- Whale transfer and profitability on the chain were the stage for a potential upward movement.

- Resistance remains strong if network growth is outweighing, but conviction is still missing.

Bitcoin [BTC] Has seen a remarkable movement on the chain, because 1,220 BTC (worth more than $ 94.5 million) was transferred from cracking to an unknown wallet, causing eyebrows to cross the market.

Such huge whale chanties often precedes volatility peaks, which indicates a possible shift in market sentiment.

At the same time, Bitcoin continues to float under the psychological resistance of $ 80,000 – an area that can define the direction of the next major movement.

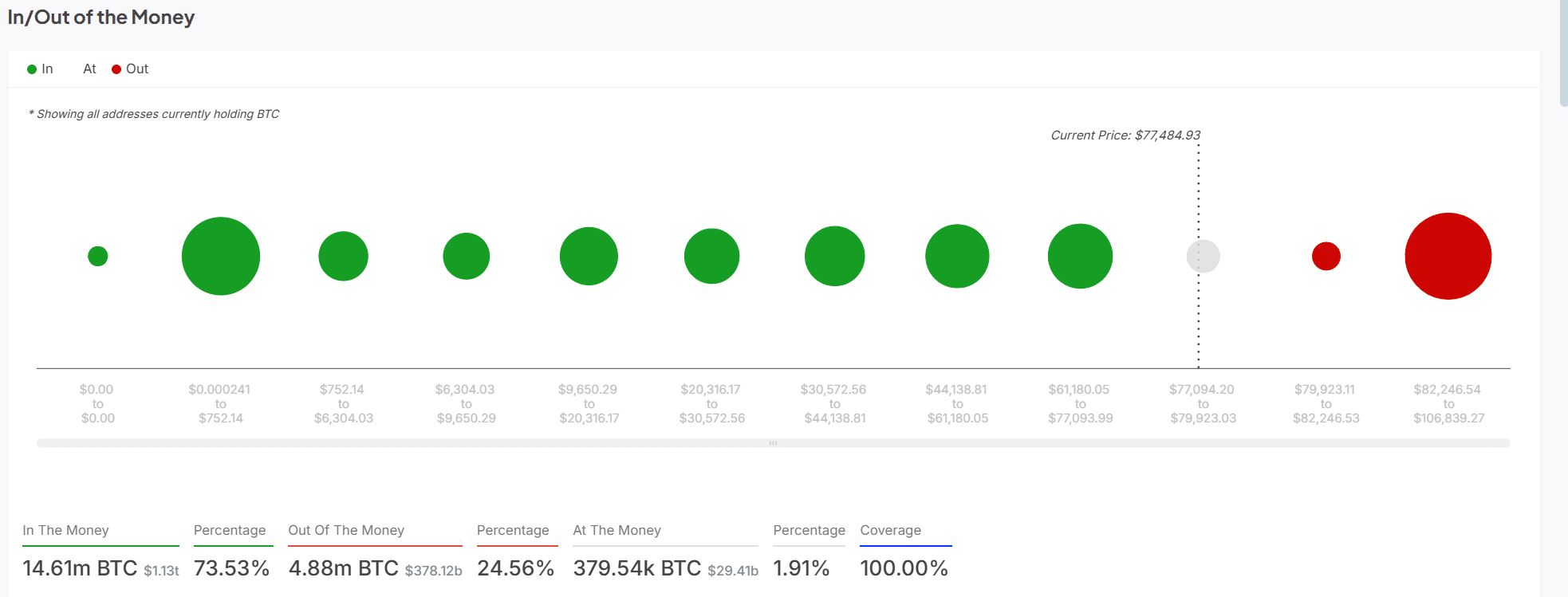

