- Bitcoin price projections showed a range of $145,000 to $249,000 in 2025

- CryptoQuant’s analysis linked BTC growth to the realized cap and declining miner reserves

Bitcoin [BTC] Investors could be looking at an explosive market by 2025, with new data revealing potential price targets that could push BTC into uncharted territory. With projections showing that Bitcoin’s market cap will reach nearly $5 trillion under optimal conditions, the question is no longer “if,” but “how high?”

The latest insights are coming true Ki Young Ju, Founder and CEO of Cryptoquant. He shared a range of possible outcomes for Bitcoin’s realized capital growth. These scenarios suggest that BTC could rise to as much as $249,000 by 2025, with a conservative estimate still placing the cryptocurrency’s price at $145,000.

An overview of key insights

CryptoQuant’s model presents three Bitcoin scenarios for 2025, based on realized capital growth and market multipliers. In the “top” scenario, realized capital growth of $520 billion, multiplied by six, would push Bitcoin’s market cap to $4.969 trillion and its price to $249,000.

Source:

While the chart simplified these scenarios, the implications are profound.

The ‘top’ goal assumes continued institutional adoption, supported by the incoming pro-crypto US administration and strong capital inflows. At $197,000 in the mid-range scenario, Bitcoin would still be a standout player in the financial markets, reflecting steady growth even in a moderately bullish environment.

The conservative projection, with a target of $145,000, highlights Bitcoin’s resilience and ability to maintain investor interest despite potential macroeconomic headwinds.

