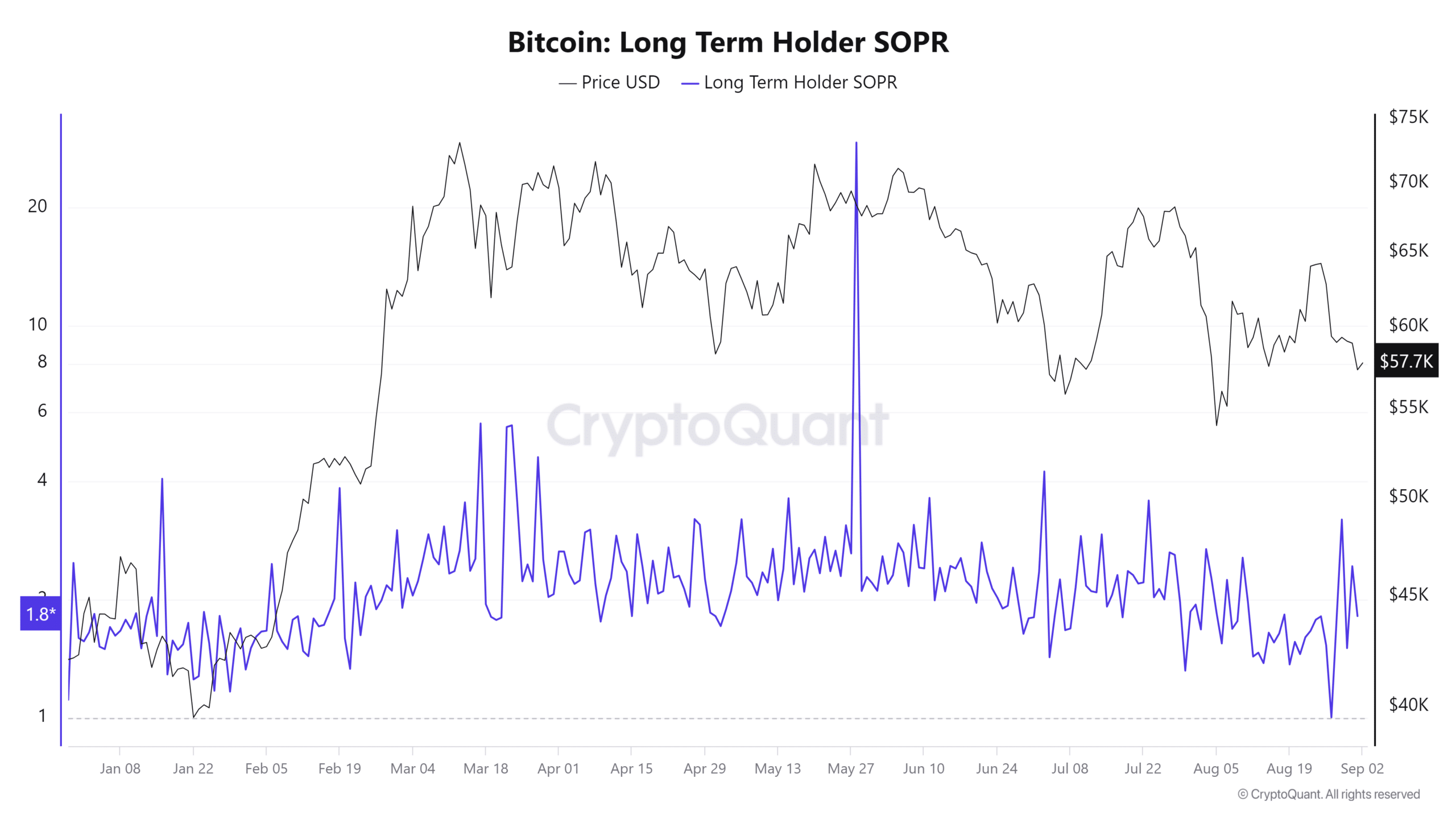

- There have been significant fluctuations in the long-term profits of Bitcoin holders.

- BTC has remained at the $57,000 price level.

Long-term holders of Bitcoin [BTC] are currently in a challenging position with their holdings. However, this trend could provide a significant accumulation opportunity for other investors.

Bitcoin SOPR Hit Lows

AMBCrypto’s analysis of the Long-Term Holder (LTH) Spend Output Profit Ratio (SOPR) at CryptoQuant revealed that Bitcoin was worth approximately $57.7K at the time of writing. The LTH SOPR also showed relatively low values.

The low LTH SOPR is significant because it indicates that these holders are not realizing substantial profits from their sales.

Instead, they might liquidate their positions due to concerns about future price declines or in response to market uncertainty.

If this trend continues and more long-term holders decide to sell, it could contribute to further downward pressure on Bitcoin’s price.

Source: CryptoQuant

The SOPR (Spent Output Profit Ratio) is essential for understanding the profitability of Bitcoin sales. The LTH SOPR specifically targets coins that are held for an extended period of time, typically more than 155 days.

A SOPR value above one indicates that long-term holders are selling at a profit. In contrast, a value below one indicates that you are selling at a loss.

