- Bitcoin’s trend score drops below zero.

- BTC has held weakly at the $66,000 price range.

Recent data suggested that certain Bitcoin [BTC] whales have reduced their holdings recently.

While this development might initially imply negative feelings, other figures indicated that this is not necessarily a cause for alarm, at least not now.

Bitcoin whales divide assets

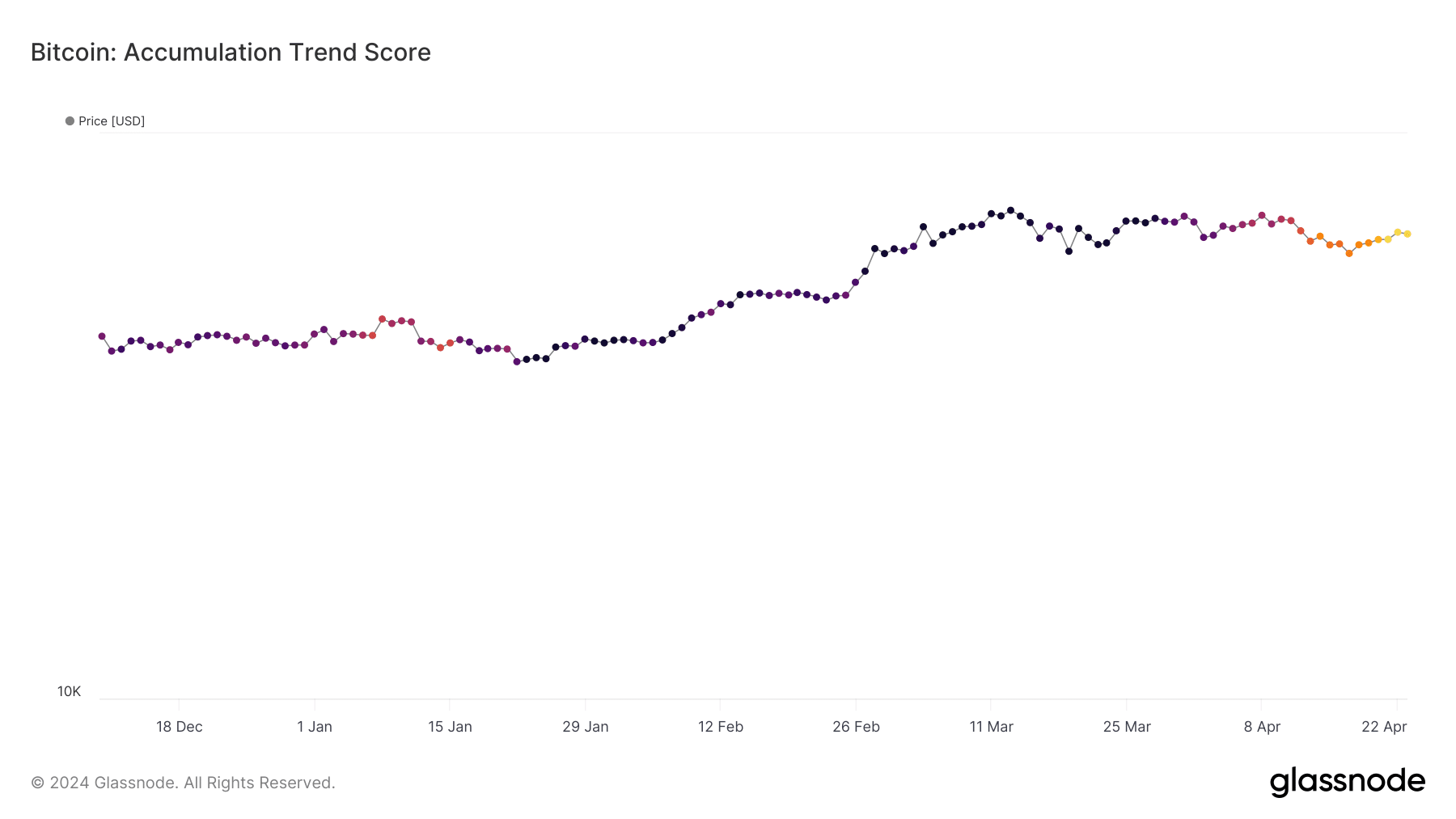

AMBCrypto’s analysis of the Bitcoin Accumulation Trend Score on Glass junction showed a significant shift, with the score hovering around zero.

At the time of writing, the Trend Score stood at approximately 0.026, which is one of the lowest points in recent times.

Source: Glassnode

The Bitcoin Accumulation Trend Score serves as an indicator of the relative size of entities actively accumulating coins on-chain, as measured by their BTC holdings.

The scale of this score reflects both the entity’s balance sheet size and the number of new coins bought or sold in the past month.

A score closer to 1 suggests that larger entities or a significant portion of the network are accumulating. In contrast, a value closer to 0 indicates distribution or a lack of accumulation.

