- The significant drop in activity on the Bitcoin network could put additional downward pressure on the cryptocurrency’s price.

- A key resistance level, where notable sell orders are concentrated, could further challenge Bitcoin’s ability to maintain its current value.

Bitcoin [BTC] has been trading within a tight range of $93,000 to $94,000 in recent days, reflecting a lack of decisive market movement. This stagnation could indicate the resilience of the market, but also points to uncertainty about the next price movement.

In the last 24 hours, the price of Bitcoin has seen a small decline of 0.75%. However, trading volume rose 68.66% to $29.41 billion, suggesting selling pressure could increase soon.

AMBCrypto analyzed broader market sentiment to assess whether this selling activity could increase.

Drop in Network Activity: Will BTC Fall?

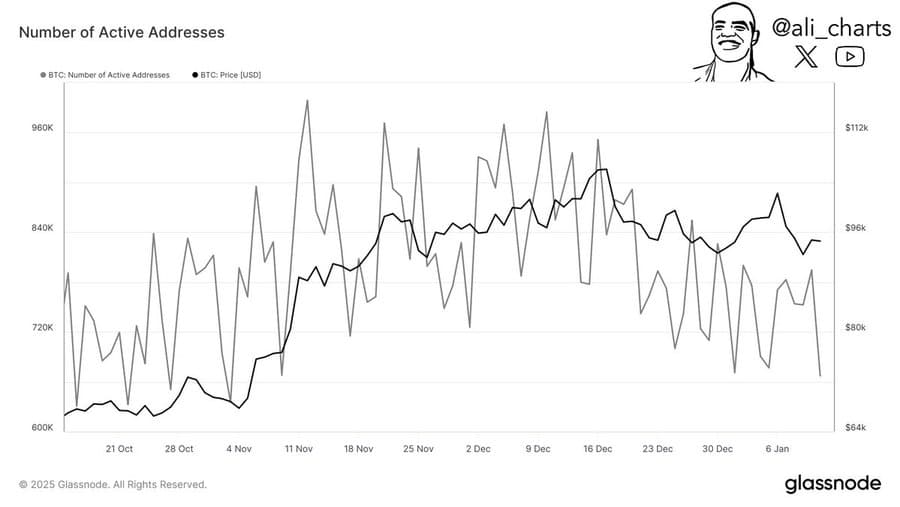

Bitcoin network activity has declined significantly over the past month, with the number of active addresses steadily decreasing.

Currently, the number of active addresses has fallen to 667,100 – the lowest level since November 2024.

Source: Glassnode

A decrease in the number of active addresses indicates decreased interaction with the Bitcoin network, possibly indicating lower transaction activity. This lack of engagement could indicate declining interest, which could contribute to a price drop.

However, it also suggests that the remaining active addresses could control a significant portion of the BTC supply. Increased purchasing activity at these addresses could potentially cause a price increase.

Obstacle to future rally

If active addresses increase their buying activity for BTC, the asset could move into a key supply zone as it moves higher, according to data from IntoTheBlock.

IntoTheBlock’s “In/Out of the Money Around Price” metric, which identifies supply and demand zones, shows that BTC could face selling pressure between $95,900 and $98,600.

At this level, approximately 1.46 million addresses have potential sell orders for a total of 1.29 million BTC.

Source: IntoTheBlock

If BTC successfully crosses this supply zone, it could regain the $100,000 region. However, the lack of a breakout would likely result in BTC falling below the $90,000 mark, indicating further downside risk.

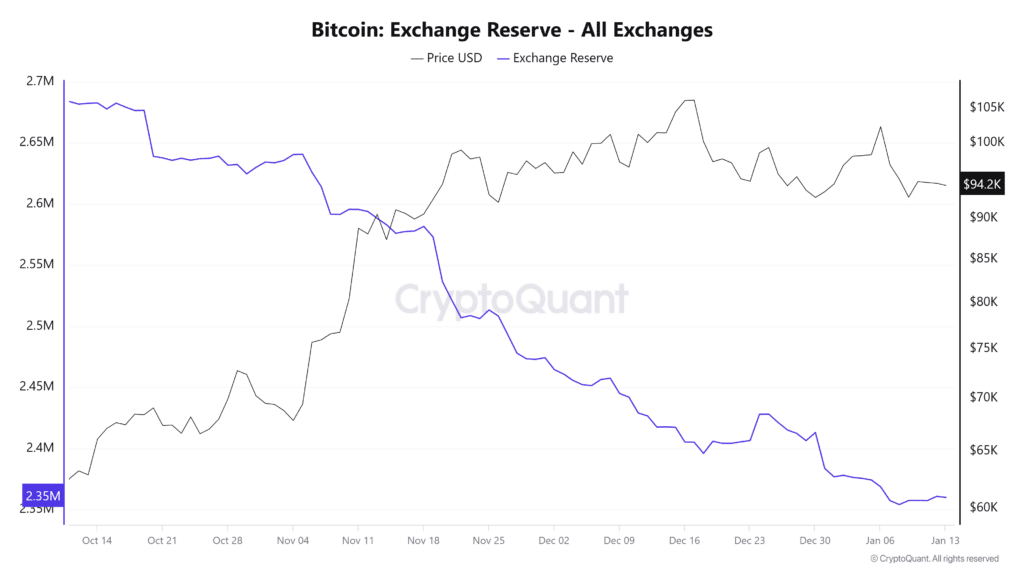

The increased supply puts the BTC rally in doubt

According to CryptoQuant, BTC exchange reserves have gradually increased. This indicates an increase in the amount of BTC available on exchanges, leading to increased supply.

– Read Bitcoin (BTC) price prediction 2025-26

Since January 8, BTC reserves on exchanges have grown from approximately 2,354,000 to 2,360,000. Typically, an increase in foreign exchange reserves is a warning sign that the asset may face additional downward pressure due to the current price level.

Source: CryptoQuant

If foreign exchange reserves continue to rise, it could hinder BTC’s ability to recover from current levels.