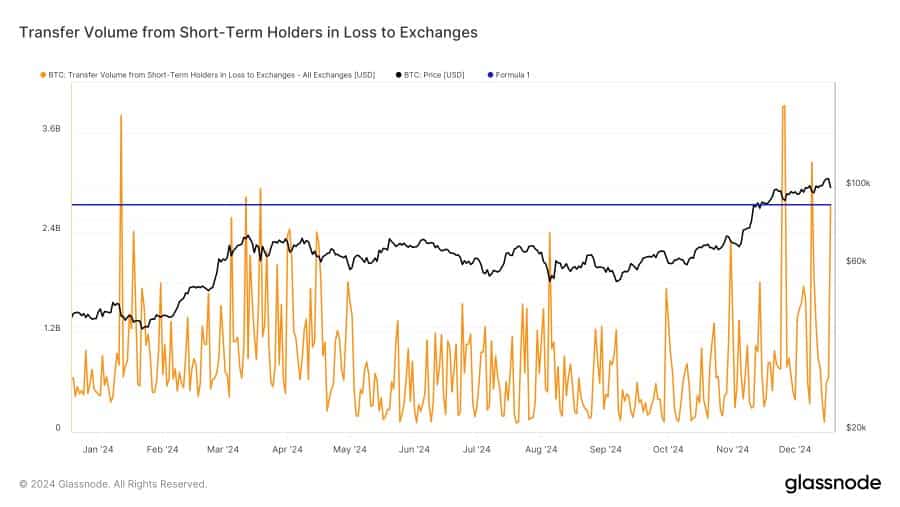

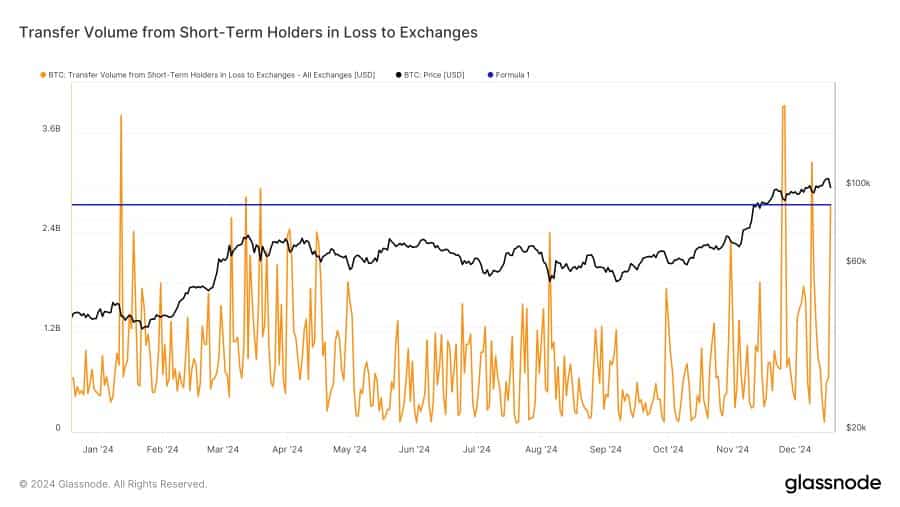

- Short-term holders sold significant volumes over the past 24 hours, while major investors, including whales, remained on the sidelines waiting for more favorable entry points.

- The buying rate is peaking at a new high last reached in April, opening up buying opportunities.

Bitcoins [BTC] has entered a corrective phase, falling 4.43% over the past 24 hours to trade below $100,000. This pullback has reduced the monthly gain to 4.94%.

If the bullish momentum continues, Bitcoin could surpass its previous all-time high and head towards $108,500 before trending higher. According to AMBCrypto’s analysis, the recovery may depend on large holders intervening at key price levels despite continued bearish market conditions.

Short-term holdings are fueling Bitcoin’s recent decline

Analyst Jam Van Straten attributes Bitcoin’s recent decline mainly to short-term holders who regularly trade the cryptocurrency. This group has collectively released approximately 26,000 BTC, worth $2.7 billion.

This sell-off includes trades at both losses and profits, reflecting the volatility of their trading activity.

Source:

Van Straten noted that large investors, or whales, are staying on the sidelines and holding significant liquidity while they wait for an ideal entry point.

He explained:

“Big players wait for the prize and don’t chase it.”

This suggests that these influential traders are unlikely to take action until market conditions align with their strategies. Once whales reenter the market, their buying activity could see Bitcoin rebound and possibly trade higher.

Buying momentum could resume soon

Santiment reports that discussions about buying Bitcoin’s recent dip have reached an all-time high, a sentiment last seen on April 12, 2024, eight months ago.

Since then, Bitcoin has risen more than 81%. If history repeats itself, current sentiment could trigger a similar rally, pushing BTC into higher price regions above current levels.

Source:

With this potential benefit in sight, whales are likely to resume their purchases. If buying momentum remains strong, Bitcoin could trend even higher.

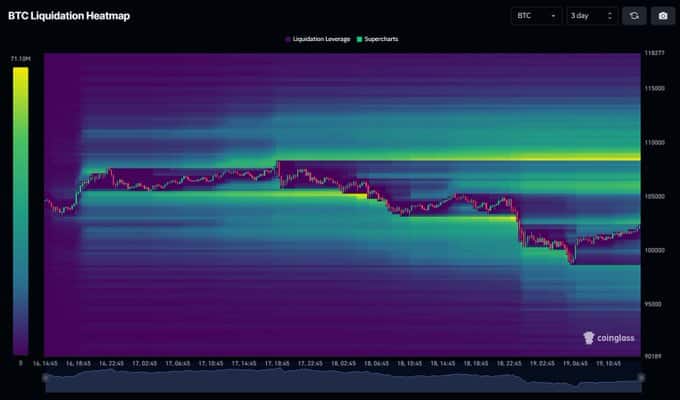

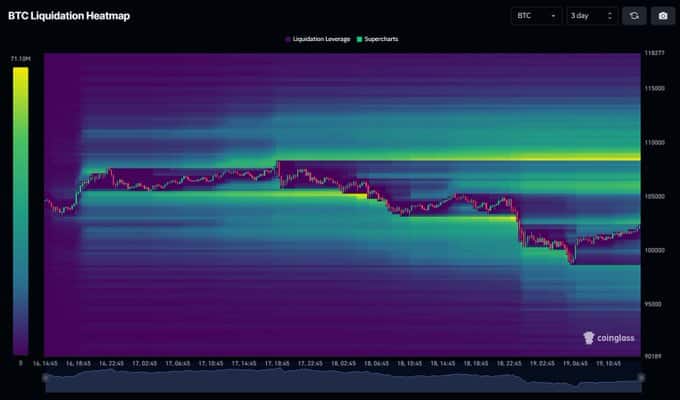

Further analysis shows that BTC is poised to trade above its previous highs, driven by the formation of a large liquidity cluster around the $108,500 level, as noted by analyst Mister Crypto.

Source:

Liquidity clusters act as magnets for price movements, as assets are often drawn to these regions to clear pending orders before continuing their trajectory.

Read Bitcoin’s [BTC] Price forecast 2024-25

This setup suggests that Bitcoin has a high chance of regaining buyer interest, especially as bullish talks continue to dominate the market.