Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Charles Hoskinson, who leads Ethereum and now leads the Cardano-Blockchain, has projected that Bitcoin could reach a price of $ 250,000 by the end of this year or next year. His prediction, made during a CNBC interview, comes to the broader financial markets despite the recent slump, including Crypto.

Why Bitcoin will reach $ 250,000 within less than 2 years

Hoskinson emphasized That rising geopolitical tensions and evolving trading dynamics create supporting conditions for decentralized networks such as Bitcoin. Speaking of a world that seems to be “from a rules-based international order to a conflict with great powers,” he suggested that this shift would emphasize the limitations of traditional banking and trade systems, which would send more transactions to cryptocurrencies.

“If Russia wants to invade Ukraine, Ukraine invades. If China Taiwan wants to invade, it will do that. So treaties don’t really work so well, and the global companies don’t really work there that well. So your only option for globalization is crypto,” Hoskinson CNBC said.

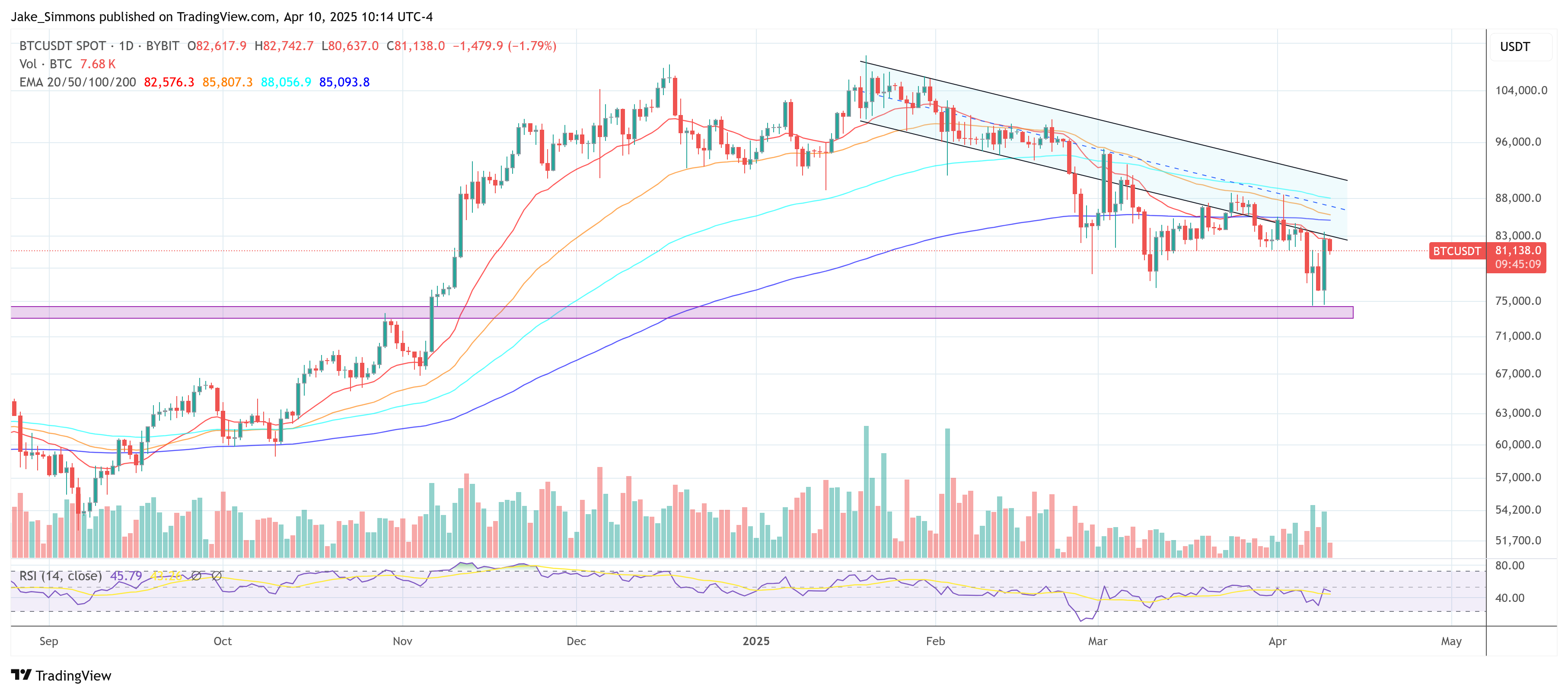

He also noted that the considerable sale in crypto and other risk assets, a trend that has partly emerged from the mutual rates of US President Donald Trump over countries worldwide. Bitcoin fell below $ 77,000 last week before he briefly surpassed $ 83,000 on Wednesday and remains considerably lower than the record high above $ 100,000 in January. Yet Hoskinson’s confidence is: “No, I think Bitcoin will be more than $ 250,000 by the end of this year or next year.”

Under the factors that could cause such a dramatic price dump, Hoskinson pointed to the Federal Reserve that may lower interest rates in response to market pressure. “Then you will have a lot of money quickly, cheap money, and then it will flow in crypto,” he said, explained how extra liquidity can lead to renewed interest in digital assets. The potential for large technology companies such as Microsoft and Apple to enter the crypto space also comes in his bullish prospects.

Another part of Hoskinson’s optimism lies in the prospect of new legislation. He has selected the expected Stablecoin legislation, as well as the market structure of the digital assets and the investor protection law, both of which are currently making road through the congress. He believes that these regulatory movements can streamline the crypto market and pave the road for institutional acceptance.

Stablecoins, who are linked to Fiat currency and supported by Real-World assets, can be particularly attractive for large technology companies that want to facilitate fast, cost-effective global transactions. “Especially the Stablecoin Bill can lead to the ‘Magnificent 7’ companies taking over the assets,” he added, referring to Apple, Microsoft, Amazon and other mega-cap-technical giants.

Hoskinson further argued that as soon as these regulatory frameworks become clearer, the market will probably hold “for probably the next three to five months”, before “a huge wave of speculative interest” comes back in the space around the late summer or autumn. According to him, that renewed enthusiasm, combined with a more fixed geopolitric landscape and a stable regulatory environment, could push the price of Bitcoin to $ 250,000.

At the time of the press, BTC traded at $ 81.138.

Featured image of YouTube, graph of TradingView.com