- Bitcoin’s average holding time is about four years, while Cardano’s is less than a year.

- Long-term BTC holders have seen more gains than ADA.

Bitcoins [BTC] dominance extends beyond price, as evidenced by key past figures.

Recent data from InTheBlok Compare Bitcoin and Cardano [ADA] further strengthened the former’s dominance, despite Cardano’s role as a decentralized platform.

According to the data analyzed by AMBCrypto, Bitcoin had a longer average holding life of four years, compared to Cardano’s 11.4 months.

This difference in holding times suggests that Bitcoin has attracted holders who anticipate a potential future price increase. This is also given the significant volume these tokens have seen over the years.

Comparison of Bitcoin and Cardano sentiment in recent months

An analysis of Bitcoin and Cardano funding rates on Mint glass showed remarkable patterns when compared. ADA showed a higher frequency of negative funding rates than BTC over the past five months.

This implies that ADA traders have taken more short positions in anticipation of a price drop than BTC traders. During this period, BTC’s highest negative funding rate was approximately -0.017%, while ADA saw approximately -0.062%.

In terms of positive funding rates, ADA’s highest in the same time frame was around 0.04%, slightly lower than BTC’s 0.05%.

These funding rate trends show that Bitcoin has generally generated more positive sentiment than Cardano for a significant portion of the year.

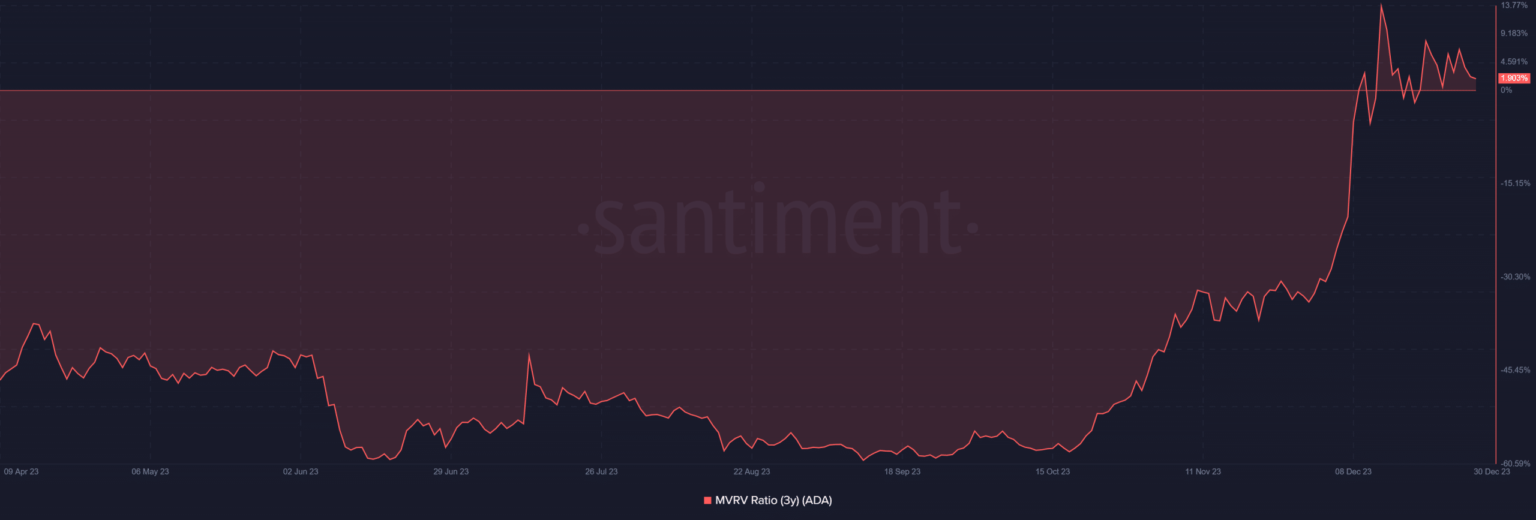

Analysis of the three-year MVRV of Bitcoin and Cardano

A study on the 3-year market value to realized value ratio (MVRV) for Bitcoin and Cardano sheds light on the preferences of long-term holders who favor BTC.

The MVRV analysis for ADA showed a higher frequency of trends below zero compared to BTC. Over the year, ADA’s MVRV was, until recently, approximately -50%. However, at the time of writing this was approximately 1.9%.

Source: Santiment

In contrast, BTC’s MVRV ratio rose above zero around October, showing more upward trends. At the time of writing, BTC’s MVRV was around 20.5%, despite a recent decline.

This positioning shows that BTC holders have made gains of more than 20% over the past three years. On the other hand, ADA holders had a gain of about 1.9% over the same period.

This difference in MVRVs provided insight into why BTC has attracted more long-term holders than ADA.

Source: Santiment

Measuring Bitcoin and Cardano in Profit

From CoinMarketCaps according to the latest data measured by AMBCrypto, the circulating supply for Bitcoin and Cardano was approximately 19.5 million and 35.3 billion respectively.

Research on profit circulation on Santiment showed that Bitcoin had a higher percentage of the circulating supply of profit compared to Cardano.

At the time of writing, the chart analysis showed that approximately 16.8 million BTCs were making profits, representing more than 85% of the circulating supply.

Conversely, the analysis for ADA found that there was currently about $27 billion in profit, accounting for about 76% of circulating supply.

As with the MVRV analysis, these findings emphasize holder profitability. It also provided insight into why one asset has attracted more long-term owners than another.

BTC and ADA are seeing a slight downward trend

Bitcoin has experienced several price increases throughout the year, with the most recent surge beginning around October. This corresponds to the period when the three-year MVRV started an upward trajectory.

Conversely, Cardano’s recent rally started in October, but the MVRV was not affected until December.

As of the last update, ADA was trading around $0.60, down less than 1%. Analysis of the daily timeframe chart shows that this was the third consecutive trading day of losses.

Nevertheless, ADA maintained a bullish trend, as evidenced by the Relative Strength Index (RSI).

Source: trading view

Read Bitcoin’s [BTC] Price forecast 2023-24

In contrast, Bitcoin’s positive trend was weakening at the time of writing. BTC’s RSI has been around the neutral line, meaning any price decline of more than 1% could push it into a bear trend.

As of the last update, Bitcoin was trading around $42,200.

Source: trading view