- Bitcoin is poised to return to $66,000 before a rebound occurs.

- Global liquidity may continue to rise until 2026.

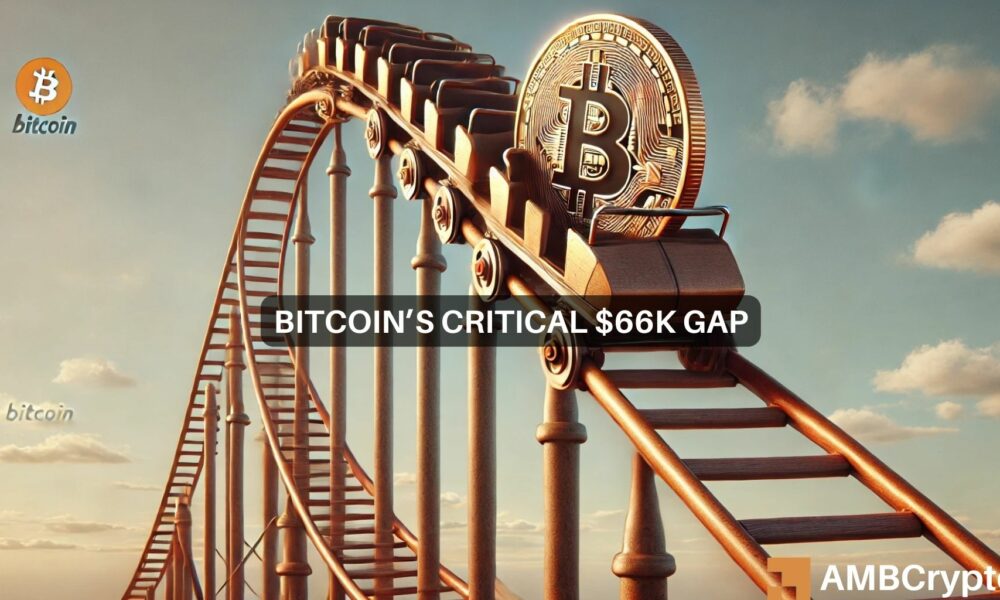

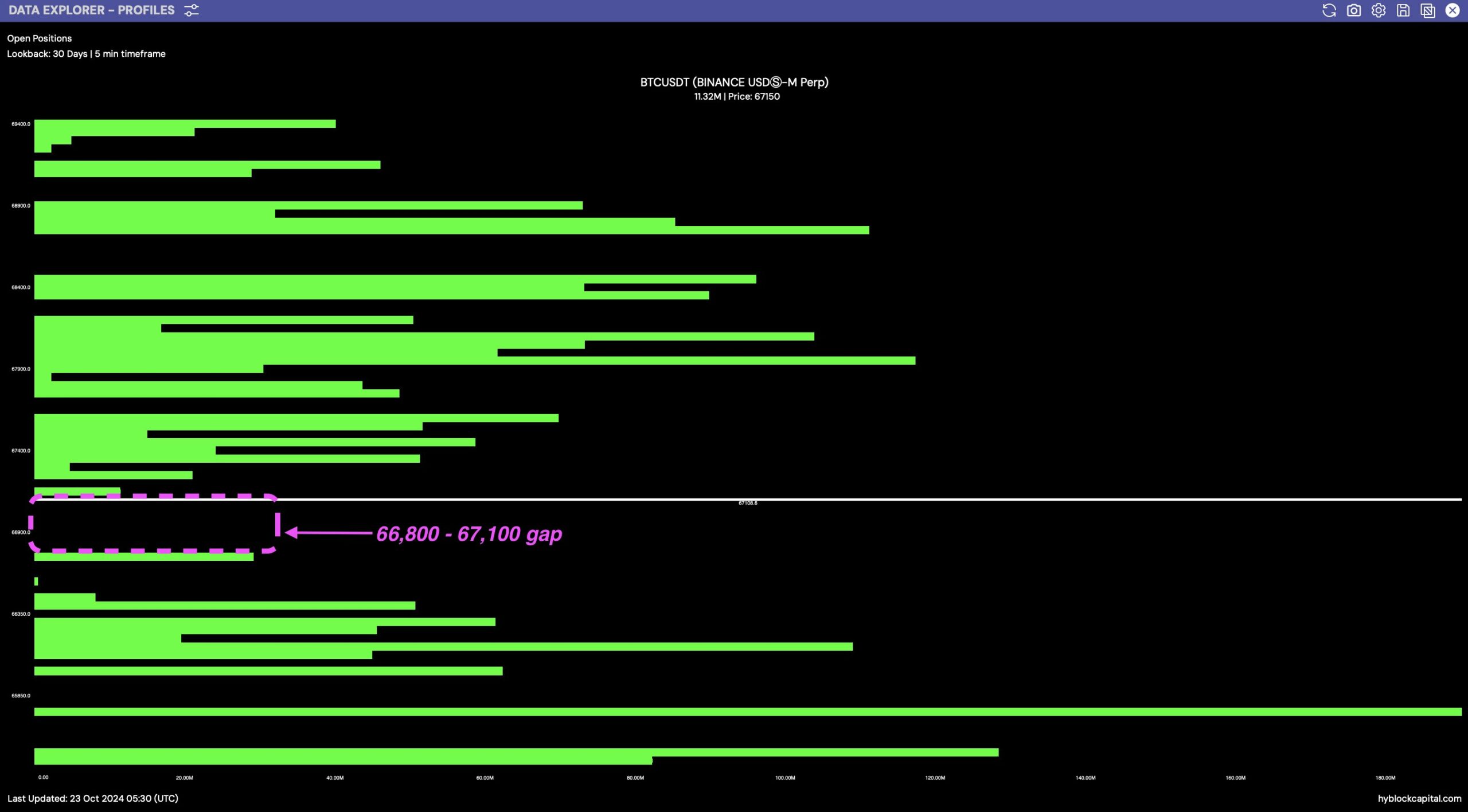

Bitcoin [BTC] was in a critical price range at the time of writing, with market observers anticipating its next move. The $66.8K to $67.1K zone on Bitcoin’s profile chart shows fewer positions, indicating a price difference.

Historically, price has tended to gravitate toward such gaps to fill them before a trend continues.

Bitcoin’s path forward depends on whether it fills this gap before heading higher or retreating further back to accumulate liquidity.

Source: Hyblock Capital

BTC is heading for a gap

BTC’s price action shows a slight correction after reaching the $70,000 level, a major milestone for the cryptocurrency.

The retracement suggests Bitcoin is gathering momentum for its next leg, but first it may need to fill the gap in the $66.8K-$67.1K range.

This zone lies below a key double bottom pattern in the 6-hour time frame of the BTC/USDT pair, reinforcing the potential for upside once the gap is filled.

The weekly chart remains bullish, with the structure broken to the upside, indicating strong market support.

Source: TradingView

Traders are keeping a close eye on this price action, with many expecting Bitcoin to linger at the $70,000-$71,000 level, which would likely lead to a move toward price discovery and a new all-time high.

Filling the gap in this price range could also act as a liquidity grab, allowing Bitcoin to gain strength before making a decisive move higher.

A successful breakout past $70,000 would mark the start of a new bullish phase, with Bitcoin potentially entering uncharted territory.

