- Bitcoin’s decreasing volatility led to increased interest from traders.

- The decline in mining revenue raised concerns about selling pressure, while long-term holder supply increased.

Bitcoin [BTC] has not been averse to the recent turbulence in the cryptocurrency market. The once unstoppable king coin faced a dip below $30,000, fueling speculation and an overriding bearish sentiment.

Read Bitcoin [BTC] Price forecast 2023-2024

Despite institutional players’ interest in Bitcoin’s future, skepticism continued to cloud the overall outlook.

Silence before the storm?

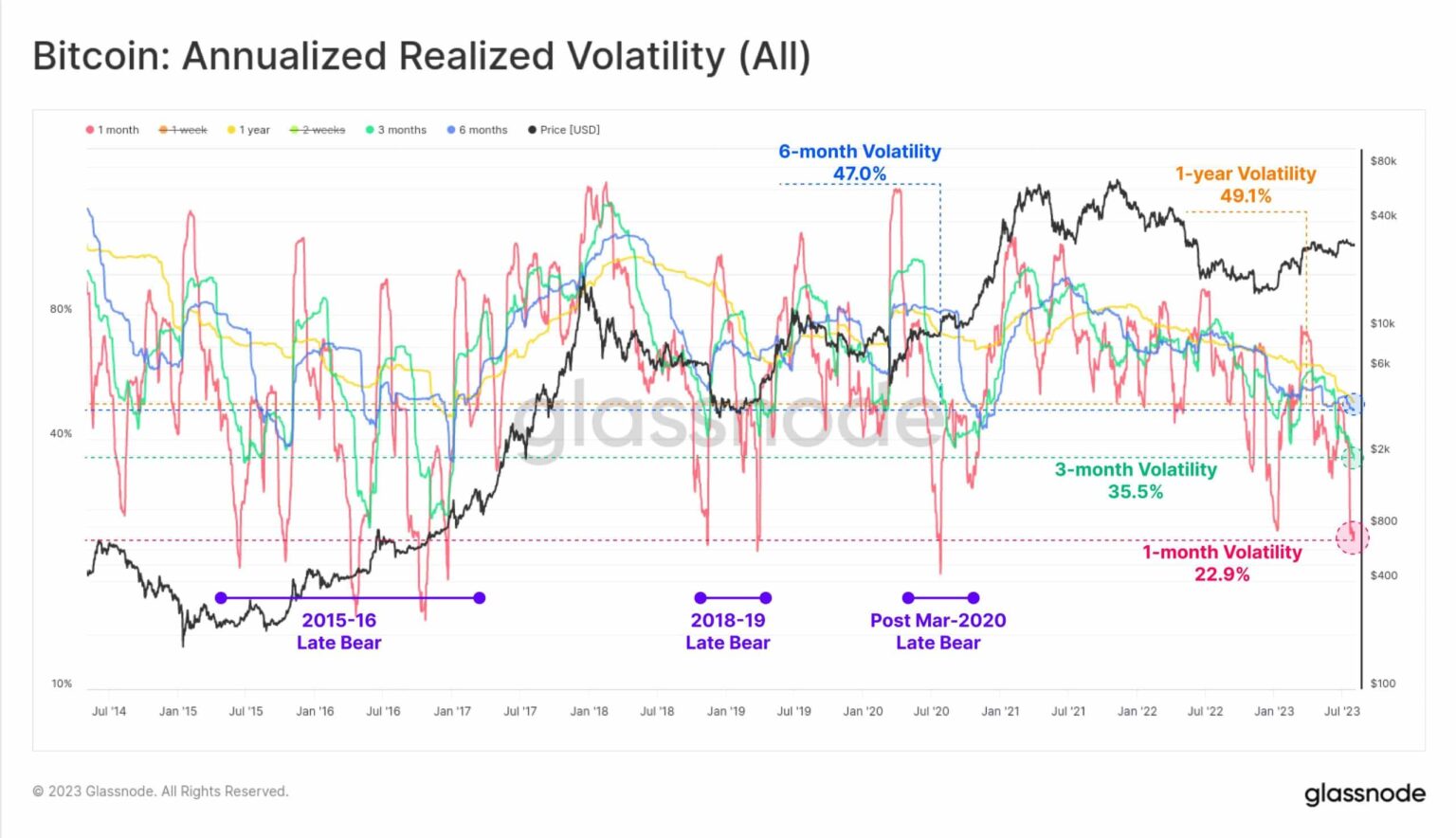

As the price of Bitcoin plummeted, a decrease in volatility was observed. The cryptocurrency, notorious for its rapid price swings, experienced a period of reduced volatility, creating ripples in the trading landscape.

This decrease in price fluctuations prompted several traders and investors to wonder if a more stable Bitcoin could spark renewed optimism.

Source: Glassnode

Adding to this story was the rising open interest in Bitcoin caused by reduced volatility. Notably, traders sought to capitalize on price movements that, while tamer, still showed profit potential.

This trend indicated a willingness among market participants to explore opportunities in a relatively stable market.

Source: Coinglass

In it for the long haul

In a parallel development, the long-term supply of Bitcoin is also on the rise. This change in behavior among long-term holders could indicate their belief in the cryptocurrency’s potential for recovery and growth.

The increasing supply of long-dated holders can help dampen selling pressure during price swings, contributing to a more stable market environment.

New all-time high for #Bitcoin Long term holder stock 🔵, now for 14.59 million $BTC (75% of the circulation).

A range of essential Long/Short-Term Holder tools are available for Advanced @glassnode members to follow HODLers vs Speculators in this dashboard 👇https://t.co/ZyvUI9zL12 pic.twitter.com/83sLGQbtT5

— _Checkɱate 🔑⚡🌋☢️🛢️ (@_Checkmatey_) August 7, 2023

Despite this, the price of BTC did not see any improvement. The price of the cryptocurrency was trading at $29,062 at the time of writing, a significant drop from previous highs. In addition, Bitcoin’s rate, which measures the rate at which the asset trades, dropped.

Weighted Sentiment, a measure of public sentiment based on social media, also increased. The rise in positive sentiment, coupled with a drop in negative comments, could indicate that despite the recent setback, optimism is slowly seeping back into the Bitcoin community.

Examining the market value to realized value (MVRV) ratio of Bitcoin revealed a negative trend at the time of writing. This ratio, which compares market value to Bitcoin’s average realized value, suggested that the currency may be slightly undervalued at the time of writing.

Is your wallet green? Check out the Bitcoin Profit Calculator

Source: Sentiment

Finally, a closer look at Bitcoin miners offers additional insights. Miner revenues are declining, indicating a possible increased selling pressure from miners.

This can be attributed to several factors, including the drop in price and the need for miners to cover operational costs.

Source: Blockchain.com