- Bitcoin whales accumulated significant amounts of BTC amid the market volatility

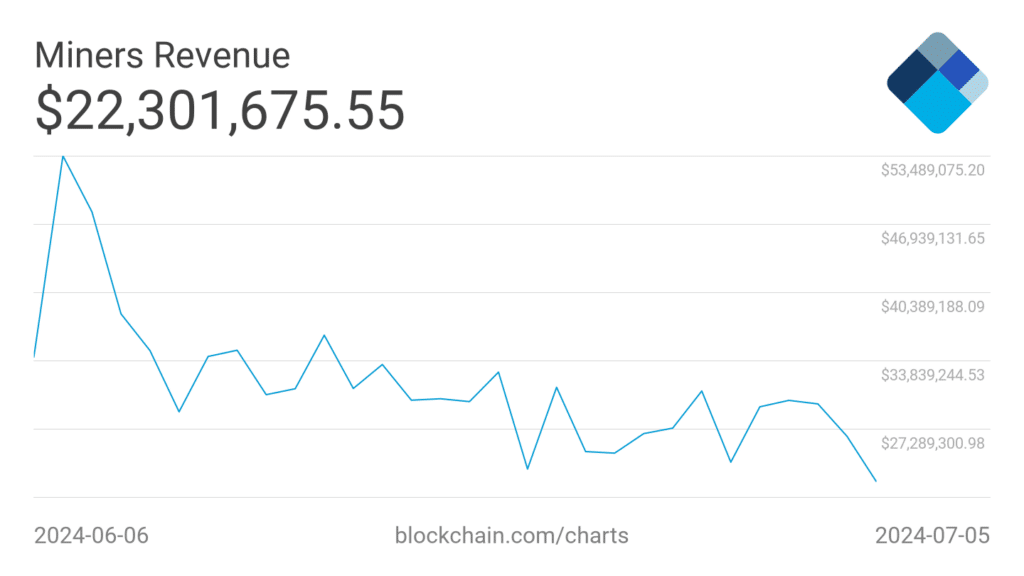

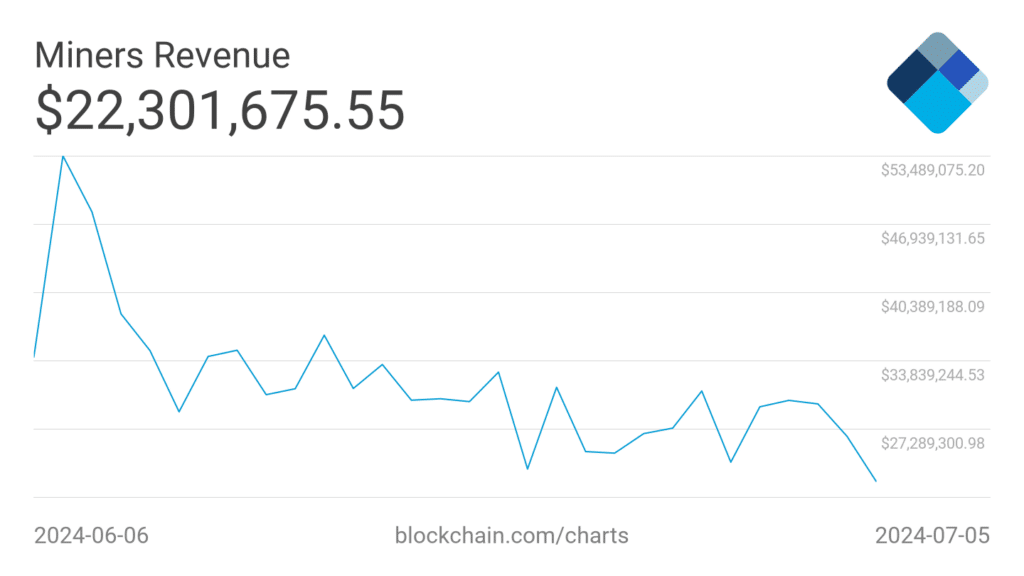

- Miner revenues fell, resulting in significant selling pressure on the crypto

Bitcoin [BTC]The company’s latest price crash shocked the crypto markets as a whole. While many market bulls suffered big losses, some addresses benefited from the cryptocurrency’s recent correction.