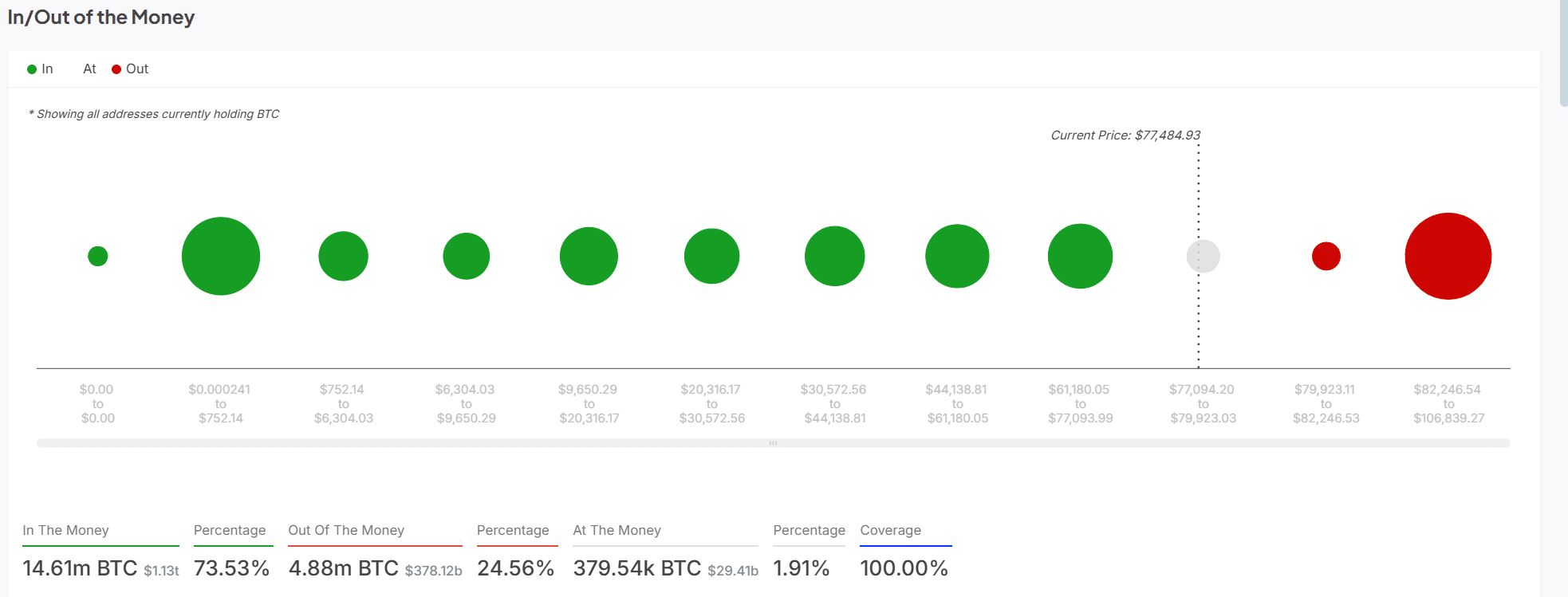

Are most Bitcoin holders in red?

In contrast to earish sentiment, the latest data on the chain outlines a more optimistic picture.

According to the ‘in/out money’ graph ‘, around 73.53% of the Bitcoin addresses are currently in profit, with only 24.56% under water.

This indicates that a majority of the Bitcoin holders have purchased at lower levels and is now on a considerable profit.

In fact, the investor pressure to sell is relatively muted for the time being and the market offers a solid psychological pillow. However, a rejection on the current price range can still entail those who have smaller non -realized profits.

