- The number of whales has risen to the highest level in three years and they hold almost 4 million BTC.

- The retail holding company has a slow growth rate, but will this trend create a new ATH?

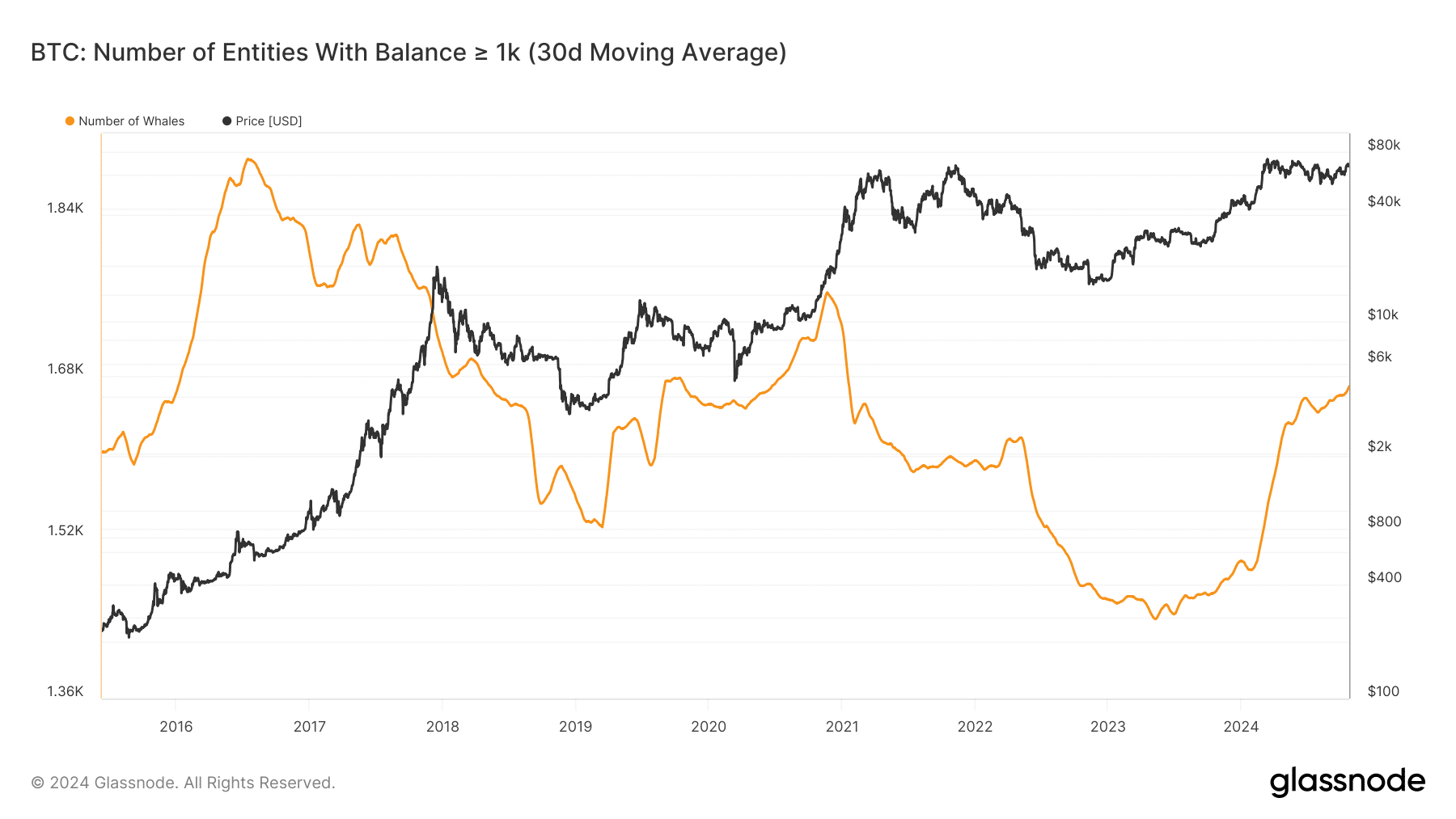

