Este Artículo También Está Disponible and Español.

In this week’s market correction, Bitcoin (BTC), the largest cryptocurrency through market capitalization, is re -testing some of his most important support levels. As the price starts to recover from the recent lows, some analysts can consider that the weekend can bring a bullish relief for investors.

Related lecture

Bitcoin recovers from $ 78,000 decrease

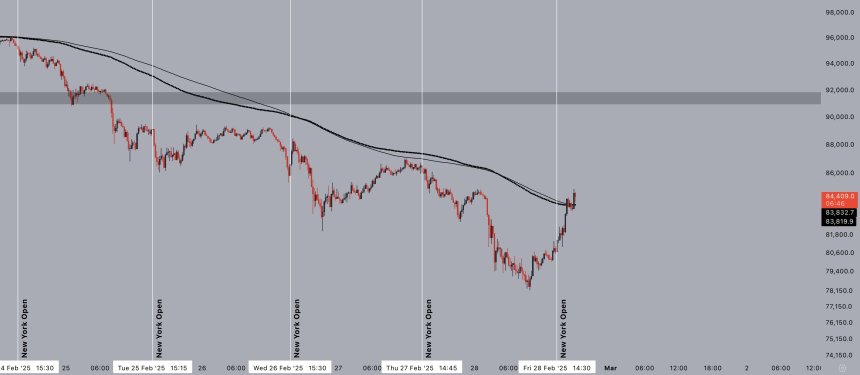

Bitcoin has experienced a considerable sales pressure last week, so that doubts about a potential market top are fueled. The Crypto flagship has fallen by 21% compared to last week’s high of $ 99,000, which for the first time since November immersed below the level of $ 80,000.

The correction also saw BTC fall nearly 30% compared to his January of all time (ATH) and trade under the election prize class after the US. A week after market bleeding started, Bitcoin hit a new three -month low, with the support of $ 78,000 being tested again on Friday morning.

Several market guards noted that the most recent decrease in BTC reached and the CME gorge of November 2024 filled between $ 78,000 and $ 80,700. Capital raises that Bitcoin is that experienced A “strong rebound against the partially filled CME gorge and does this at the above-average volume of the seller.”

The flagship Crypto has risen around 7% of today’s low points, and floats in the last hours between the support zone of $ 83,000 and $ 84,000.

For the analyst, the CME GAP support and the sales side of the sales side will be two important indicators to pay attention to the weekend, because constant, uninterrupted BTC sales pressure is not untenable and the depletation of the seller will accelerate possible in the coming days.

Bitcoin finally starts to experience the above -average seller volume. There is still room for more seller volume to come in, but the opportunities for the seller are increasing. And exhaustion of the seller tends to the price outlets in advance.

Will there be a weekend debound?

Crypto analyst Jelle marked That Bitcoin did “three discs in deeply sold -off territory” this week and restores the local lows before the drop of today, which suggests that a “weekend lighting seems likely.”

The analyst stated that reclaiming the support of $ 84,500 is the key to the recovery of BTC, because “the last two retests ultimately resulted in new lows.”

Nevertheless, he noted that today’s rebound seems different because of BTC that touches the 200-omm cluster for the first time this week “and breaks above it. For Jelle this can indicate an “interesting weekend”, with the new CME gorge open for $ 93,000.

Stretching capital noted That Bitcoin “has filled every CME opening that has formed since mid-March 2024” and that only the newly formed CME gorge between $ 92,800 and $ 94,000 after this withdrawal remains open. If BTC continues this pattern, the price can see a rebound to quickly fill the new gap.

Related lecture

The analyst has sketched Two potential scenarios for the current ‘narrow deviation’ of BTC. According to the post, the price of Bitcoin could visit $ 93,500 by the end of the week if the deviation “to end up like a downward wick.”

In the meantime, if the deviation is “to end as the mailing abnormality with weekly candle closes under the re-accumulation range”, the price of BTC could revise the level of $ 93,500 in the next two to three weeks as “part of a post-breakdown relief rally.”

Bitcoin is currently acting at $ 85,120, an increase of 0.5% in daily age.

Featured image of unsplash.com, graph of TradingView.com