Source: Intotheblock

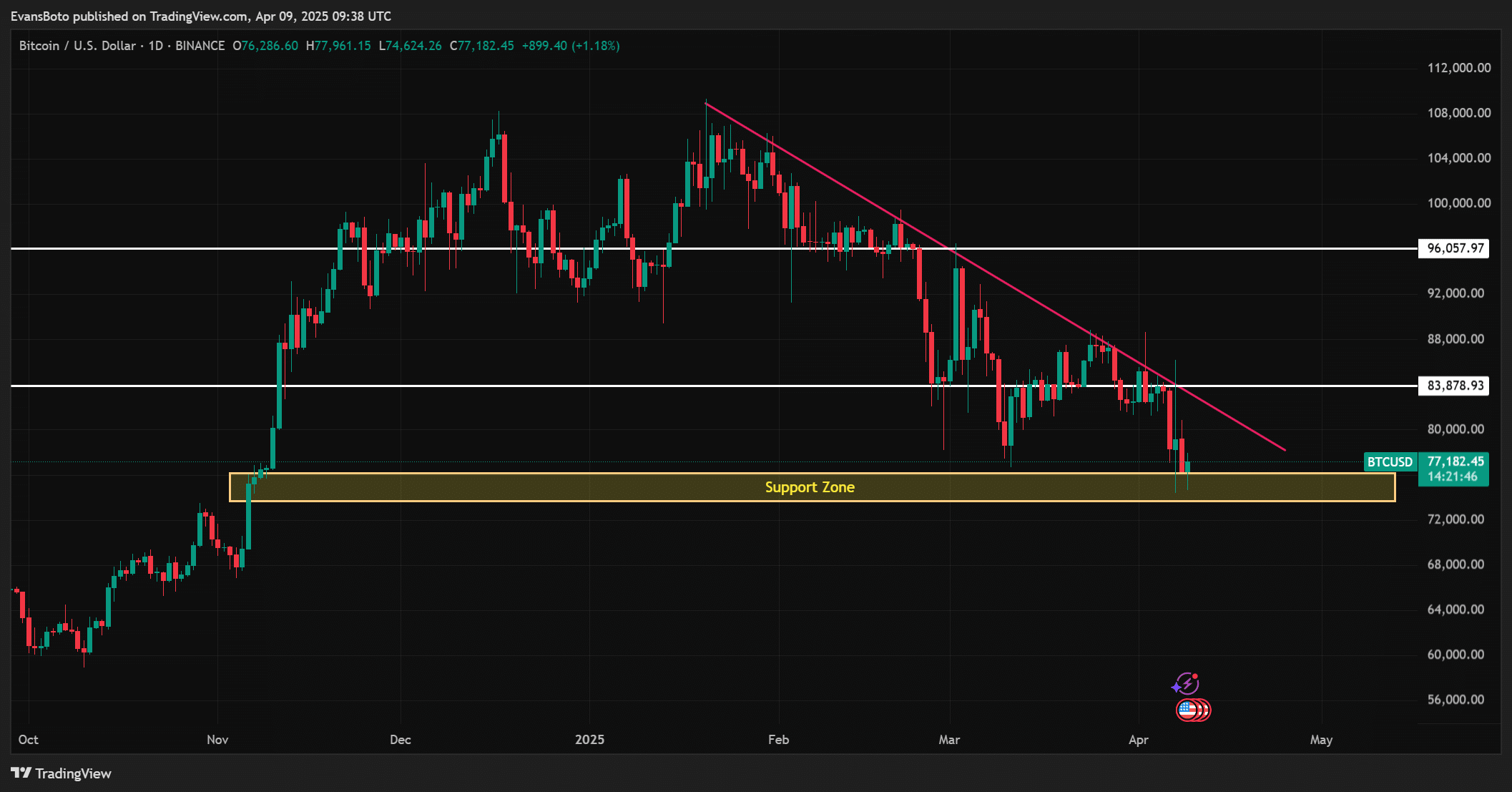

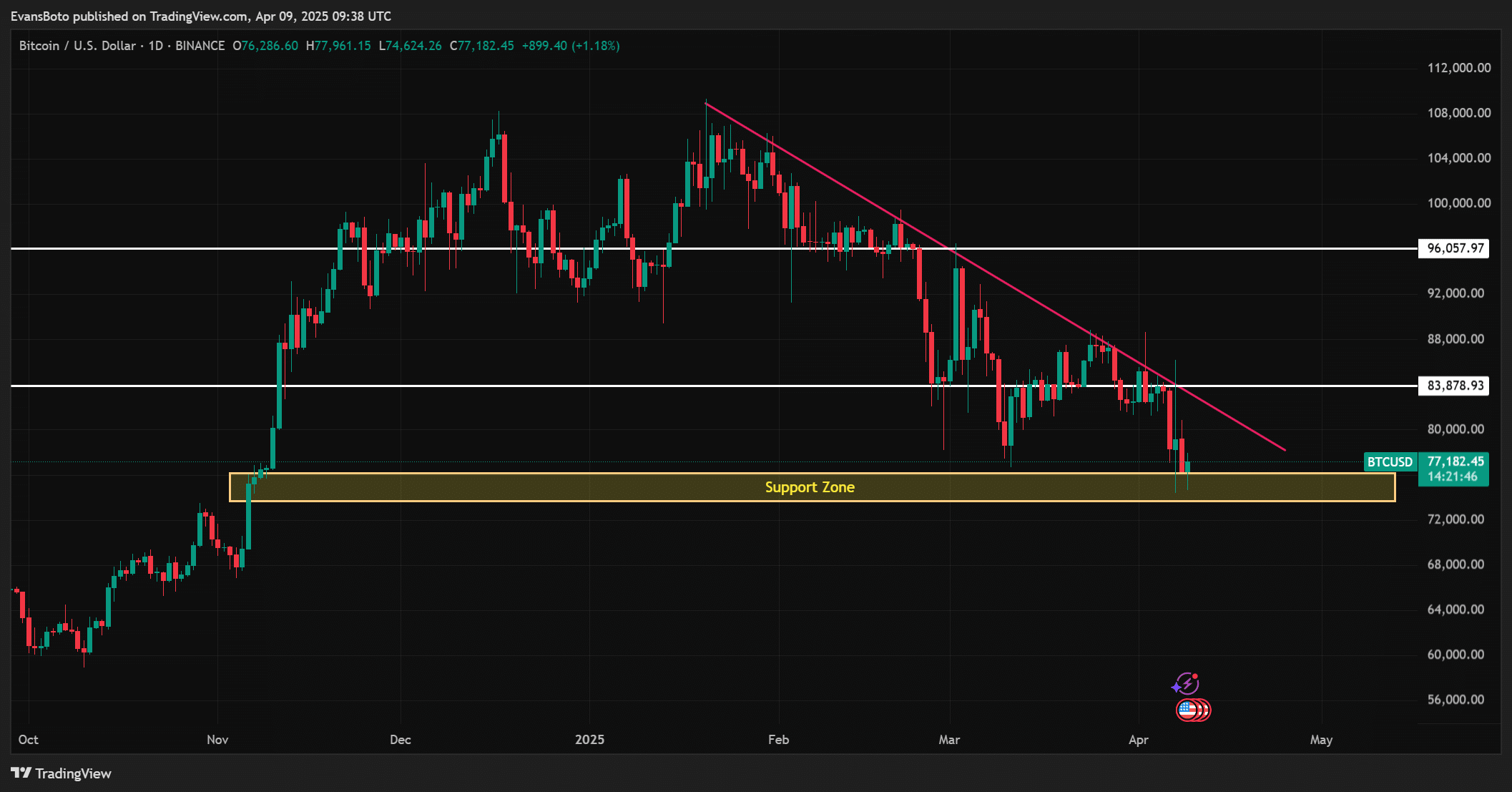

Can Bitcoin contain the support level of $ 77K?

At the time of writing, Bitcoin acted at $ 77,175 after a decrease of 2.33% in the last 24 hours.

Price promotion remains bearish, limited under a falling trendline and floats slightly above the $ 72,000 – $ 75,000 support zone.

