Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

In a new publication entitled The Mustard Seed, Joe Burnett – Director of Market Research at Unchained – makes a thesis that proposes Bitcoin by 2035 $ 10 million per coin. letter Takes the long representation, aimed at “time arbitration” while it is investigating where Bitcoin, technology and human civilization can now be a decade.

The argument of Burnett revolves around two main transformations that, according to him, form the scene for an unprecedented migration of worldwide capital to Bitcoin: (1) the “large stream of capital” in an active with absolute scarcity, and (2) the “acceleration of deflationary technology” such as AI and Robotics reshape industries.

A long -term perspective on Bitcoin

Most economic comments zoom in on the next winning report or the immediate price volatility. The mustard seed, on the other hand, clearly announces its mission: “In contrast to the most financial comment that is established on the following quarter or next year, this letter takes the long display – identifies deep shifts before they become a consensus.”

The core of Burnett’s prospects is the observation that the global financial system – which contains around $ 900 trillion in total assets – contains the continuous risks of “dilution or devaluation”. Bonds, currencies, shares, gold and real estate have each expansive or inflatory components that erode their store-or value function:

- Gold ($ 20 trillion): mined at about 2% per year, increases the supply and slowly thinning its scarcity.

- Real estate ($ 300 trillion): about 2.4% grows per year as a result of new development.

- Equits ($ 110 trillion): Business profits are constantly eroded by competition and market saturation, which contributes to devaluation risks.

- Getting stuck and Fiat ($ 230 trillion): structurally subject to inflation, which reduces purchasing power over time.

Burnett describes this phenomenon as a capital “looking for a lower potential energy state”, in which the process is compared with water that breaks down a waterfall. According to him, all pre-bitcoin activa classes were effective “open premes” for dilution or devaluation. Wealth managers can spread capital under real estate, bonds, gold or shares, but each category was wearing a mechanism with which its real value could extract.

Related lecture

Enter Bitcoin, with his hard cap of 21 million. Burnett sees this digital active as the first monetary instrument that is unable to be diluted or devalued from within. Delivery is fixed; The question, if it grows, can immediately translate into price valuation. He quotes Michael Saylor’s “Waterfall Analogy”: “Capital is of course looking for the lowest potential energy status – just like water flows downwards. Before Bitcoin, wealth had no real escape of dilution or devaluation stored in any activa classes acted as a market program.”

As soon as Bitcoin was generally recognized, Burnett says, the game changed for capital allocation. Just like discovering an untouched reservoir far below the existing water basins, the Global Wealth Supply found a new outlet – one that cannot be supplemented or diluted.

To illustrate Bitcoin’s unique supply dynamics, the mustard seeds attract a parallel with the half -time cycle. In 2009, miners received 50 BTC per block – Akin to Niagara Falls at full power. From today, the reward fell to 3,125 BTC, which is reminiscent of repeatedly halving the current of the waterfalls until it is considerably reduced. In 2065, the newly beaten range of Bitcoin will be negligible compared to the total volume, which reflects a waterfall that is reduced to a ray.

Although Burnett admits that attempts to quantify the worldwide acceptance of Bitcoin, depends on uncertain assumptions, he refers to two models: the Power Law model that projects $ 1.8 million per BTC per BTC by 2035 and the Bitcoin model by Michael Saylor, that that is that $ 2.1, that that that $ 2.

He resists that these projections can be ‘too conservative’ because they often accept a decreasing return. In a world of accelerating technological acceptance – and a growing realization of the properties of Bitcoin – Price objectives can considerably exceed these models.

The acceleration of deflatoire technology

A second important catalyst for the upward potential of Bitcoin, according to the mustard seed, is the deflatory wave caused by AI, automation and robotics. These innovations quickly increase productivity, lower costs and make goods and services more abundantly. By 2035, Burnett believes that the global costs in various important sectors can undergo dramatic reductions.

The “speed factories” of Adidas cut the sneaker production from months to days. The scaling of 3D printing and AI-driven mounting lines can lower the production costs by 10x. 3D-printed houses will rise 50 times faster at much lower costs. Advanced Supply Chain automation, combined with AI logistics, can make quality housing 10x cheaper. Autonomous riding hailing may lower rates by 90% by removing labor costs and improving efficiency.

Burnett underlines that, under a Fiat system, natural deflation is often ‘artificially suppressed’. Monetary policy – such as persistent inflation and stimulus – has broken the prices, the real impact of masking technology on reducing costs, on the market.

Bitcoin, on the other hand, would let the deflation ‘his course’ run, which increases purchasing power for holders as goods become more affordable. In his words: “A person with 0.1 BTC today (~ $ 10,000) could see the purchasing power increase 100 times or more in 2035 as goods and services become exponentially cheaper.”

In order to illustrate how delivery growth of a value of a Winkel erodes in the course of time, Burnett repeats Gold’s performance since 1970. The nominal price of Gold from $ 36 per ounce to around $ 2,900 per ounce in 2025 seems significant, but that the price win was constantly diluted by the annual 2% increase of Gold. For five decades, the worldwide stock almost tripled.

If Gold’s offer had been static, the price would have reached $ 8,618 per ounce according to 2025, according to Burnett’s calculations. This supply limitation would have strengthened the scarcity of Gold, which may make the demand and the price even higher than $ 8,618.

Related lecture

Bitcoin, on the other hand, contains precisely the permanent supply condition that gold has never had. Every new question will not stimulate extra currency issue and must therefore send the price directly up.