Analyzing key statistics

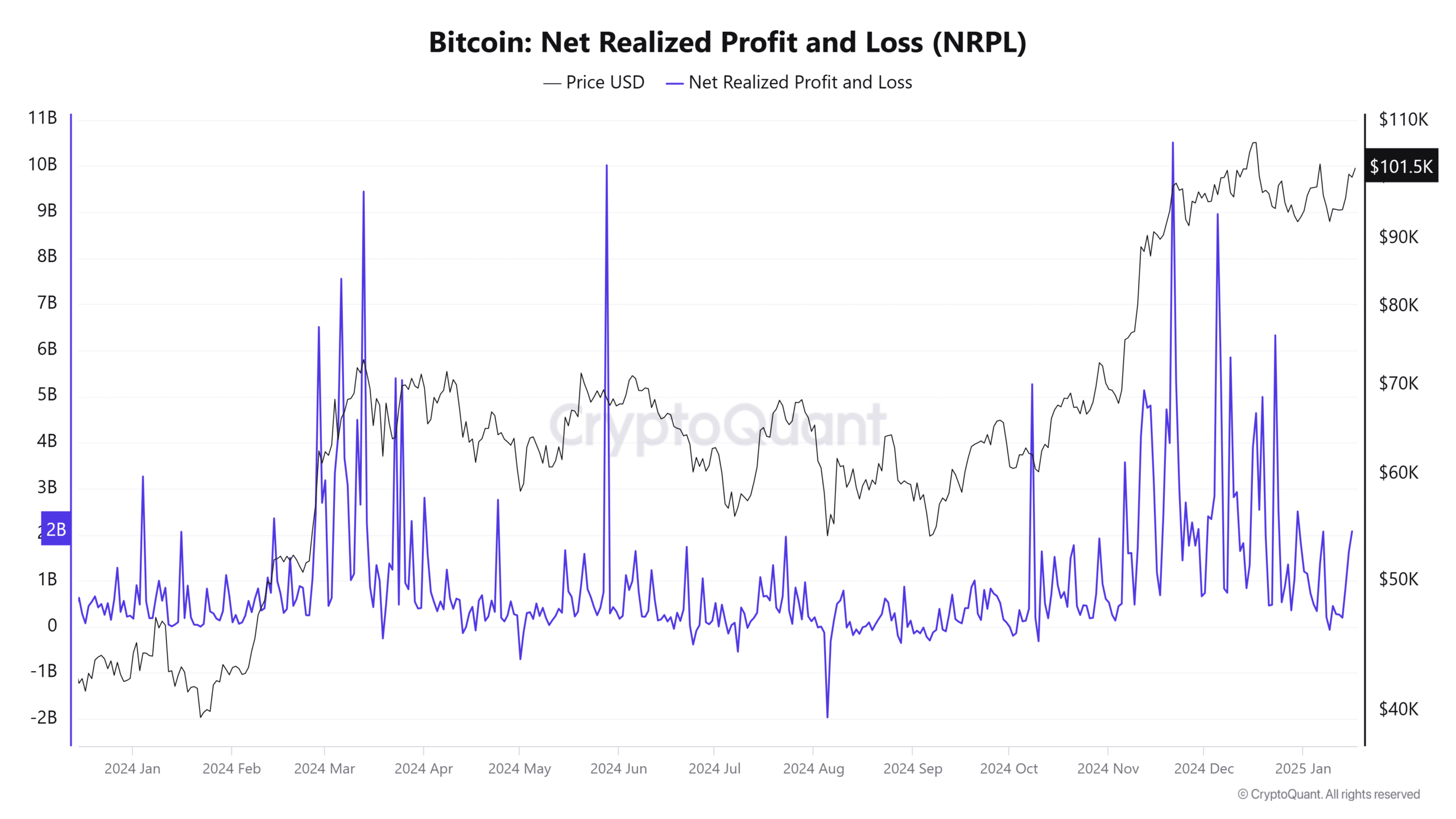

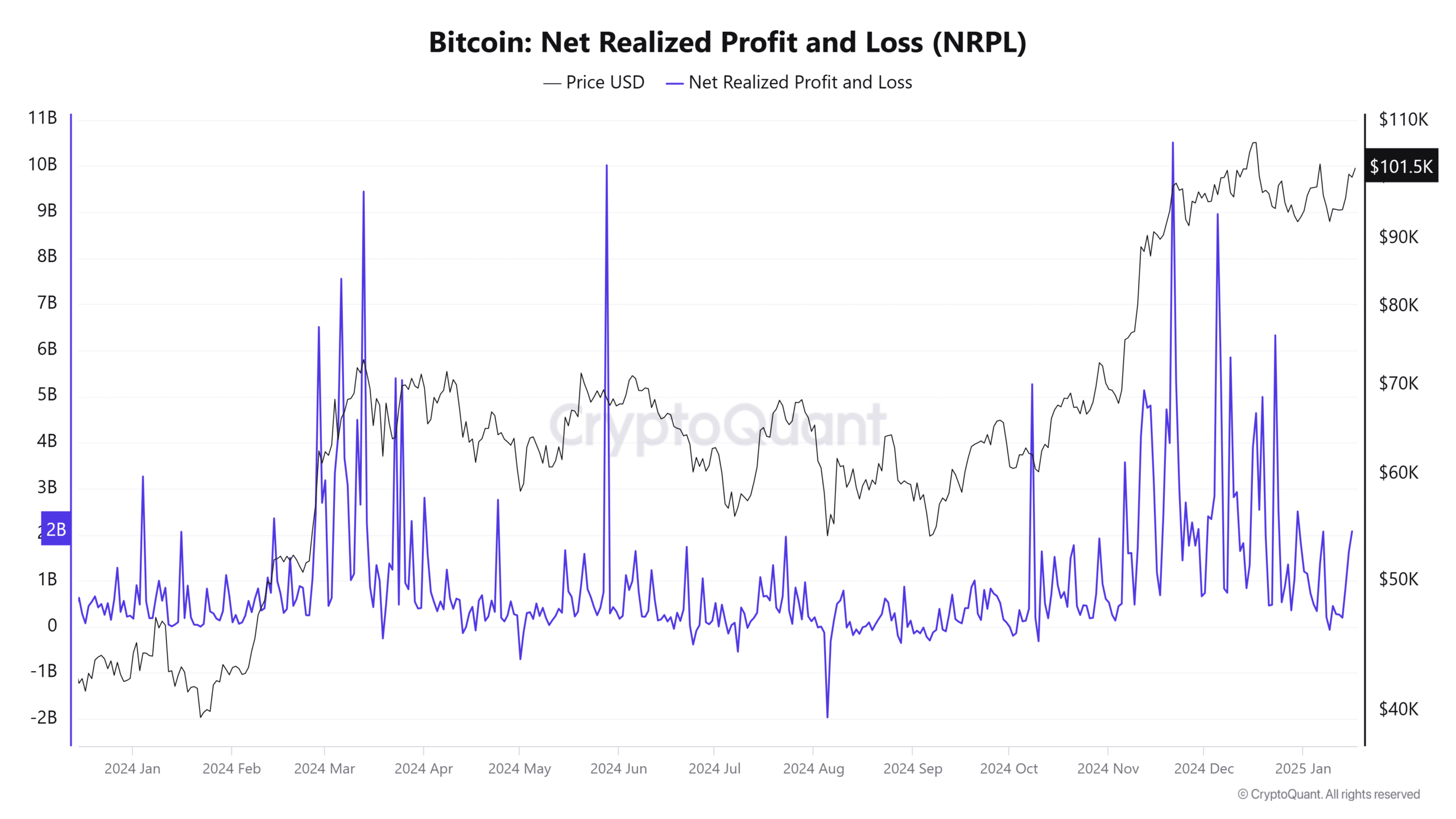

Source: Cryptoquant

At the time of writing, net realized gains and losses indicated increased profit taking during Bitcoin’s rallies, demonstrating strong market confidence at higher price levels.

