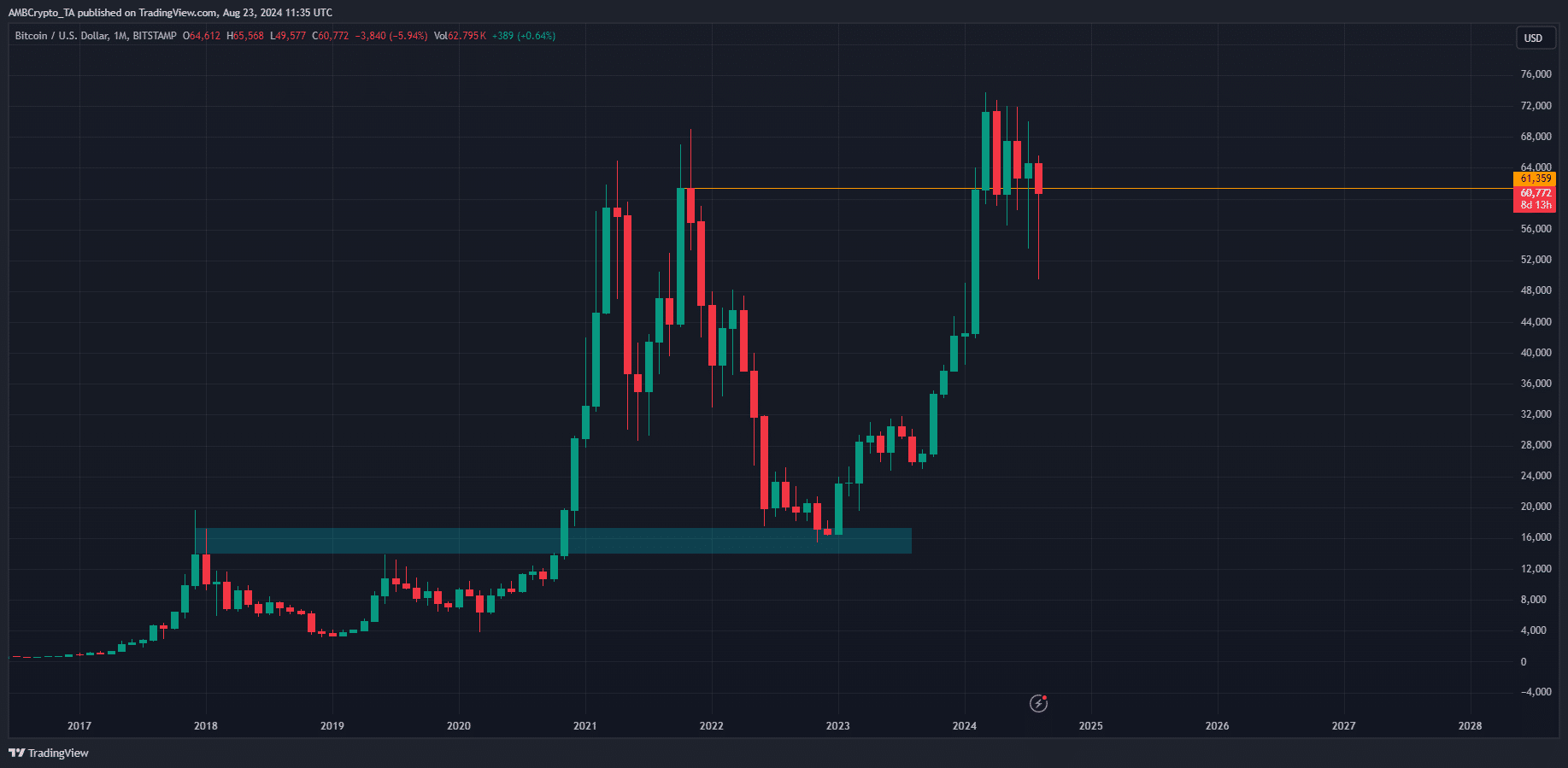

Bitcoin [BTC] was in a downtrend on the weekly chart, but in an uptrend on the monthly chart. Since March, it has consolidated within the $50,000-$70,000 region.

