- BTC investors remain optimistic despite recent market volatility.

- The average financing percentage of Bitcoin in four major stock markets has fallen in negative territory.

The last day, Bitcoin [BTC] has experienced extreme volatility. During this period, the prices were rocked from a low of $ 81k to a highlight of $ 85k and then withdrawn to $ 84k to $ 84k on the $ 84k press.

Despite current market volatility, important stakeholders remain optimistic and anticipate market stability.

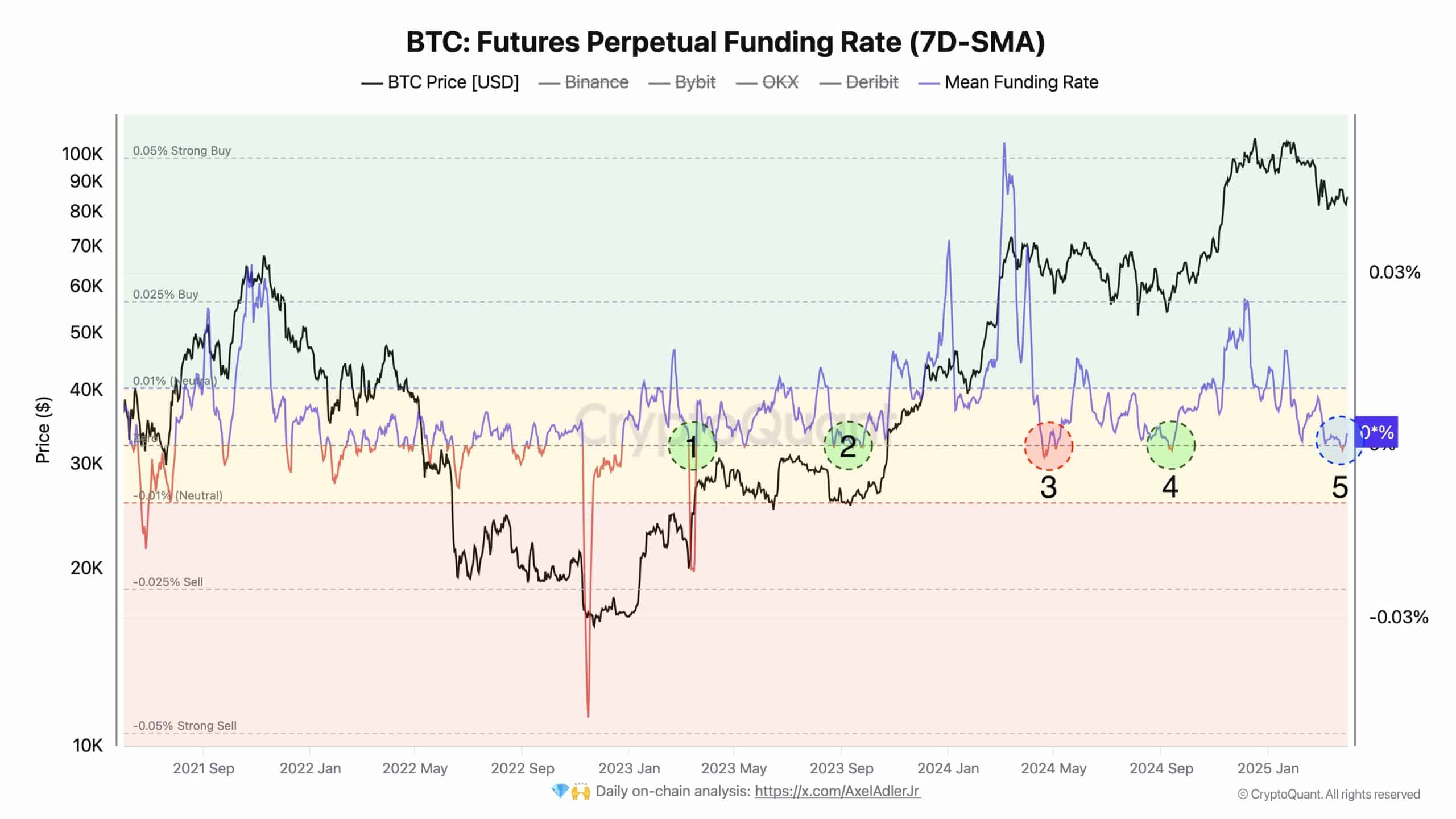

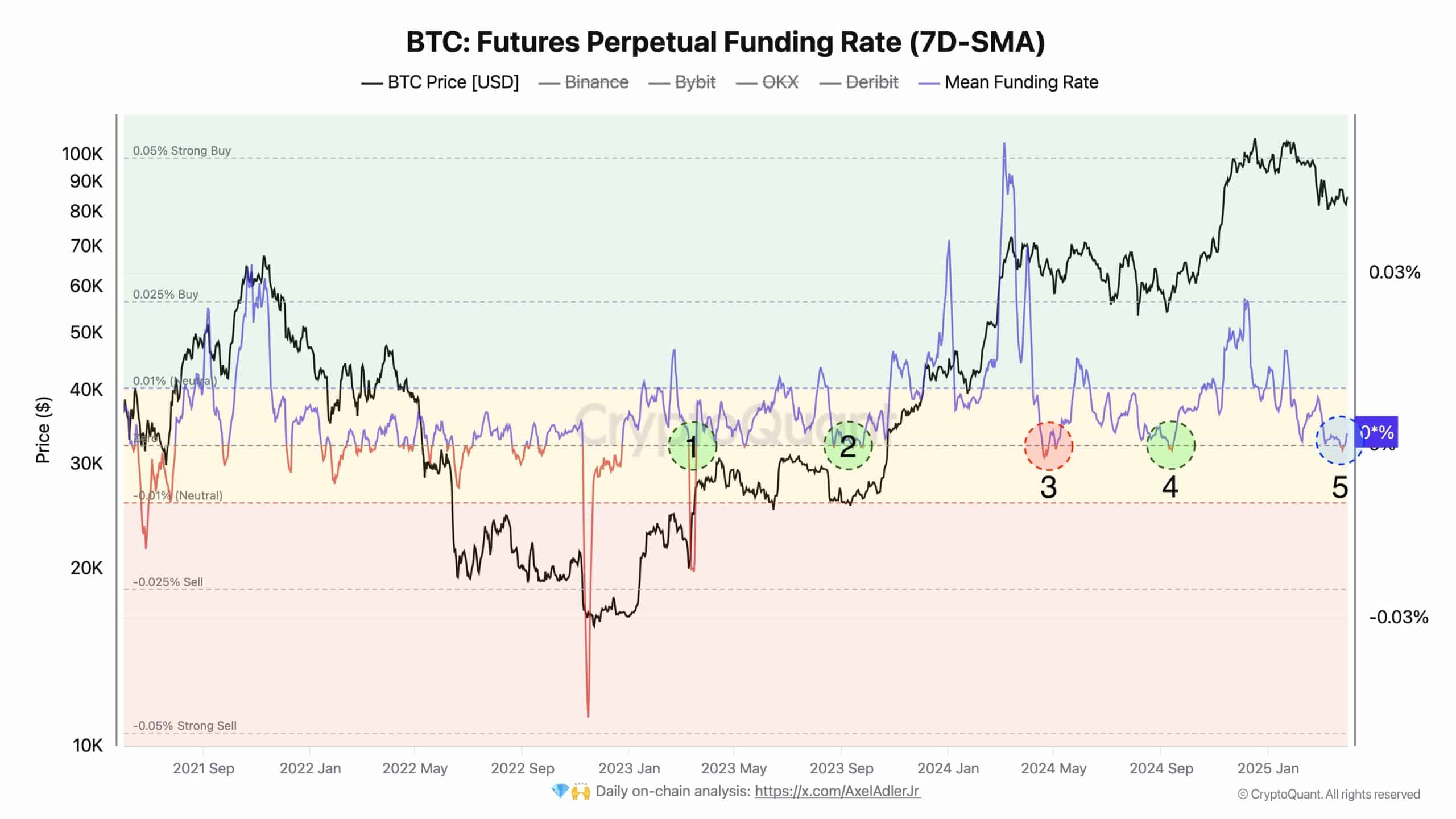

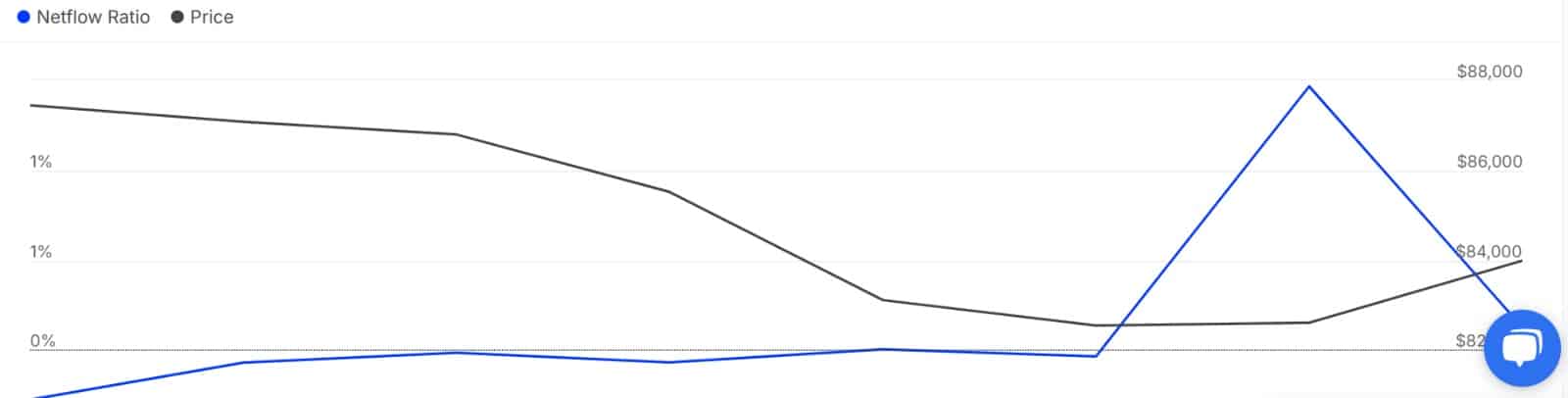

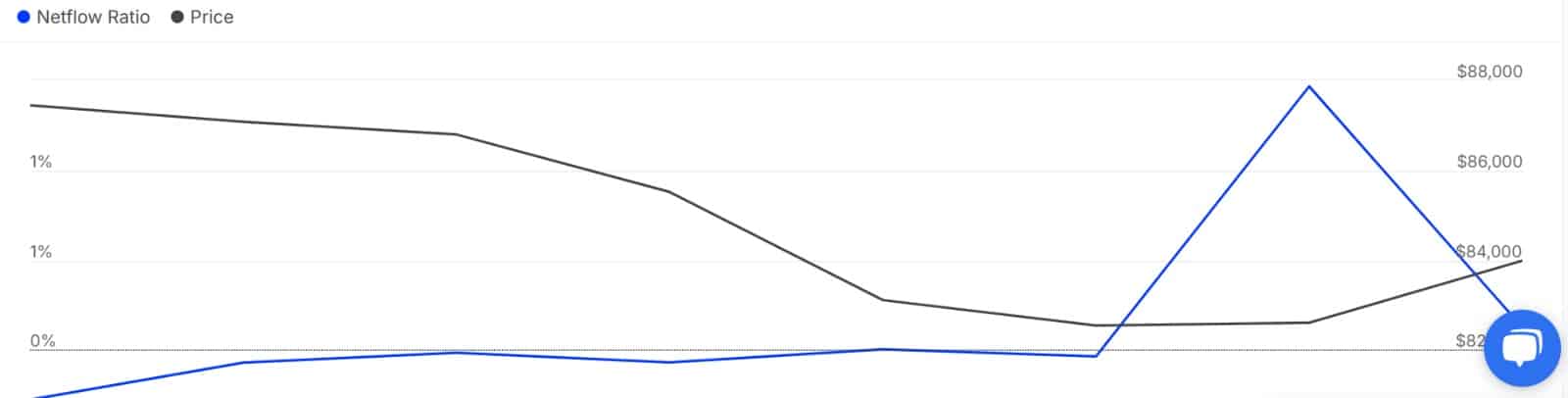

As far as, cryptoquing analyst Axel Adler has predicted upcoming market stability, with reference to the average financing percentage of Bitcoin.

Bitcoin’s financing percentage becomes negative

In his analysis, Adler noted that at the four major stock markets; Binance, Bybit, OKX and DERIBIT The average financing percentage has fallen in negative territory.

During this cycle, the market witnessed four similar cases in which the average financing percentage has fallen negatively. During these cases, BTC prices came back, while only once those prices fell.

This suggests that a decrease to negative territory will probably lead to a price increase than decrease.