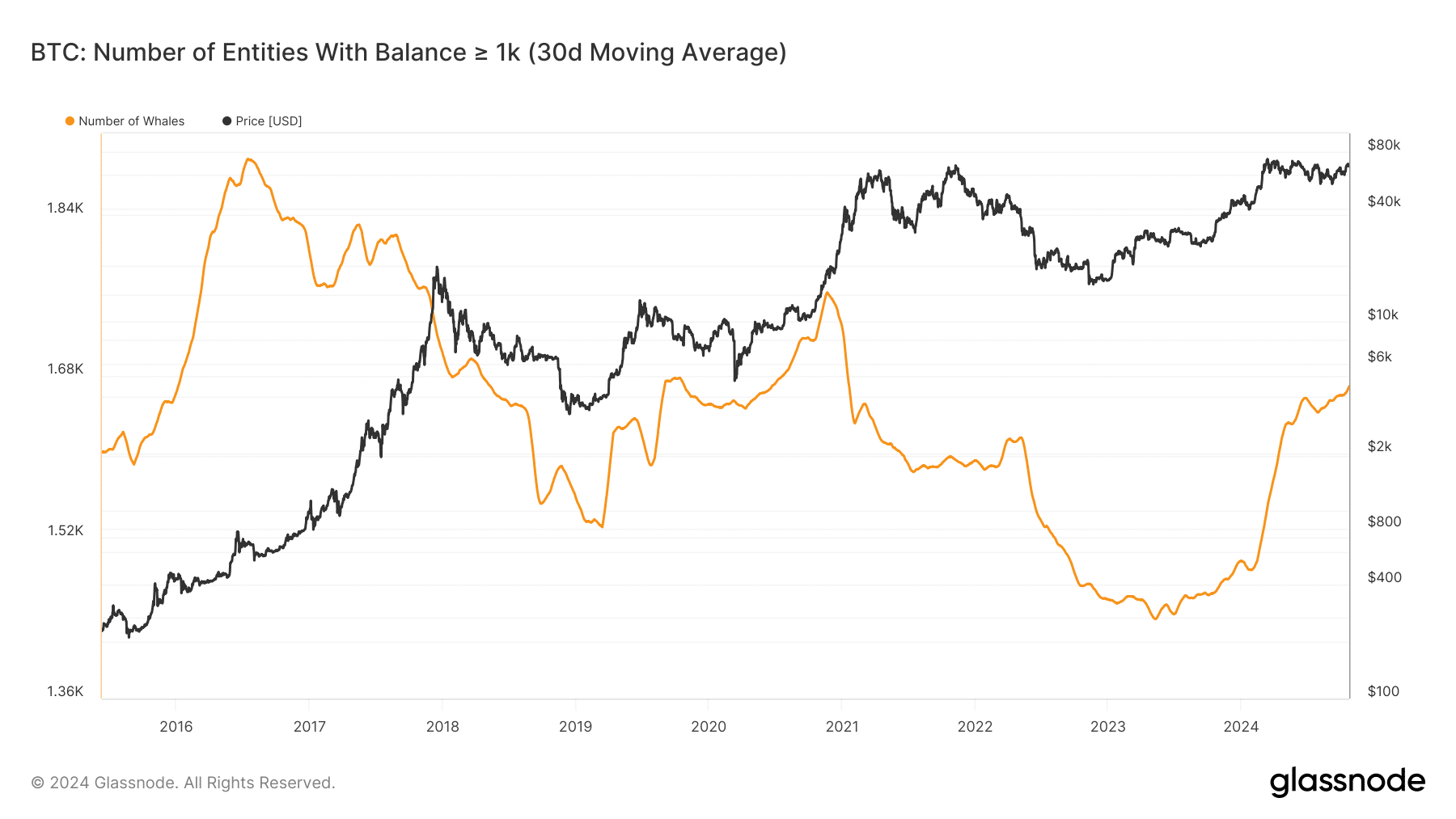

Bitcoin [BTC] whales, entities with over 1,000 coins, have increased in 2024, reaching levels last seen in early 2021, just before assets exploded to a last cycle high of $69,000.