While traders and investors may be frustrated by the lack of movement, BTC remained extremely bullish on the higher timeframes.

Like one popular crypto analyst noted, Bitcoin is closed six monthly trading sessions above the close of the March 2021 monthly session.

Even the halving and numerous FUD events in the market were not enough to dethrone the king of cryptocurrency.

Unprecedented Bitcoin Price Performance

Source: BTC/USDT on TradingView

In terms of pure percentage gains, previous Bitcoin cycles have been stronger. Still, this run has something that hasn’t happened before. During the BTC halving in April 2024, the price was above $61,000.

It has been trading at or very close to the previous cycle’s ATH during and after the halving. During the 2020 halving cycle, BTC prices were almost 60% lower than ATH, compared to around 10% this cycle.

So, aside from the lower volatility, Bitcoin remained extremely bullish for long-term investors.

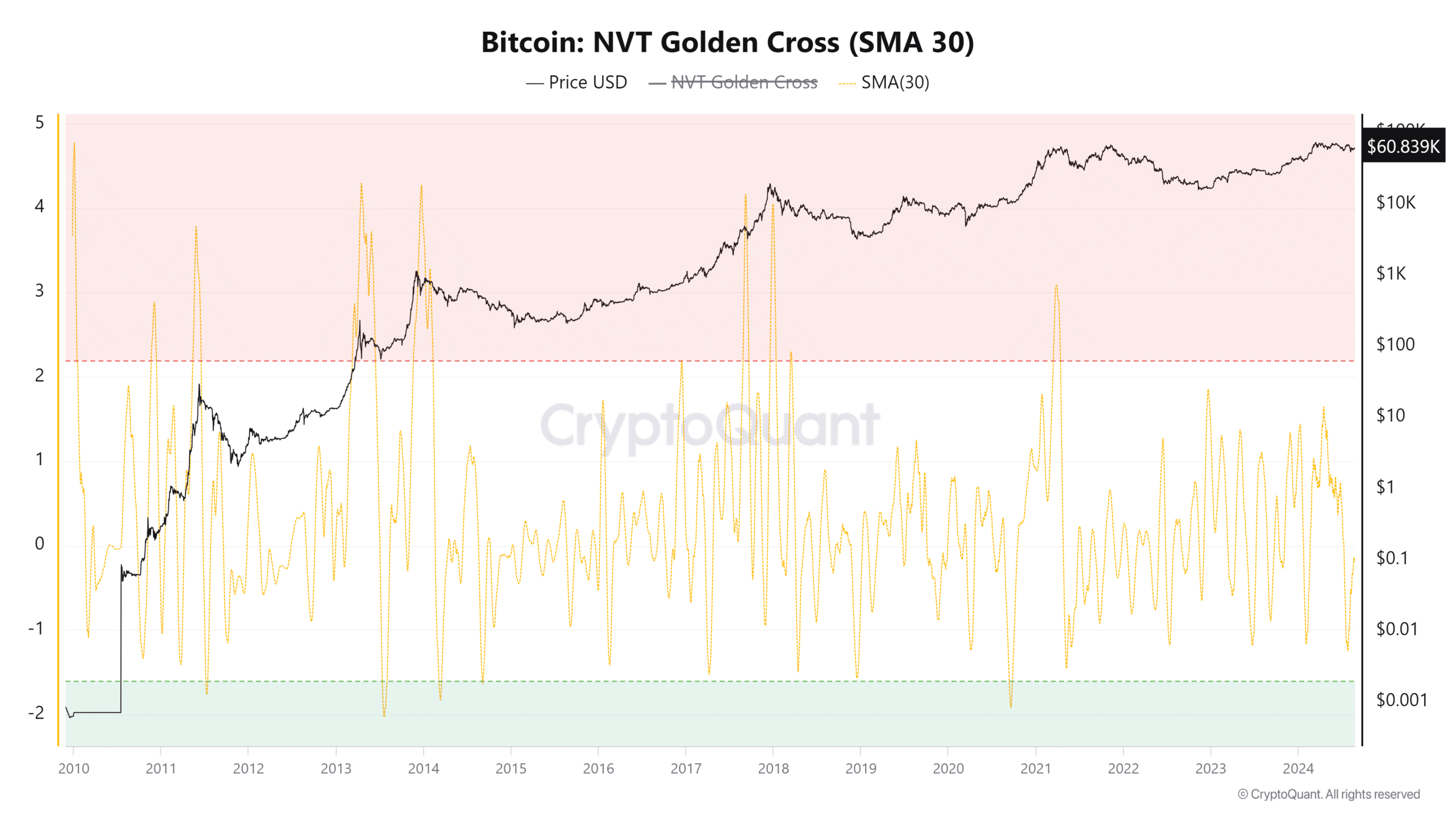