This region has repeatedly recorded the sales pressure and acts as a battlefield between bulls and bears.

However, a confirmed movement above $ 83,878 can invalidate the downward trend and form the stage for a movement to $ 96,000.

Until that time, the Bearish structure remains intact and each drop can accelerate the sales pressure to lower levels.

Source: TradingView

Is market sentiment still positive?

The net non -realized profit/loss (NUPL) was at 0.43, an increase of 0.98% in the last 24 hours, which indicates that investors still have moderate non -realized profit.

Although this suggests that there is no widespread panic, the buffer is thinner and the price of the price remains aside.

If Bitcoin continues to hold under resistance, the sentiment can quickly turn Bearish. That is why even a small dip can cause emotional outputs of investors who expect an outbreak that does not come true.

Source: Cryptuquant

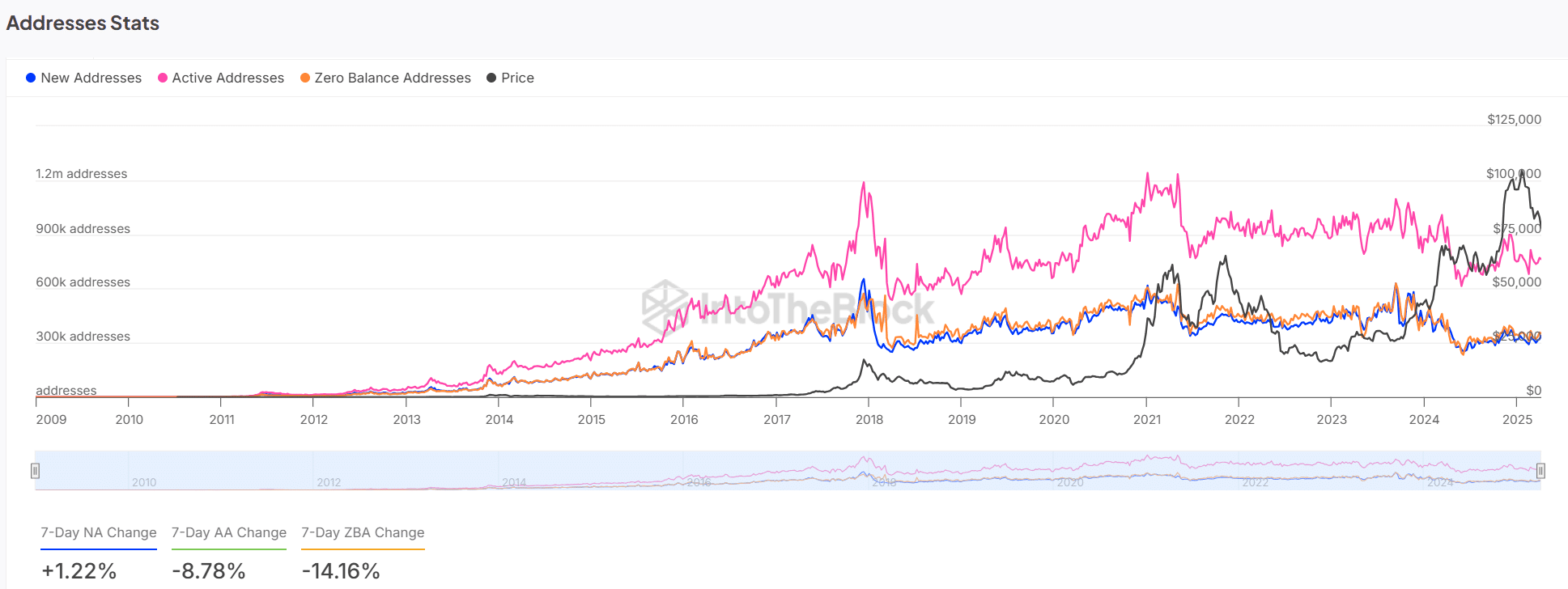