Whales buy the dip

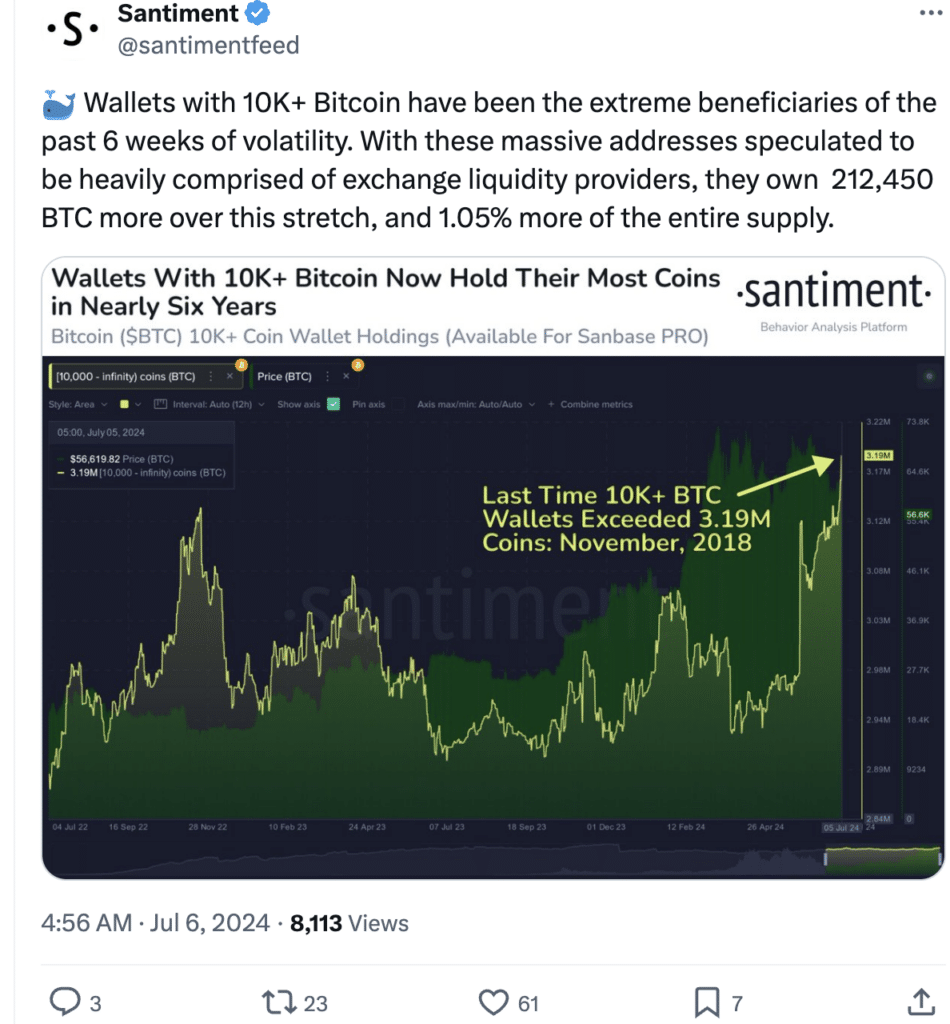

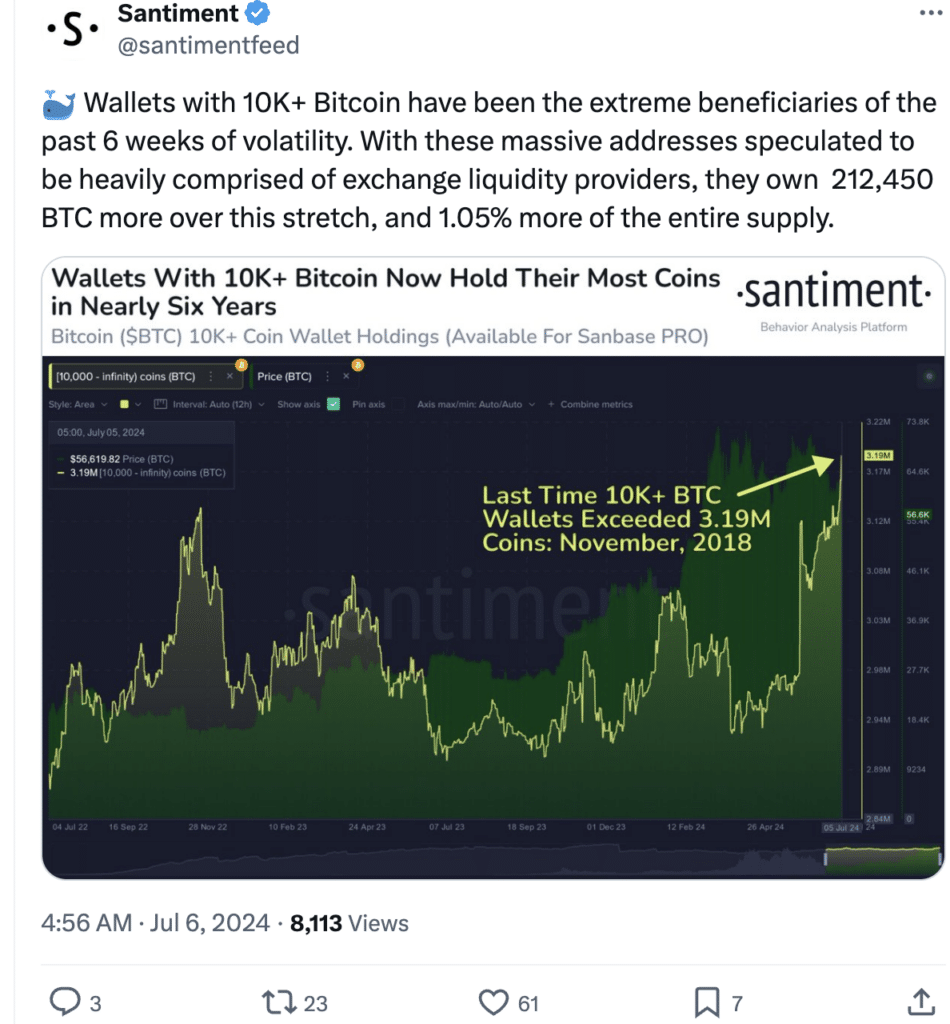

Wallets holding more than 10,000 Bitcoin have been major beneficiaries of the recent market volatility. These large addresses, believed to be owned mainly by exchange liquidity providers, have significantly increased their holdings over the past six weeks. By some estimates, these addresses have accumulated an additional 212,450 BTC, representing a 1.05% increase in their share of the total Bitcoin supply.

The actions of these major wallets can be seen as a sign of confidence in Bitcoin’s long-term potential. This positive sentiment could attract other investors to the market, causing the price to rise further. This could also help BTC regain previously reached levels and could help it reach the $60,000 level, if there is no additional selling pressure.

However, this is a double-edged sword. If whales continue to accumulate large amounts of BTC, this could impact the centralization of BTC. These whale addresses will have a lot of power and can manipulate BTC prices depending on their behavior. This could leave retail investors vulnerable, especially if these whales decide to sell their assets.

Source:

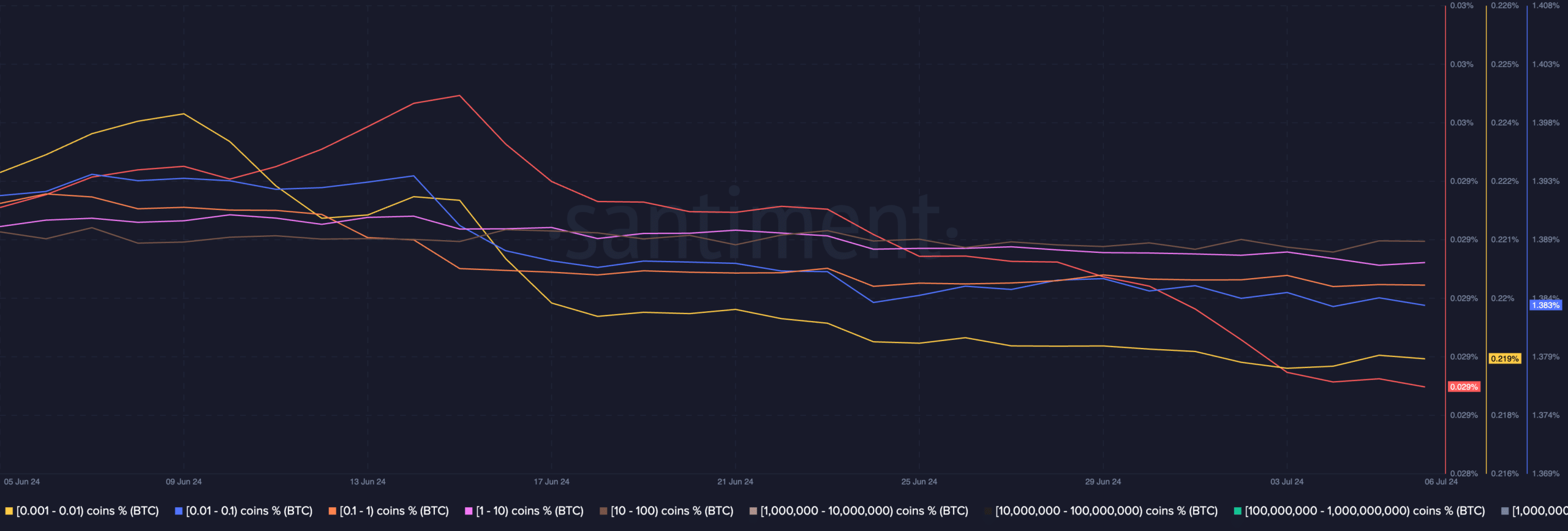

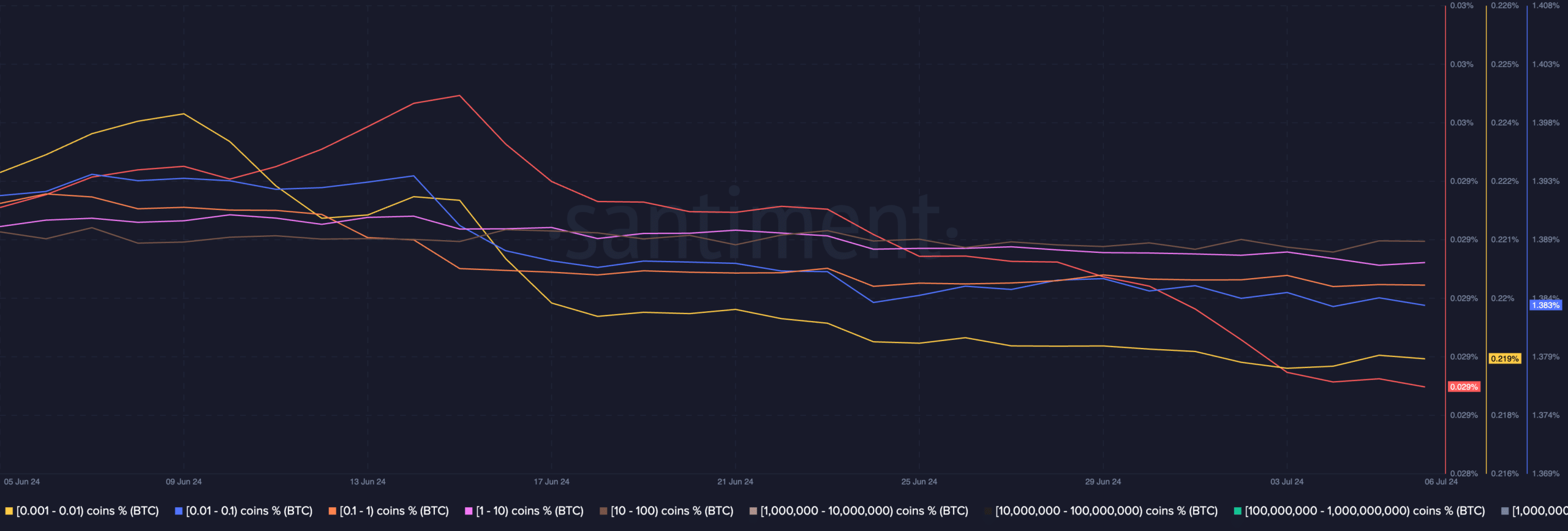

Another worrying factor is the fact that retail investors are not showing the same enthusiasm as whales.

AMBCrypto’s analysis of Santiment’s data showed that the number of store addresses in the 0.1 BTC to 1 BTC cohort did not show any interest in buying BTC. If sustained over the long term, this could fuel centralization and leave retail investors at the mercy of whale addresses.

Source: Santiment

How do miners survive?

While interest in whales could temporarily boost Bitcoin’s price, struggling miners could increase selling pressure. Miners’ daily earnings have fallen significantly in recent days, underscoring their financial pressure. This drop in revenue could prompt miners to sell their BTC shares to cover operating costs, putting downward pressure on the price.

Read Bitcoin’s [BTC] Price forecast 2024-25

At the time of writing, BTC was trading at $56,741.70, with the price rising 2.8% over the past 24 hours. Despite the tepid recovery, crypto volume fell by more than 37% during the aforementioned period.

If this remains consistent over the next week, it will be difficult for BTC to get past $60,000 on the charts.

Source: Blockchain