Source: Cryptuquant

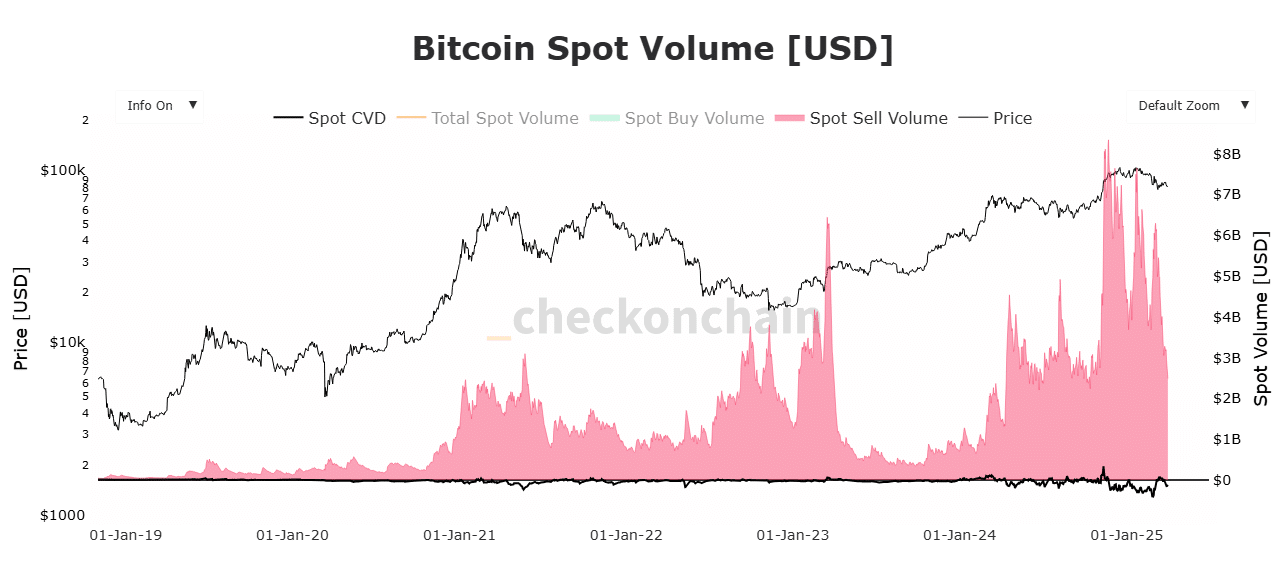

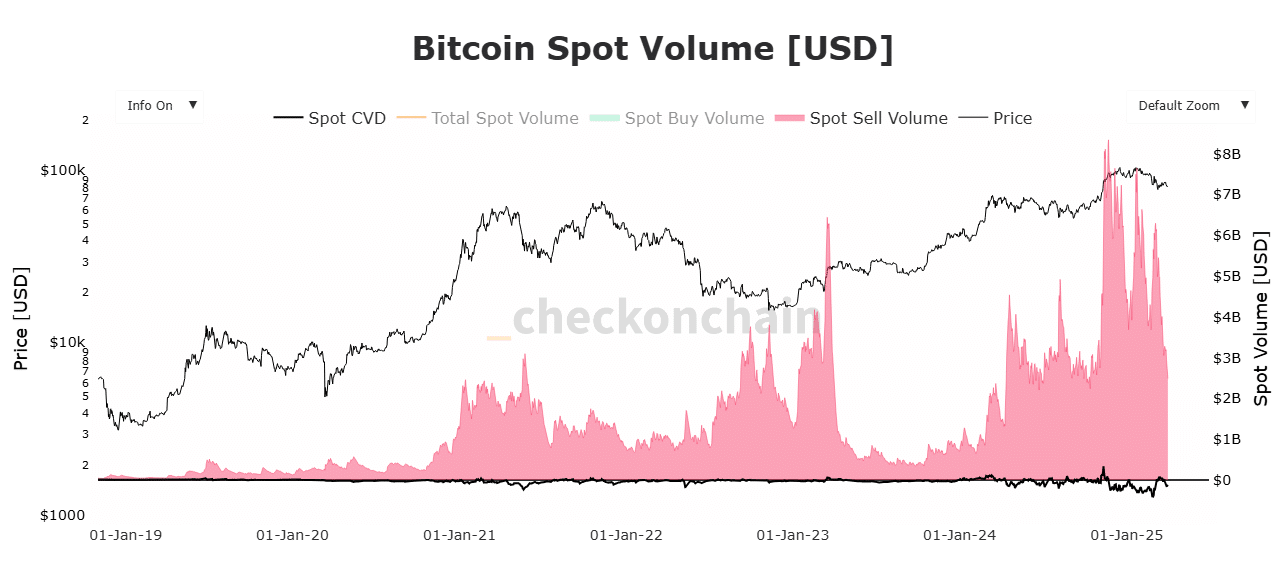

To argue his business, the analyst noted that the business sector is currently actively buying Bitcoin, while the sales pressure of the spot market is minimal because experienced investors have stopped selling.

The reduced sale is proven by the falling spot sales volume that has fallen from $ 6.2 billion on 5 March to $ 2.4 billion from 1 April.

This means that selling volume in less than a month has been reduced by $ 3.8 billion.

Source: Checkonchain

Whales don’t sell much either. The activity of whale for exchange has even seen a sharp decline.