According to data from Glassnode, there were more than 1,660 whale entities as of October 23.

Commenting on the rise in the number of major BTC investors, Bitwise head of research Andre Dragosch said: wondered whether this could mean a likely new all-time record (ATH).

“The total number of #Bitcoin whales just reached the highest level since January 2021! New ATHs coming in?’

Source: Glassnode

For context, in 2020 the number of whales increased from 1650 to over 1760. Then BTC switched to a new ATH the following year. Whether the same trend will continue in 2024 remains to be seen.

Whale watching 4 million BTC

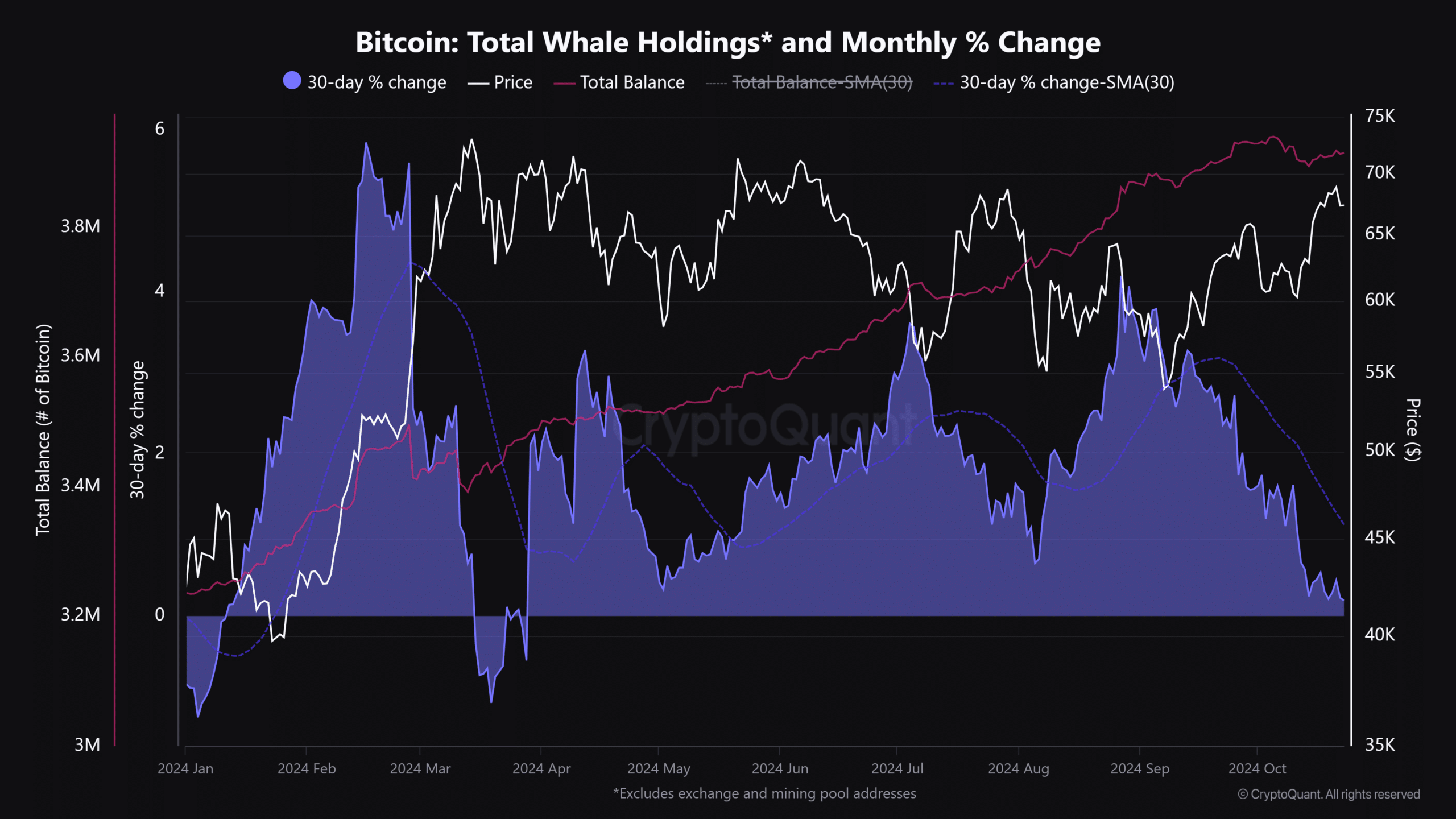

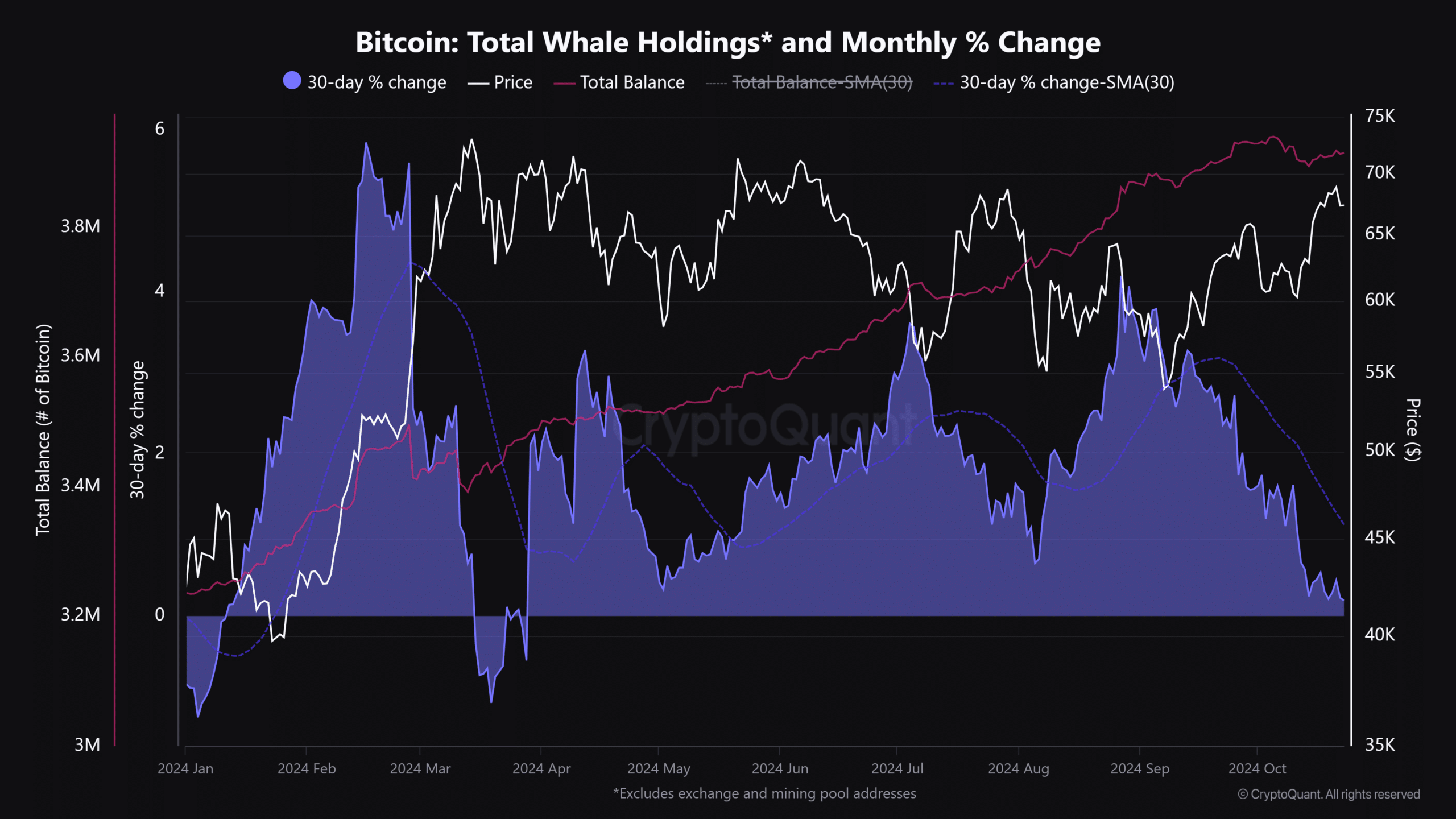

Source: CryptoQuant

According to CryptoQuant, whales’ total holdings at the time of writing were 3.9 million BTC.

