- Bitcoin has risen by 1.04% in the past day.

- The King Coin has to retain above $ 96k to strengthen bullish sentiments.

In the past week, Bitcoin [BTC] Started within a consolidation range, because the King Coin did not succeed in maintaining an up -like momentum and to reclaim higher resistance.

As such, it continued to float around $ 96k, making it a critical point for STHS, according to cryptoquant analyst Shayan.

Why $ 96k is the key for Bitcoin

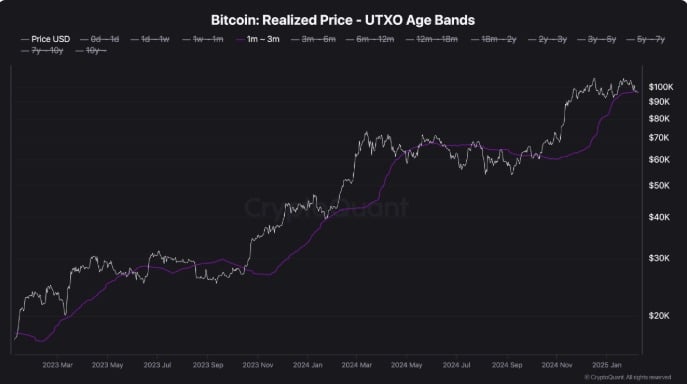

In his analysis, Shayan noted that the realized price of Bitcoin for the 1-3 months cohort was at $ 96k.

Historically, when BTC drops to this level after an upward trend, it acts as critical support, which suggests that STH’s have confidence in their positions despite the rising prices.

Source: Cryptuquant

Holding above this important level is crucial because it strengthens the bullish market sentiment, which increases the chance of an extensive upward trend.

Conversely, if Bitcoin does not do this support with this critical threshold and interrupts, this can cause a shift in sentiment. As such, the market sentiment will shift to fear, which may lead to a distribution phase.

That is why the next step around this point will play a key role in shaping Bitcoin’s short to medium -term process.

Can BTC retain above $ 96k?

With Bitcoin who remains about $ 96k, the question is whether the King Coin can hold above and can strengthen the bullish sentiment among short -term holders.

According to the analysis of Ambcrypto, although Bitcoin misses an upward boost, investors are optimistic and believe that there is still a leg up.