Smaller Bitcoin Addresses Clearing Sale

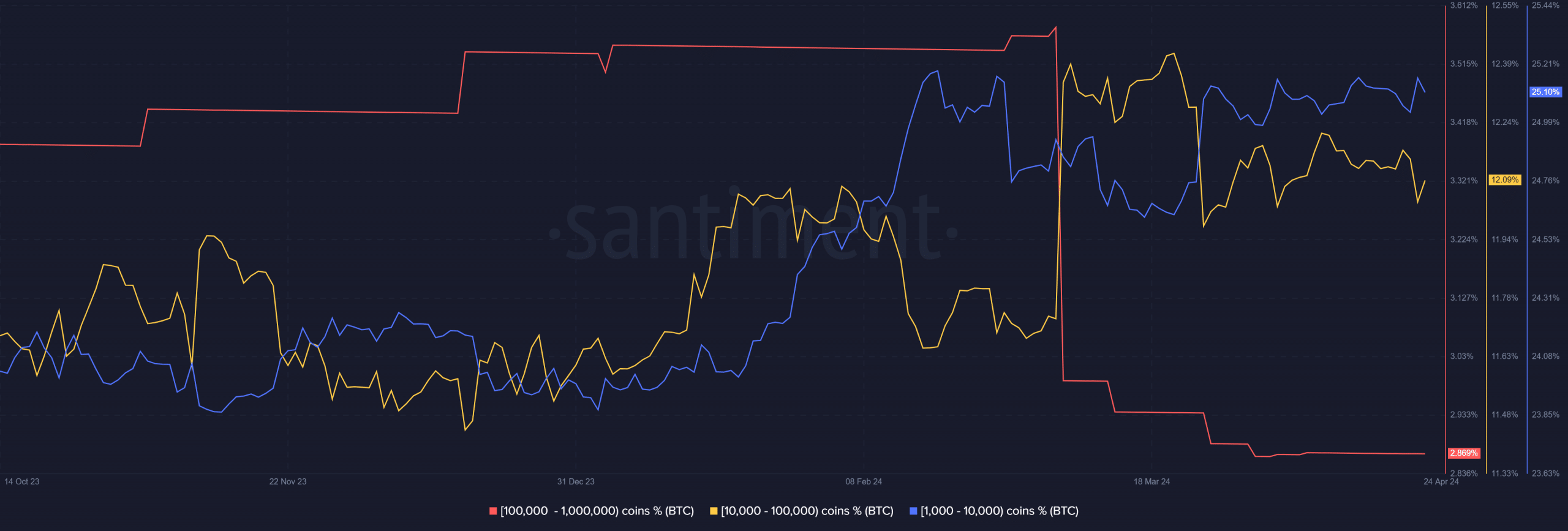

AMBCrypto’s supply distribution metric analysis on Santiment revealed a notable decline in Bitcoin whale ownership. Ownership at these addresses fell from almost 3% to approximately 2.8%.

However, AMBCrypto noted that while top whale addresses saw a decline, other whale addresses piled up.

Source: Santiment

Closer examination of the graph illustrated that while these addresses also experienced some declines, they recovered.

Contrary to the stagnant trend of the major whale addresses, these other addresses have shown activity.

This suggests that not all whale addresses divide their assets; instead, some are actively accumulating.

Bitcoin holders continue to grow

Research into the total number of holders on Santiment showed continued growth. At the time of writing, the total number of Bitcoin holders stood at 53.68 million.

This figure suggested an addition of approximately 1 million holders between April 1 and time of publication.

This increase in the number of holders implied that BTC accumulation had not seen a significant decline, despite the spread observed from whale addresses.