That’s a whopping $261 billion, almost 20% of BTC’s market size. Since mid-2023, the whale entities have added approximately 670,000 BTC.

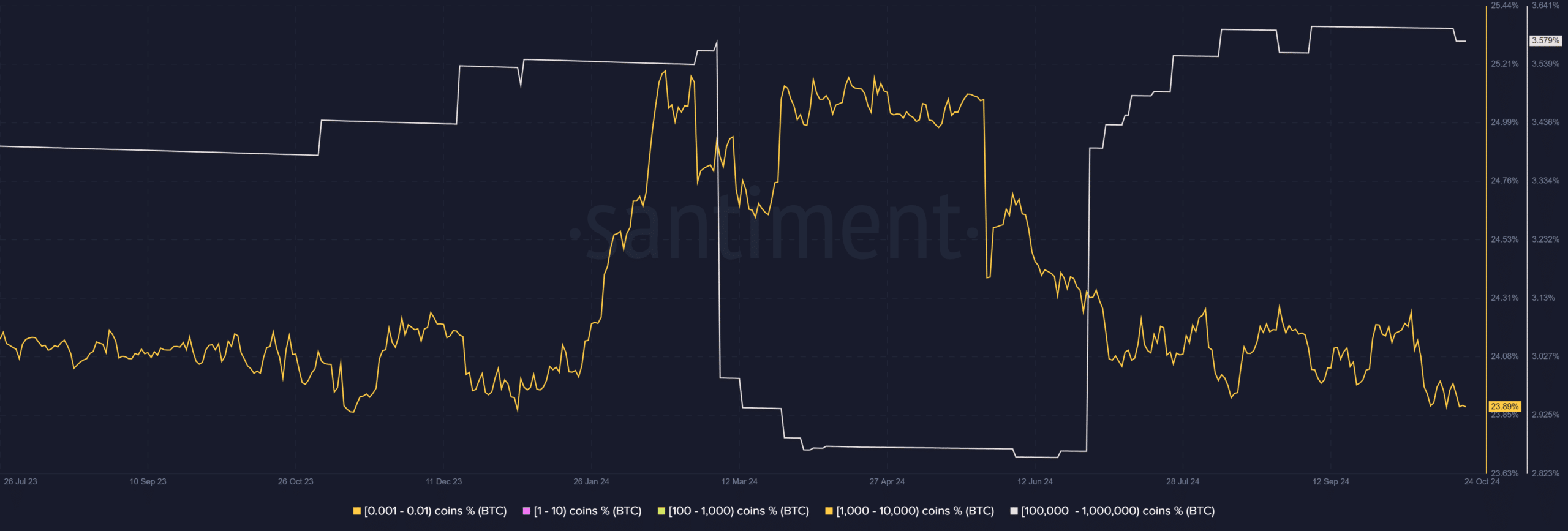

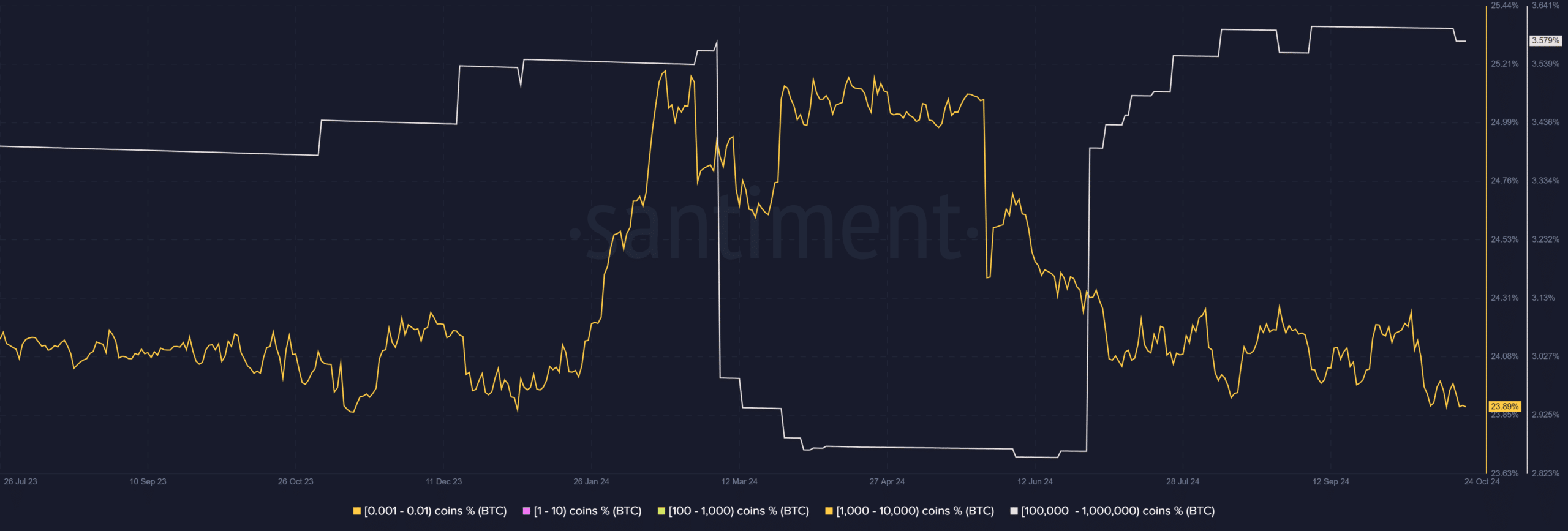

However, not all whale cohorts stacked up strongly. According to Santiment data, those who owned 100,000 to 1 million BTC faced aggressive accumulation in 2024. However, those with 1,000 to 10,000 BTC have reduced their exposure.

Source: Santiment

But overall, whales have added more BTC than their retail counterparts, CryptoQuant analysts noted. They stated:

“Since the beginning of 2024, the assets of other larger investors (1-10,000 BTC holders) have grown faster than the assets of retail investors on an annual basis. As of today, private investments have grown by 30,000 Bitcoin, compared to 173,000 Bitcoin from other larger investors.”