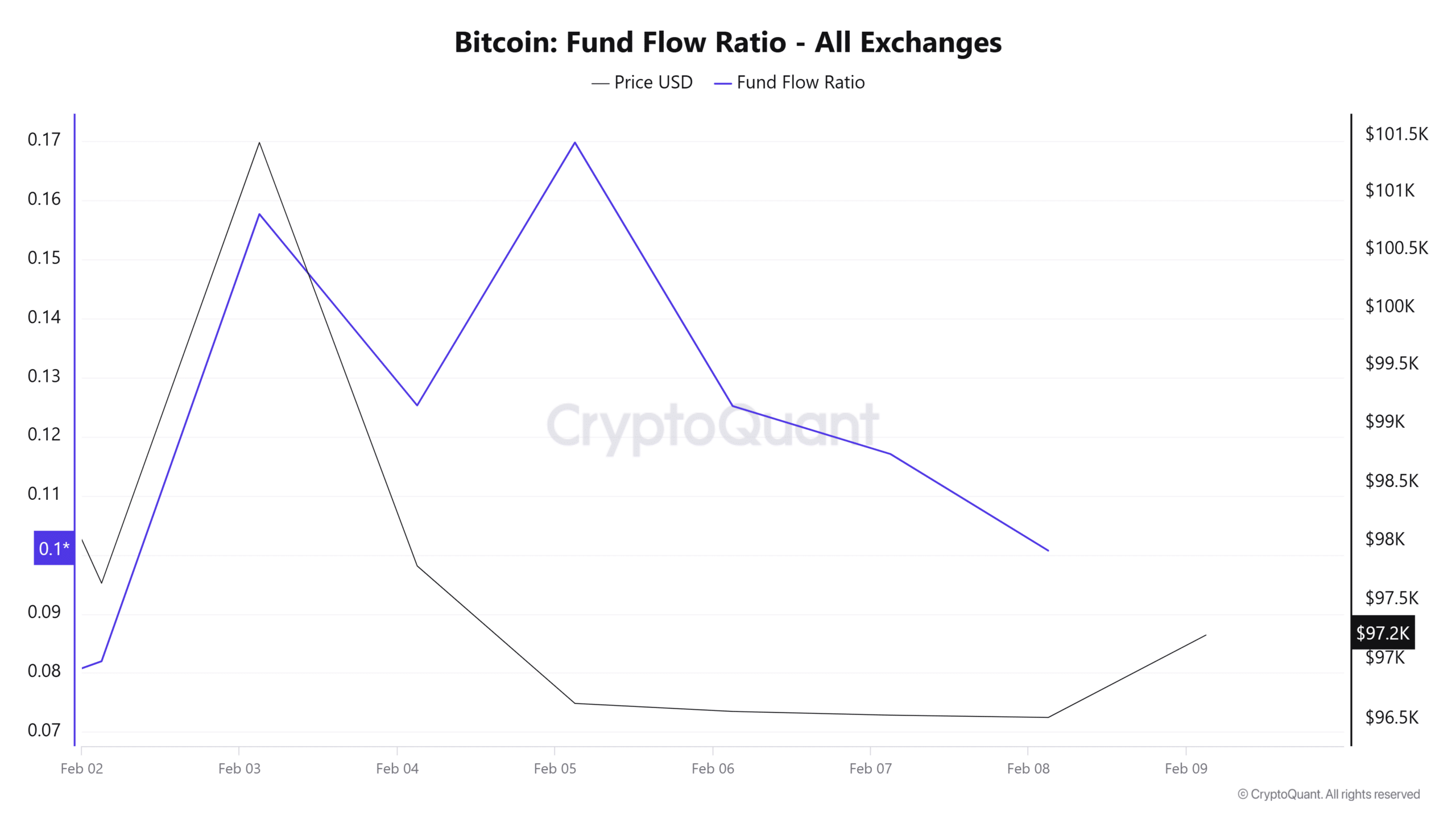

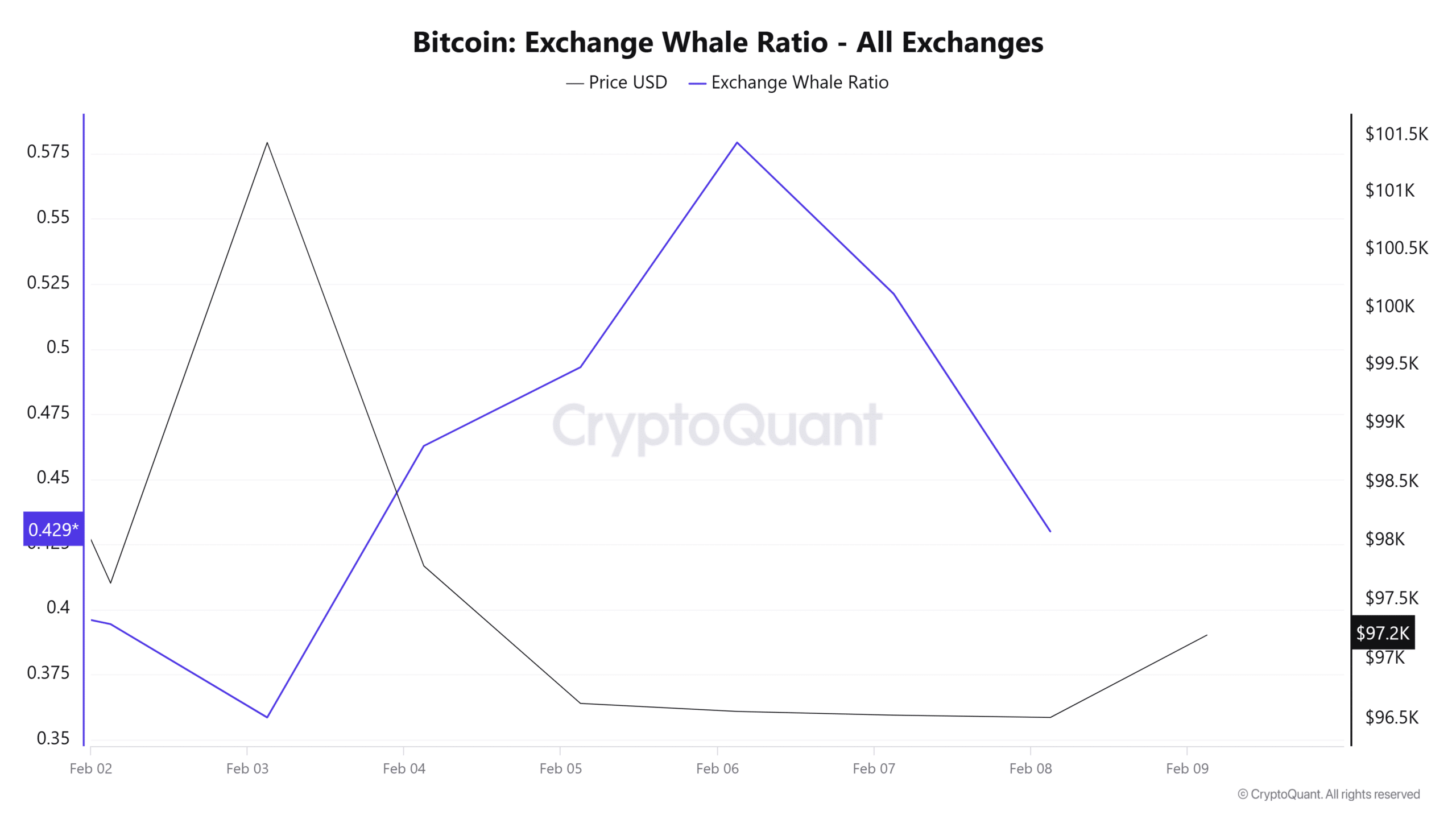

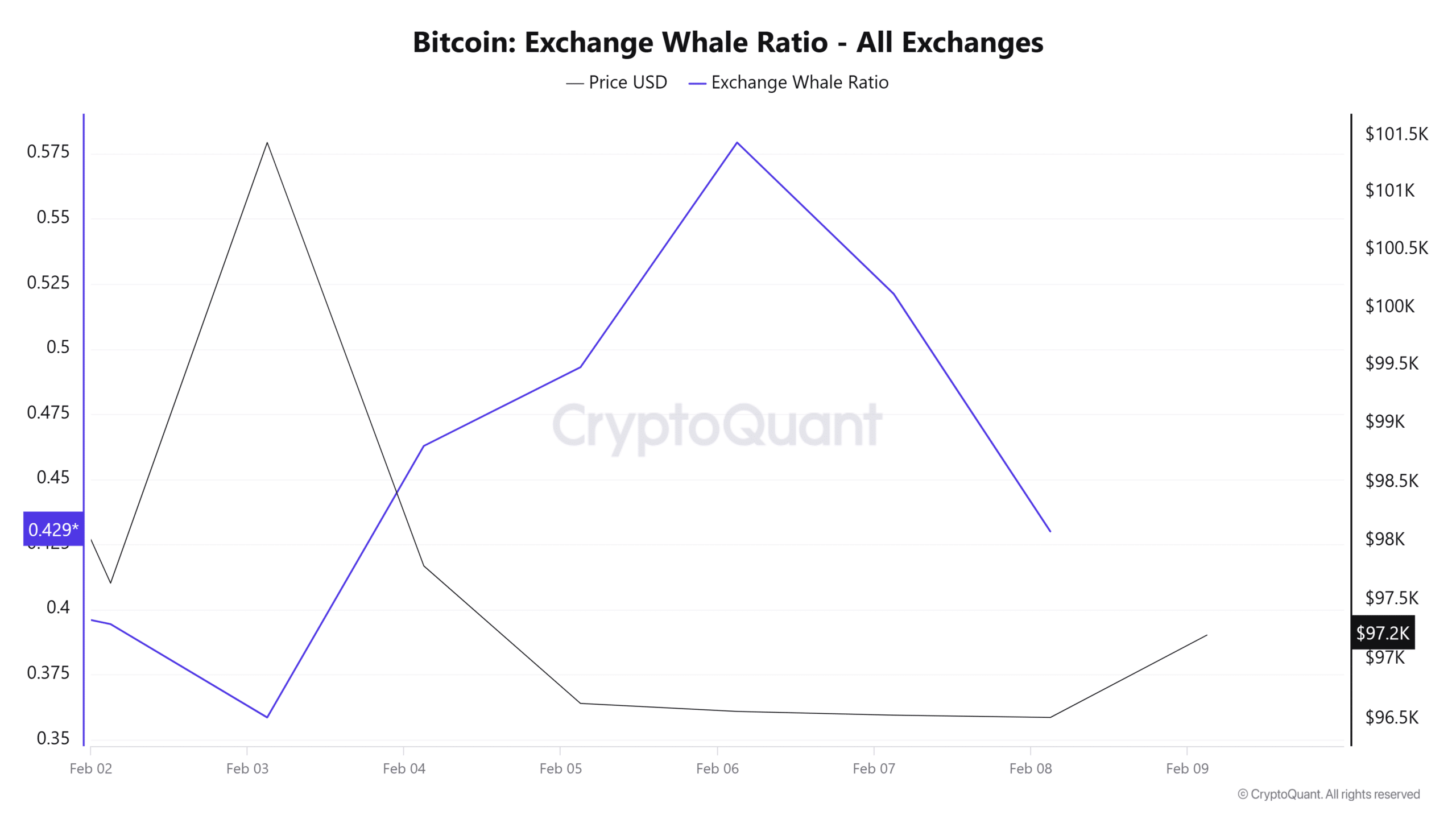

Source: Cryptuquant

For example, the fund current ratio of Bitcoin has fallen for three consecutive days. This implied that a smaller part of BTC transactions includes scholarships.

Such a trend suggests that investors hold their assets instead of selling. This market behavior often corresponds to the battery phase before prices rise.

Source: Cryptuquant

This accumulation also seems to be strong in whales. This is confirmed by the falling WxChange -Walvisratio, which has fallen over the past three days.

Such a decline implied that whales continued to hold BTC because they expected further price gains.