Read Bitcoin’s [BTC] Price forecast 2024-25

BTC trends are weak at the neutral line

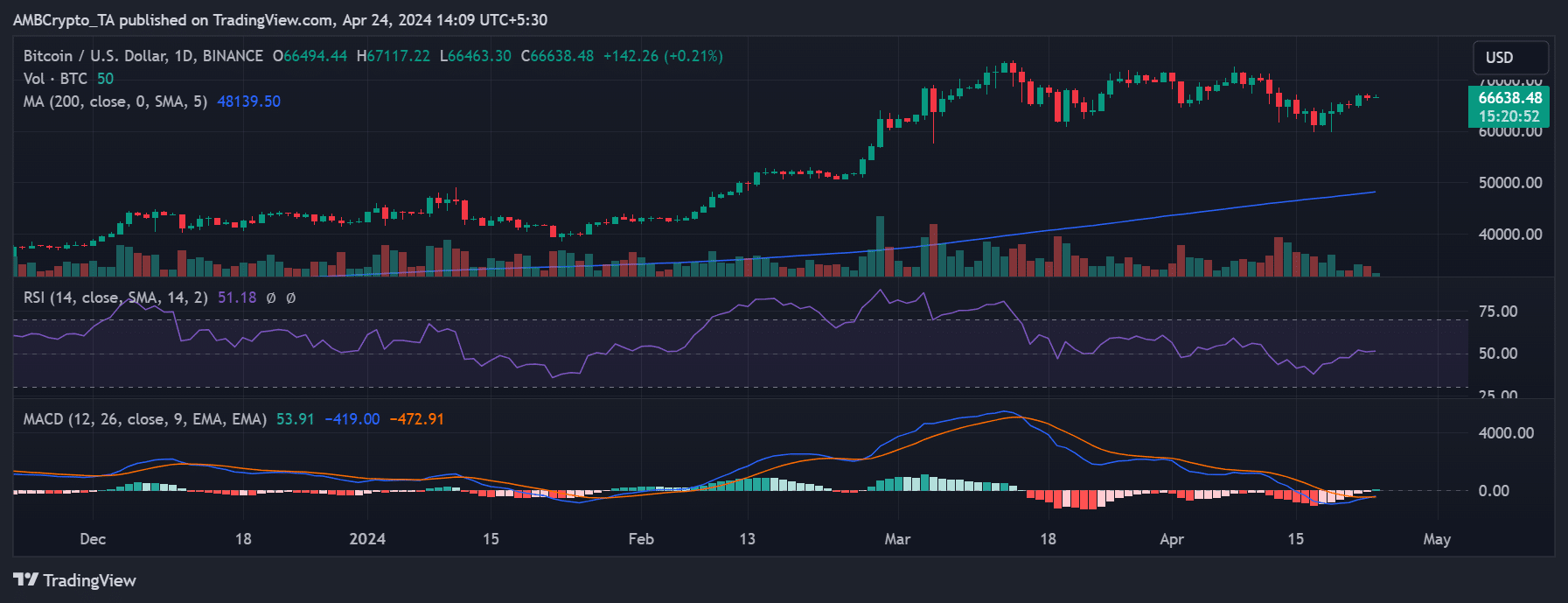

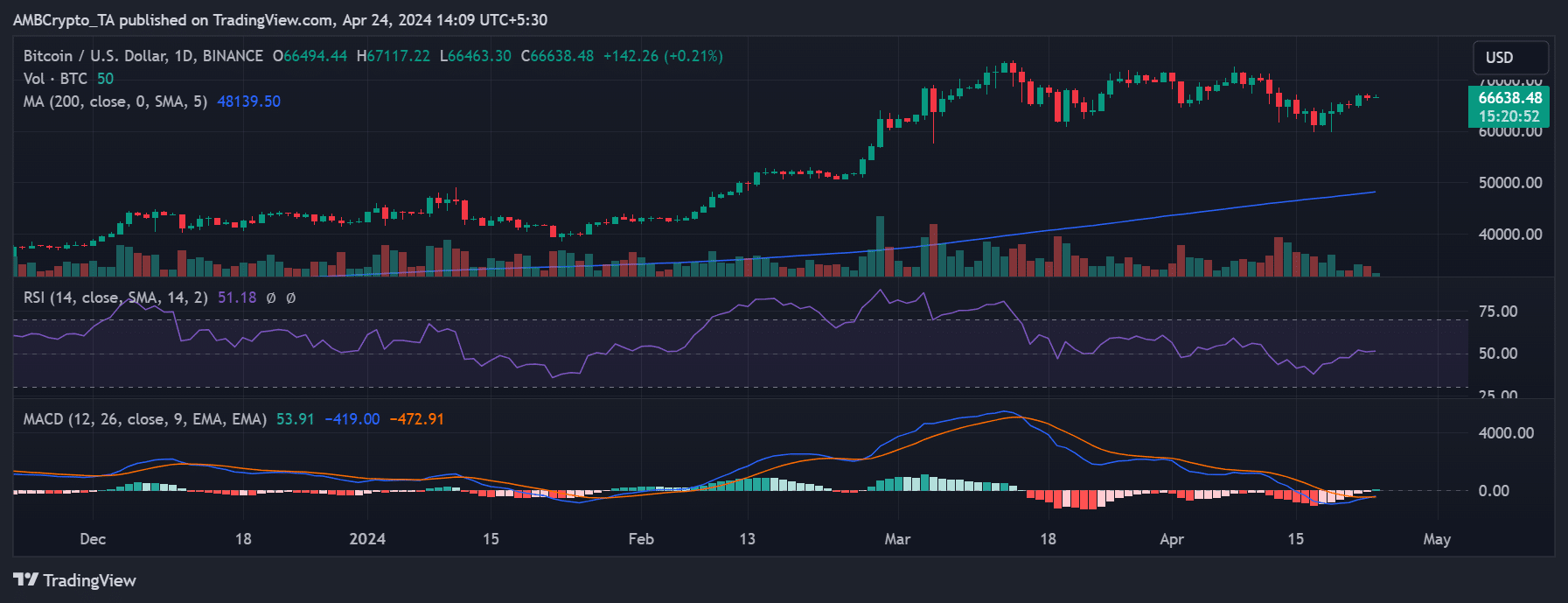

At the time of writing, Bitcoin was aiming to maintain the $66,000 price level. According to AMBCrypto’s analysis of the daily timeframe chart, it was trading around $66,600, reflecting an increase of less than 1%.

The Relative Strength Index (RSI) also indicated a weak bull trend. AMBCrypto’s look at the RSI revealed a slight increase above the neutral line as the price rose about 2.7% on April 22.

Source: TradingView