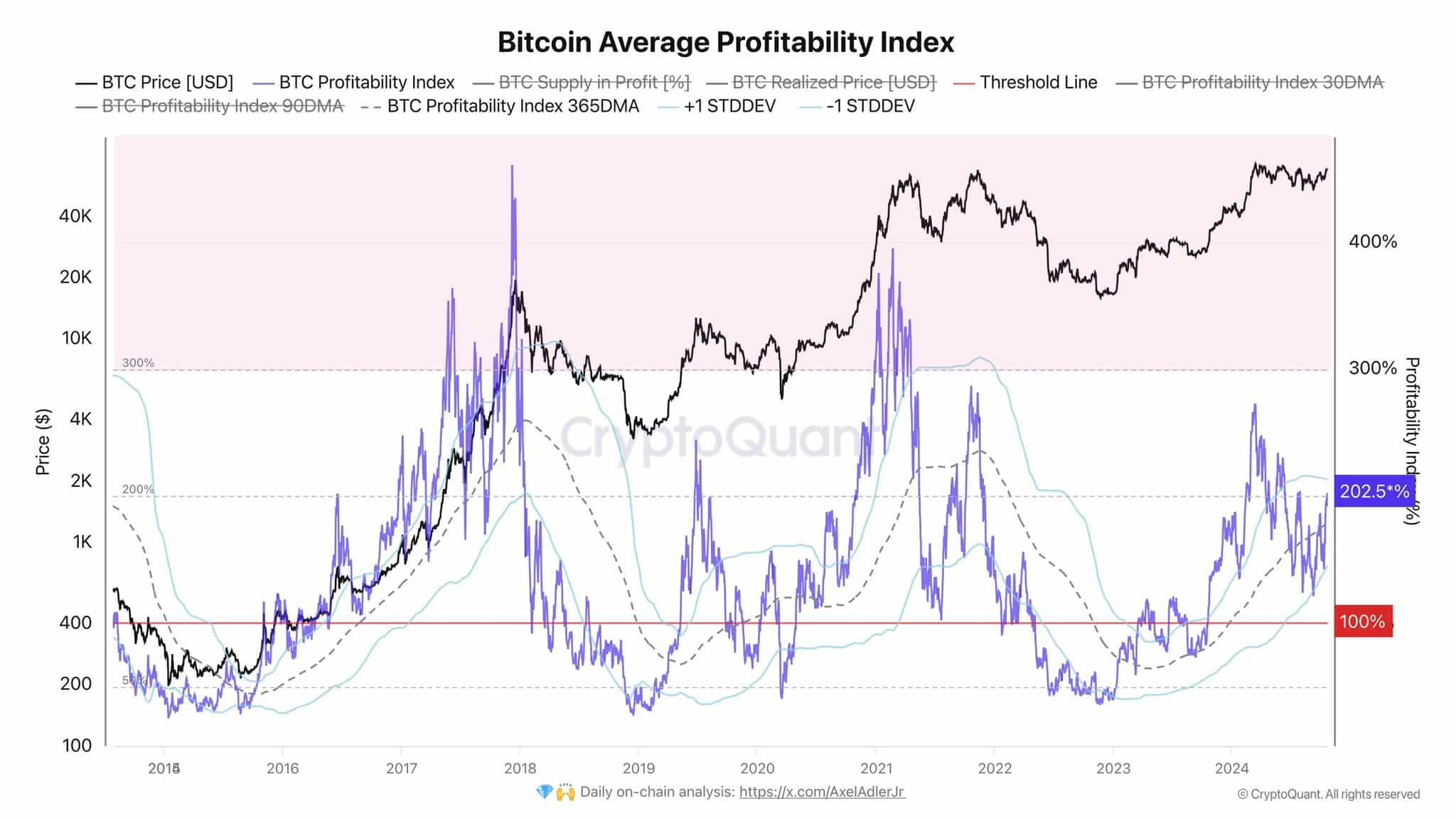

Profitability and global M2 supply

The Bitcoin Average Profitability Index further supports this outlook. The index currently stands at 202%, which means that the price is more than double the realized price.

Historically, investors have tended to take profits when this index rises above 300%, but for now this indicates that the market is not yet in big profit-taking mode.

This leaves room for BTC to continue its upward trajectory after the price gap closes, with long-term holders still optimistic about higher price levels.

