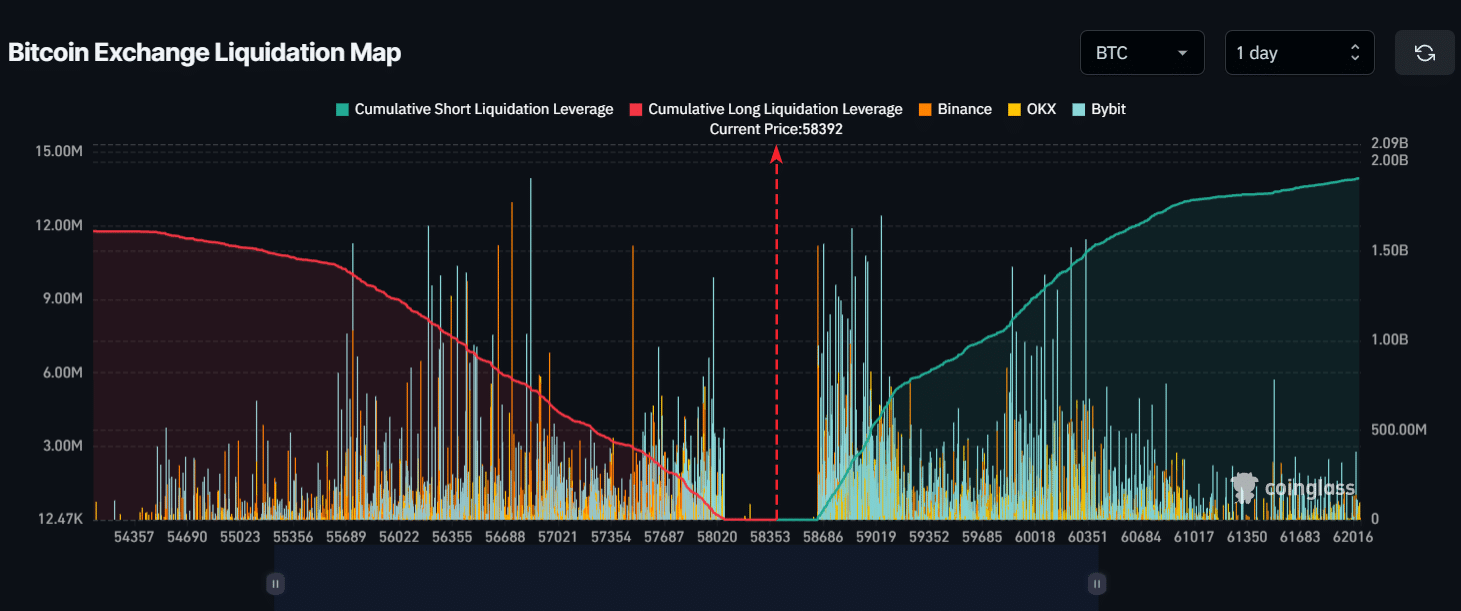

- After the collapse of the consolidation, there is a good chance that BTC could fall to the $54,600 level.

- If BTC falls to the $56,850 level, long positions worth nearly $721 million will be liquidated.

As the cryptocurrency market continues to struggle, whales have increased their buying activity.

On August 16, a newly created wallet raised a significant 533.5 Bitcoin [BTC] worth $31 million from Binance [BNB]the world’s largest cryptocurrency exchange at the level of 58,188, per Spot on chain.

Whales’ interest in Bitcoin

This post has attracted a lot of attention from the crypto community. The market is bad and whales see this price drop as an opportunity.

Additionally, Spot On Chain noted that six whales amassed a significant 4,046 BTC and WBTC worth $239.5 million through centralized exchanges (CEXs) this week.

However, in the last 24 hours and the last seven days, BTC’s foreign exchange reserves have fallen by 0.37% and 0.47% respectively.

On the other hand, due to high volatility, the number of active addresses has fallen by 27.6% in the past 24 hours, according to on-chain analytics company CryptoQuant.

How is BTC doing?

At the time of writing, Bitcoin was trading around the $58,430 level after remaining stable over the past 24 hours. Trading volume increased by 6% over the same period, indicating greater investor participation.

Furthermore, BTC Open Interest has increased by 2% over the past 24 hours, indicating increased curiosity among traders during this period.

