Bitcoin’s price has risen by about 2% in the past 24 hours, rising above $70,000, a psychological level. As bulls prepare for more gains, Willy Woo, a supply chain analyst, says believes the coin could rise even higher after breaking the all-important resistance level at $72,000.

Will Bitcoin Rise to $75,000 Due to a Short Squeeze?

Even after the May 20 peak took the coin above $66,000 after days of lower lows, pushing Bitcoin to $56,500, the bulls didn’t follow suit. As things stand now, Bitcoin is within a wider range, reaching a high of $72,000, the first local support, and $73,800, the all-time high.

Related reading

However, a break would be significant given the importance of $72,000, a level that has only been retested but not broken for several weeks. One explanation for the potential price increase is that a breakout, ideally with rising volume, could signal the start of a new surge, causing demand to pick up.

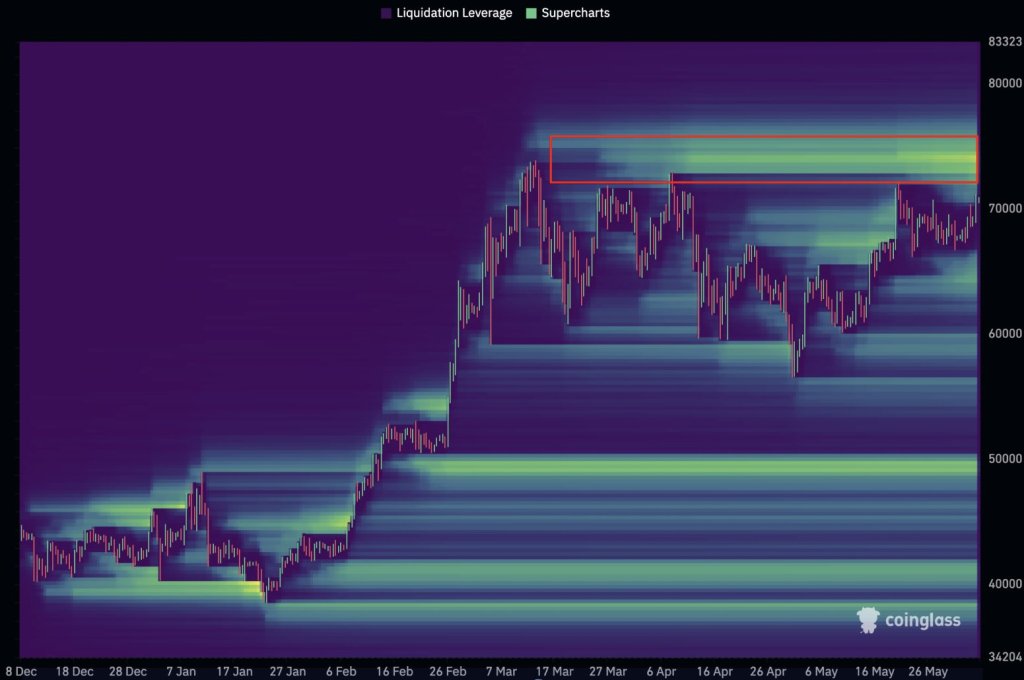

For Woo, closing at $72,000 could send prices rising quickly, even breaking $75,000 due to a short squeeze. Once the bulls push above this interest level and close, a wave of liquidations would occur, forcing many short positions to close, sending prices higher.

Based on Woo’s analysis, short positions worth roughly $1.5 billion will be liquidated “up to $75,000.” If this happens, it is very likely that Bitcoin will register new all-time highs approximately seven weeks after the halving.

Inflows to watch BTC ETFs rise, demand will only continue to rise

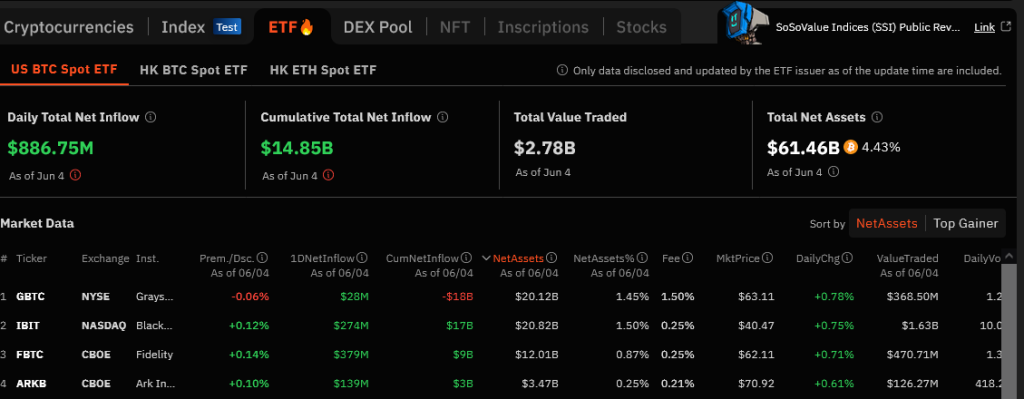

Underlying this bullish sentiment is the impressive surge in institutional inflows into Bitcoin Exchange Traded Funds (ETFs) on June 4. According to sosovalue factsBitcoin ETF issuers spotted $886.6 million worth of BTC yesterday.

Fidelity bought $378.7 million worth of BTC, while BlackRock, behind the largest spot BTC ETF, bought $274.4 million worth of the coin. Bitwise also made substantial demand, adding $61 million in BTC.

Interestingly, Grayscale also saw inflows, adding $28.2 million worth of BTC on behalf of its clients. This inflow was the second highest daily inflow volume since the launch of spot Bitcoin ETFs in January 2024.

Related reading

With this wave of institutional demand, Bitcoin is above $71,500. Most importantly, prices remain above $70,000, confirming the bull peak from the mid-BB on June 3.

The demand for these complex derivatives will only increase. Yesterday, the Thailand Securities and Exchange Commission (SEC) approved the country’s first Bitcoin ETF. The product will only be accessible to wealthy and institutional investors. The green light comes after a similar product went live in Australia.

Feature image of DALLE, chart from TradingView