Thus the whale-to-exchange current has fallen from 1.76% to 0.15%, suggesting that whales have reduced the amount of Bitcoin that they send in fairs to sell.

This market behavior suggests that although markets see sales activities, it gradually decreases.

Source: Intotheblock

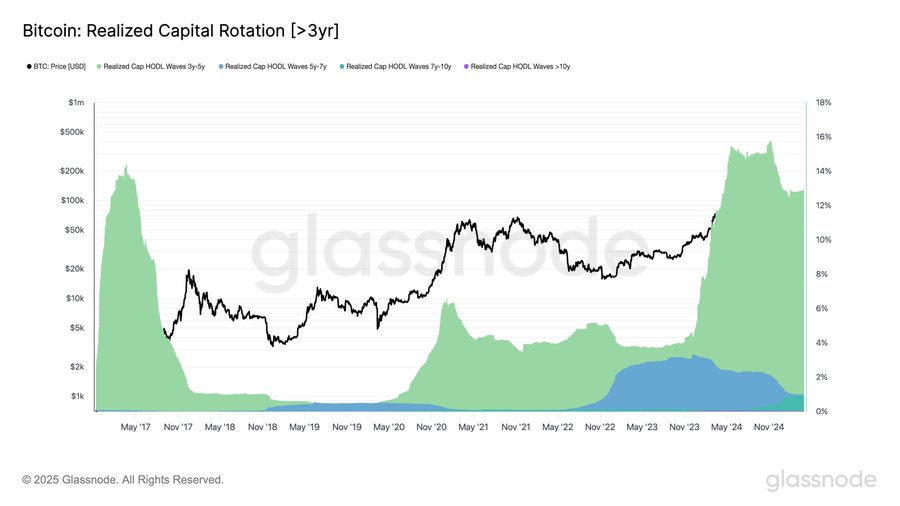

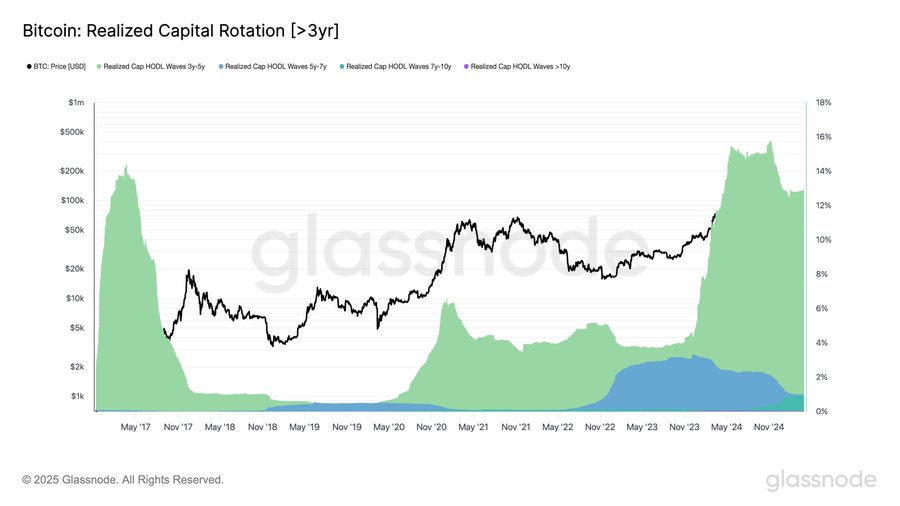

Another recovery of the market for aspect is the fact that holders have returned to the market for accumulation in the long term.

Although the share of the wealth of investors who bought $ BTC 3-5 years ago, since the peak of November 2024 has fallen by 3%, it remains at historically increased levels.

This suggests that the majority of investors who came on the market between 2020 and 2022 are still in force.

Source: Glassnode

These three aspects indicate a standardization of market conditions after the overheating phase. However, the market is still confronted with one important condition that is now at a potential price rebound.

The only problem is bad macro -economic indicators that block the growth of BTC.

That is why positive signals from the FED and the Trump administration can renew the influx of cash via ETFs, which may activate the start of a new rally.

What is the next step for BTC?

As observed above, Bitcoin investors are in the religious phase and expect a stabilizing as soon as macro -economic issues, BTC prices will come back.

As such, with retailers, whales and long -term whales that become bullish, Bitcoin could see a strong rebound on its price charts as soon as external factors become favorable.

Therefore, if history repeats itself, accompanied by bullish sentiments that have currently being observed on the market, the BTC prices will rise.

An upward step from the current rate will reclaim BTC $ 86701 resistance to set the crypto for an outbreak above $ 87k.

Conversely, as the anomaly of one copy observed during this cycle, a retirement will see a decrease to $ 81155.