The low SOPR value for long-term holders highlights that these participants are not enjoying significant gains and may be selling due to concerns about the market’s near-term prospects.

This could be a bearish signal, indicating that these holders are now uncertain about the immediate price direction.

What this means for Bitcoin

The low LTH SOPR indicates that Bitcoin holders will not realize significant gains in the long term and may reduce their positions.

If this trend continues, LTH SOPR hovering around or below 1 could lead to continued downward pressure on Bitcoin’s price. This could herald a period of further declines as the market digests these sales.

However, such a scenario also presents a potential accumulation opportunity for those looking to enter the market at lower prices.

Historically, periods of low SOPR have sometimes been followed by market recoveries. Investors are taking advantage of the reduced prices to accumulate more Bitcoin.

A recent example of this type of accumulation can be seen in the actions of a whale address.

Data from Spot on chain shows that this whale bought 1,000 BTC, worth about $57 million when Bitcoin’s price bottomed out.

Also, the same whale reportedly deposited 7,790 BTC, worth $467 million, when the price fell by around 14% a few months ago.

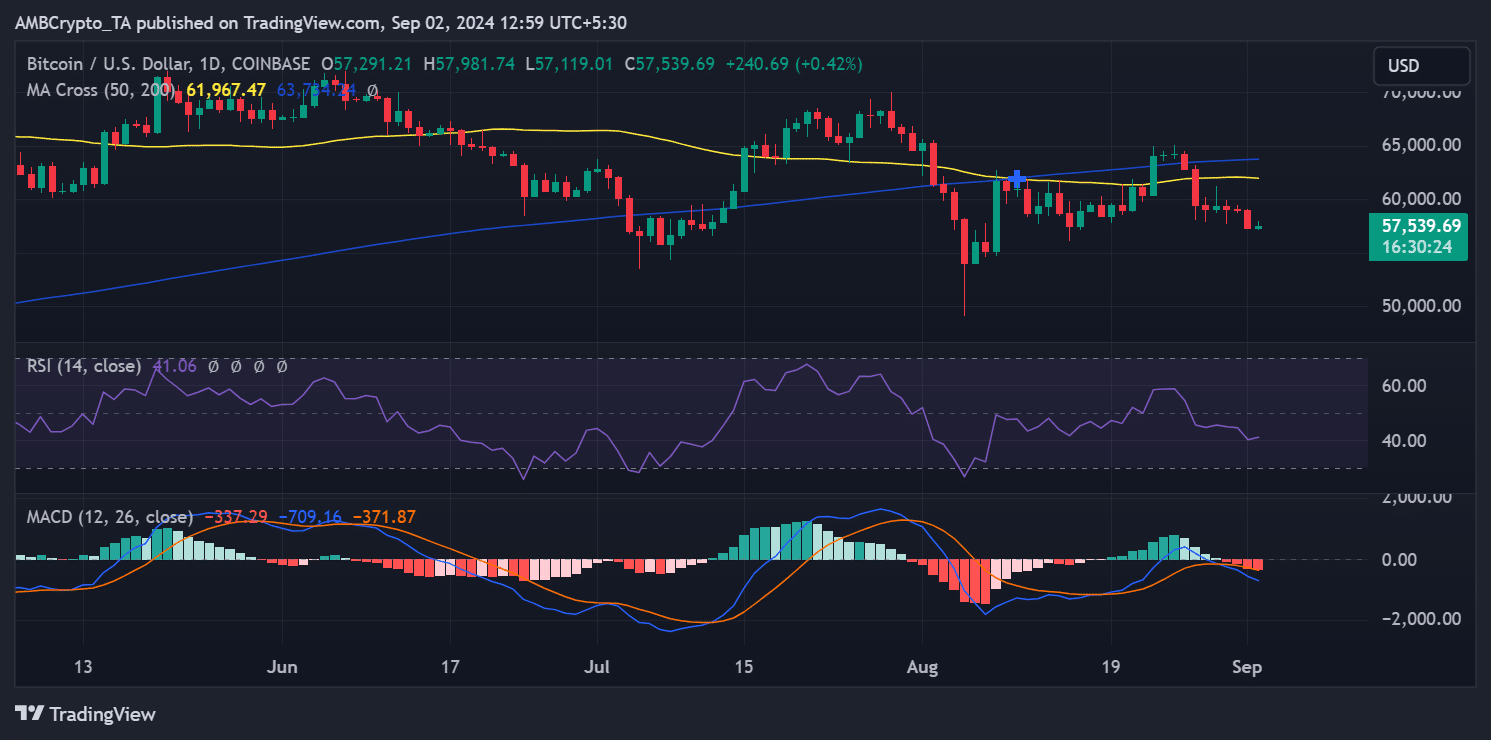

The current state of BTC

AMBCrypto’s look at Bitcoin’s price trend indicated that the king coin saw a decline of almost 3% during the last trading session.

Read Bitcoin’s [BTC] Price forecast 2024-25

The price fell from a high of around $59,000 during the session to around $57,299. At the time of writing, Bitcoin was trading around $57,500, reflecting a modest increase of less than 1%.

Source: TradingView

The chart analysis, especially the position of the moving averages, confirmed that Bitcoin was in a bearish trend.