The NVT values encouraged buyers

The 30-day simple moving average of the NVT gold cross was -0.14. In general, values above 2.2 indicate a cycle top and below -1 indicate a possible bottom. Therefore, the Bitcoin bull run still has a long way to go.

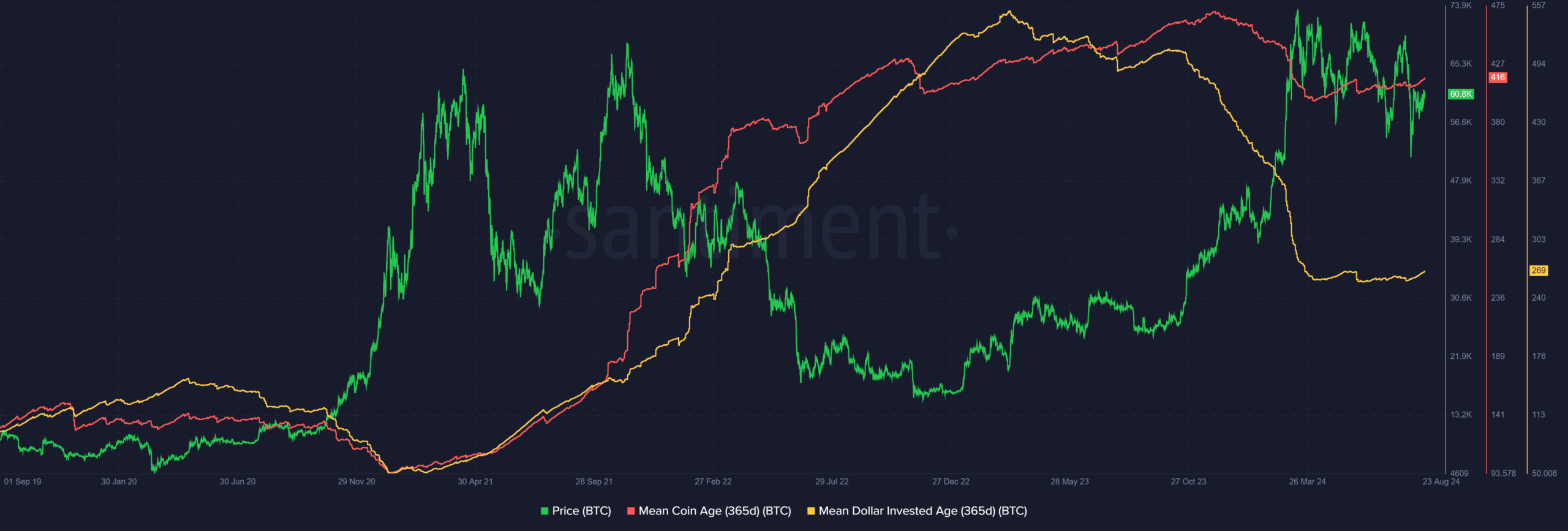

The average dollar invested began to decline in November 2023 as prices rose rapidly. It has been relatively flat in recent months.

A declining MDIA is a sign that investments are coming back into circulation and newer investments are taking place.

The MDIA could fall much further from 269 to the previous cycle low of 51 before the continued uptrend would begin to indicate network stagnation.

Read Bitcoin’s [BTC] Price forecast 2024-25

The average coin age slowly started to rise after the sharp decline in February and March, as rapid price increases led to profit-taking and selling pressure.

A continuation of this upward trend would indicate network-wide accumulation.