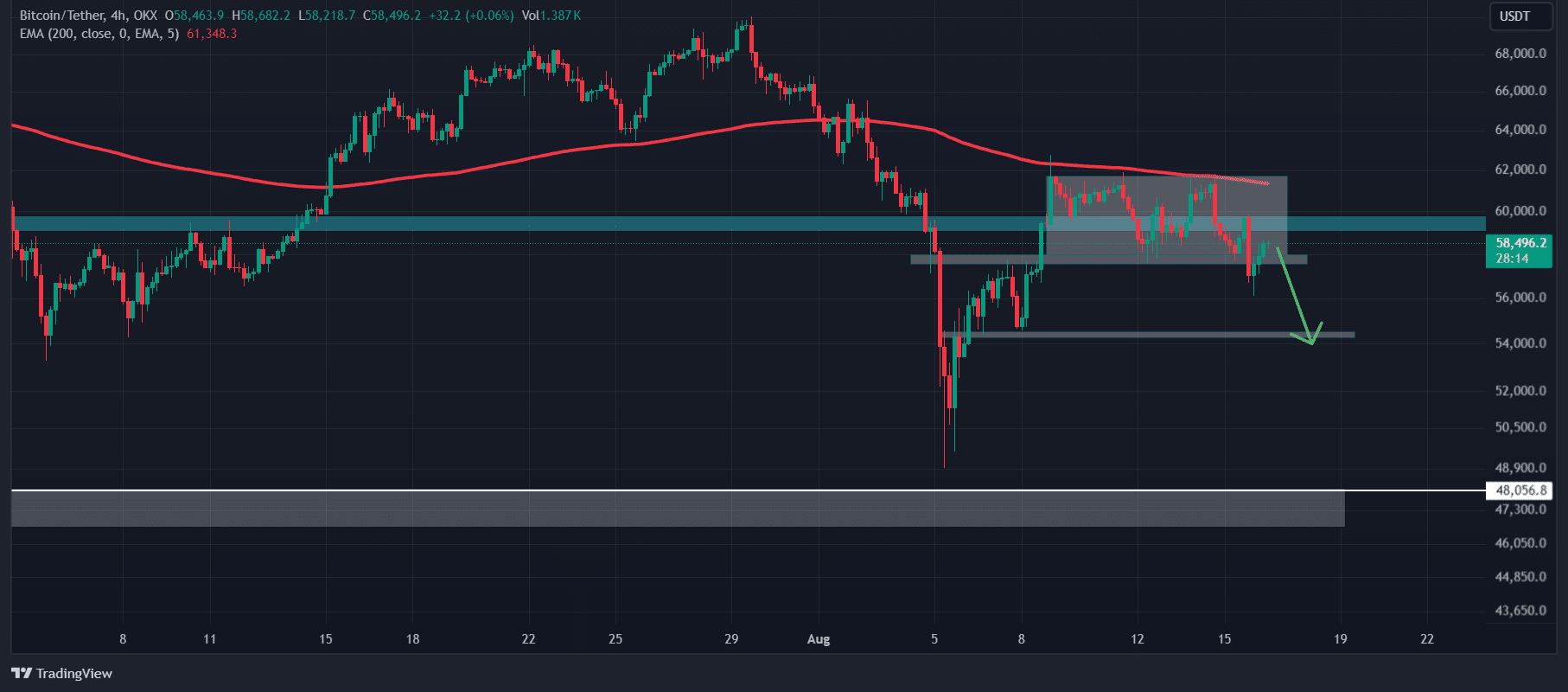

According to AMBCrypto’s technical analysis, BTC looked bearish as it traded below the 200 Exponential Moving Average (EMA) on a daily time frame.

Also, the king coin has split the consolidation zone between $61,800 and $58,500. After this breakdown, there is a good chance that BTC will soon fall 6.5% to the $54.6000 level.

Source: TradingView

At the time of writing, the two major liquidation levels were near $56,850 at the low end and $59,000 at the high end, according to analytics firm Coinglass.

Source: Coinglass

Is your portfolio green? Check out the BTC profit calculator

If bearish sentiment continues and the price falls to the $56,850 level, nearly $721 million in long positions will be liquidated.

Conversely, if sentiment changes and the BTC price rises to the $59,000 level, nearly $581.3 million worth of short positions will be liquidated.