- BTC’s year-over-year volatility dropped to levels last seen in December 2016.

- However, Glassnode reported that this was not a new phenomenon.

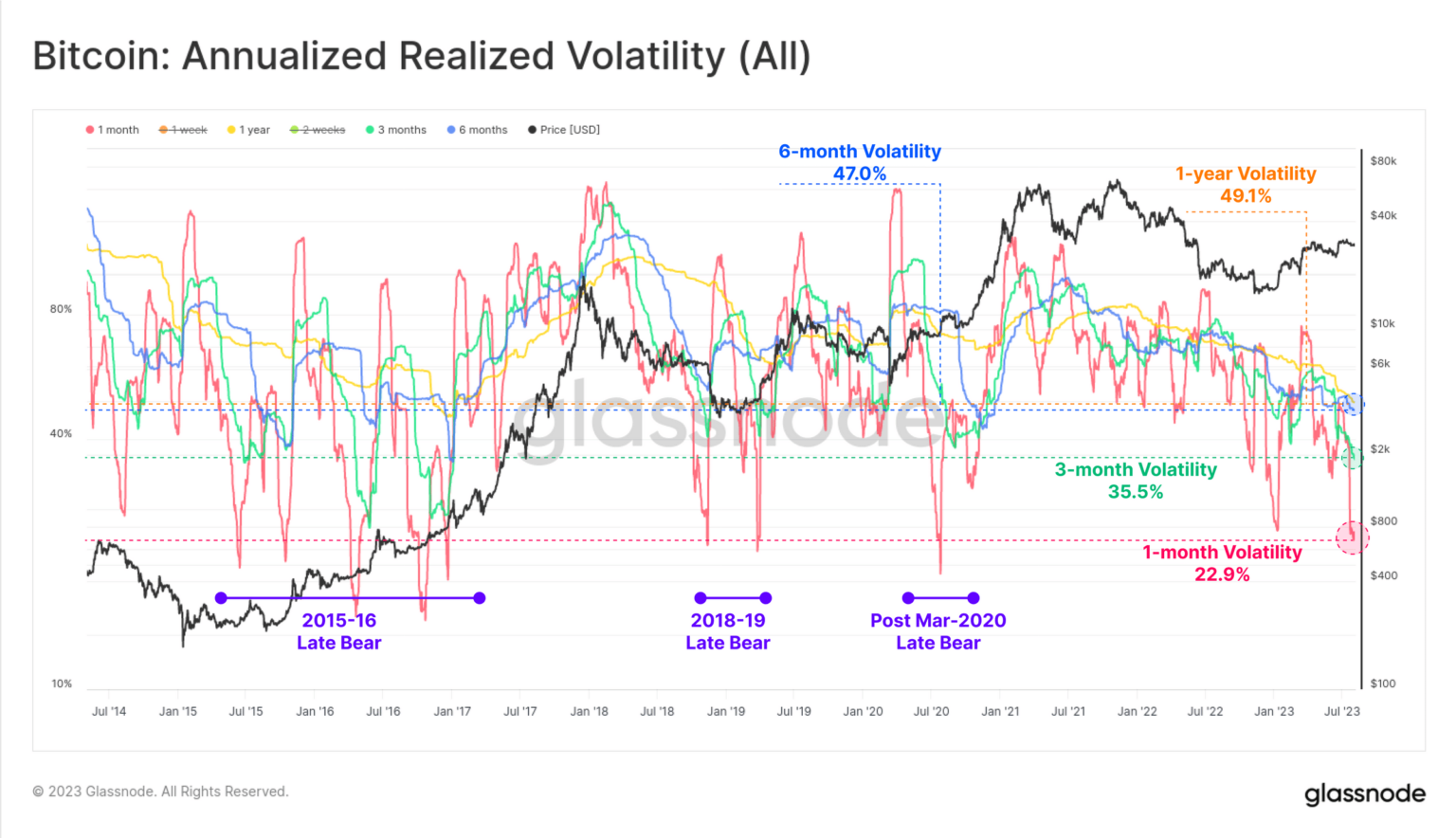

Notorious for significant volatility in its price, the past few months have been marked by volatility compression for leading coin Bitcoin [BTC], Glasnode found in a new report. With most BTC trading sessions marked by “silence,” “less than 5% of trading days have narrower trading ranges,” the on-chain analytics firm noted.

Is your wallet green? Check out the Bitcoin Profit Calculator

Mama says the market

According to Glassnode, BTC’s year-over-year volatility has steadily declined this year. Observed within the 1 month to 1 year window period, this has dropped to levels last seen since December 2016.

Glassnode noted that this is not a new phenomenon, highlighting four periods of extreme volatility compression in BTC’s price since 2015.

These include the late-stage bear market of 2015 in the re-accumulation period of 2016, the late-stage bear market of 2018, which fell 50% in November of the same year, March 2020, as the world struggled with the COVID-19 outbreak and late 2022 after the collapse of FTX.

Source: Glassnode

Glassnode assessed BTC’s 7-day price high and low and found that they are only 3.6% apart. This refers to the highest and lowest prices at which the King Coin has traded in the past seven days. It is often used to gauge the price volatility of the coin and identify potential support and resistance levels.

Source: Glassnode

At 3.6%, only 4.8% of trading days have had a tighter weekly trading range since the coin began trading in 2009.

After a 30-day evaluation, Glassnode further found:

“The 30-day price range is even more extreme, limiting the price to just 9.8% over the past month, and tighter by just 2.8% of all months. Periods of consolidation and price compression of this magnitude are extremely rare events for Bitcoin.”

Source: Glassnode

Read Bitcoin [BTC] Price Forecast 2023-24

State of the derivatives market

Regarding the volatility in the BTC derivatives market, Glassnode found that volatility remains severe in the options market. Volatility crush describes the sharp drop in implied volatility, the market’s expectation of future price volatility.

Per Glassnode:

“Bitcoin markets are notoriously volatile, with options trading at implied volatility between 60% and over 100% for most of 2021-22. However, options are currently pricing in the smallest volatility premium in history, with IV (implied volatility) between 24% and 52%, less than half of the long-term baseline.