This article is available in Spanish.

Bitcoin is in a challenging position, struggling to regain the coveted $100,000 mark after a rapid shift in market sentiment. Just weeks ago, optimism dominated the landscape, with prices soaring to new highs. However, the story has taken a sharp turn as fear now grips the market following a sudden correction.

Related reading

Bitcoin’s price action, currently trading below $100,000, reflects increased uncertainty among investors. Top analyst Axel Adler recently shared his insights on X, highlighting the significance of the $90,000 level as a robust support zone. According to Adler, this zone extends to a lower range of $79,000, providing a safety net in case further declines occur. He emphasizes that maintaining this support is crucial for Bitcoin to stabilize and regain bullish momentum.

While current sentiment leans toward caution, historical trends suggest that Bitcoin often thrives after testing key support levels. The market’s focus has now shifted to whether BTC can defend this critical zone and stage a recovery. In the coming days, the $90,000 mark will be a crucial battleground that will determine whether Bitcoin can regain its position or continue its descent. Investors and analysts are watching these developments closely in anticipation of the next big move.

Bitcoin finds demand below $100,000

Bitcoin’s price action has shifted from testing new all-time highs to finding solid demand below $100,000. This zone will determine whether the rally resumes or whether the market confirms a deeper correction. Amid this uncertainty, top analyst Axel Adler has done just that provided critical insights on Xwhich sheds light on the key levels shaping Bitcoin’s trajectory.

Adler’s analysis highlights the importance of the $79,000 level, which recently recorded the largest unrealized profit and loss (P/L) of the past decade. This data suggests that the $79K zone is not only a psychological benchmark, but also a crucial support level with significant market activity.

Moreover, he highlights the $90,000 mark as a robust support area, with a lower bound of $79,000. Adler notes that a position above $90K in the coming weeks would strengthen bullish momentum, making a rise above $100K very likely.

Related reading

However, Adler also warns about the possibility of a lateral consolidation phase. Such a move could serve as a cooling-off period for the market, allowing it to digest recent gains before resuming its upward trajectory. For now, Bitcoin’s price action remains at a crucial crossroads, with its ability to maintain support levels determining whether the next phase will be a breakout or a correction. Investors are watching it closely.

Technical Analysis: Key Levels to Hold

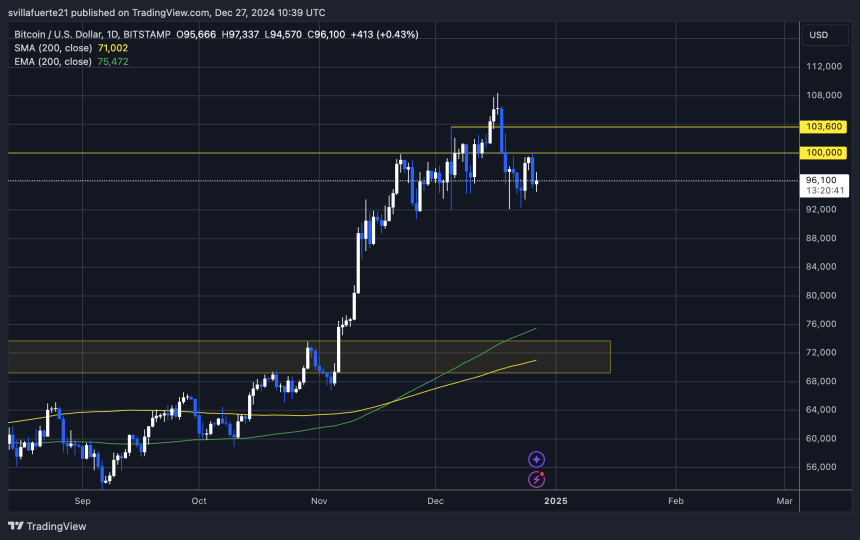

Bitcoin is currently trading at $96,200, reflecting days of indecision and sideways price action that has left traders unsure of its next move. Despite this consolidation phase, BTC remains within a critical range, with the next direction likely depending on whether bulls or bears take control.

For the bullish momentum to return, Bitcoin must decisively break above the psychological barrier of $100,000. Reaching this milestone would be a sign of renewed strength and could pave the way for further price development, potentially fueling another part of the rally. On the other hand, holding above the USD 92,000 level would still maintain a bullish narrative as it shows resilience in a crucial support zone.

However, concerns about a possible downturn among analysts remain. Some experts predict that Bitcoin could fall as low as $70,000 in the coming weeks if the $92,000 support does not hold. This bearish scenario would mark a significant correction and could shake market sentiment.

Related reading

In the current environment, Bitcoin’s price is at a crucial point where bulls need to regain control to push the market higher. Until then, the market remains vulnerable to both bullish breakouts and bearish breakdowns, leading investors to keep a close eye on these key levels for further clues.

Featured image of Dall-E, chart from TradingView