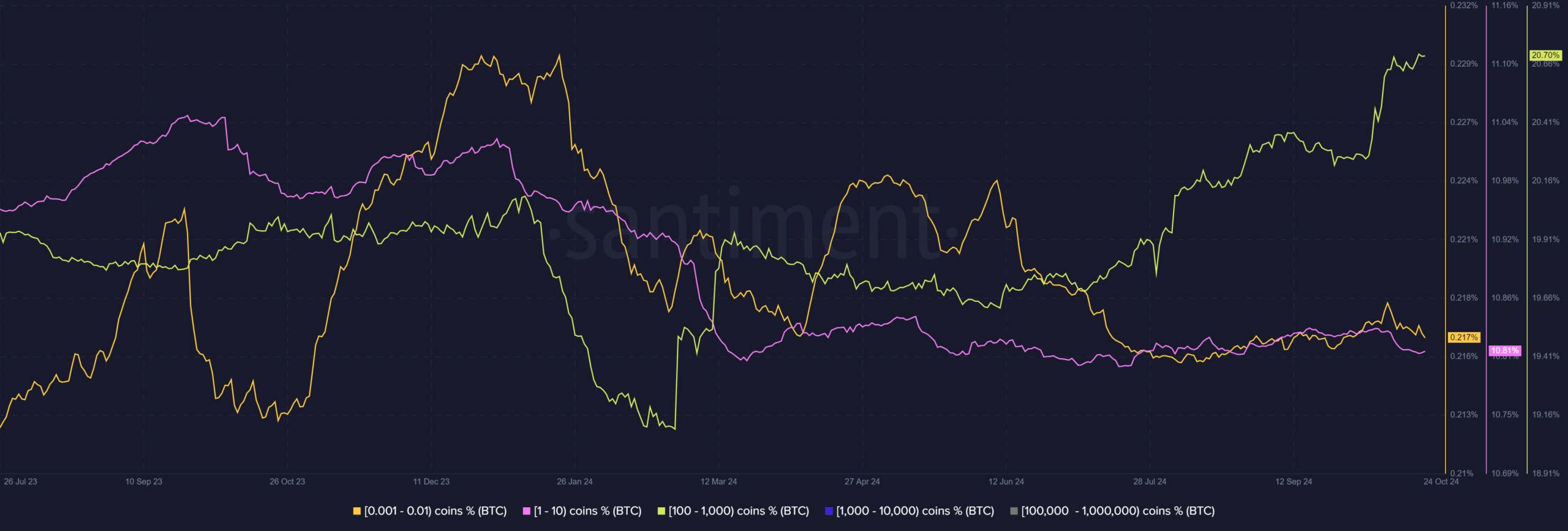

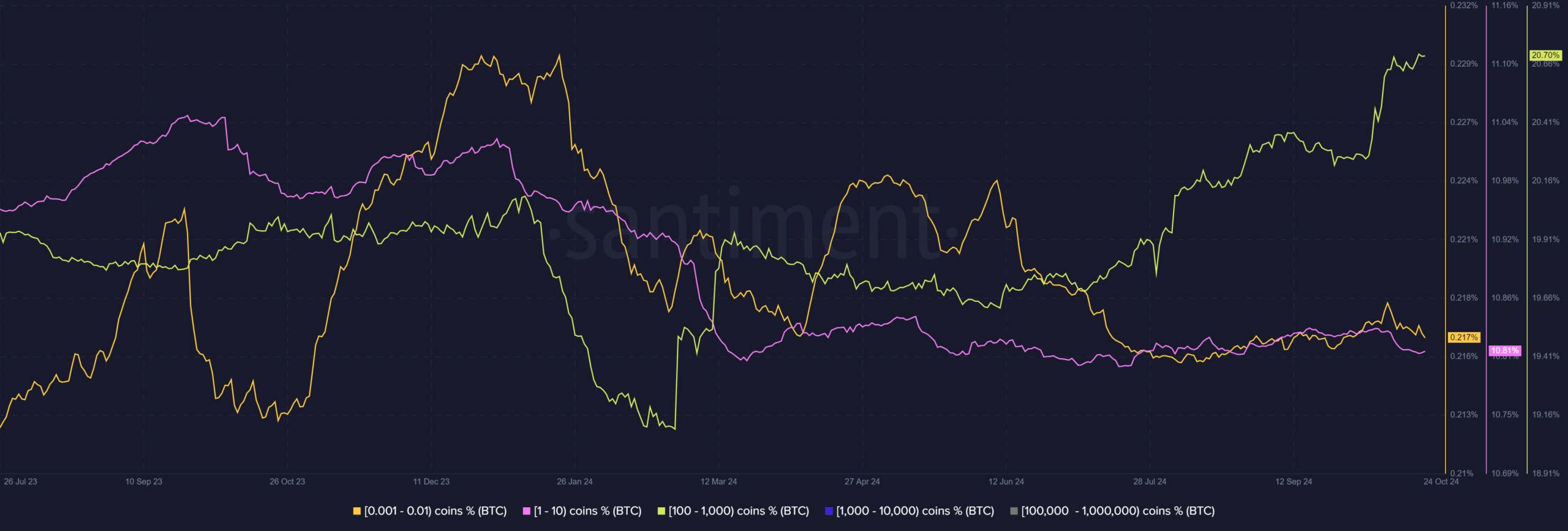

Santiment data showed that those who owned less than 10 BTC had experienced a slow growth rate in recent months.

However, those with 100 to 1000 BTC have increased their positions and market dominance from 19% to 20%.

Source: Santiment

Despite the slow growth rate of BTC retail inventory, the overall trend is skewed toward a holding strategy, as evidenced by the sharp increase in BTC accumulation balances.

Analysts have seen the above trends as positive catalysts for BTC’s likely new ATH attempt, but that remains to be seen.