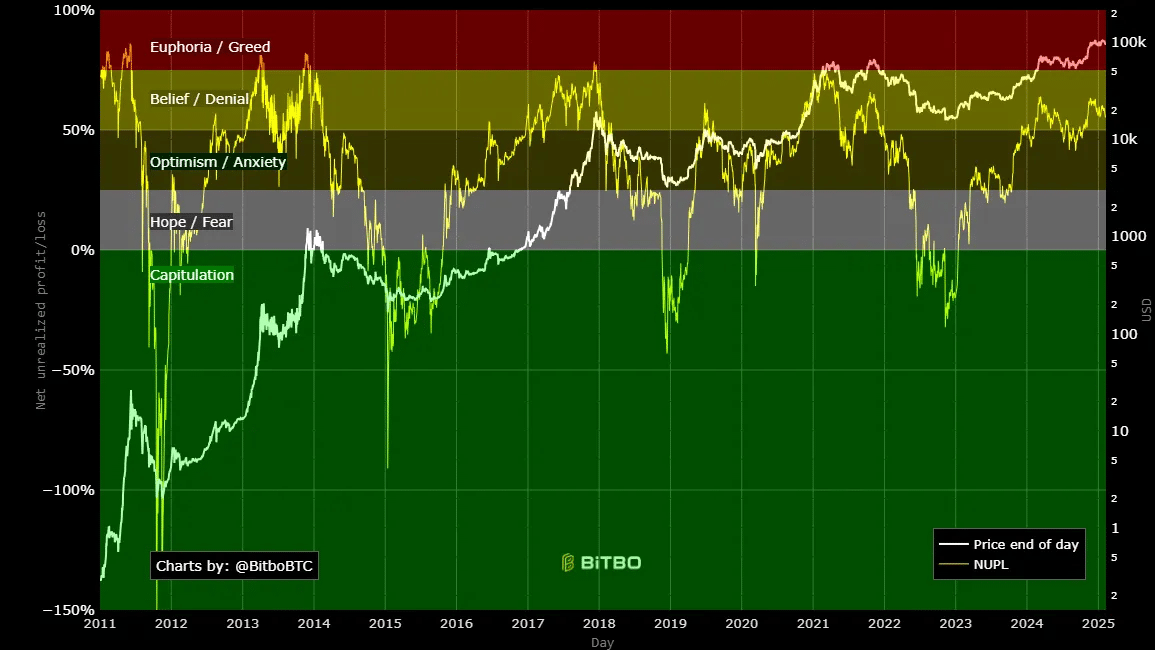

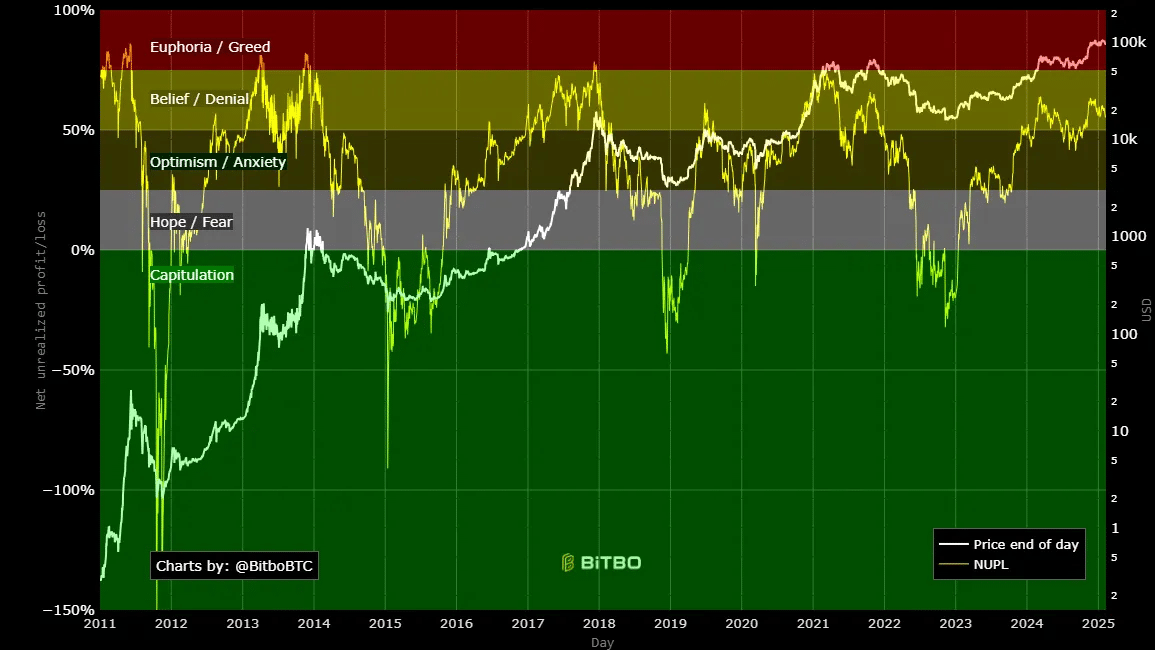

Source: Bitbo

Finally, Bitcoin’s Nupl remained in the faith/denial zone. At this level, BTC was still in a bullish phase and climbed to cycle heights.

With NUPL with 58%, the upward trend still has room for growth before the market top is reached.

Read Bitcoin’s [BTC] Price forecast 2025–2026

Simply put, although Bitcoin has had difficulty keeping above $ 96k, the crypto still has room for growth. With more profit, the trust of STHs will be reinforced, which further strengthens bullish sentiments.

With investors still optimistic, BTC can make a movement above this level, try $ 98900 and then be confronted with $ 100k resistance. However, if it does not hold above this level, BTC can fall to $ 94k, causing further decline.