Source: CryptoQuant

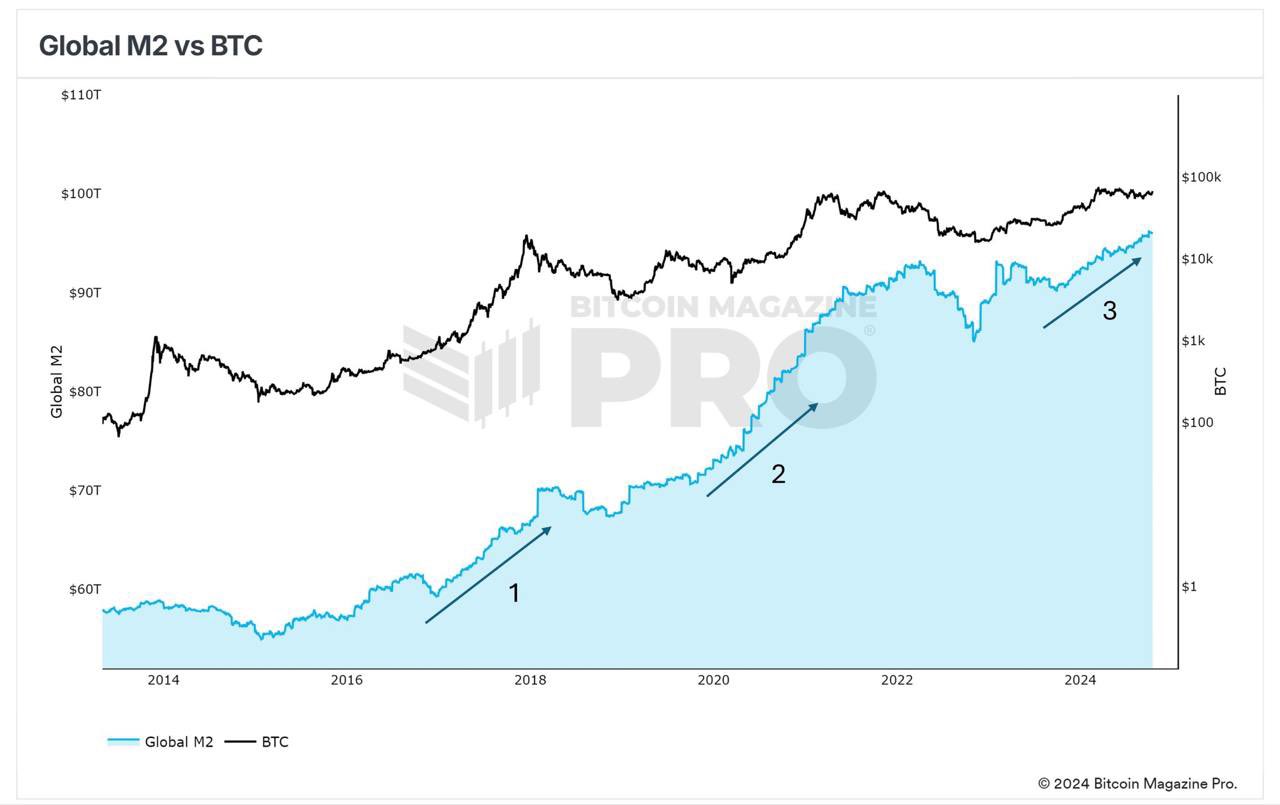

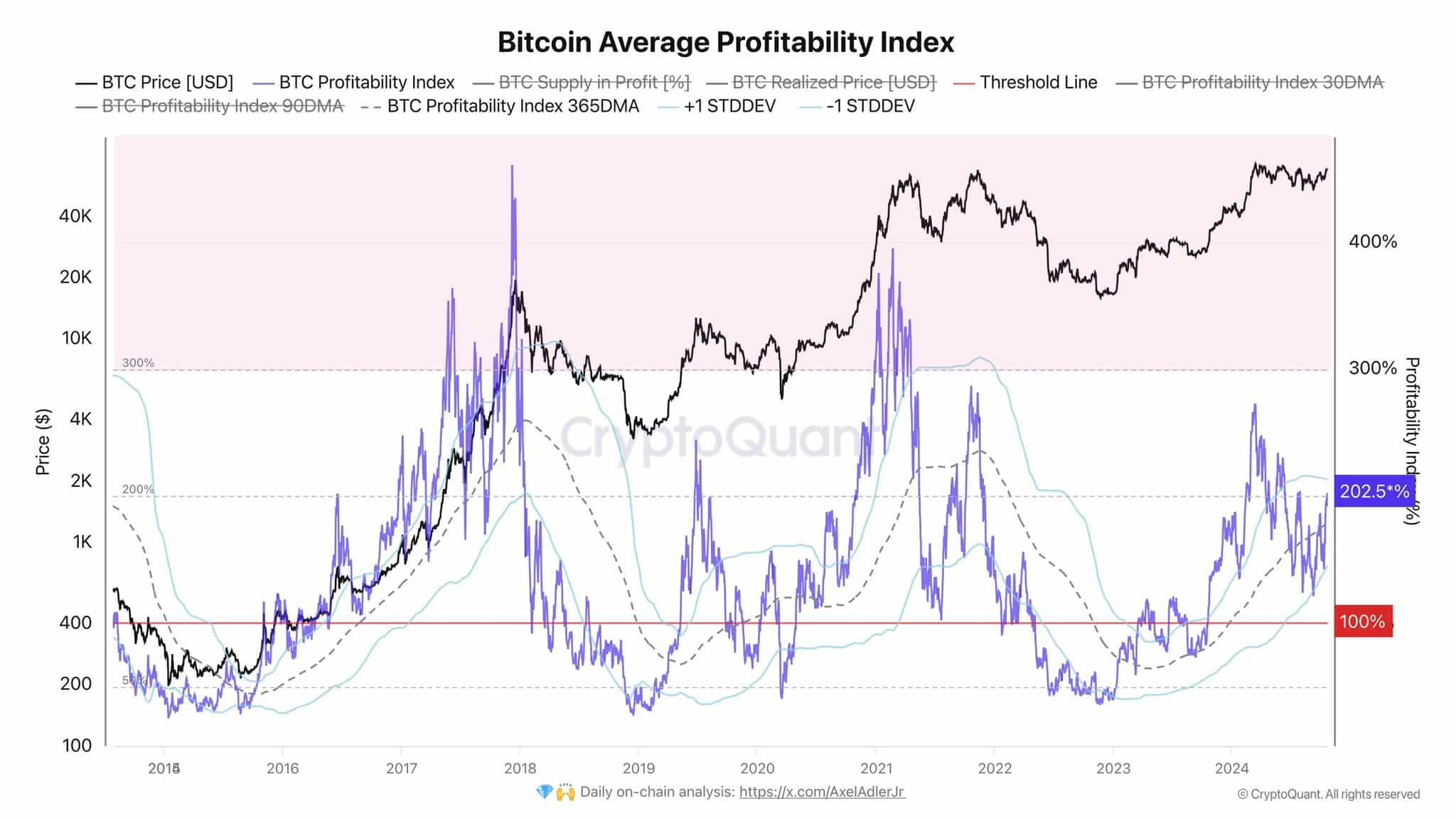

In addition to these indicators, global M2 money supply data provides insight into Bitcoin’s broader potential.

During previous bull cycles, such as 2016-2017, the expansion of M2 supply coincided with significant Bitcoin price growth.

2021 saw a similar expansion, but external factors such as the collapse of the FTX and rising interest rates dampened Bitcoin’s momentum.

Read Bitcoin’s [BTC] Price forecast 2024-25

IIf M2 supply continues to grow until mid-2026, as some analysts predict, it could add additional liquidity to the market and extend Bitcoin’s current cycle.Bitcoin’s path remains bullish, with the price gap acting as short-term support to be tapped before continuing the rally.