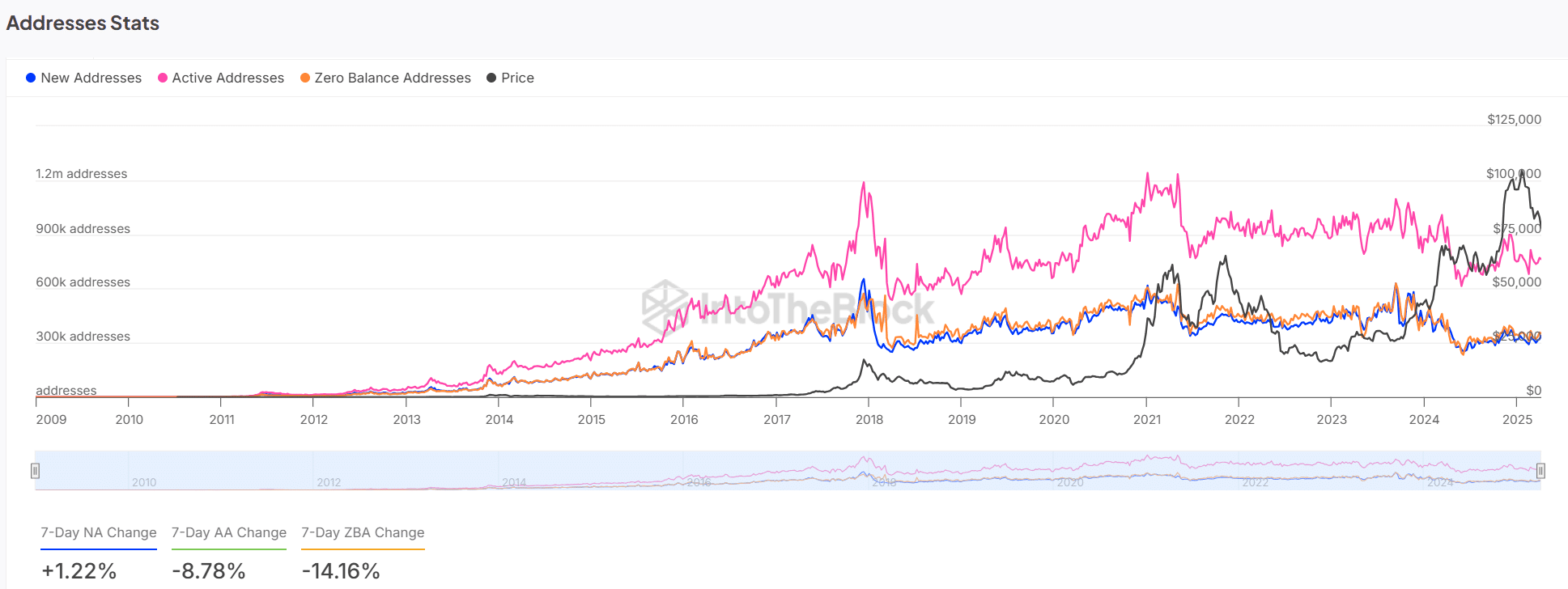

Are network fundamentals supportive?

Network fundamentals are mixed.

Active addresses have fallen with 8.78% and zero balance addresses with 14.16%, which appears to be some decrease in participation in light. However, new addresses have risen by 1.22%, which suggests that new interest is starting to drip back.

Historically, a steady increase in new addresses precedes strong bullish trends. For now, the data shows that while user activity is immersed, there is a growing basis that forms below the surface.

Source: Intotheblock

Bitcoin takes all this into consideration and positions for a possible aid, with more than 70% of the holders in profit, price that is above the support and new users who slowly enter the market.

However, the resistance nearly $ 80,000 remains a major obstacle. Unless bulls above it break with conviction, the risk of a local rejection still remains.

Caution is necessary, but the conditions for a rebound gradually fall into place.