- Outflows for Bitcoin started to rise, giving HODLers hope.

- Miner revenues rose, easing selling pressure on BTC.

Bitcoins [BTC] The rally has had a major impact on the overall state of the crypto market. But many are beginning to wonder whether this rally will hold in the future.

State of the king’s coin

However, some factors may still aid BTC’s bullish dream. In particular, there has been a strong outflow of BTC.

This increase leads to an increase in transaction costs, which directly quantifies the demand on the network. Higher fees during peak hours indicate users’ urgency to validate transactions, crucial data for miners and investors alike.

The on-chain behavior of #Bitcoin reflects a cyclical pattern, often stimulated by exogenous events.

The heatmap visualizes various behavioral measures over time, highlighting how coins are mobilized in response to environmental stimuli, or in anticipation of future stimuli

— NeuroInvest Research (@Neuro__Invest) December 1, 2023

The pronounced spikes in BTC outflows could have several significant consequences for the Bitcoin ecosystem.

First, the higher transaction costs resulting from this increase reflect the increased demand on the network. This question also indicates high user activity.

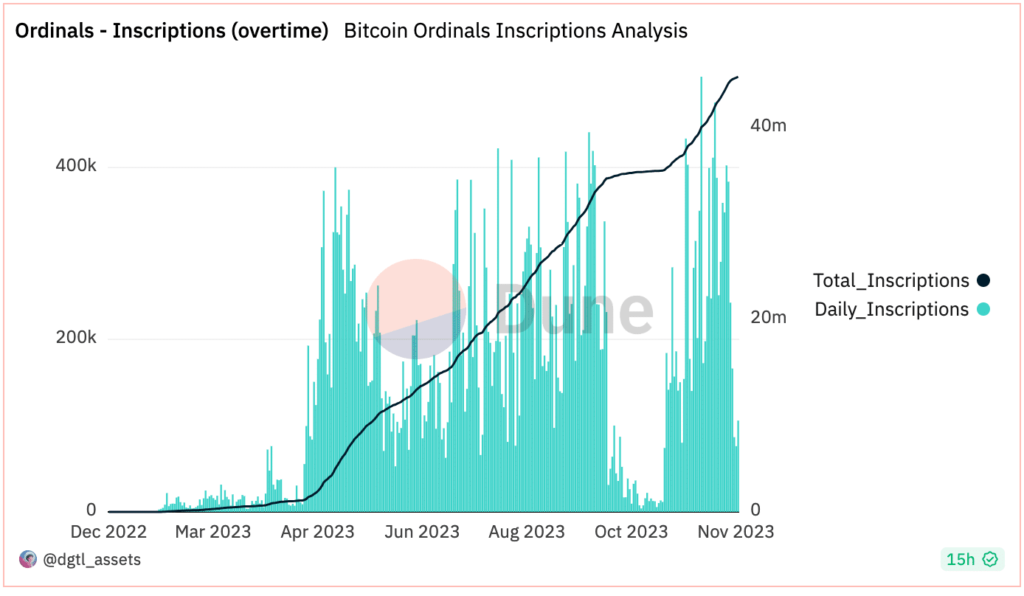

One of the reasons for the increase in the number of addresses could be the increasing interest in BTC ordinal numbers. According to data from Dune Analytics, registrations for the Ordinals had also grown.

The increasing interest in Ordinals also allows NFT investors to gain access to the Bitcoin network. This increasing use of BTC, coupled with increased outflows, could play a major role in supporting BTC’s current price.

How are miners doing?

For miners, the cycles of higher transaction fees during high traffic periods become financially beneficial.

The combination of newly created coins and transaction fees serves as an incentive for miners to continue contributing computing power to the network.

Is your portfolio green? look at the BTC profit calculator

In recent weeks, miners’ incomes have grown. This could help ease the selling pressure on these miners. This is because as miners’ incomes decline, miners are forced to sell their assets, which ultimately drives the price of Bitcoin down.

At the time of writing, BTC was trading at $38,777.65 and is up 1.56% over the past 24 hours. The volume on which BTC traded also grew. In recent weeks, BTC trading volume has increased from 8.39 billion to 19.27 billion.