- Nearly 10 addresses have been added to the whale cohort in the past two weeks.

- Exchange Whale Ratio was on the low side, indicating less whale outflow.

Despite a disappointing price performance, major investors have increased their Bitcoin [BTC] property over the past few weeks.

Read Bitcoin [BTC] Price Forecast 2023-24

Prominent on-chain sleuth Ali Martinez took to social platform X to highlight the growth in the number of whale addresses on the Bitcoin network. The data, sourced from Glassnode, showed that nearly 10 addresses have been added to the cohort in the past two weeks.

About 10 in the last two weeks #Bitcoin whales, each numbering at least 1,000 $BTC (worth at least $29.4 million), have joined the network! pic.twitter.com/TyOHkt1emi

— Ali (@ali_charts) August 13, 2023

Whales gobbled up Bitcoins

Most organizations that track on-chain activity define whales as wallets that can store at least 1000 coins at any given time. Whale movements have become the subject of intense research over the years, providing traders and analysts with valuable clues about market sentiment.

Because they own a significant portion of BTC’s circulating supply, these powerful investors contribute significantly to price changes through their transactional activity. An increase in whale ownership typically signals a long-term bullish trend.

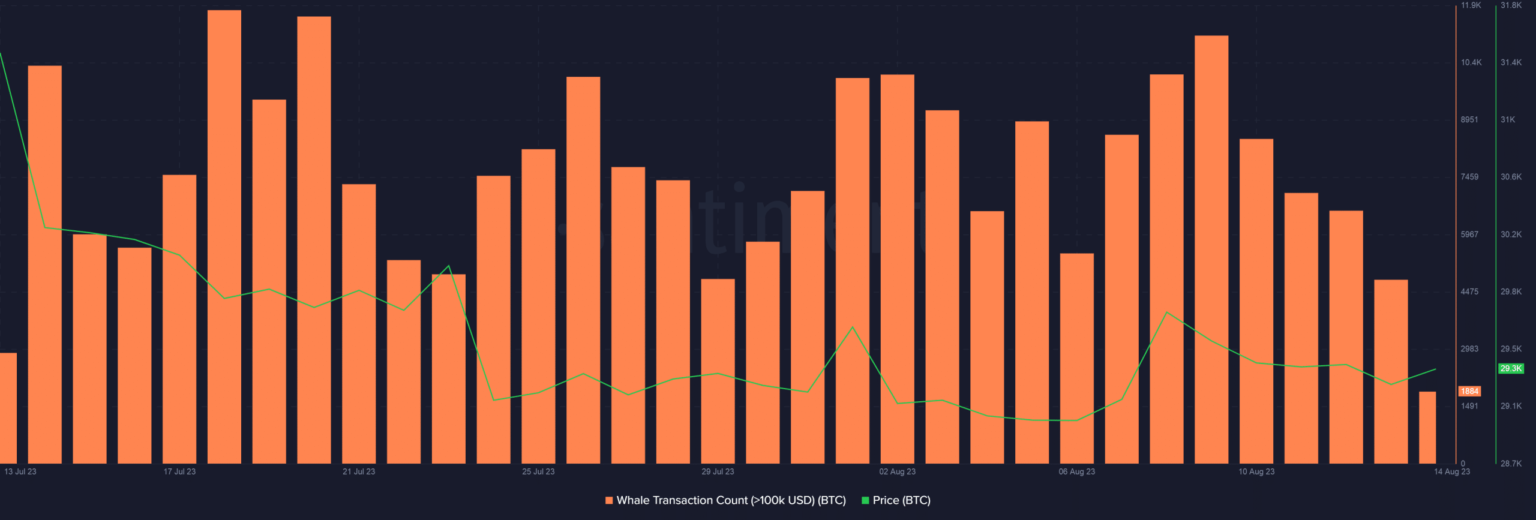

The price of BTC has stagnated in recent weeks, and during such times of inactivity, whale investors strategically turn to accumulation. Whale transactions hit a three-week high earlier this week, according to data from Santiment.

Watching the price action, it appeared whales were buying into the dip, after short-term holders liquidated their stock following the previous day’s gains.

Source: Sentiment

In for the long haul

The Exchange Whale Ratio indicator provided additional evidence that whales were stocking up for big game.

Exchange Whale Ratio is actually the relative size of the top 10 inflow transactions relative to the total inflow on an exchange, according to CryptoQuant. Simply put, it’s a measure of how often whales used the exchanges compared to the rest of the market.

At the time of publication, the metric showed a reading of 0.39, indicating significantly low outflows from whale portfolios.

Source: CryptoQuant

Is your wallet green? Check out the Bitcoin Profit Calculator

Large part of the supply in the hands of long-term holders

Long-term investors have warmed to Bitcoin’s safe haven and inflation hedge narrative. Consequently, sentiment has shifted to HODLing rather than trading.

Long-term holders controlled more than three-quarters of Bitcoin’s total circulating supply, according to a recent post by Will Clemente.

The percentage of Bitcoin’s supply held by long-term holders has just passed 75% pic.twitter.com/gFrxUsxs6I

— Will Clemente (@WClementeIII) August 14, 2023