Burnett’s prediction for a $ 10 million bitcoin against 2035 would imply a total market capitalization of $ 200 trillion. Although that figure sounds colossal, he points out that it only represents about 11% of global wealth – the assumption of global wealth continues to expand by an annual percentage of ~ 7%. From this viewpoint it may not be far -fetched to allocate about 11% of the assets of the world to what the mustard seed ‘calls the best long -term storage’ of value assets’. “Every value of the past is constantly extensive in the supply to meet demand. Bitcoin is the first to do that. “

An important piece of the puzzle is the security budget for Bitcoin: Miner Revenue. By 2035 Bitcoin’s Block subsidy will be fallen to 0.78125 BTC per block. With $ 10 million per coin, miners could earn $ 411 billion in total turnover every year. Because miners sell the bitcoin they earn to cover the costs, the market should absorb $ 411 billion in newly mined BTC annually.

Burnett attracts a parallel with the global wine market, which was valued at $ 385 billion in 2023 and is expected to reach $ 528 billion in 2030. If an “everyday” sector such as wine can support that level of consumer demand, an industry can be found that the leading digital digital store that bones the digital value.

Despite the public perception that Bitcoin Mainstream becomes, Burnett emphasizes a sub -reported metric: “The number of people worldwide with $ 100,000 or more in Bitcoin is only 400,000 … That is 0.005% of the world’s population – only 5 out of 100,000 people.”

In the meantime, studies can demonstrate that around 39% of Americans have a certain level of “direct or indirect” Bitcoin exposure, but this figure includes any fractional ownership-such as shares of Bitcoin-related shares or ETFs through investment funds and pension plans. Real, substantial adoption remains niche. “If Bitcoin is the best long -term saving technology, we would expect everyone with substantial savings to have a considerable amount of bitcoin. Yet today, hardly anyone does that. “

Burnett emphasizes that the road to $ 10 million does not require that Bitcoin will replace all the money worldwide – just to ‘absorb a useful percentage of worldwide wealth’. The strategy for future-oriented investors, he argues, is simple but non-trivial: ignore short-term noise, focus on the multi-year horizon and acts before the global consciousness of Bitcoin’s properties becomes universal. “Those who be able to see the larger whole beyond the short -term volatility and focus will recognize Bitcoin as the most asymmetrical and overlooking bets on global markets.”

In other words, it is about “at the front of capital migration”, while the Bitcoin user base is still relatively tiny and the vast majority of traditional wealth remains in old assets.

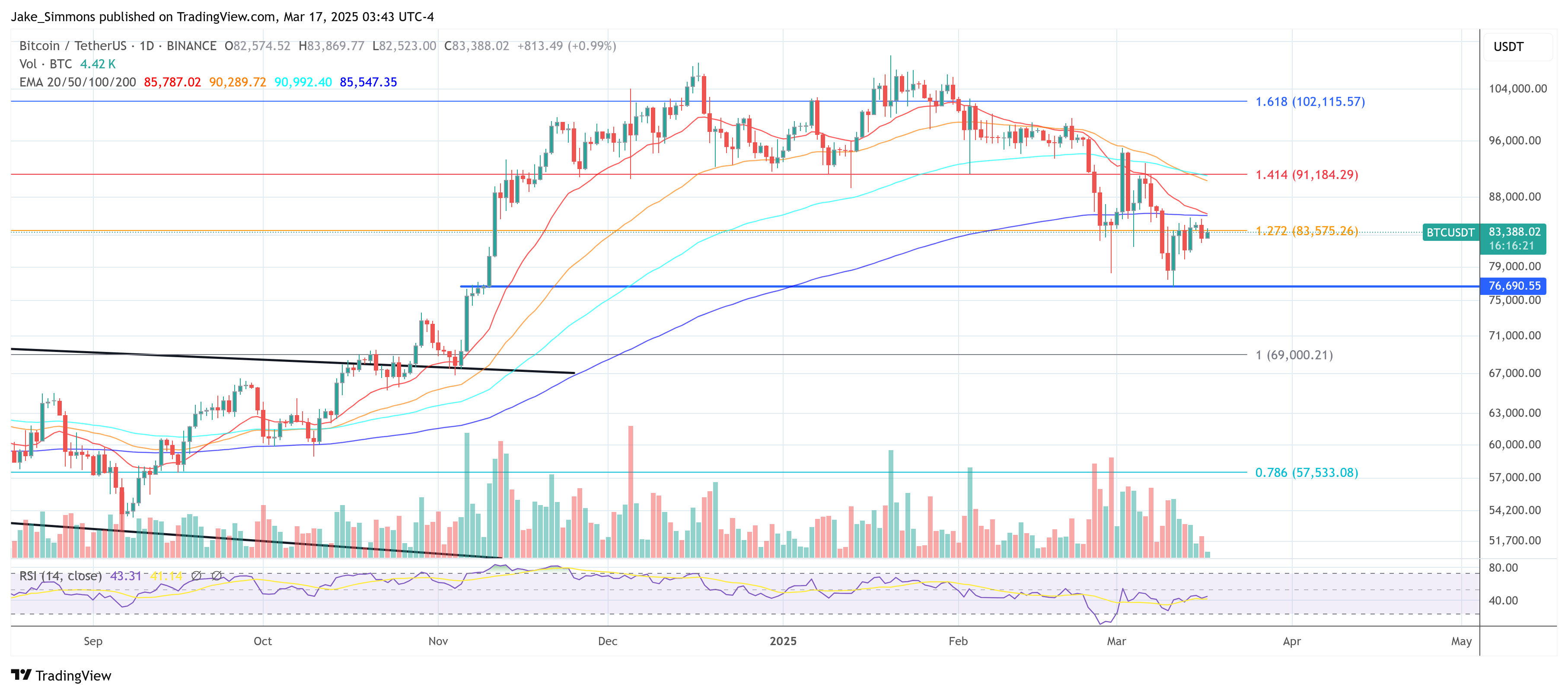

At the time of the press, BTC traded at $ 83,388.

Featured image made with dall.e, graph of tradingview.com