Spikes in the NRPL often correspond with new spikes in the price of BTC, indicating robust investor participation.

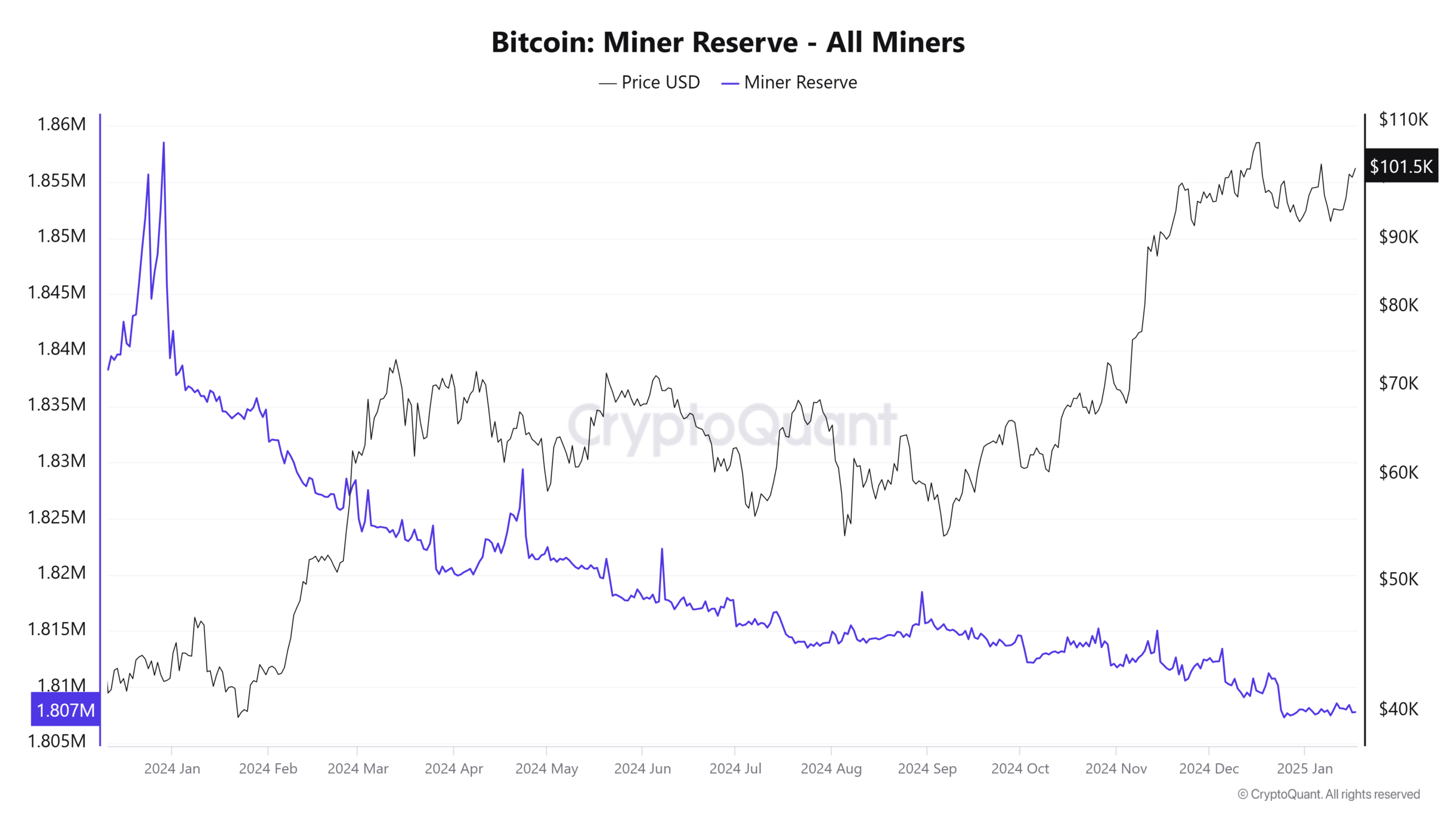

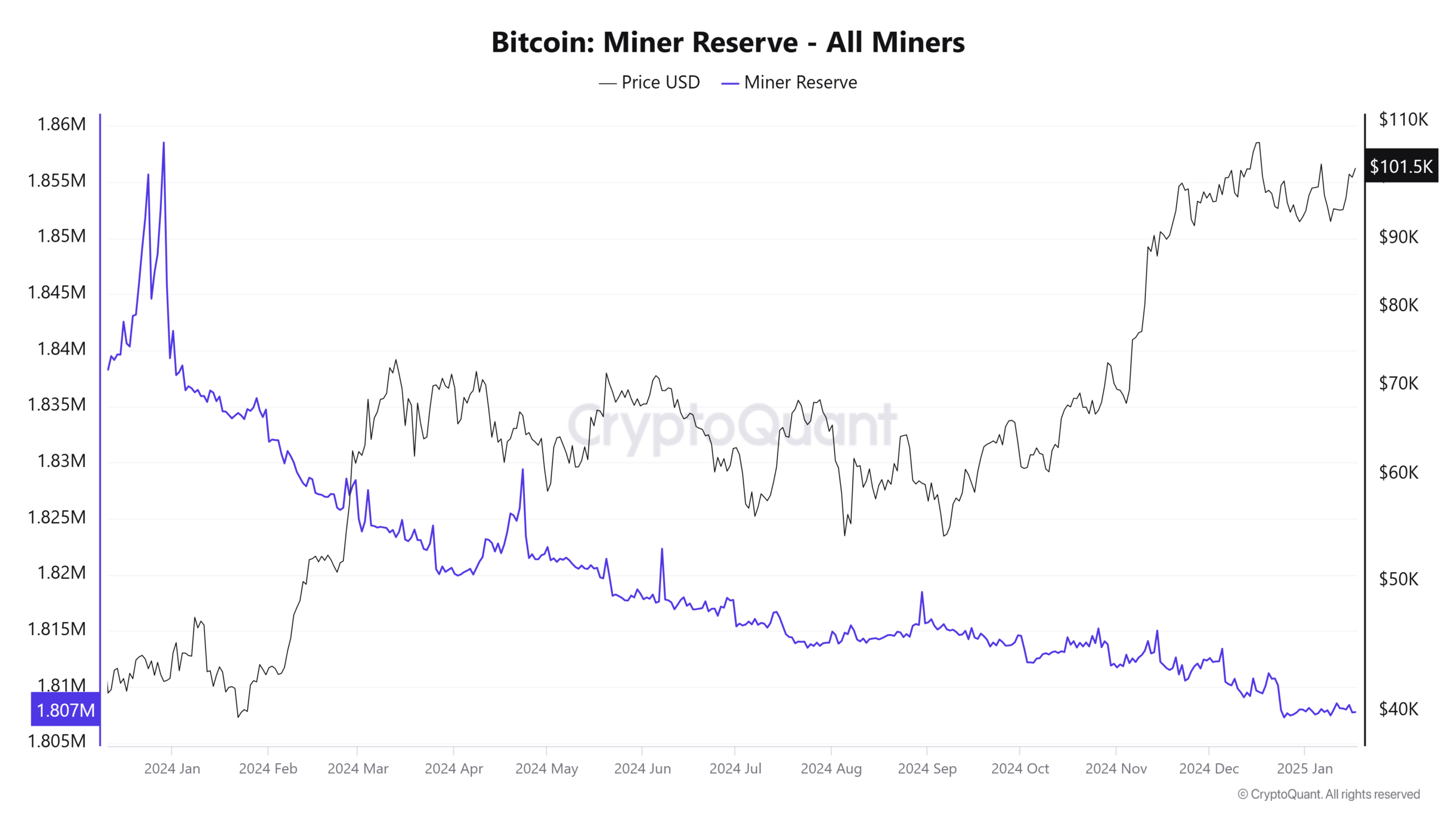

Source: Cryptoquant

At the same time, the decline in miner reserves exposed supply-side constraints as miners increasingly liquidate their assets, likely in anticipation of higher prices. This downward trend in reserves corresponds to a decrease in selling pressure, creating a favorable environment for upward price momentum.

Read Bitcoin’s [BTC] Price forecast 2025-26

Comparison with previous cycles

Bitcoin’s historic bull runs in 2017 and 2021 revealed a pattern of exponential growth driven by adoption cycles and macroeconomic factors. The 2017 peak of $20,000 marked Bitcoin’s rise as a speculative asset, fueled by retail euphoria. In contrast, the 2021 peak of $69,000 was marked by institutional adoption, widespread adoption of crypto as an asset class, and narratives around inflation hedging.

CryptoQuant’s projections for 2025 suggest that the next phase of growth could surpass previous cycles in scale and maturity. The top target of $249,000 is in line with Bitcoin’s long-term logarithmic growth curve and reflects increasing scarcity, amplified by halvings and limited miner reserves.

Unlike previous cycles, the 2025 trajectory depends on structural shifts – such as expected pro-crypto regulations and capital inflows through ETFs – that could drive continued demand.